Though there are signs of this rate-cutting momentum slowing in the one-year sector.

Fixed rate bonds weather yet another wave of cuts, as top returns across various sectors were found to have fallen month-on-month.

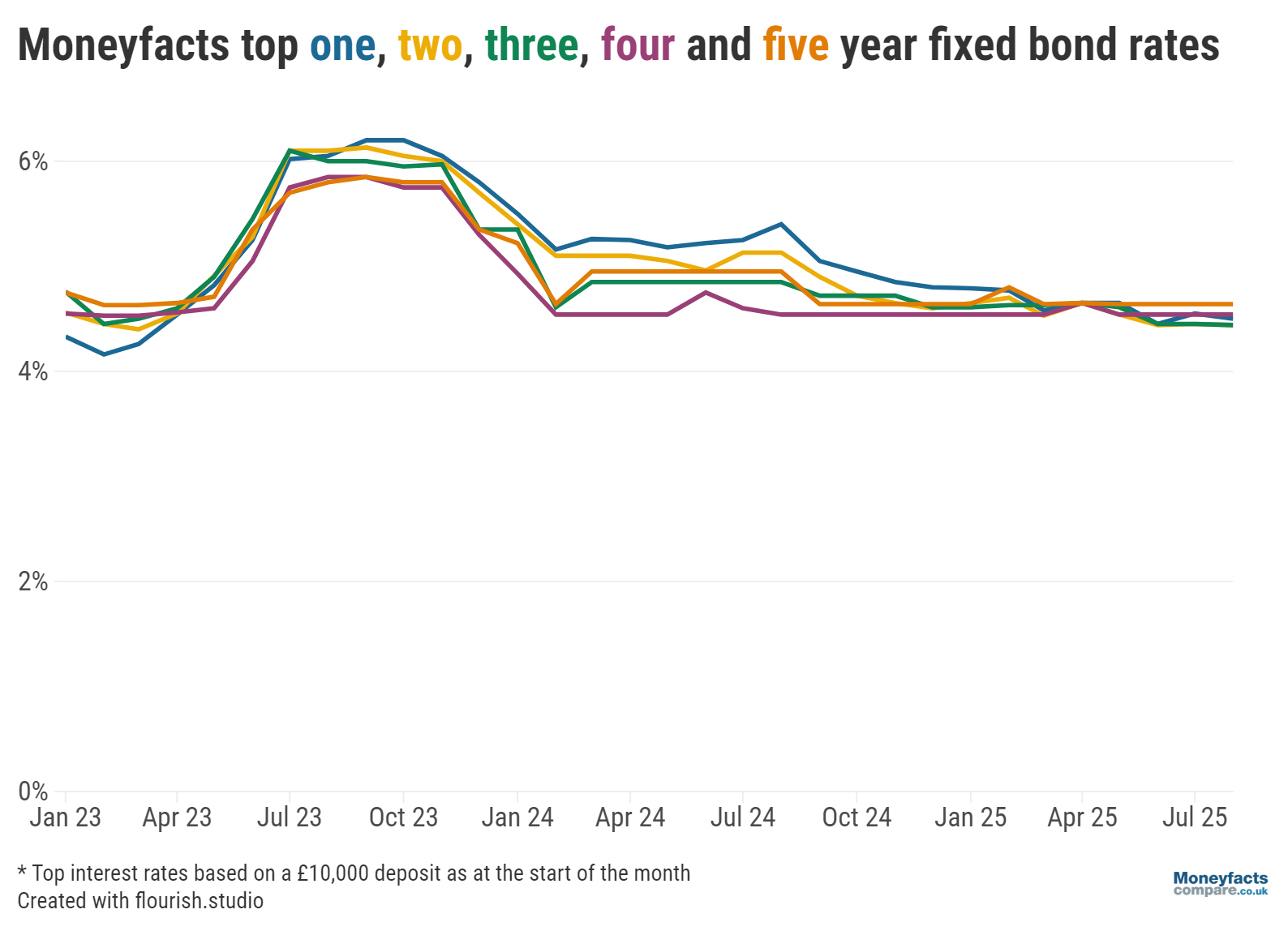

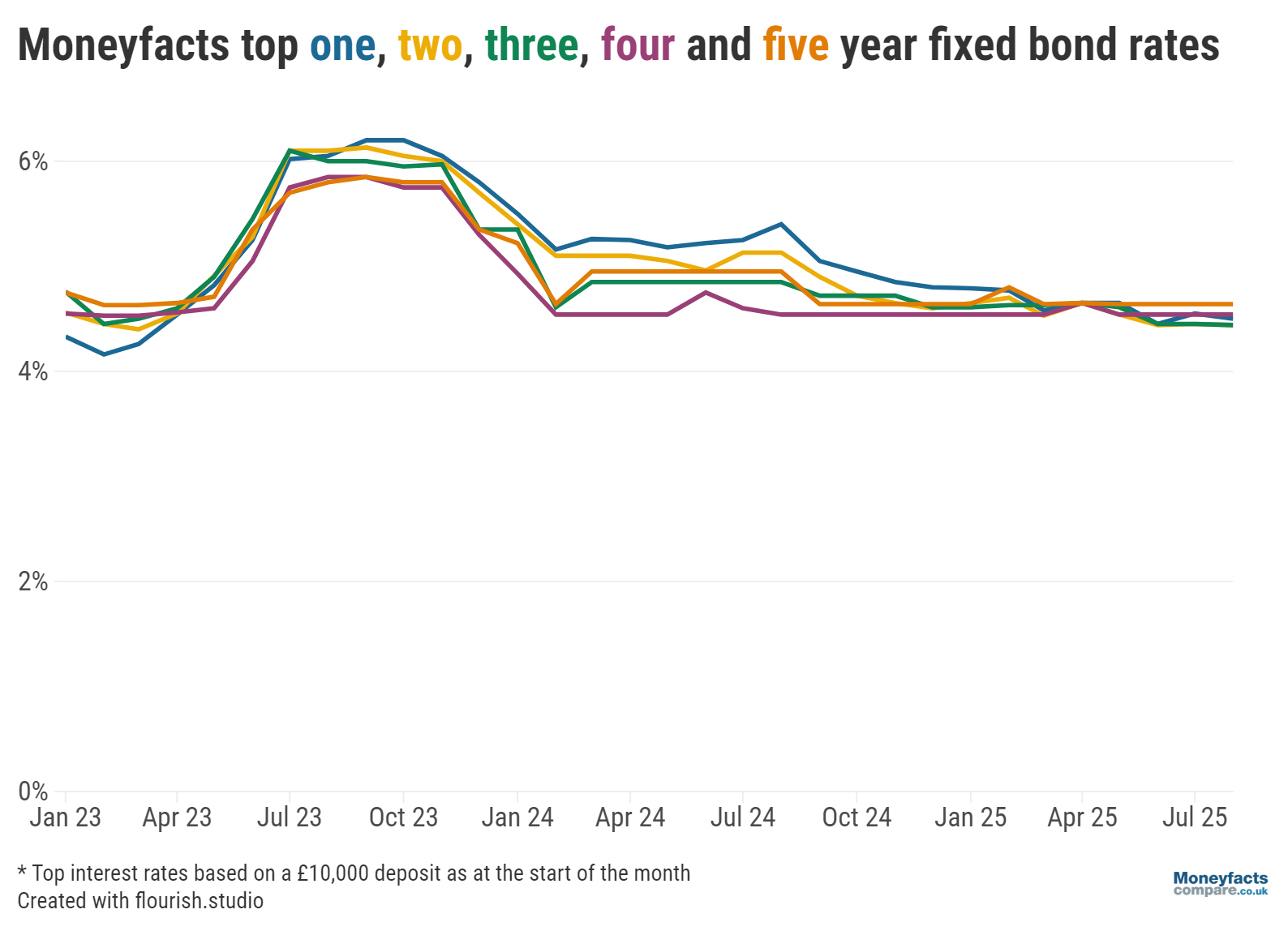

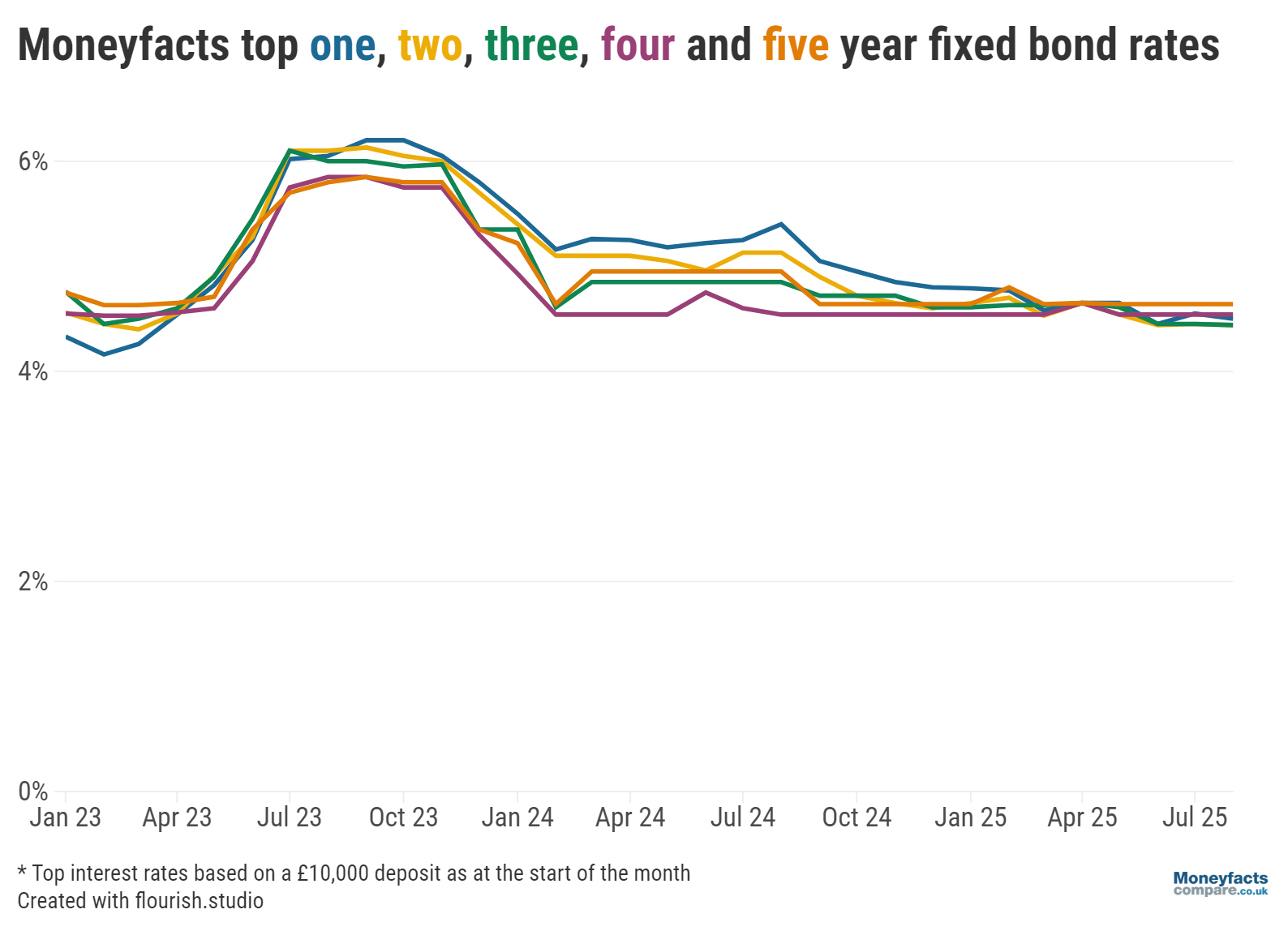

Analysis from Moneyfactscompare.co.uk revealed that, as of the first of the month, the leading one-year rate dropped from 4.55% in July to 4.50% in August, while top returns for both two- and three-year bonds slipped from 4.45% to 4.44%. Meanwhile, longer four- and five-year terms proved more resilient by holding firm at 4.54% and 4.64% respectively.

