The Financial Conduct Authority is set to extend Consumer Duty rules to closed products and services from the end of this month, but savers shouldn’t be complacent.

Savers may be missing out on greater returns as they let their hard-earned cash idle in poor-paying closed accounts, latest analysis from Moneyfactscompare.co.uk revealed.

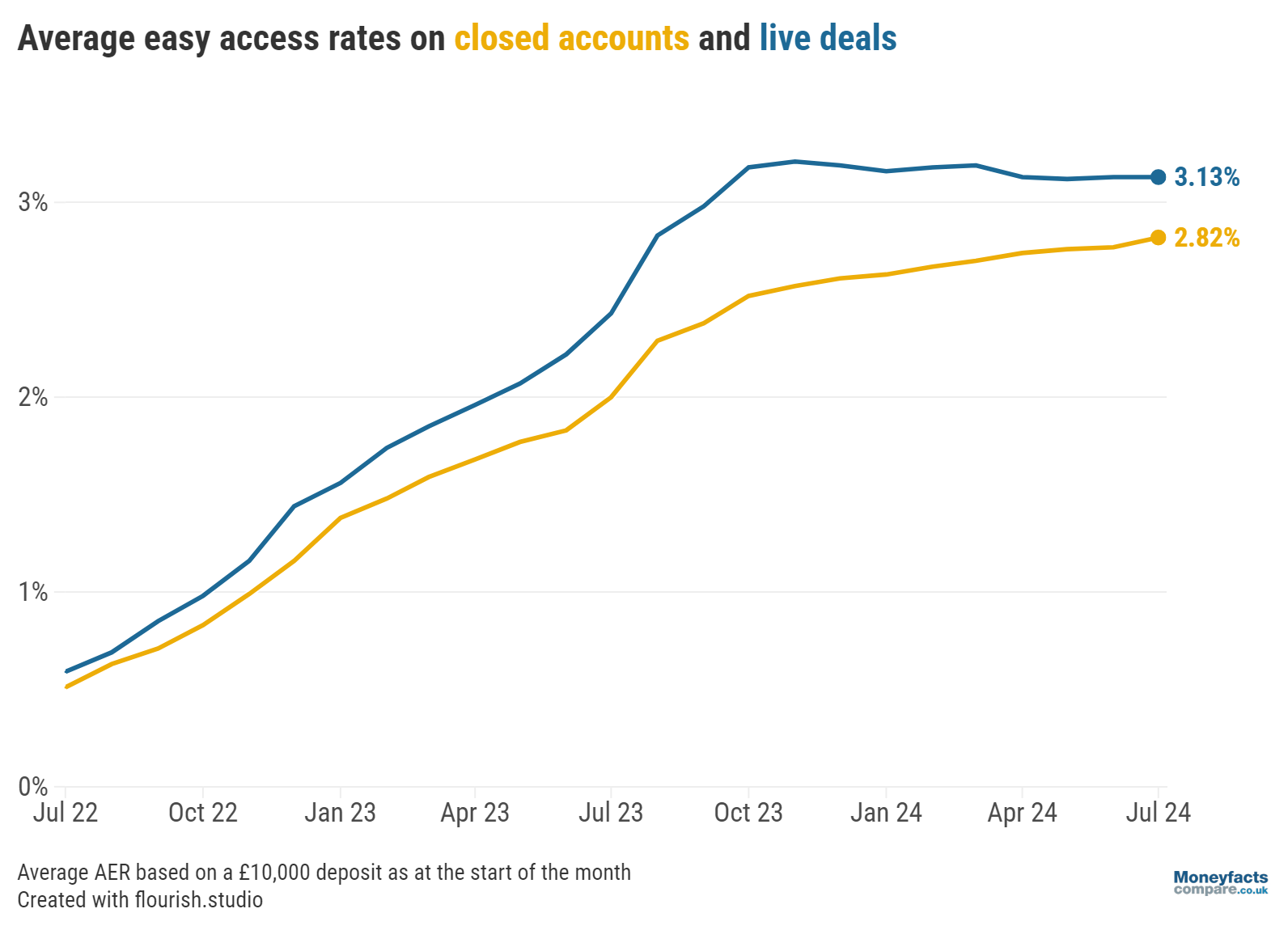

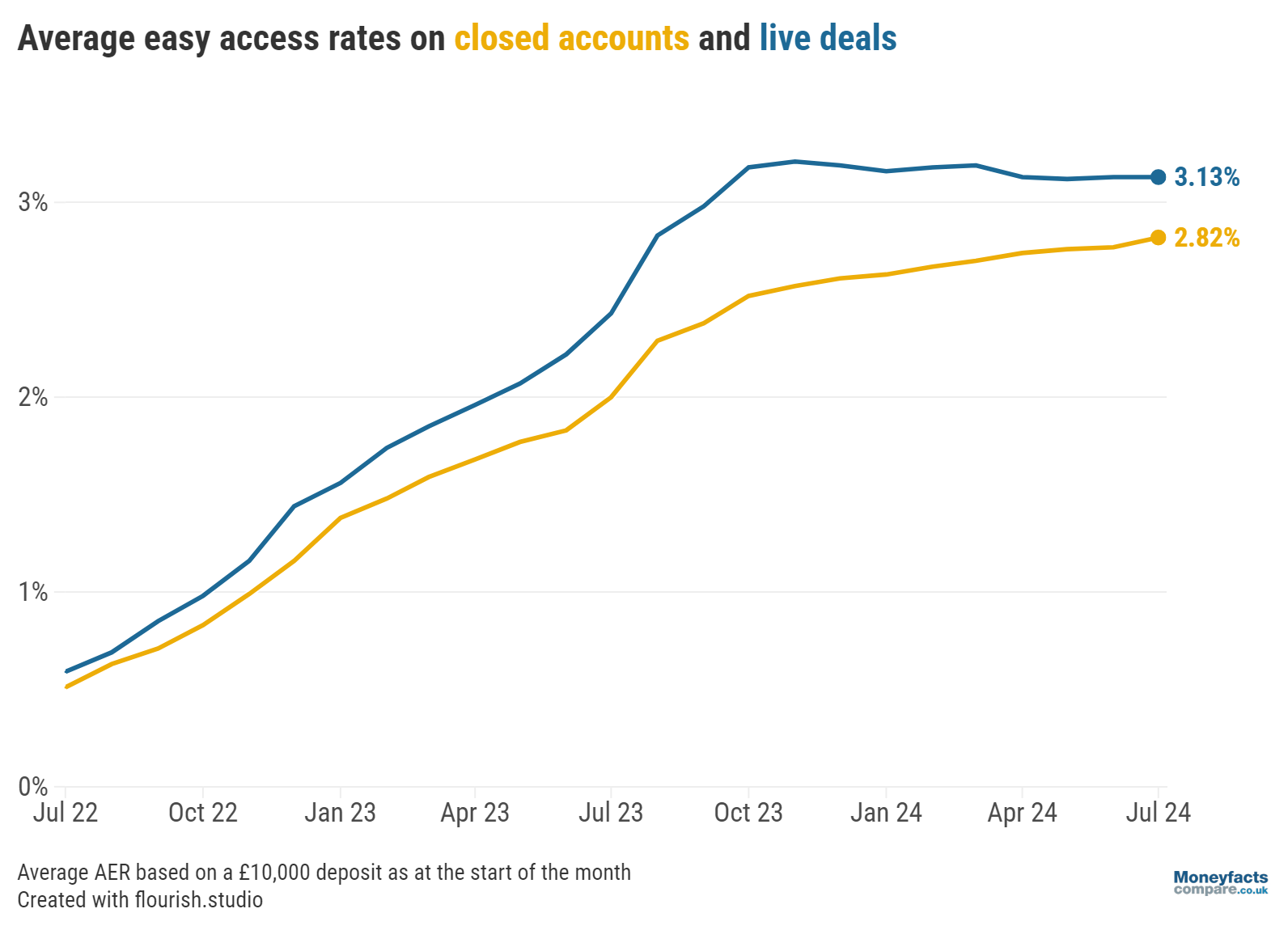

Our team of experts reported a 0.31 percentage point difference between the average rate offered by a live easy access account (3.13%) and a closed easy access account (2.82%) at the start of July. This could be costing those with a balance of £10,000 an additional £31 in interest over 12 months.

A ‘closed’ product refers to an account or service that is no longer available to new business. In contrast, ‘live’ products are open to new customers.

While the gap between average live and closed easy access rates narrowed from 0.53 percentage points since the start of the year, it remains significantly larger than two years ago. In July 2022, the average closed easy access account paid 0.51% - just shy of the average live easy access rate (0.59%).

Graph: Average rates of live and closed easy access accounts between July 2022 and July 2024.

“Savers are being short-changed if they don’t proactively review and switch from their closed easy access accounts,” commented Rachel Springall, Finance Expert at Moneyfactscompare.co.uk. She encouraged consumers to “shake any apathy” towards moving their savings pots at the risk of being “left disappointed when their loyalty is not rewarded”.

