They’re being urged to shop around for better interest rates, with product choice at a record high.

It might soon be more difficult for savers to make a real return on their hard-earned cash, as the Bank of England expects UK inflation to reach 4% when latest figures are released next week. To make matters worse, many rates from across the savings market continued to suffer month-on-month, according to the most recent Moneyfacts UK Savings Trends Treasury Report.

It found the average rate paid by an easy access savings account and easy access ISA are currently at their lowest levels in over two years after falling by 0.10 percentage points to 2.49% and 2.72%, respectively, between September and October. Similarly, the average rate paid by a notice savings account experienced a marginal decline from 3.52% to 3.50% over the same timeframe and is also at its lowest since July 2023.

While typical returns on a notice ISA bucked the trend - rising by 0.06 percentage points to 3.43% - they too sit well below the 4% threshold.

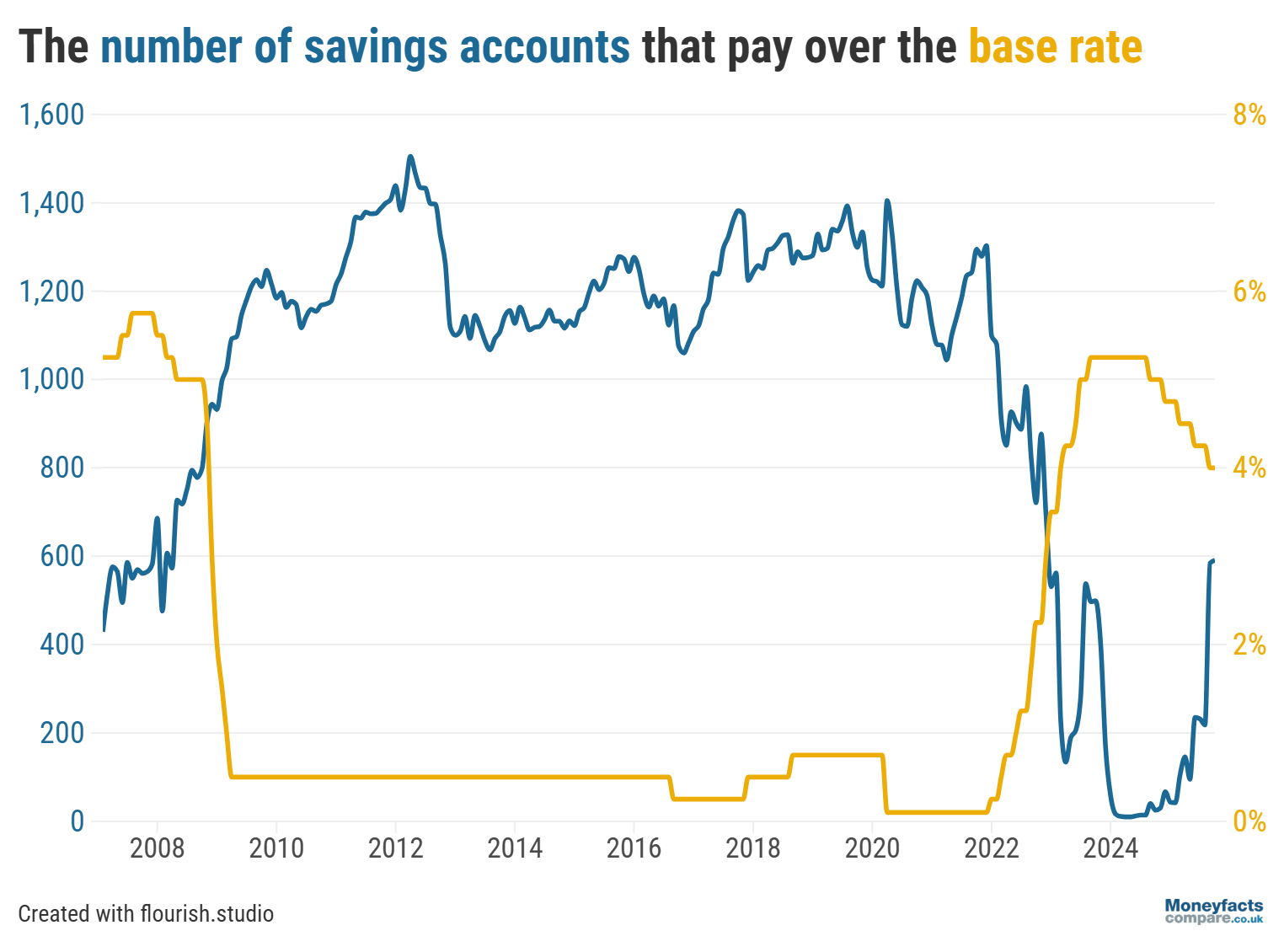

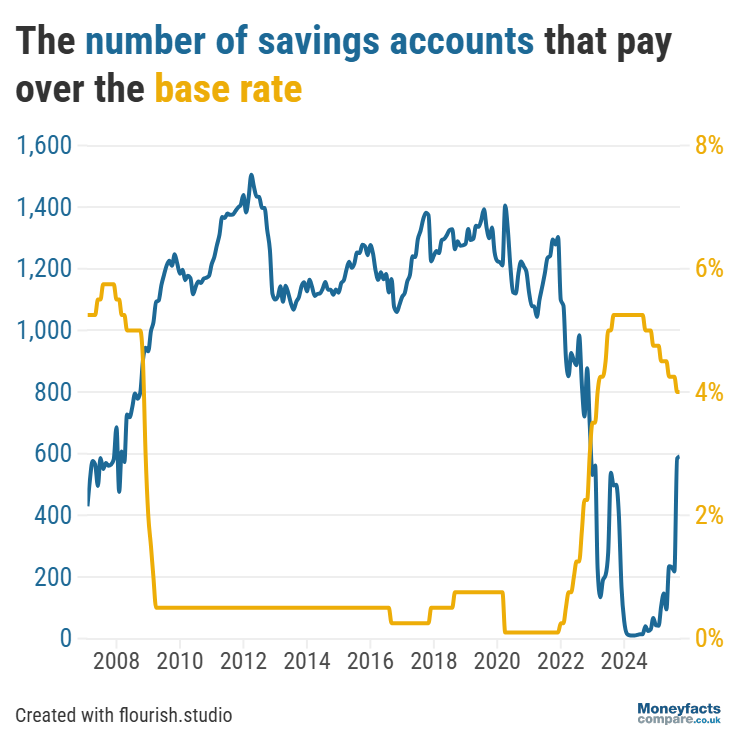

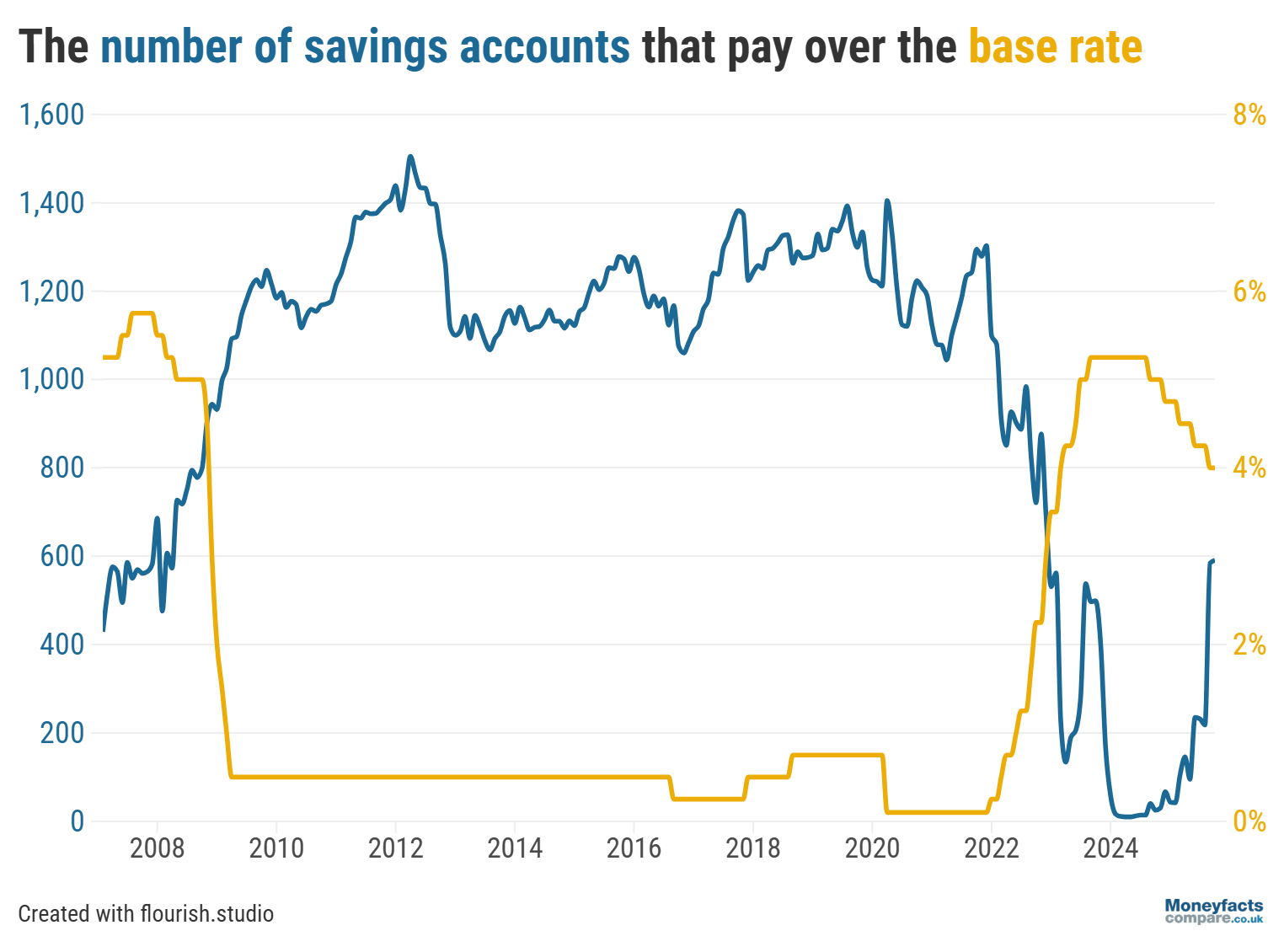

