Despite its first increase since July 2025, the rate of UK inflation is still broadly expected to slow throughout 2026.

The annual rate of inflation rose from 3.2% in November to 3.4% in December 2025, latest figures from the Office for National Statistics (ONS) revealed today.

Several economists had predicted that inflation would see a slight uptick in December, but the recorded increase was higher than many had expected, largely due to rising tobacco and transport costs.

This is likely to be a blow for consumers and their hard-earned money but, more encouragingly, inflation is still forecast to remain on an overall downwards trend.

The key metric that’s used to measure inflation is the Consumer Price Index (CPI). It looks at how the cost of different household goods and services have changed over the past year, to come up with an average, overall rate of inflation.

December’s inflation figure means that, on average, prices are 3.4% higher than the previous year. However, some sectors may have seen a larger increase than this while others may be cheaper than this time last year. See our guide to learn more about inflation and what it means for you.

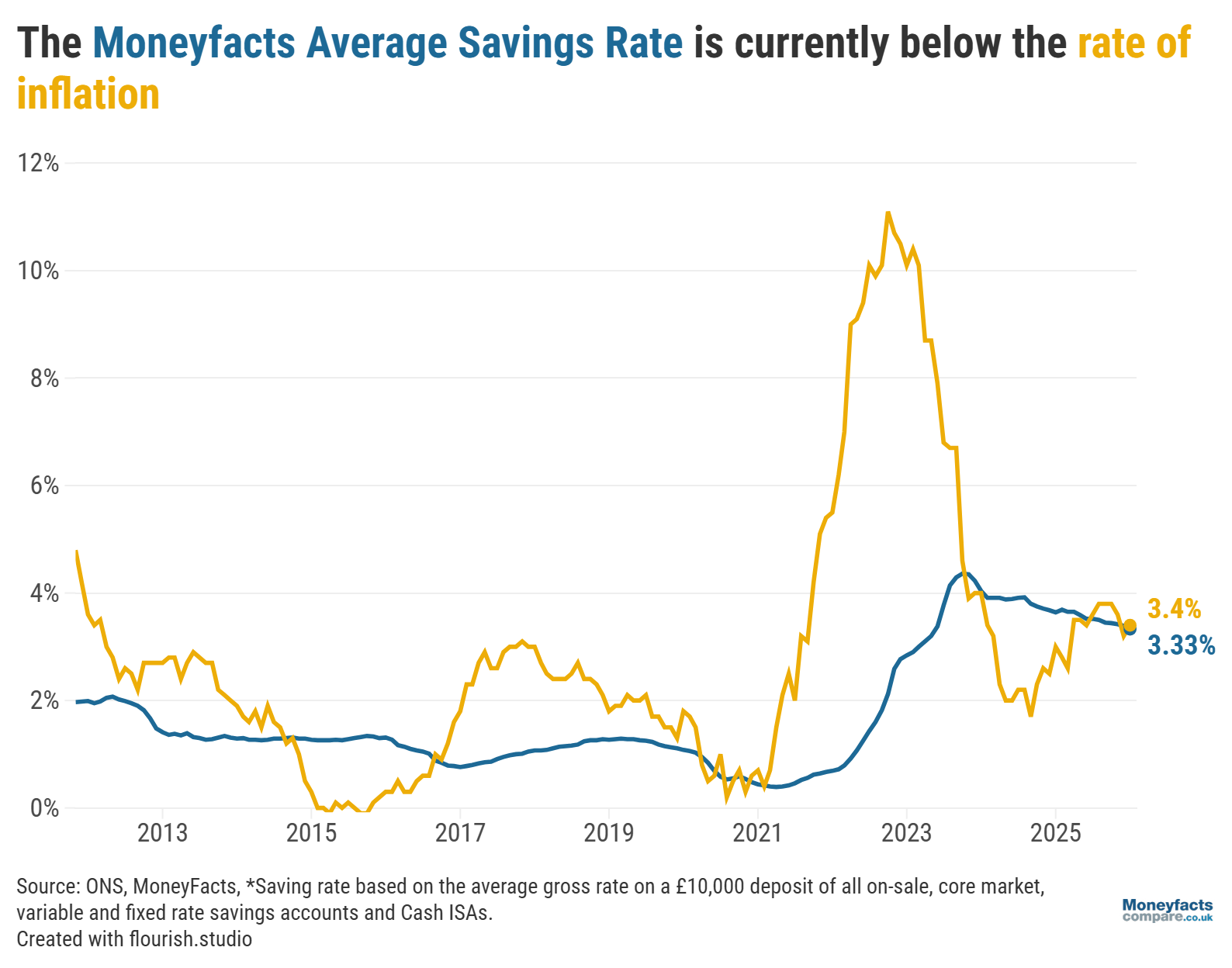

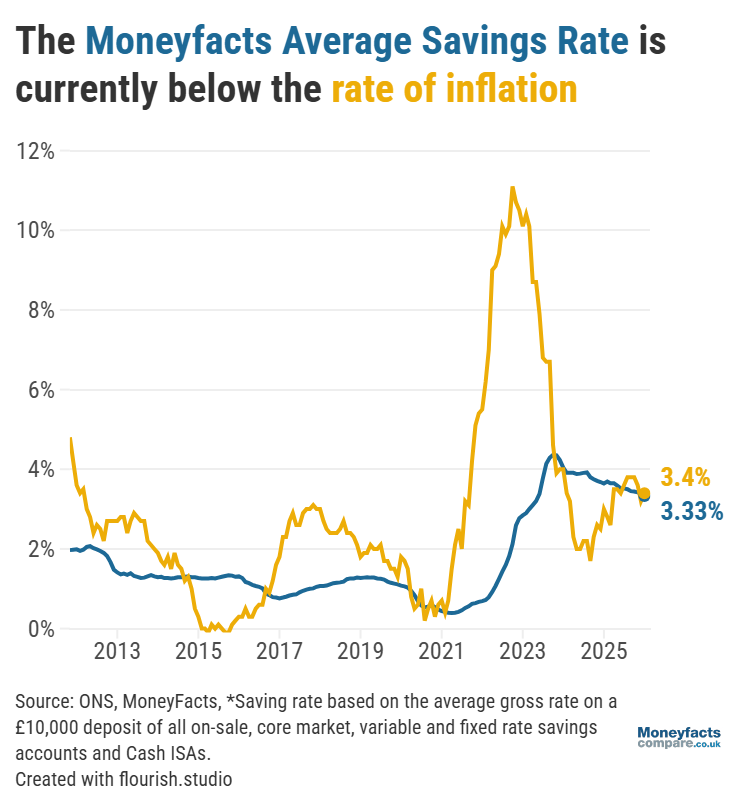

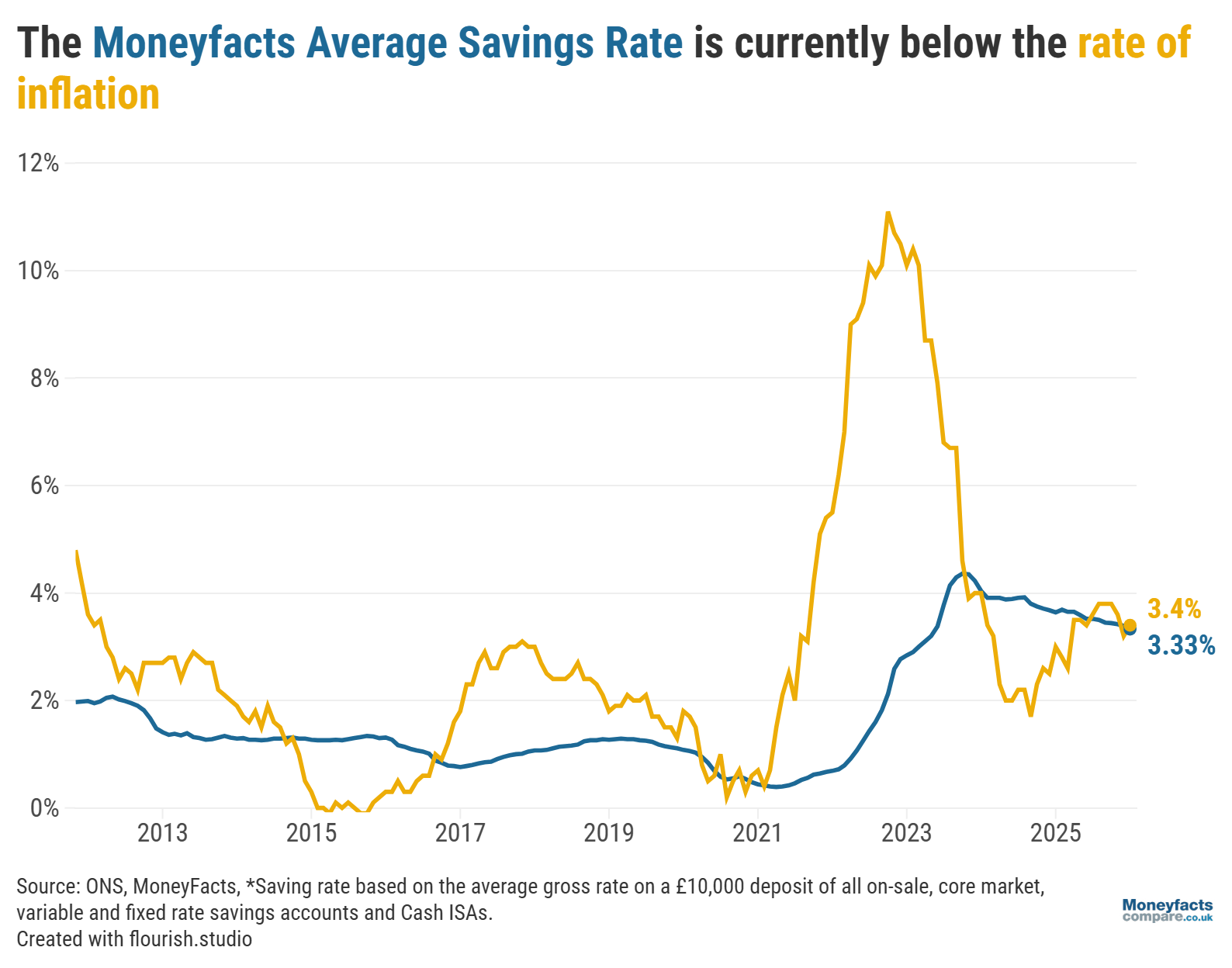

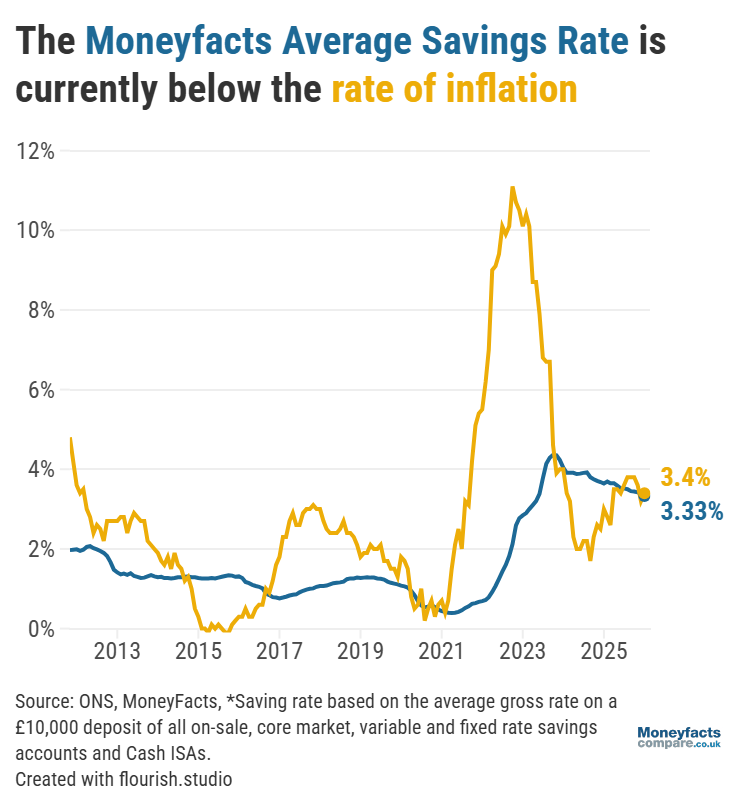

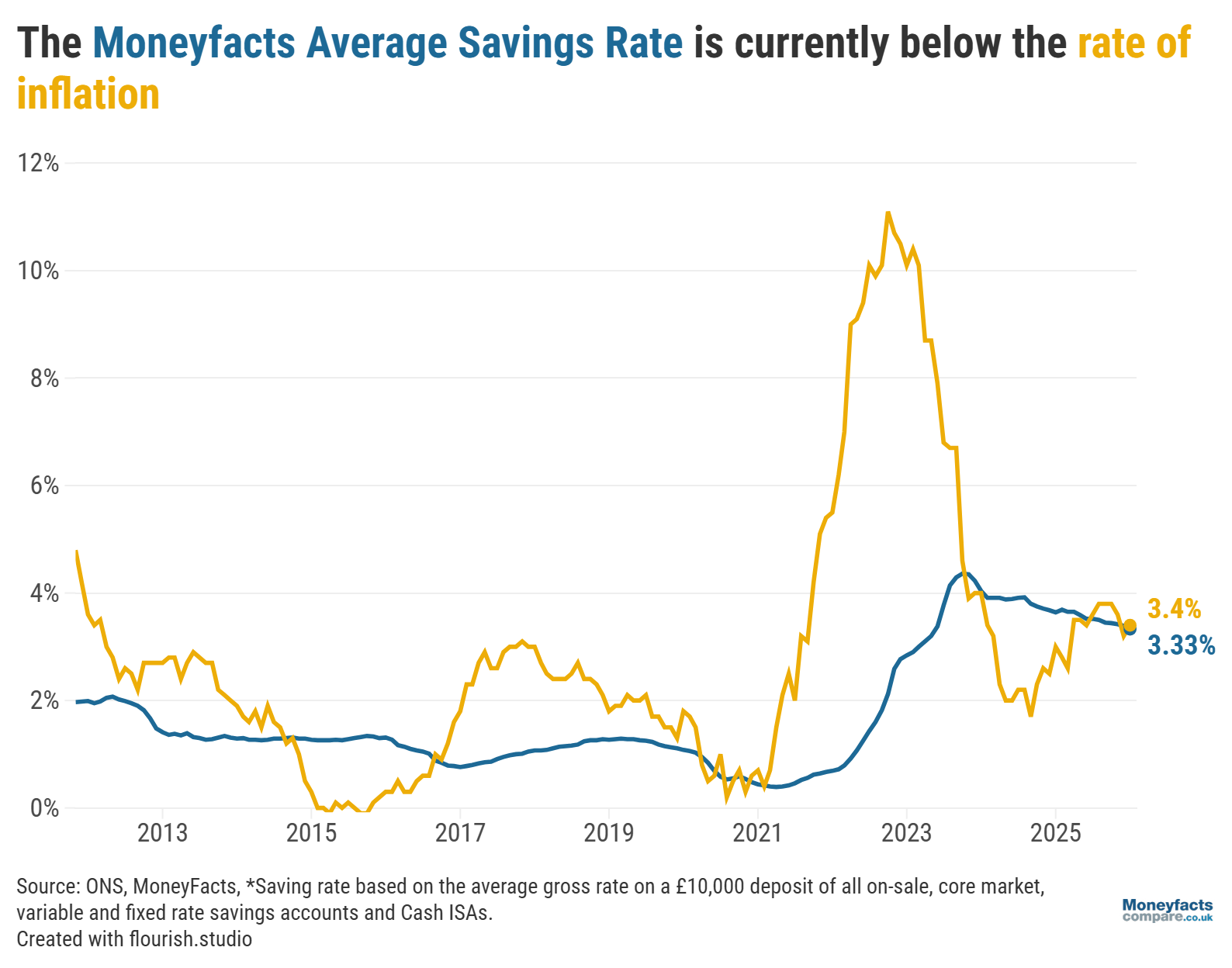

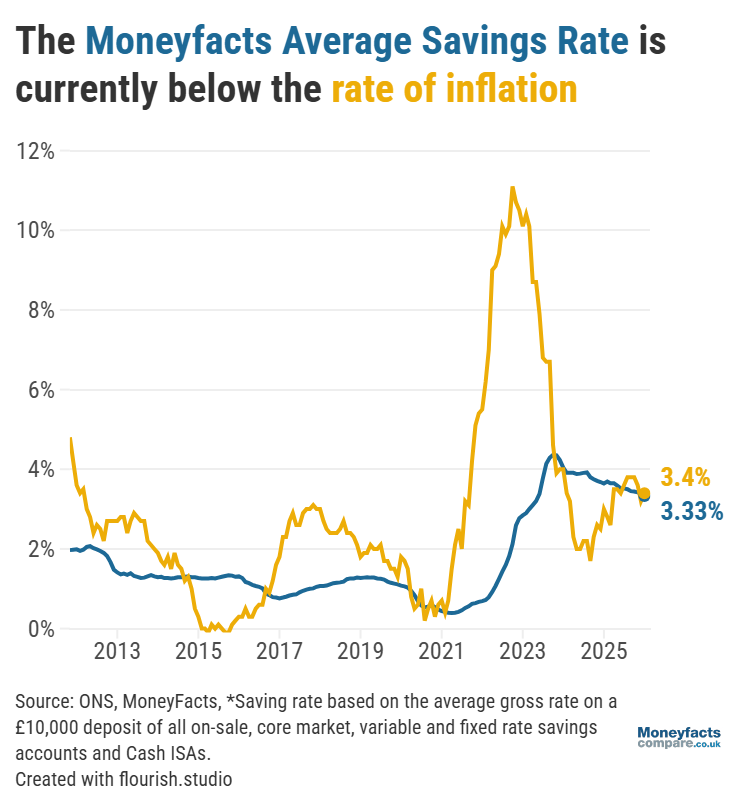

“Inflation is set to fall this year, reaching its target around mid-2026. This will be promising news for savers’ returns as they could grow in ‘real’ value,” Caitlyn Eastell, Personal Finance Analyst at Moneyfactscompare.co.uk, noted.

“However, pair this with tumbling savings rates and savers may find themselves in a similar situation where their accounts are struggling to keep pace,” she warned.

Although Eastell points out that the Bank of England seems unlikely to lower the base rate at its next meeting on 5 February, which could give savers some reprieve, a cut is possible later in the year if inflation eases and gets closer to its 2% target.