Having introduced Consumer Duty rules for open products and services last year, the Financial Conduct Authority (FCA) is set to extend the duty to closed products and services as of the end of this month (31 July 2024). According to the FCA, this will require banks and building societies to “demonstrate that they are providing fair value to customers in closed products and services”.

“In the months ahead, it will be interesting to see if any savings providers pull closed savings accounts or move customers onto different products as Consumer Duty rules on closed products come into force,” said Springall.

In the meantime, savers shouldn’t be complacent. Many of the UK’s biggest high street brands, including Barclays Bank, HSBC, Lloyds Bank, NatWest and Santander, continue to pay less than 2.00% on their most flexible live savings accounts.

| Provider | Account | Gross rate |

| Barclays Bank | Everyday Saver | 1.65% |

| HSBC | Flexible Saver | 1.98% |

| Lloyds Bank | Easy Saver | 1.40% |

| NatWest | Flexible Saver | 1.74% |

| Santander | Easy Access Saver | 1.70% |

| Deals available to new customers with a £10,000 deposit that allow multiple withdrawals without penalty. | ||

Meanwhile, the very best easy access accounts offer around 5.00%.

“Despite using a trusted brand, the convenience of leaving cash in an easy access account can mean missing out on higher interest rates elsewhere, so it is imperative savers ditch and switch to a better return,” urged Springall.

“Building societies and challenger banks continue to work hard to entice new deposits and reward loyal customers so they are worth comparing against the more familiar high street brands.”

Whether you’re looking for an easy access account, fixed rate bond or notice account, our dedicated savings charts are regularly updated throughout the day to show the very best rates currently available.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.