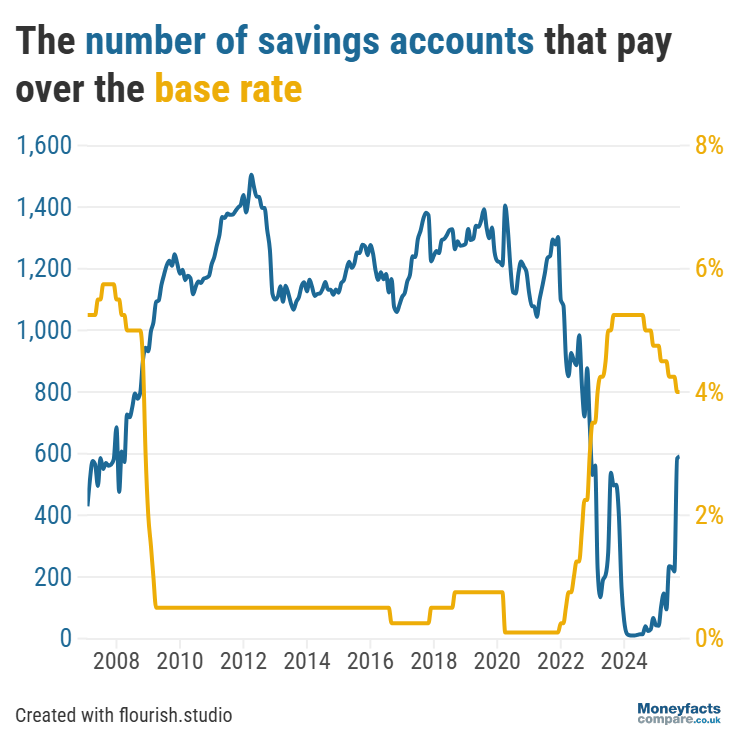

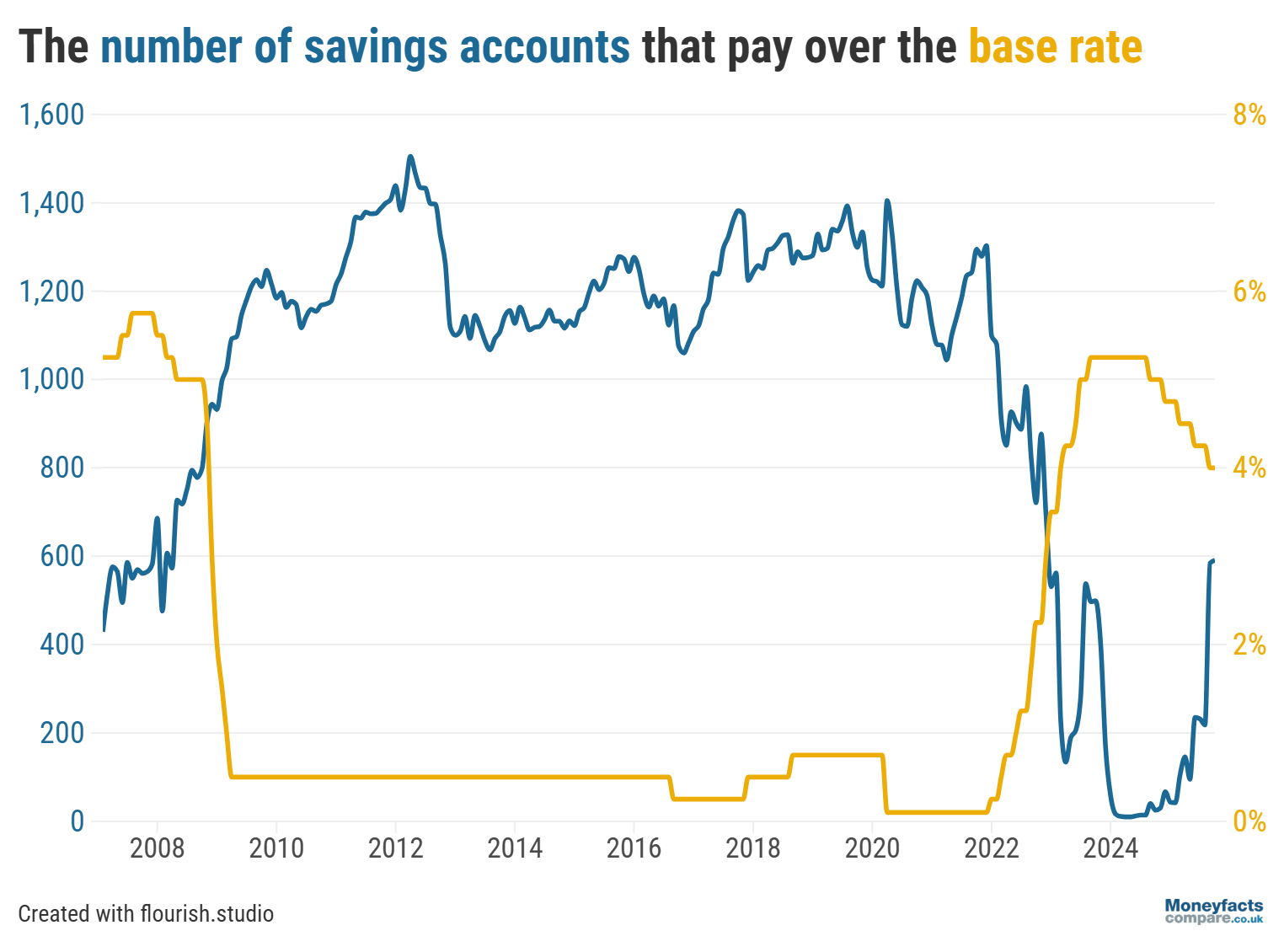

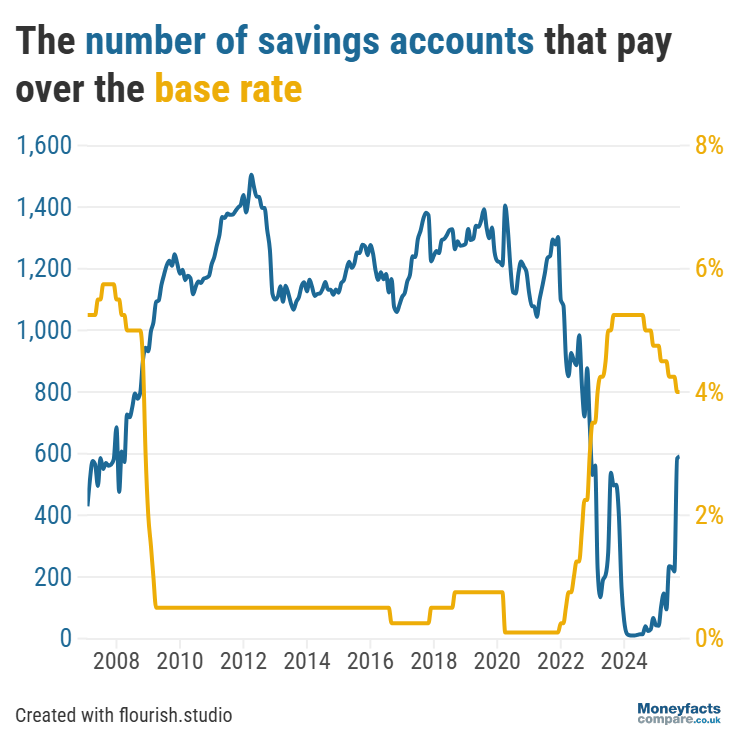

“In fact, only around one in four accounts is paying better than 4%, which is also the current level of the Bank of England Base Rate,” Adam French, Head of News at Moneyfacts, remarked. He added that it’s “essential savers take the initiative and shop around to secure the best return” to avoid their money losing value in real terms.

UK savings trends: The number of savings accounts that pay over the base rate between 2008 and 2025.

Inflation measures by how much the costs of goods and services have risen. If your savings account pays less interest than the rate of inflation, your money is losing value in real terms. Learn more about what inflation means for your finances.

