As tax on interest from savings accounts for a growing portion of Income Tax liabilities.

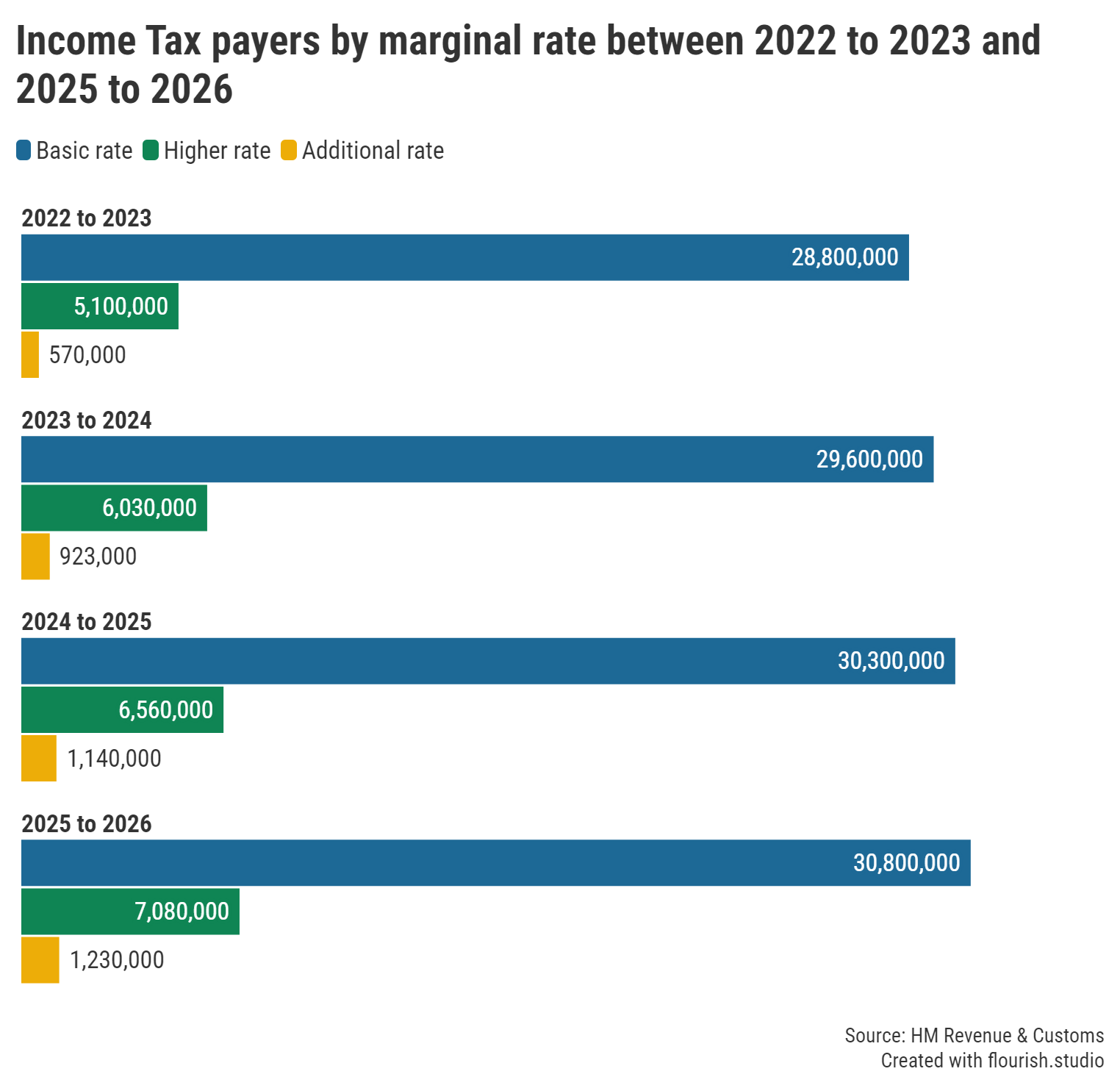

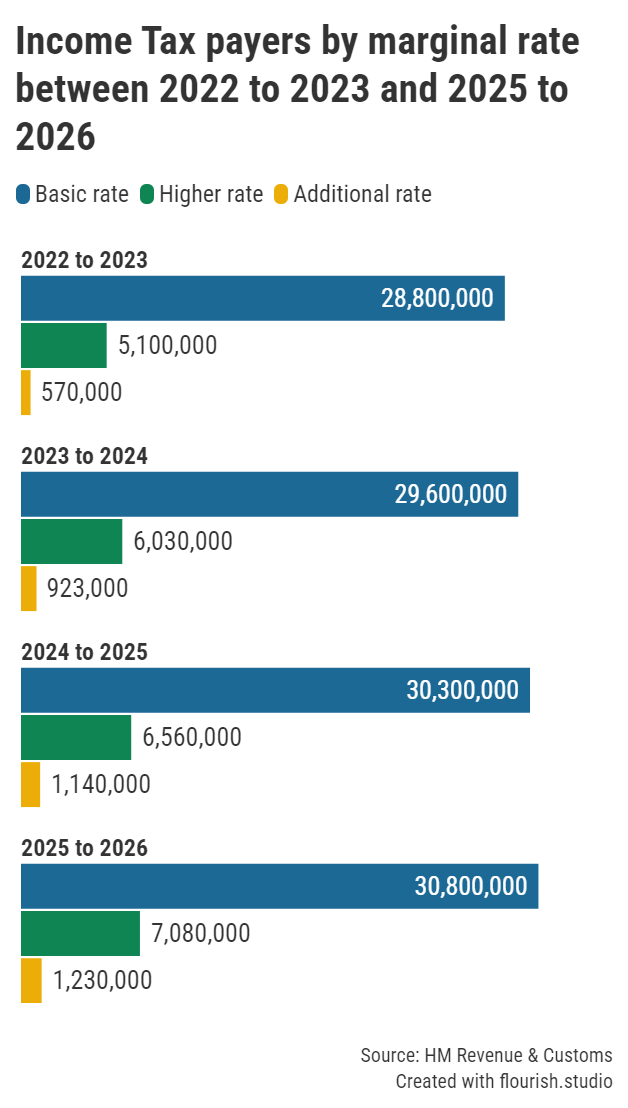

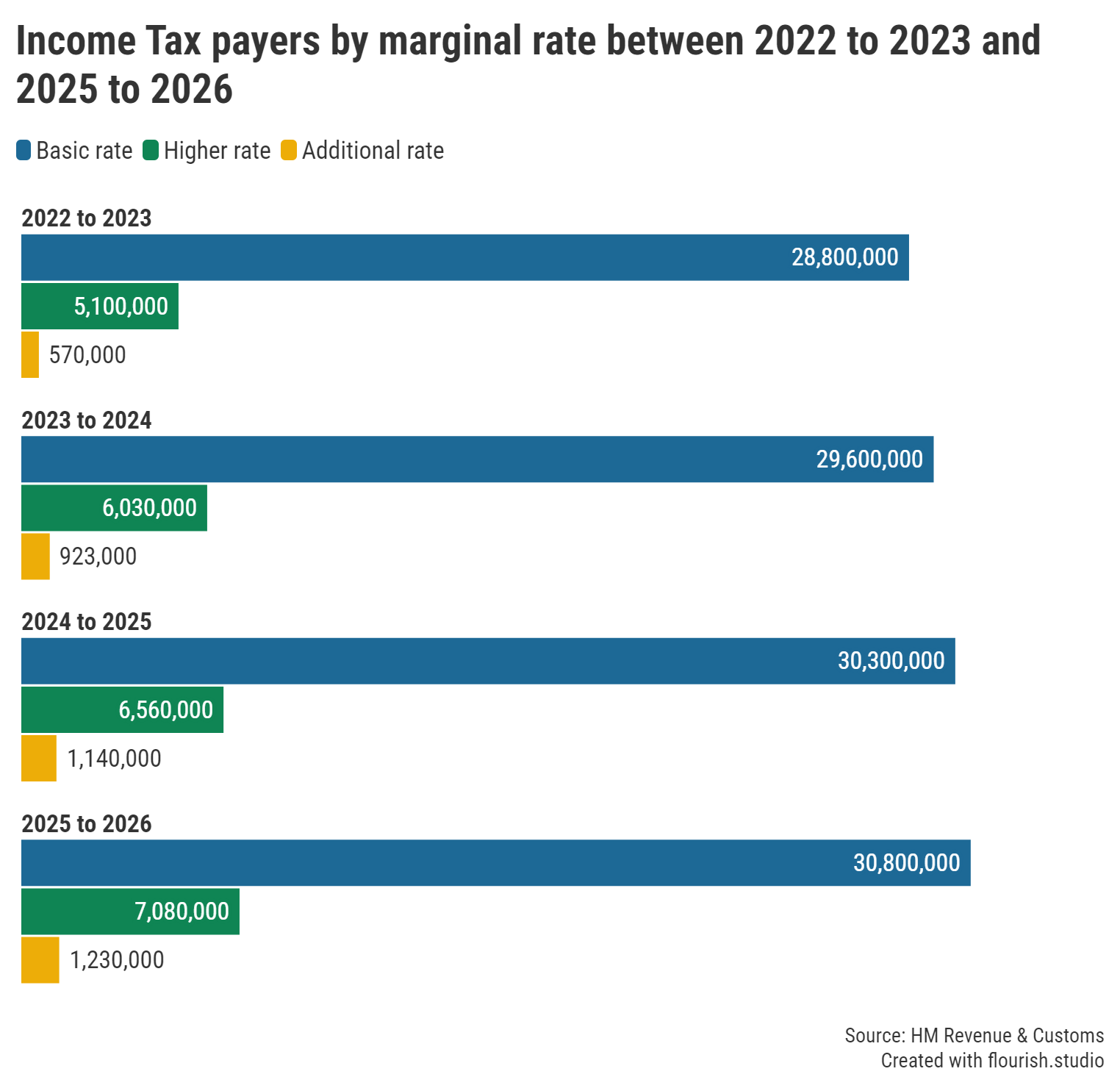

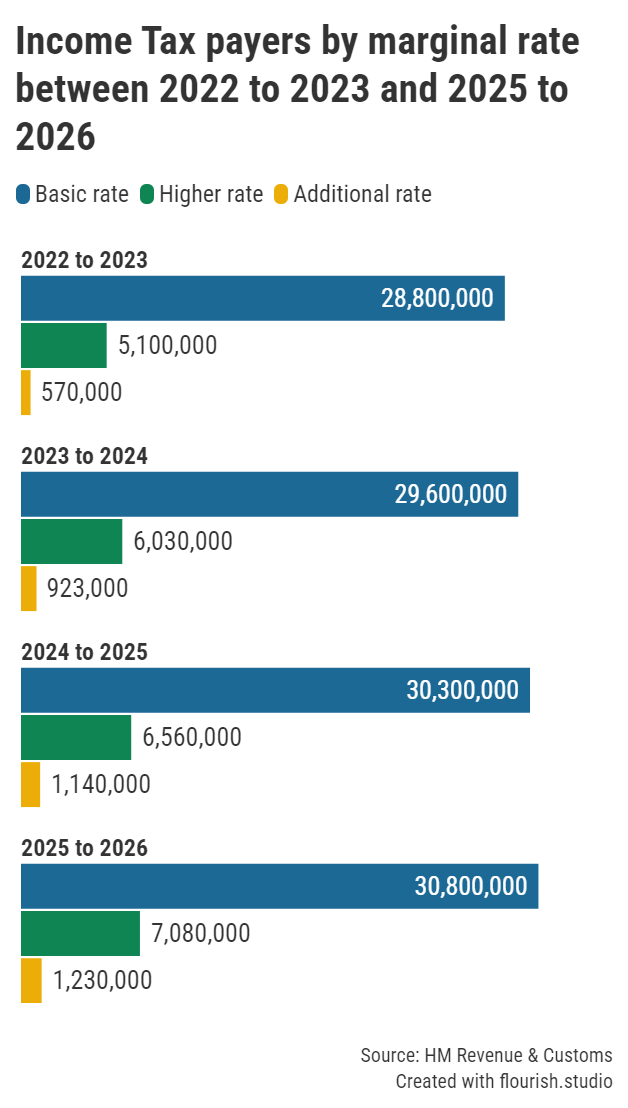

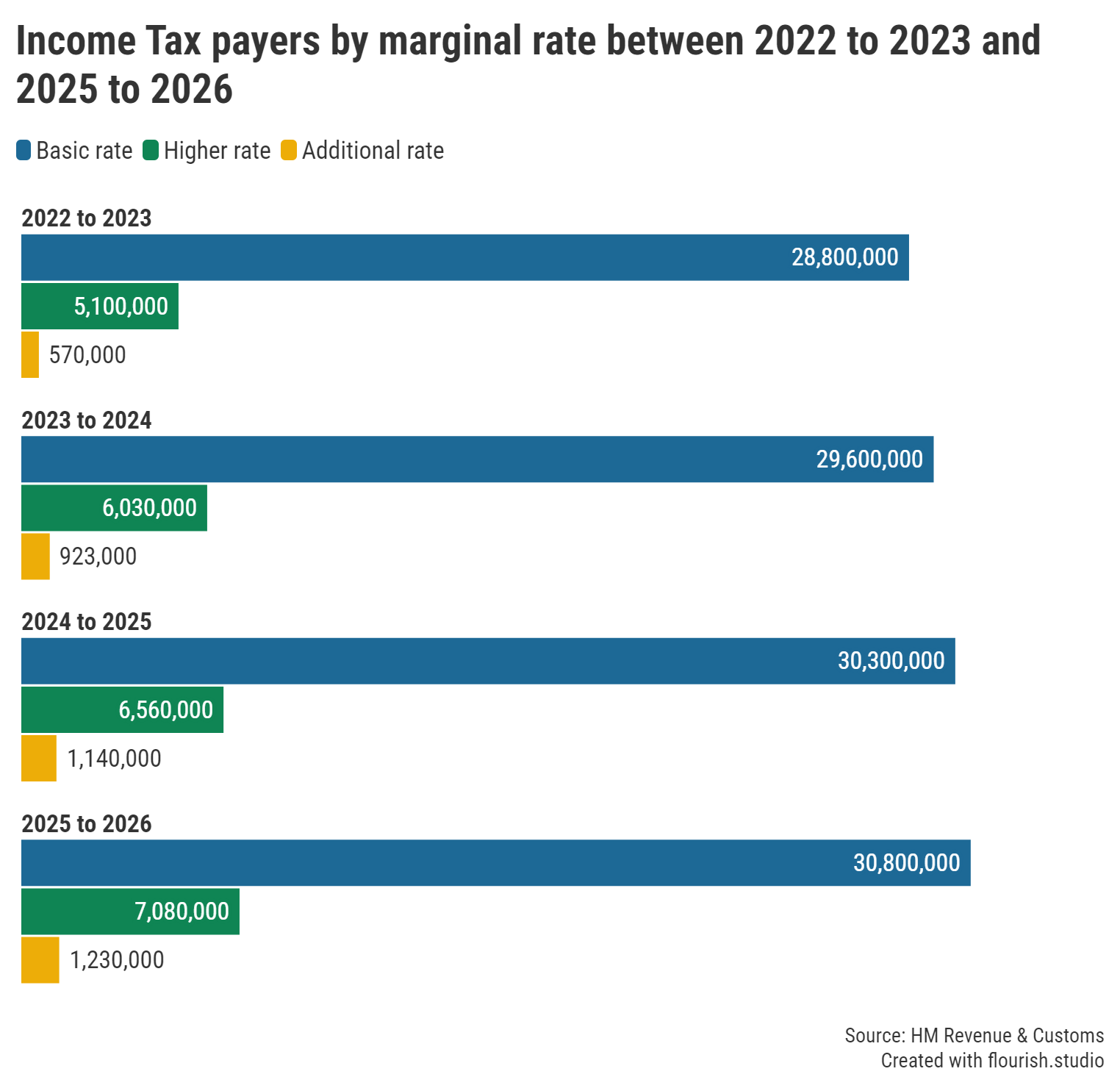

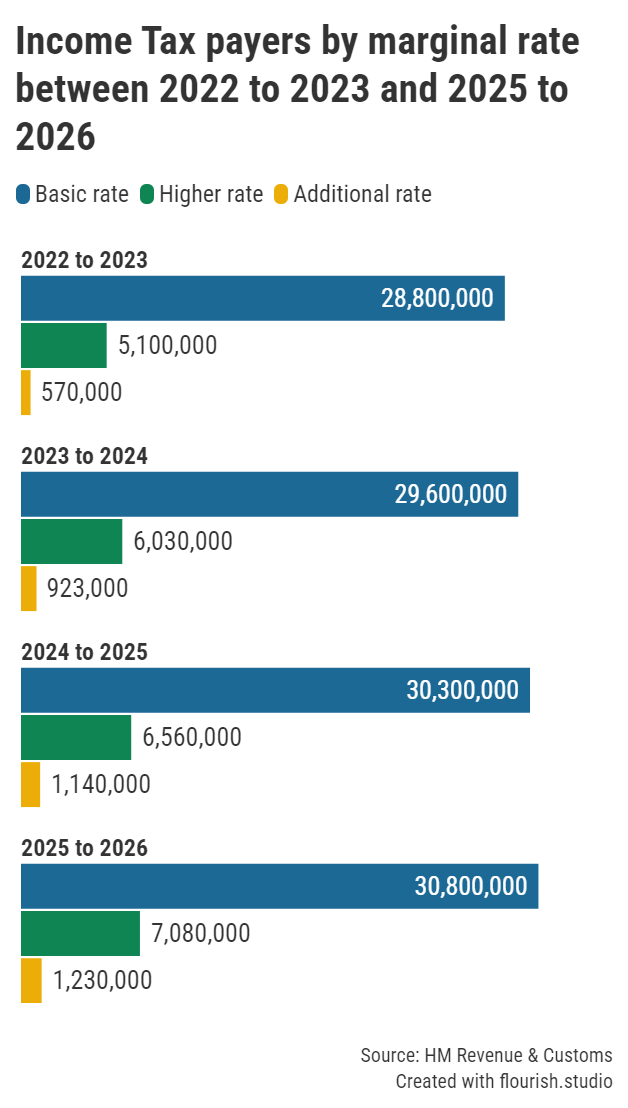

Over seven million people are set to pay higher-rate tax in the 2025/26 tax-year, the latest Income Tax liabilities statistics from HMRC today revealed. This marks a substantial 38.7% increase from 5.1 million higher-rate taxpayers in the 2022/23 tax-year.

Worryingly for those being dragged up the tax ladder, higher-rate taxpayers receive a smaller Personal Savings Allowance (PSA) and can earn just £500 in interest from their savings before being taxed (compared to £1,000 for basic-rate taxpayers).