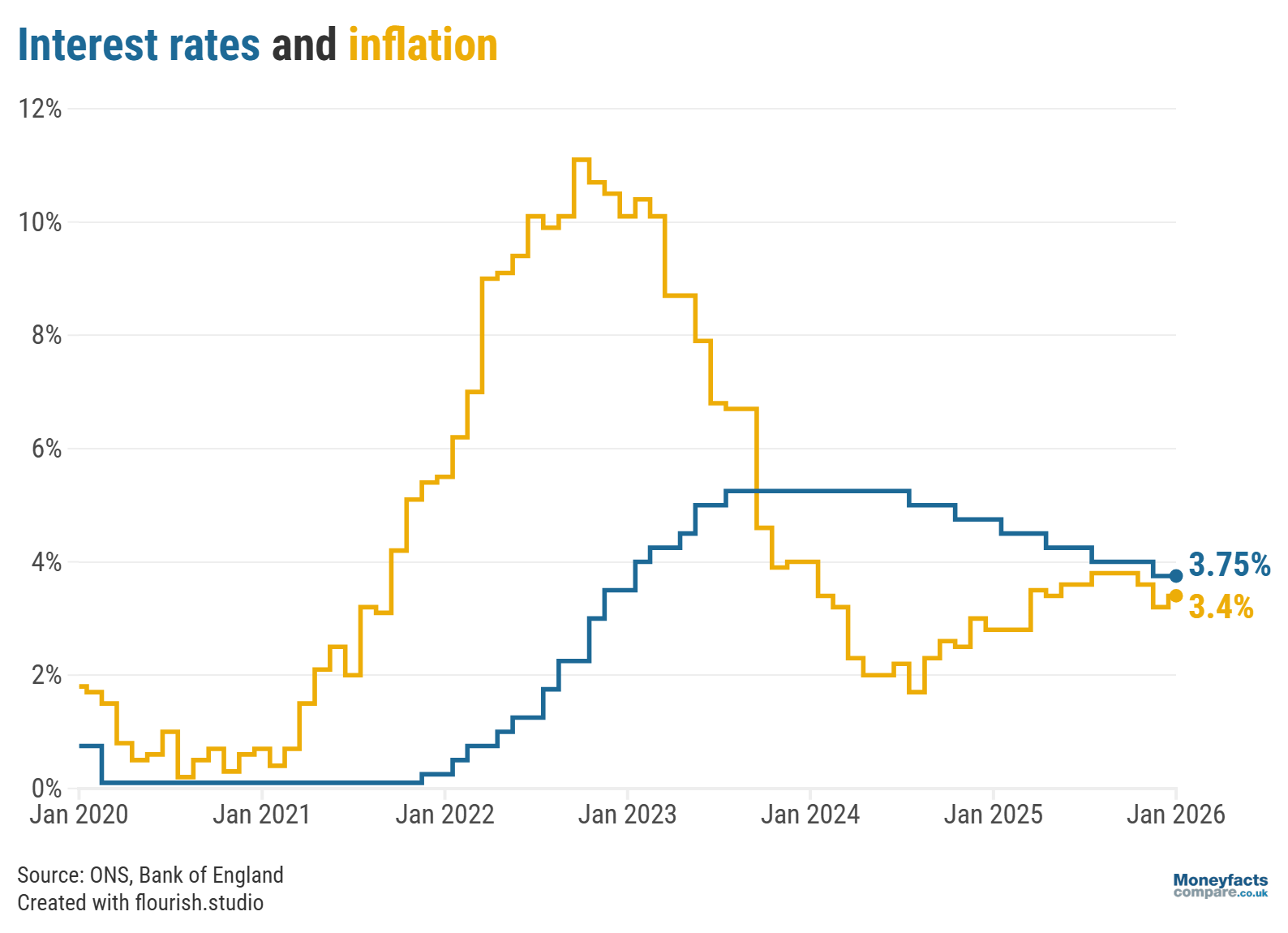

