Many average savings and ISA rates also increased month-on-month.

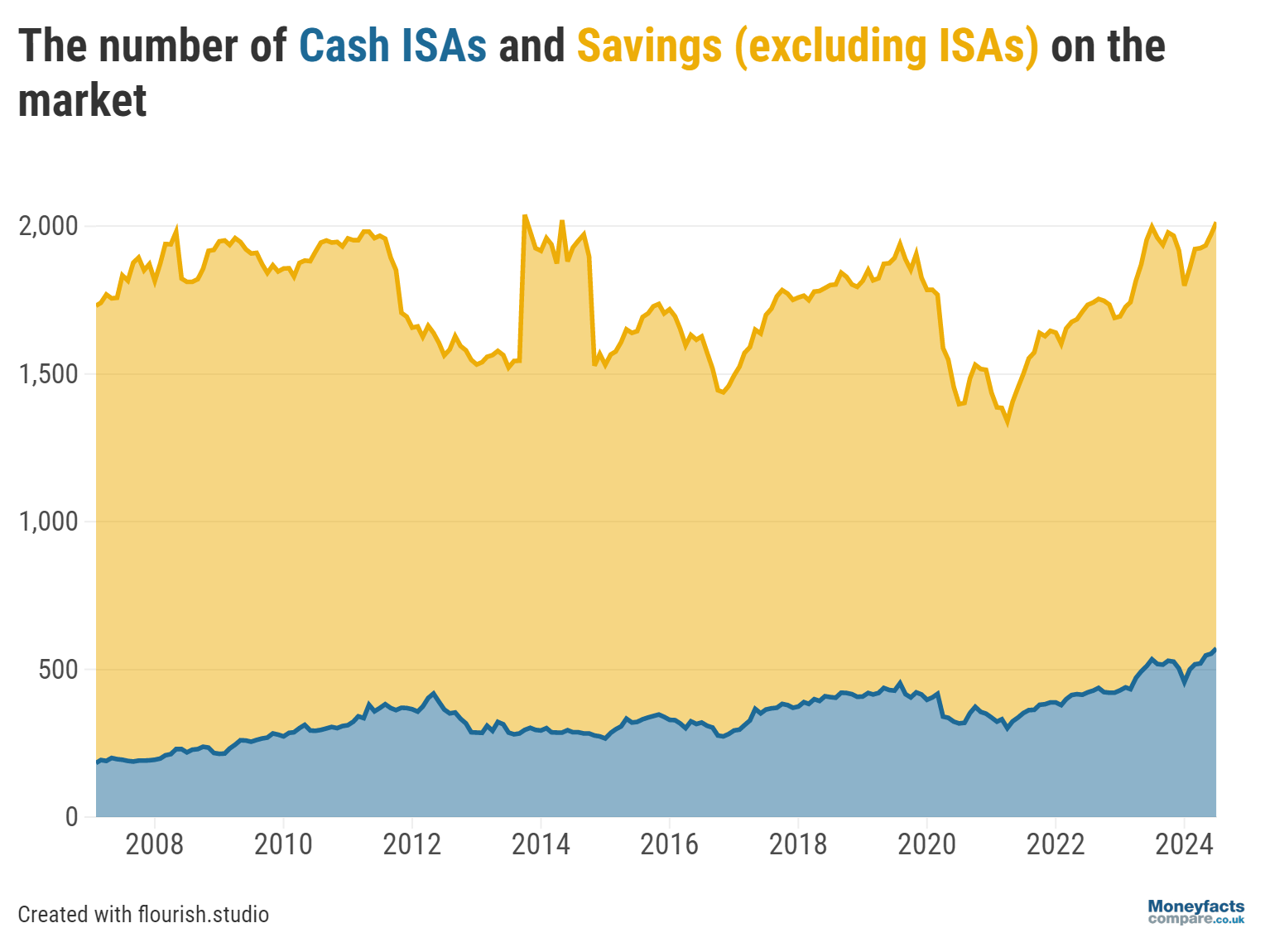

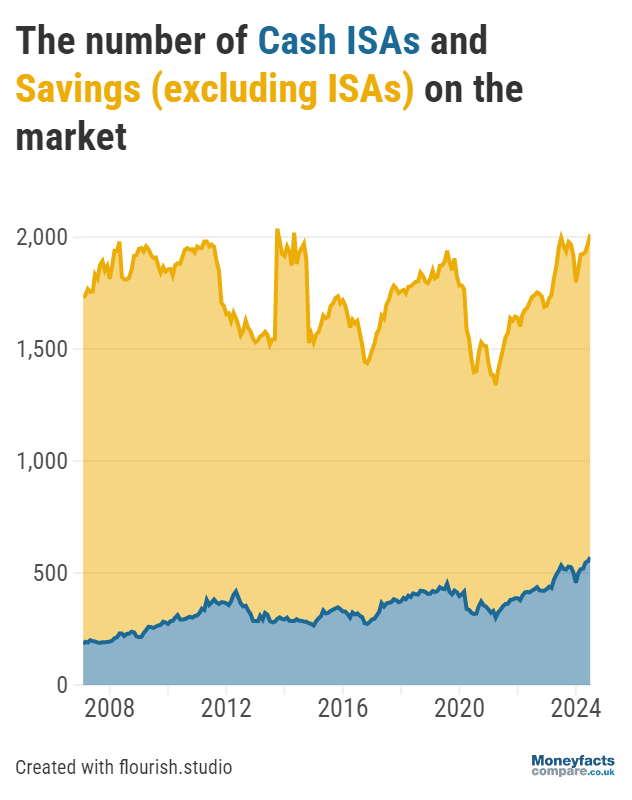

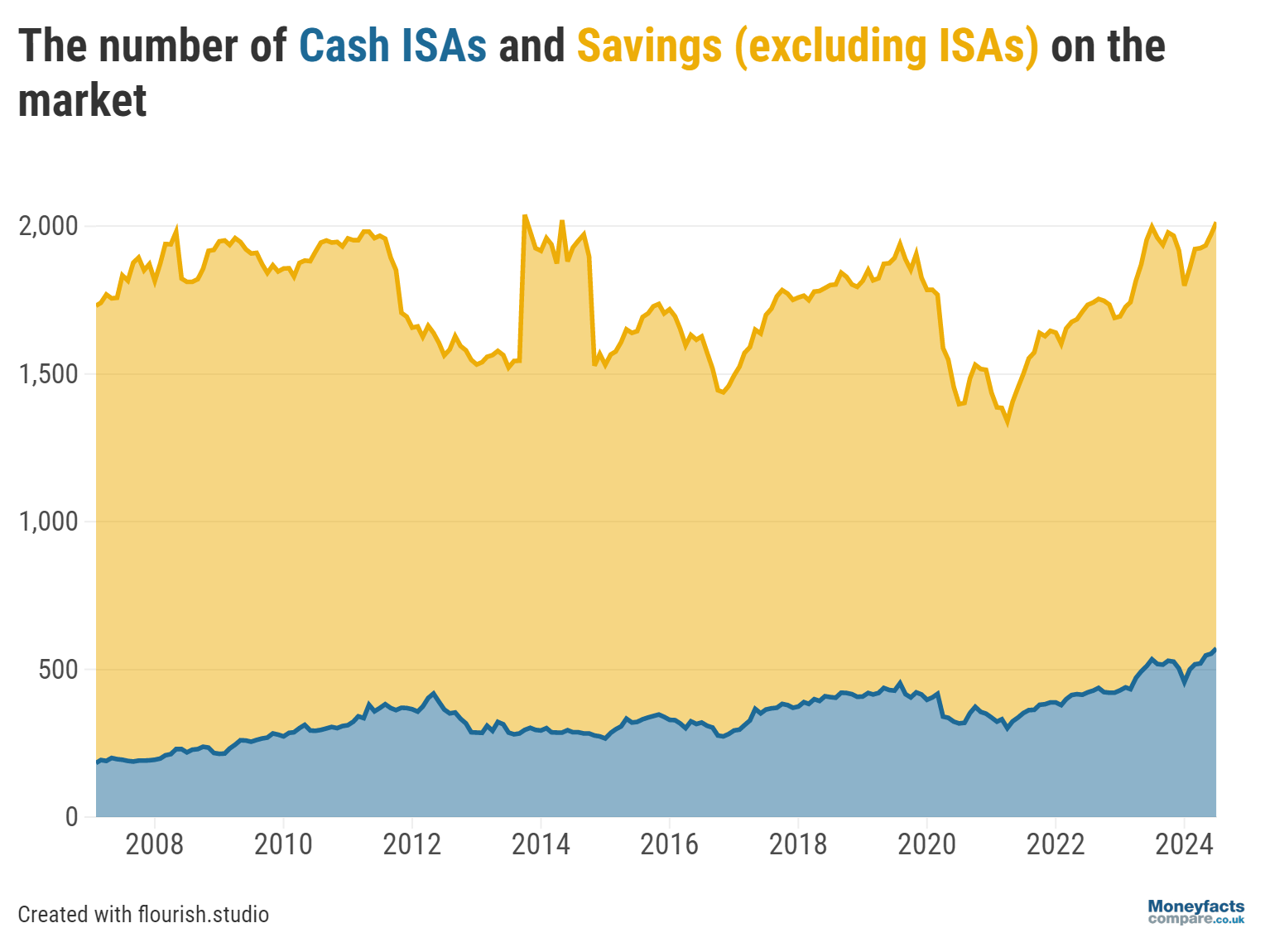

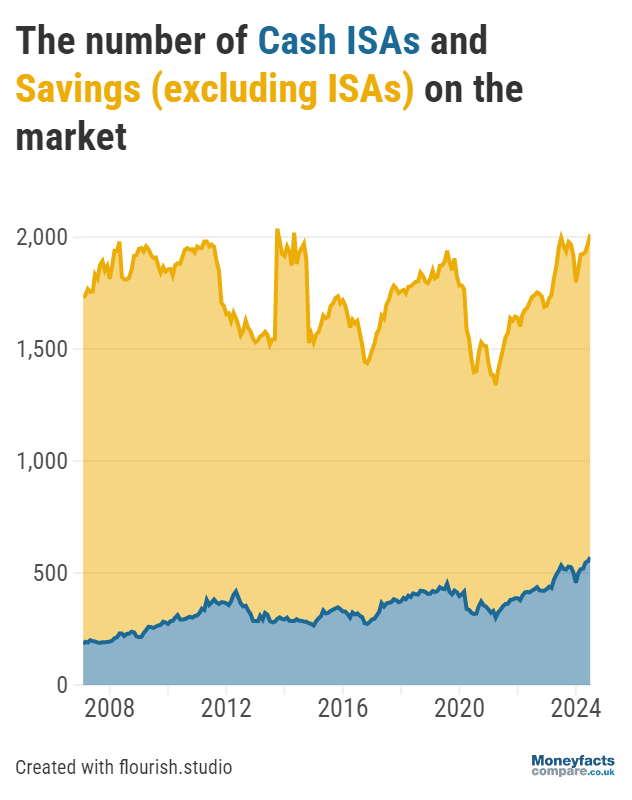

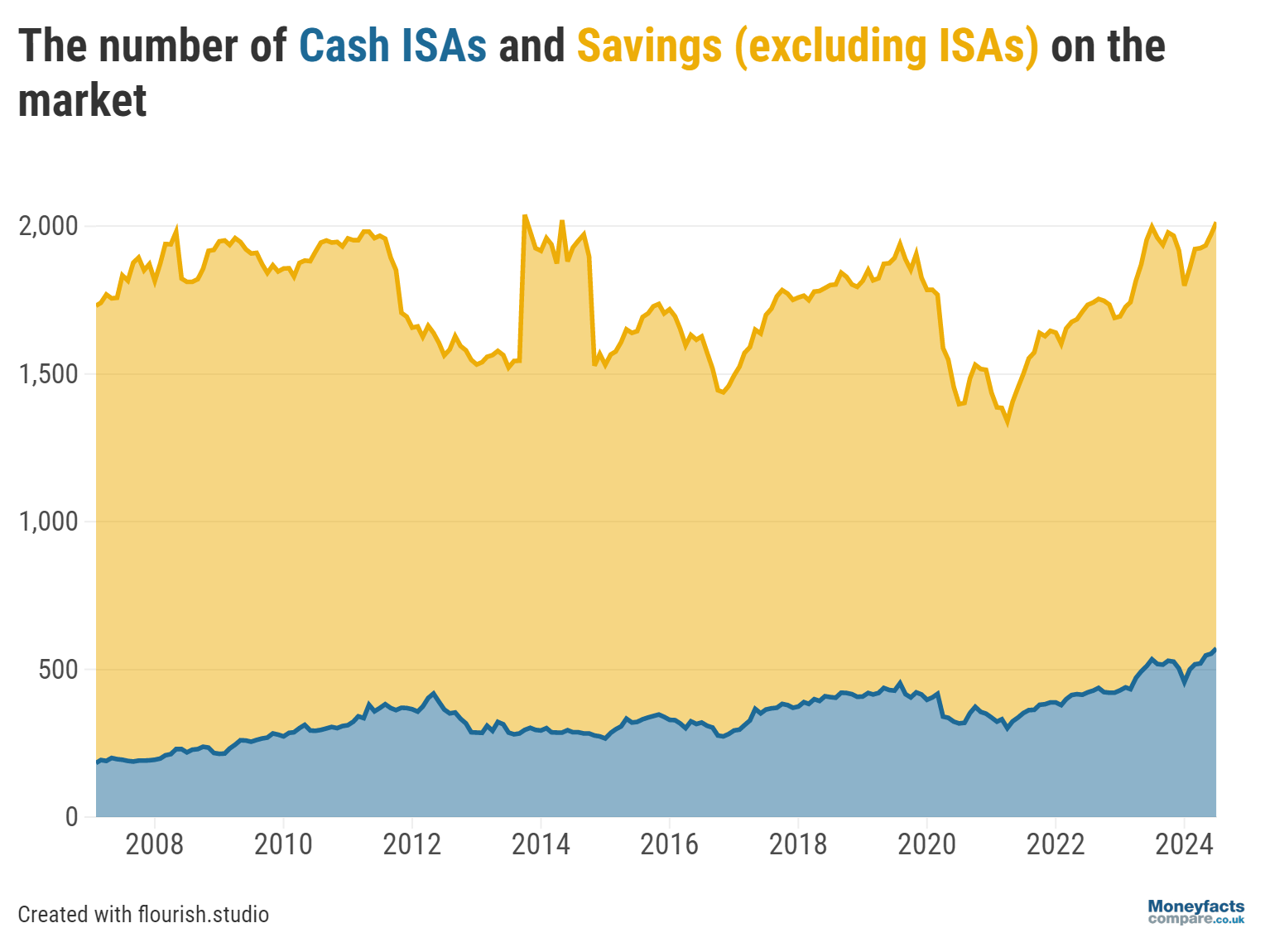

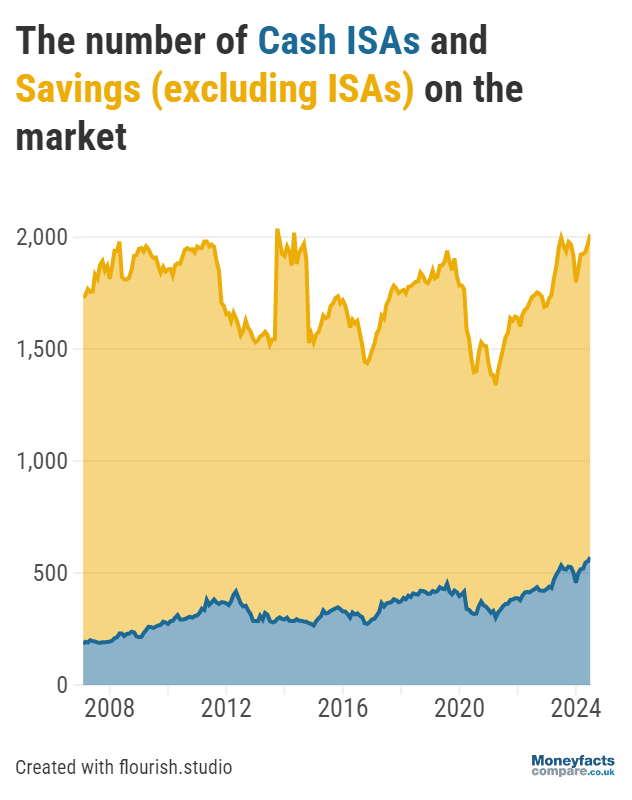

The number of savings products (including ISAs) on the market rose to 2,014 at the start of July, according to the Moneyfacts UK Savings Trends Treasury Report. This marks its highest level since May 2012 and compares to 1,973 products this June.

Cash ISAs also saw a month-on-month rise in deals to 571 accounts, the highest count since Moneyfacts’ electronic records began in 2007.