While tax on savings interest accounts for just 1.9% of the £323 billion expected to be generated by Income Tax within the current tax-year, this portion has grown significantly from 0.8% in the 2022/23 tax-year, which HMRC attributes to changes in interest rates since 2021.

Graph: The number of basic-, higher- and additional-rate taxpayers each tax-year between 2022/23 and 2025/26.

With a typical easy access account paying just 0.33% at the start of the 2022/23 tax-year (gross, based on first-of-month data) only higher-rate taxpayers holding hundreds of thousands of pounds in such accounts were at risk of breaching their PSA.

In the years following, average returns in the sector rocketed above 3.00%. Despite having since cooled, a typical easy access account continued to pay a more generous 2.77% at the beginning of the 2025/26 tax-year – threatening higher-rate taxpayers with balances just over £18,000 or more with a bill from the taxman.

Those earning between £50,271 and £125,140 in taxable income pay tax at the higher rate of 40%.

Since 2021, more people have become higher-rate taxpayers due to a combination of wage inflation and frozen income tax bands (otherwise known as ‘fiscal drag’). The freeze is expected to last until April 2028.

With plenty of savings accounts still offering above average returns, those wanting to earn a competitive rate without worrying about their hard-earned cash being diminished by tax could consider an ISA. “Cash ISAs [are] seen as a tax-free sanctuary for millions of savers, especially for those who now have to pay higher-rate tax at 40%,” explained Rachel Springall, Finance Expert at Moneyfactscompare.co.uk.

The annual ISA allowance enables savers to deposit a combined total of up to £20,000 across these accounts each tax-year, on which they’ll accrue tax-free interest. As a result, they’re