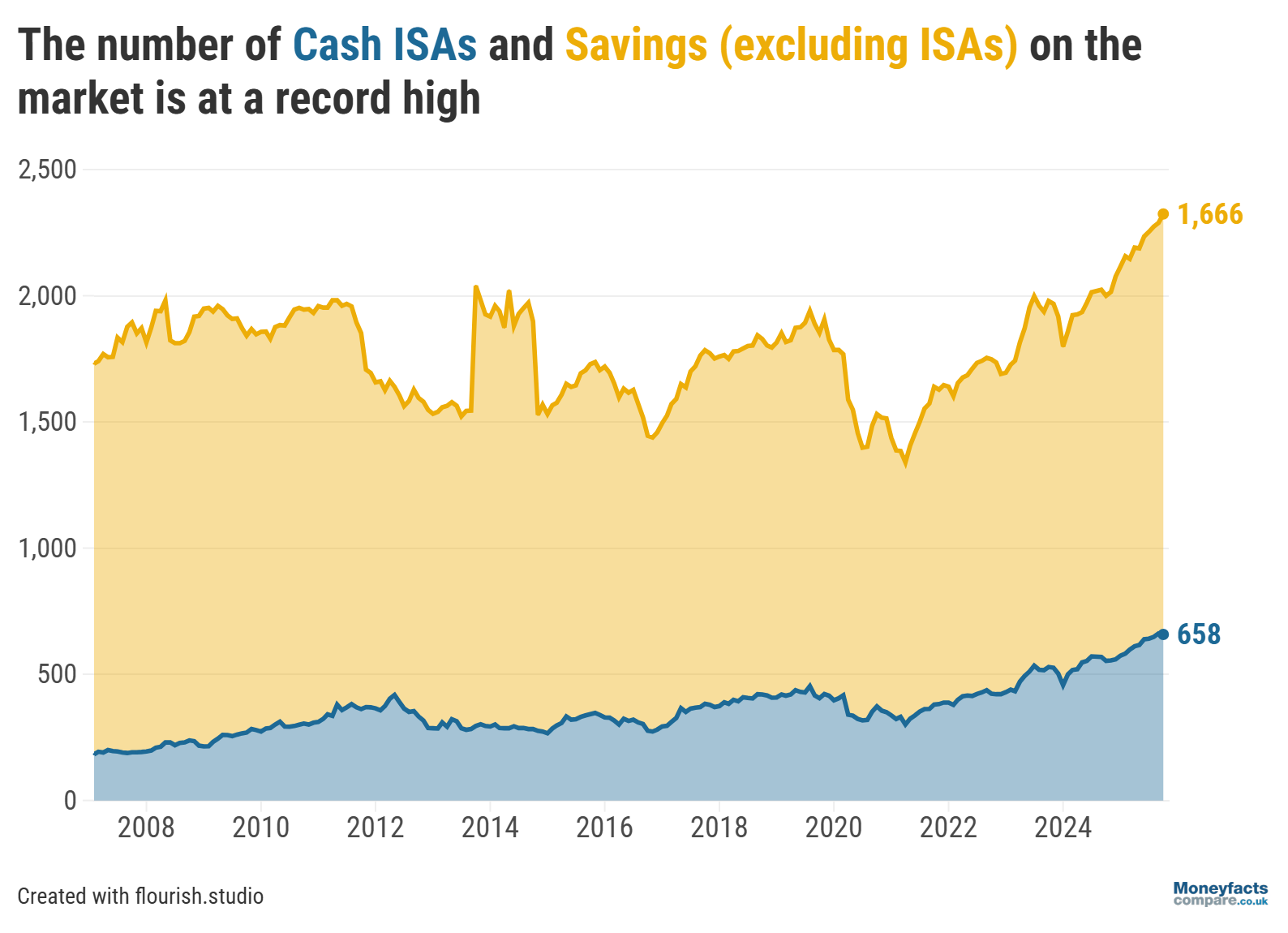

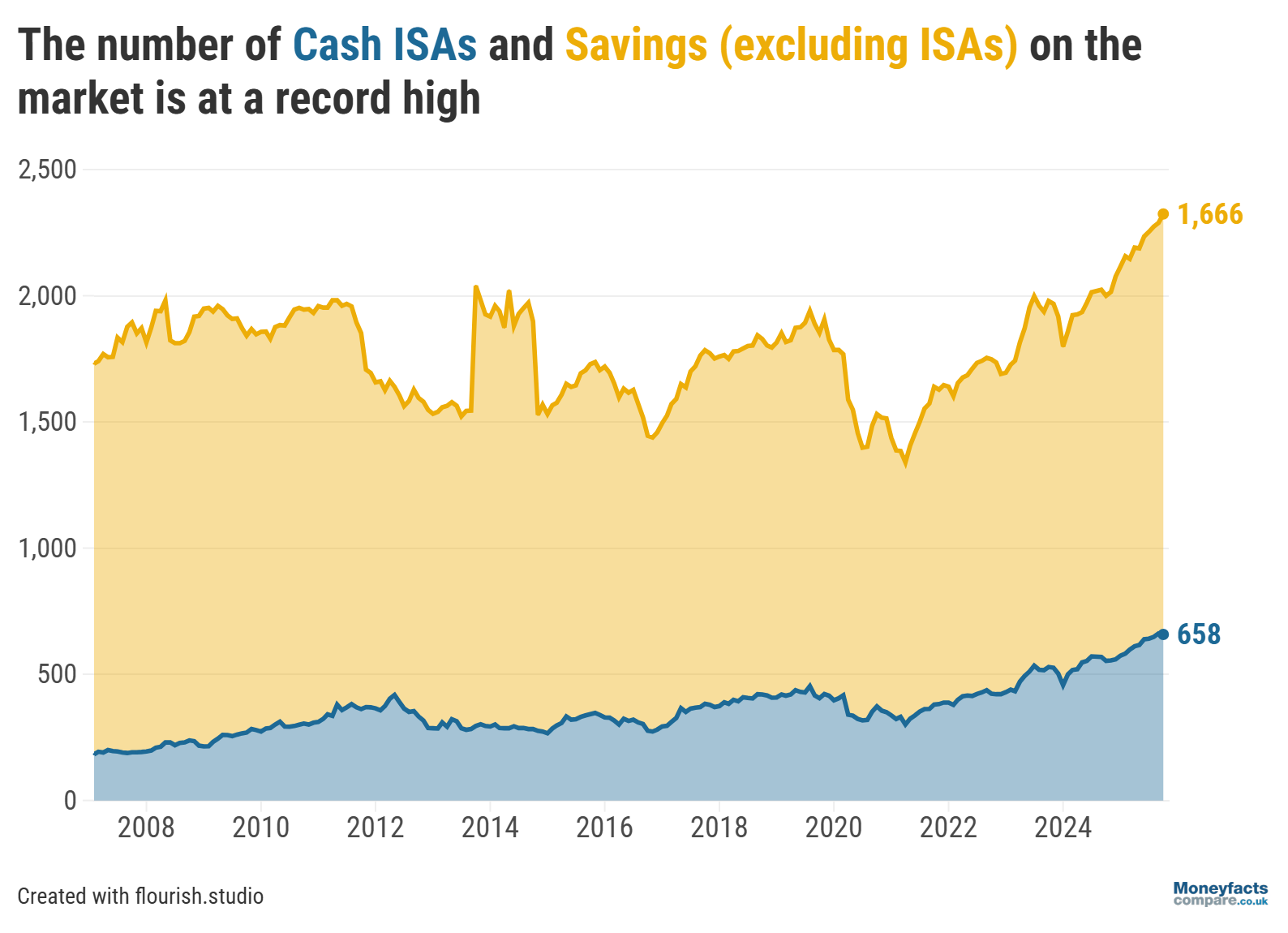

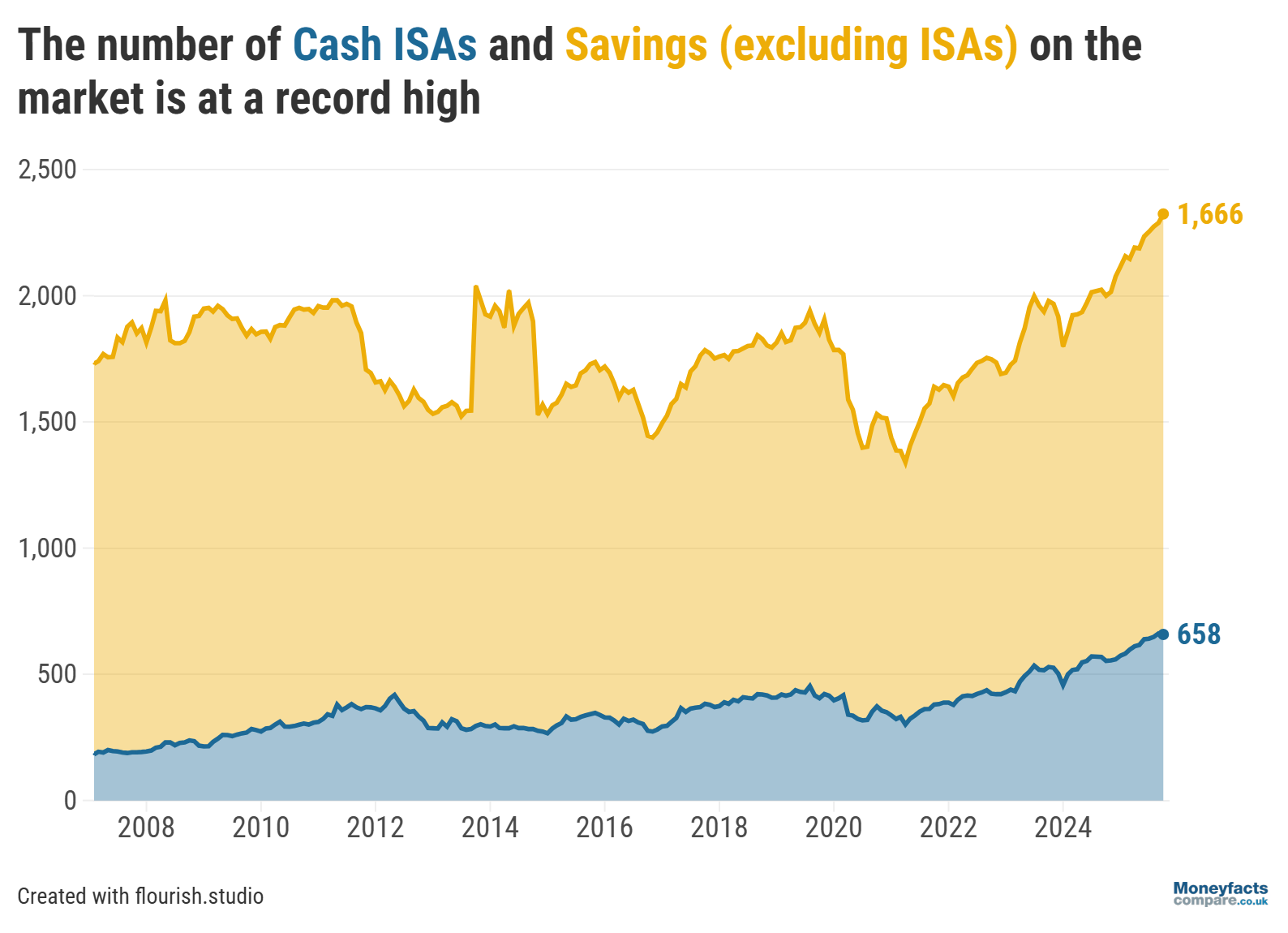

Despite the drop in average rates, savers still have plenty of options when it comes to finding an attractive deal. The total number of savings accounts on the market increased to a record-breaking 2,324 month-on-month, offered by an unprecedented 156 providers.

UK savings trends: Total number of savings account and ISAs on the market between 2008 and 2025.

What’s more, French said banks and building societies are “working harder than ever” to entice deposits. “Several providers offer accounts with short-term bonus rates designed to attract new customers who are hunting the best returns,” he explained. As a result, the average bonus rate now stands at 1.45% - its highest on record.