The number of Cash ISAs on the market has grown by 114 in the past six months alone.

Graph: Product choice for cash ISAs and savings accounts (excluding ISAs) between February 2007 and July 2024.

Alongside more deals for consumers to choose from, the number of providers offering savings accounts also increased to 144 in July, another all-time high for Moneyfacts’ records.

Back in 2012, when product choice was last over 2,000, this number was only 116.

“A rise in both product choice and providers can instil an optimistic view for the savings market, particularly if the new participants are eager for deposits to fund their future lending and boost their rates to stand out from their peers,” explained Rachel Springall, Finance Expert at Moneyfactscompare.co.uk.

Moneyfacts’ data also found that average rates across various sectors rose between June and July.

More choice and higher rates may therefore prompt many to consider whether they’re receiving the most competitive returns on their savings.

Average rates for a one-year fixed bond jumped up significantly from 4.59% to 4.65%, while rates for longer-term term bonds saw a smaller increase from 4.13% to 4.16%.

Short-term bonds have consistently outperformed longer-term accounts since August 2023 when the base rate was last changed.

However, should the Bank of England Monetary Policy Committee (MPC) decide to cut the base rate, longer terms may again become more tempting.

Despite inflation holding at 2%, experts are still undecided about potential changes to interest rates next month.

“As murmurs continue of a cut to the Bank of England base rate in August, variable rate accounts could face cuts,” said Springall.

Some variable sectors are already seeing reductions, with average easy access rates declining to 3.11% between June and July.

As a result, it’s worth reviewing your savings to ensure you’re getting a good rate, and not missing out.

You can visit our savings and ISA charts, which are regularly updated to show the best rates currently available.

Our weekly savings and ISA roundups can also give more information on accounts offering competitive returns.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.