Graph: Top fixed savings rates between January 2023 and August 2025.

It’s a similar story when looking at average rates, with four- and five-year bonds being the only sectors to escape reductions over the same timeframe.

Encouragingly, despite this downward trend, the top one-year bond fell by its smallest margin in six months, a positive sign for those on the fence about locking in returns over the short-term. Unfortunately, the same cannot be said for those nearing the end of a competitive one-year bond looking to re-invest.

These savers are likely to find themselves short-changed considering top returns sat considerably higher at 5.40% as of August 2024, which based on a £10,000 deposit, could see them £90 worse off.

Among the largest influences behind falling fixed rates have been the multiple cuts to the Bank of England base rate this year. As of yesterday (7 August), this central interest rate was reduced from 4.25% to 4.00% - the lowest it’s been in almost two and a half years (March 2023), and follows previous cuts made in May and February.

Although a base rate cut typically has a larger impact on variable returns, “it is not unheard of for providers to also factor this into their fixed rate pricing”, as suggested by Caitlyn Eastell, Spokesperson at Moneyfactscompare.co.uk. This may have been further amplified as this cut was widely anticipated by the market, which likely caused many providers to begin altering rates even before any base rate changes have been officially announced.

Indeed, in the week between 1 August and the base rate announcement, providers continued to re-adjust top fixed rates – leading four- and five-year fixed rates were hit the hardest, having fallen considerably to a much lower 4.40% AER and 4.52% AER respectively. Conversely, one-year returns held fast (though have since dropped to 4.44% AER as of 8 August) while the best two- and three-year rates have since climbed higher to 4.46% AER.

Last updated: 13/08/2025

Account: 1 Year Fixed Rate Bond

Term: 1 Year Bond

Rate: 4.50% AER

Account: Prosper - 2 Year Fixed Term Deposit

Term: 2 Year Bond

Rate: 4.46% AER

Account: Prosper - 3 Year Fixed Term Deposit

Term: 3 Year Bond

Rate: 4.46% AER

Account: Fixed Term Savings Account

Term: 4 Year Bond

Rate: 4.40% AER

Account: Fixed Term Savings Account

Term: 5 Year Bond

Rate: 4.52% AER

Top interest rates correct as of 7 August 2025.

These latest figures may give many savers pause for thought about committing to a fixed term, however, these accounts may still be worth considering. Since yesterday’s base rate announcement, for instance, the leading easy access rate has already been slashed from 5.10% AER to 5.00% AER and could continue to fall in the coming weeks, increasing the appeal of locking in returns sooner rather than later.

This, coupled with sticky inflation, which soared to an 18-month high of 3.6% in June, makes it even more important for savers to actively hunt for accounts that out-pace the rise in costs of goods and services, ensuring their investments are earning money in real terms.

“Loyalty is not always rewarded, so it is important that savers don’t leave their hard-earned cash languishing in a savings account earning poor interest for the sake of convenience,” Eastell explained.

“The Moneyfacts Average Savings Rate currently sits around 3.50%, which is a good ballpark figure to ensure savers do not miss out on the next attractive deal once their current bond matures,” she continued.

You can compare the latest top-performing fixed rate bonds over on our regularly updated charts, whether you're looking to secure returns for five-years or even up to one-year.

Meanwhile, if you want a quick overview of the top returns available, why not check out our weekly savings roundup.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.