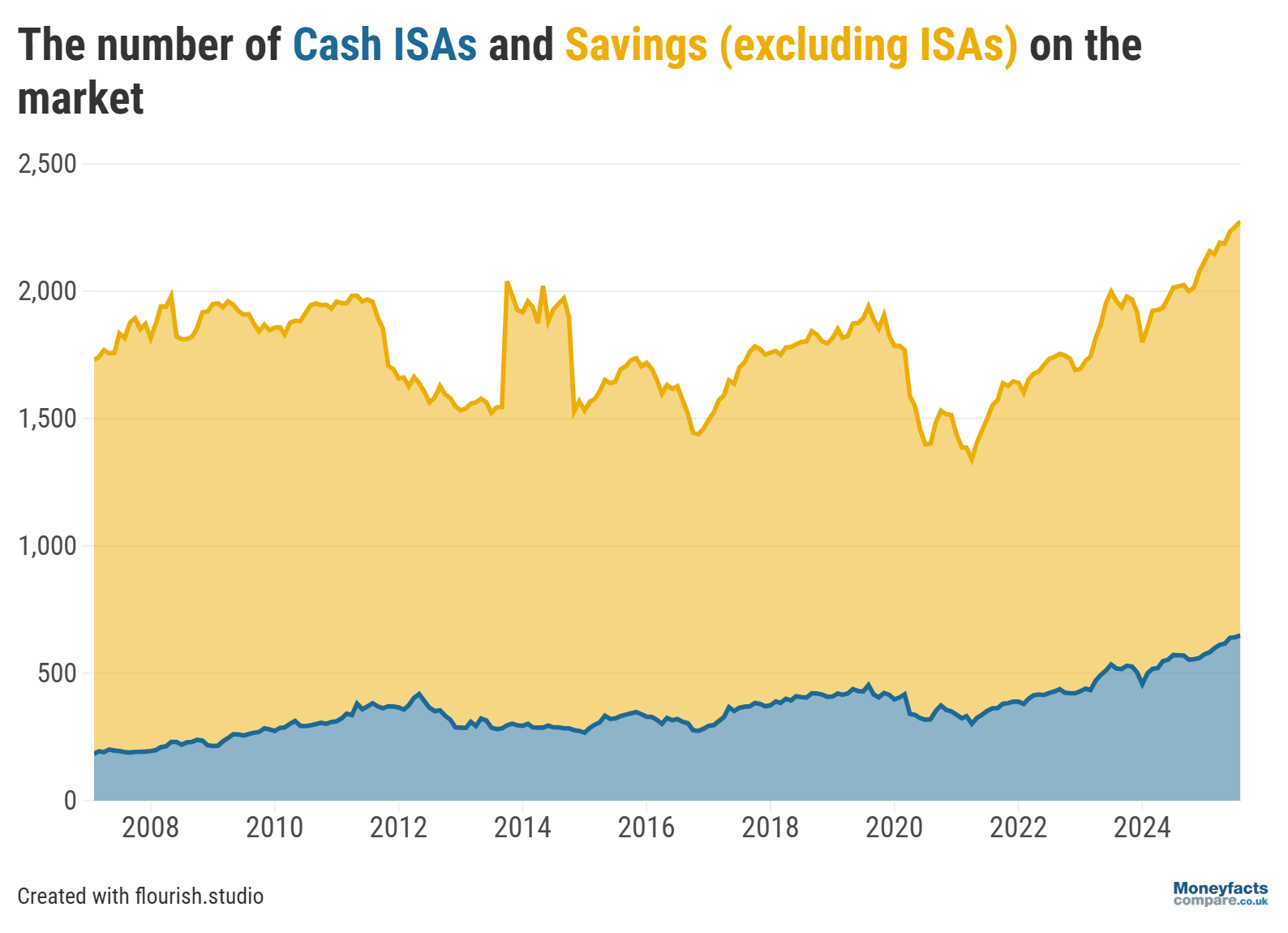

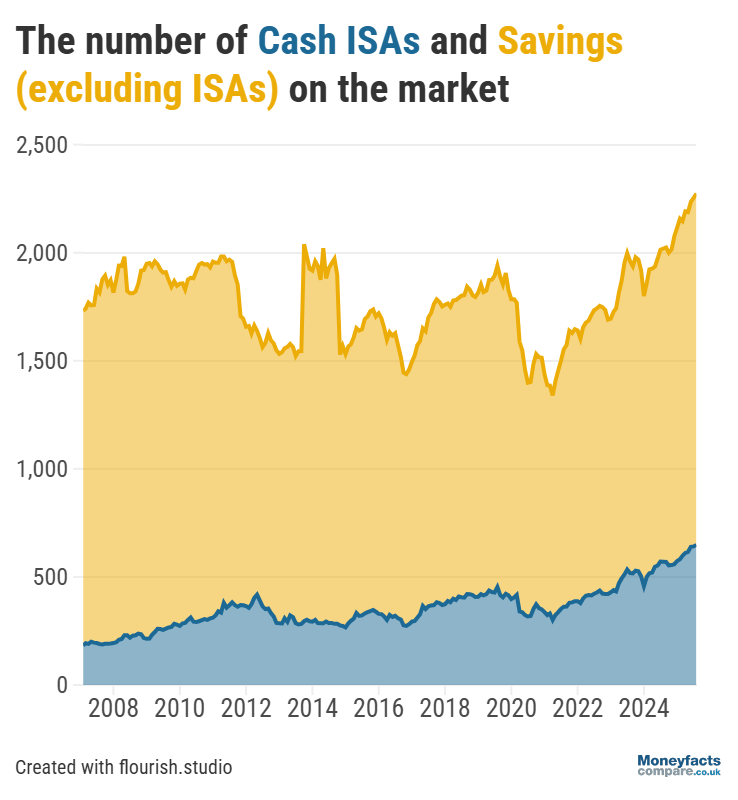

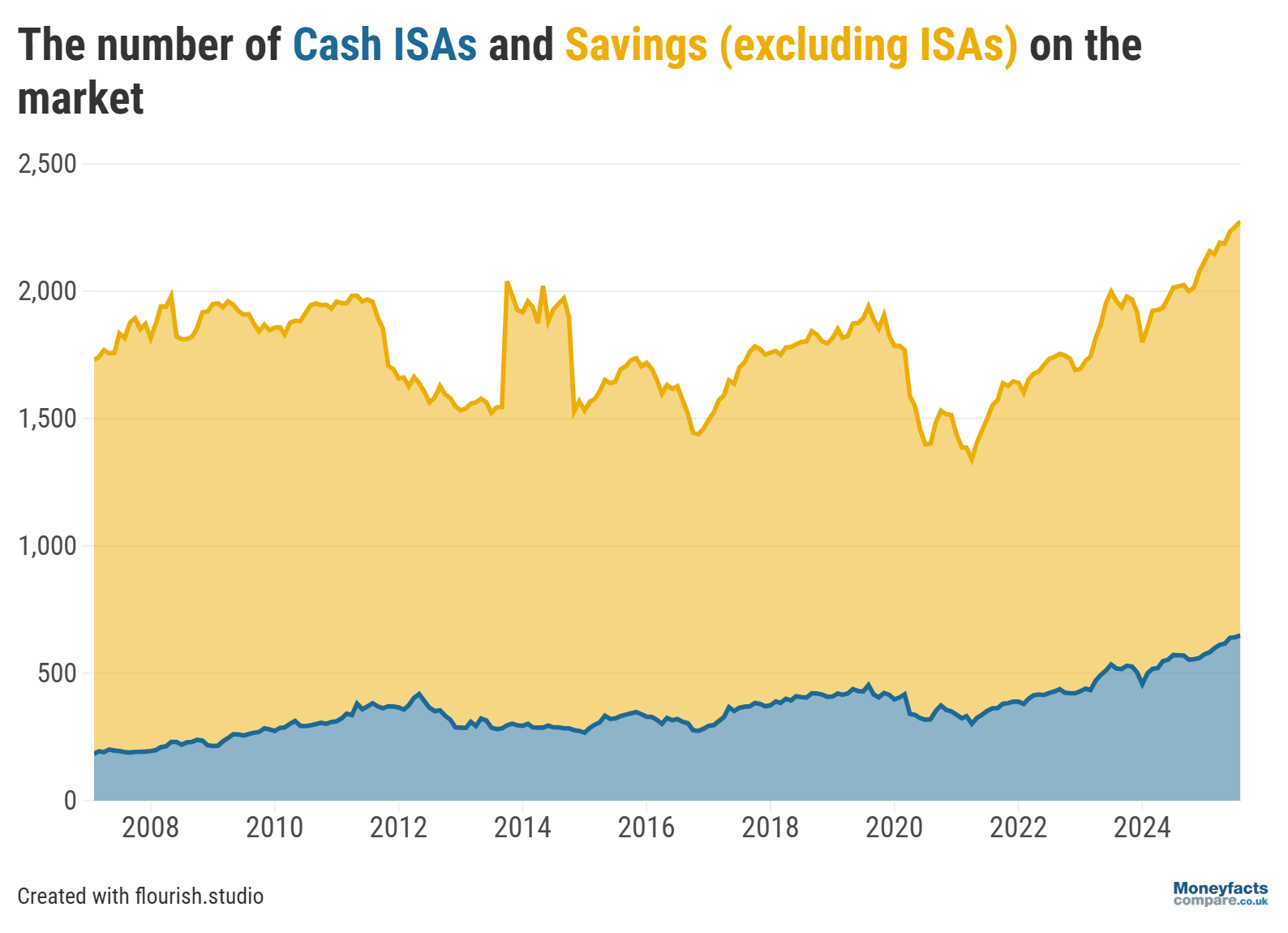

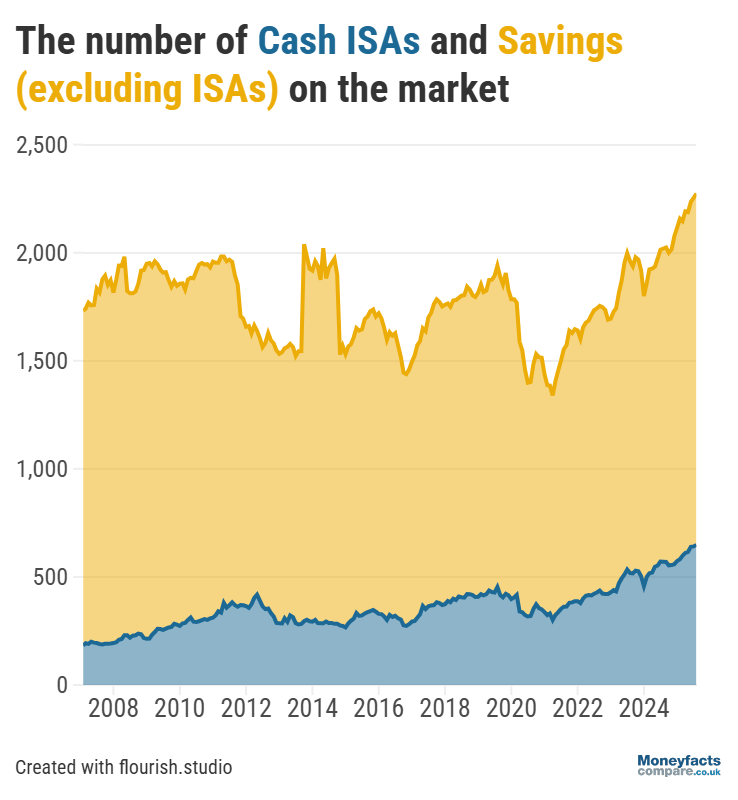

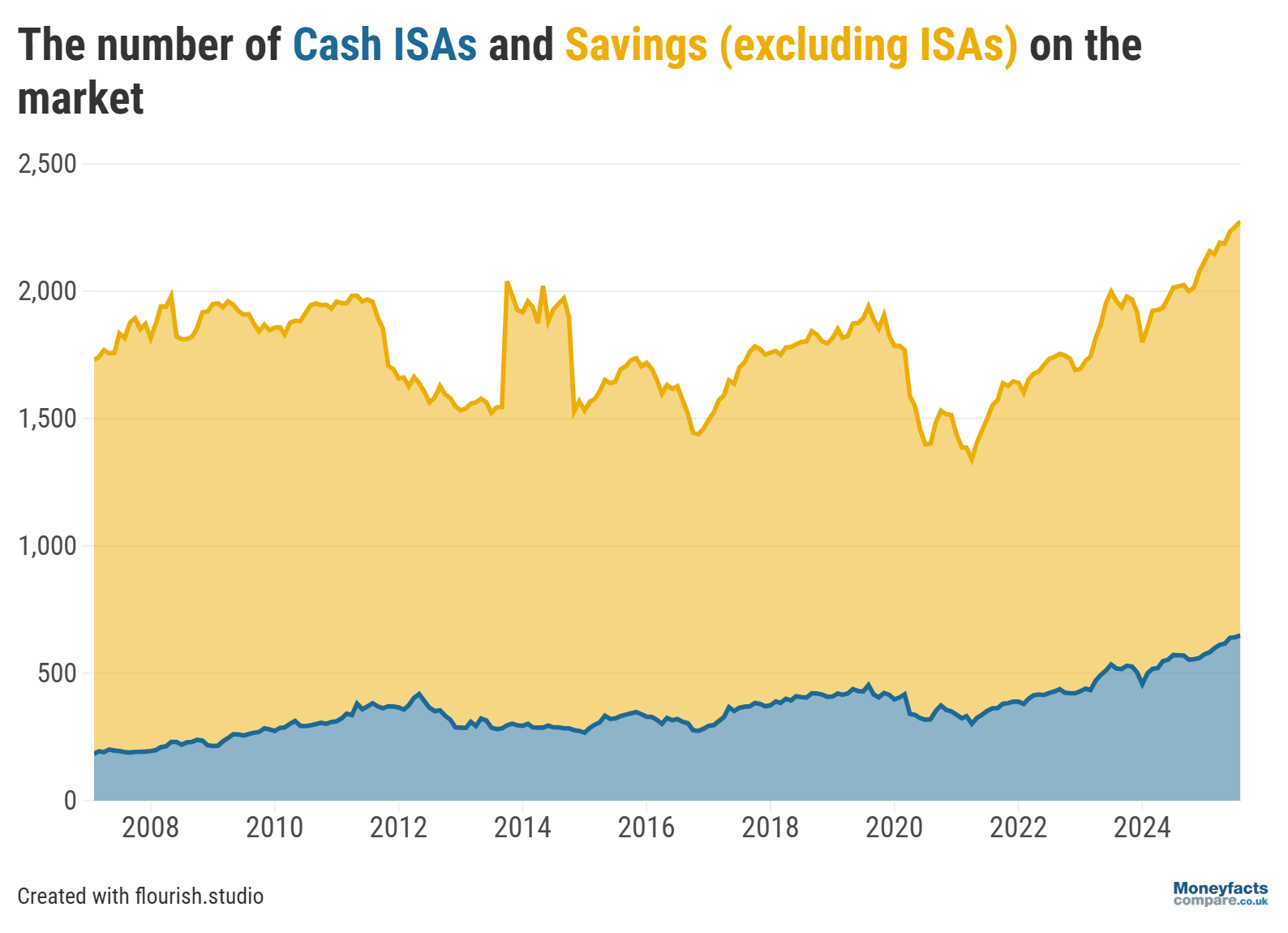

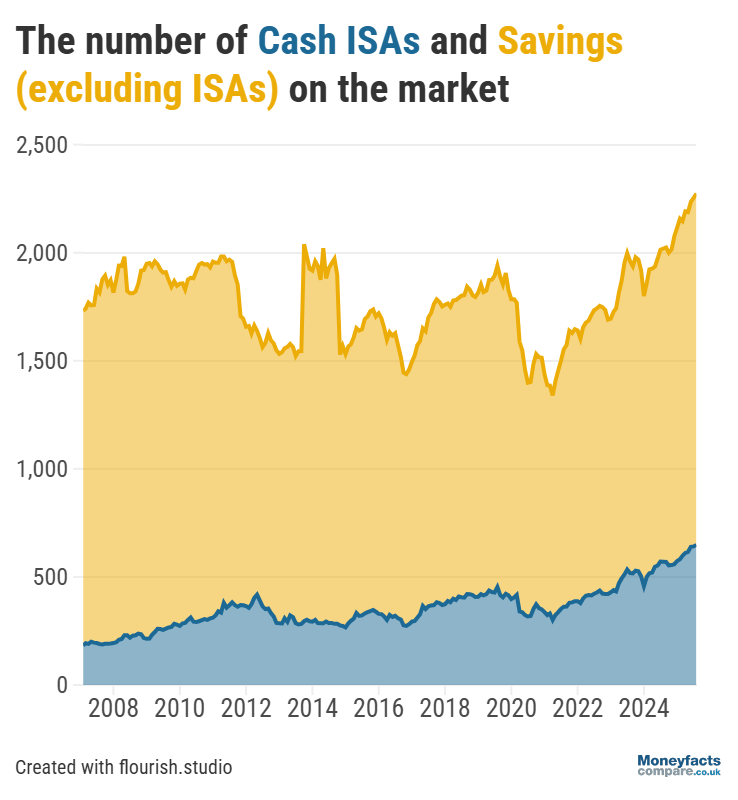

While savings rates suffer, the number of accounts to choose from continues to thrive.

The number of savings accounts and ISAs on the market continued to increase, rising to another record high of 2,274 (including ISAs) at the start of August. This is according to the latest data from the Moneyfacts UK Savings Trends Treasury Report.

Within this total, the number of standard savings accounts rose to 1,626 and the number of cash ISAs to 648, offered by 154 different savings providers.

“Savings product choice has reached a record high, and this has been largely fuelled over time by the increase of new challenger banks entering the market,” Rachel Springall, Finance Expert at Moneyfactscompare.co.uk explained.