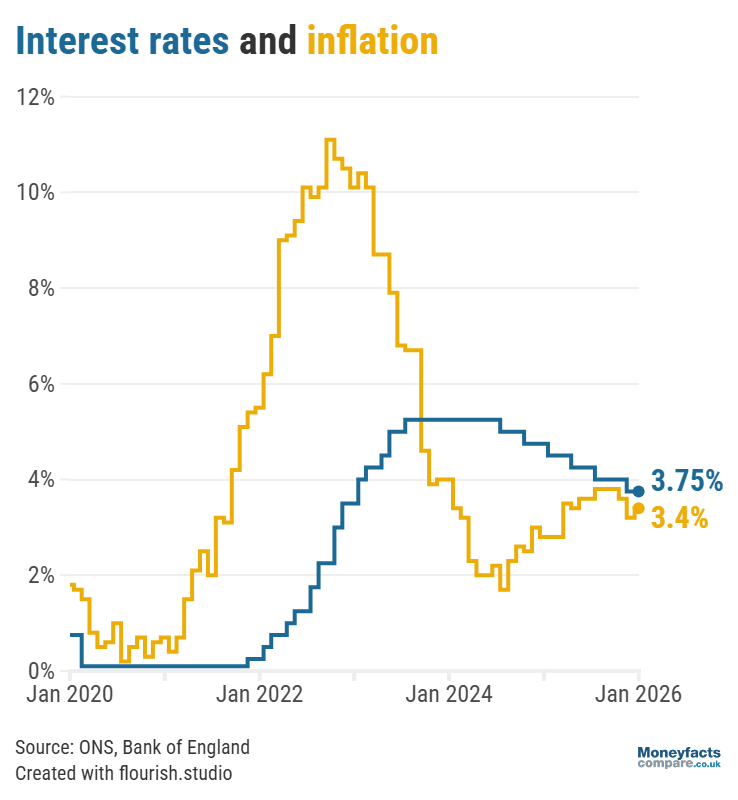

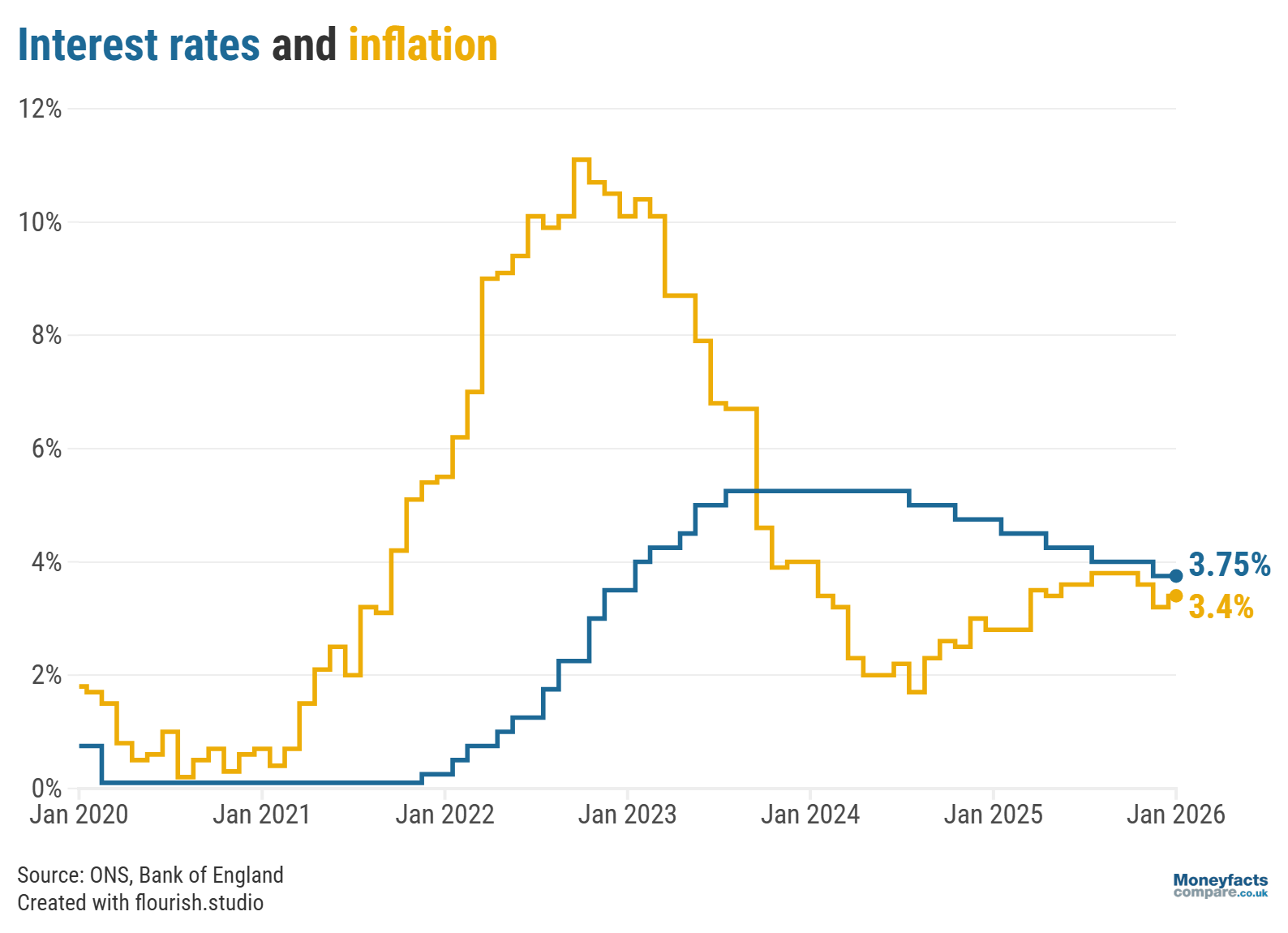