However, French warned that while bonuses “can be a great way to boost returns initially, they tend to drop off after a few months and savers who forget to review their account risk being moved onto much lower ongoing rates”.

Those who opt for an account with an introductory bonus would therefore be wise to explore other options if it’s no longer competitive once the offer expires.

Anyone worried about rates falling further and who doesn’t need immediate access to their cash could consider a fixed savings account. Even though the very best rates in this corner of the market have steadily declined, on the whole fixed accounts proved slightly more stable than their variable counterparts between September and October.

For instance, the average returns on a one-year fixed bond and longer-term fixed bond (of over 550 days) both rose by 0.02 percentage points month-on-month to 3.98% and 3.91%, respectively. While the average one-year fixed ISA rate dropped 0.02 percentage points to 3.89% over the same period, typical returns on a longer-term fixed ISA also saw a slight uptick from 3.83% to 3.84%.

But, although fixed accounts offer protection against falling interest rates, it’s important to remember you could be left out of pocket if inflation rises above the rate at which you locked in.

Our savings and ISA charts are regularly updated throughout the day so you can find an account that betters the rate of inflation and see your money grow in real terms.

Alternatively, read our weekly savings and ISA roundups for more information on the most competitive accounts, or subscribe to our Savers Friend newsletter for regular updates from across the savings markets.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.