“New brands bring positive energy into the arena, as they typically fight harder for savers deposits to fund their future lending,” she added.

Despite the rising choice of providers, savings rates are continuing their downwards trend as the Moneyfacts Average Savings Rate fell from 3.51% at the start of July to 3.50% one month later.

Nevertheless, Springall still urges savers “to compare deals and switch regularly, and not to let apathy win”.

Graph: The number of Cash ISAs and savings accounts on the market rose to 2,274 in August 2025.

There wasn’t much change in the average variable savings and ISA rates in the month to August, as the average easy access savings rate remained at 2.68% and the average notice rate stayed at 3.62%. Meanwhile, the average easy access ISA rate fell by just 0.02 percentage points to 2.90%.

Springall puts this lack of movement down to a “stalling approach from providers” as they waited for the Bank of England’s next base rate announcement on 7 August.

As many expected, the Bank’s Monetary Policy Committee (MPC) cut the base rate to 4.00%, which has since prompted a flurry of cuts from savings providers on their variable accounts, causing average savings rates to head even lower.

Fixed accounts aren’t immune from rate reductions, with the average one-year bond falling to 3.99% at the start of August, its lowest level since May 2023. This now means that average rates on fixed bonds and fixed ISAs (including one-year and longer-term accounts) all sit below 4% for the first time since April 2023.

“Providers have been cutting fixed rates due to fluctuations in swap rates, and anticipation for rates to head downwards in the months ahead. As a result, the average shelf-life of a fixed rate bond fell to 38 days, down from 44 days,” Springall commented.