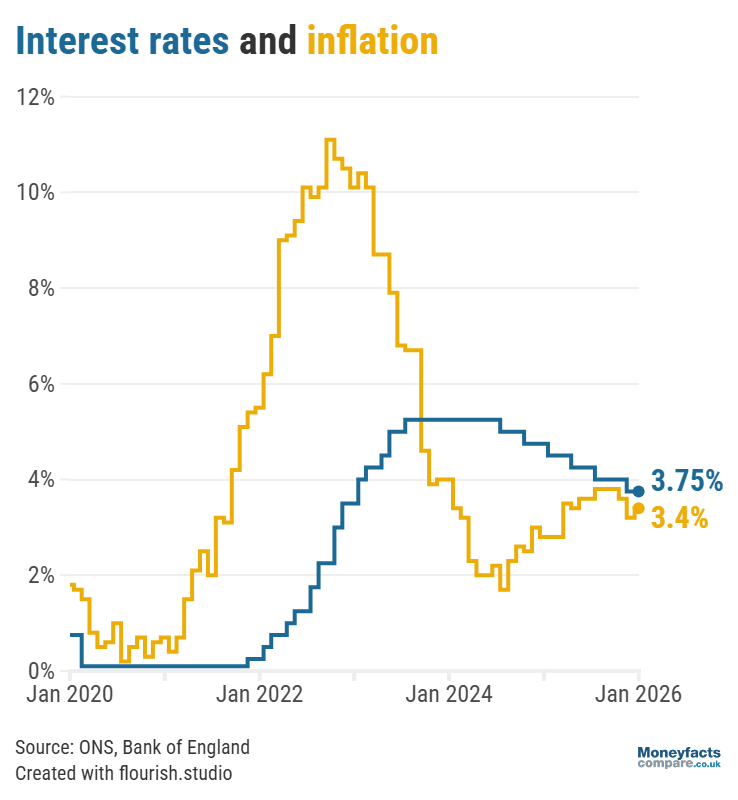