a popular choice among those looking to save tax-efficiently, with recent figures from the Bank of England revealing households poured a record £14 billion into ISAs throughout April.

Those yet to make the most of their annual allowance would be wise to explore their options. “Shopping around is a crucial at a time when more brands have taken residence in the cash ISA market, and the most attractive returns are on the shelf from challenger banks,” said Springall.

Digital providers Chip, Plum and Trading 212 currently occupy top spots on our easy access ISA chart with accounts offering in the region of 5.00% AER.

Last updated: 26/06/2025

Account: Chip Cash ISA

Notice: None

Rate: 5.00% AER (includes a bonus)

Transfers In: Cash ISA

Account: Plum Cash ISA

Notice: None

Rate: 4.92% AER (includes a bonus)

Transfers In: Cash ISA, LISA, Stocks and Shares ISA, Stocks and Shares LISA, Help to Buy ISA, Innovative Finance ISA, Cash APS ISA, Stocks and Shares APS ISA

Account: Cash ISA Promo Rate

Notice: None

Rate: 4.92% AER (includes a bonus)

Transfers In: N/A

Meanwhile, those wanting a rate guaranteed to remain the same over a course of a term will find Cynergy Bank, United Trust Bank and Close Brothers Savings lead our fixed ISA charts.

However, Springall urged savers to “ensure they understand any specific caveats for any cash ISA, particularly as some of the best rates include short-term bonuses or may only be available via mobile app”, excluding those who prefer more traditional methods of banking.

Our ISA charts are regularly updated throughout the day to show the best rates currently available. Alternatively, you can find out more about accounts offering the most competitive rates with our weekly ISA roundup.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.