With rates on a downwards trend, savers who are looking to protect their money from falling rates may find a fixed account more appealing. However, with inflation rising to 3.8% in July and forecast to reach 4%, it’s crucial that savers review their accounts and check the top rates to ensure they’re getting an inflation-beating return on their savings.

Wanting to secure a guaranteed return on your savings? See our charts for the top fixed bonds and fixed ISAs currently available.

When choosing a savings account, it’s important to check all the terms and look out for any bonus rates that only apply for a limited period.

Many providers, particularly challenger banks and newcomers to the savings market, may add bonus rates to their accounts to make them more competitive and attract customers. But, while these bonuses can offer a generous return on your money, savers need to be aware that the interest rate could drop significantly after 12 months, or even as little as three months.

At the start of August, Moneyfacts recorded the highest number of savings accounts with an interest rate bonus in more than a decade, with the highest average bonus recorded across all products.

Bonus rates are particularly common on easy access ISAs, with the top four accounts all including a bonus for a limited period.

Any savers who take out one of these accounts with a bonus rate should set a reminder when the bonus expires, so they can check if they are still receiving a competitive return or if they should switch to a higher-paying account.

Our charts are regularly updated throughout the day to show the latest savings rates and ISA rates currently available.

Alternatively, our weekly savings roundup and ISA roundup show a summary of the top rates in the market.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.