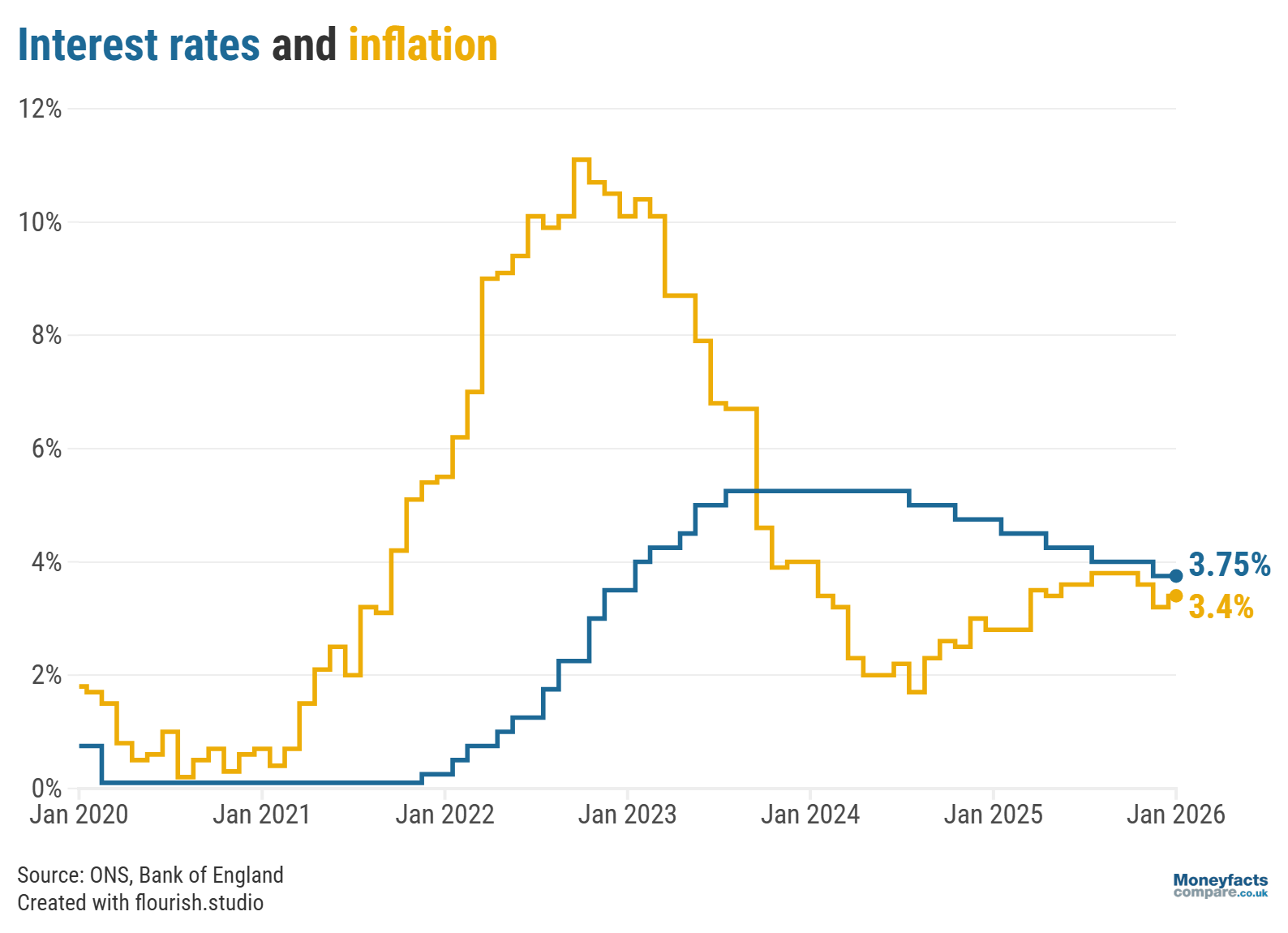

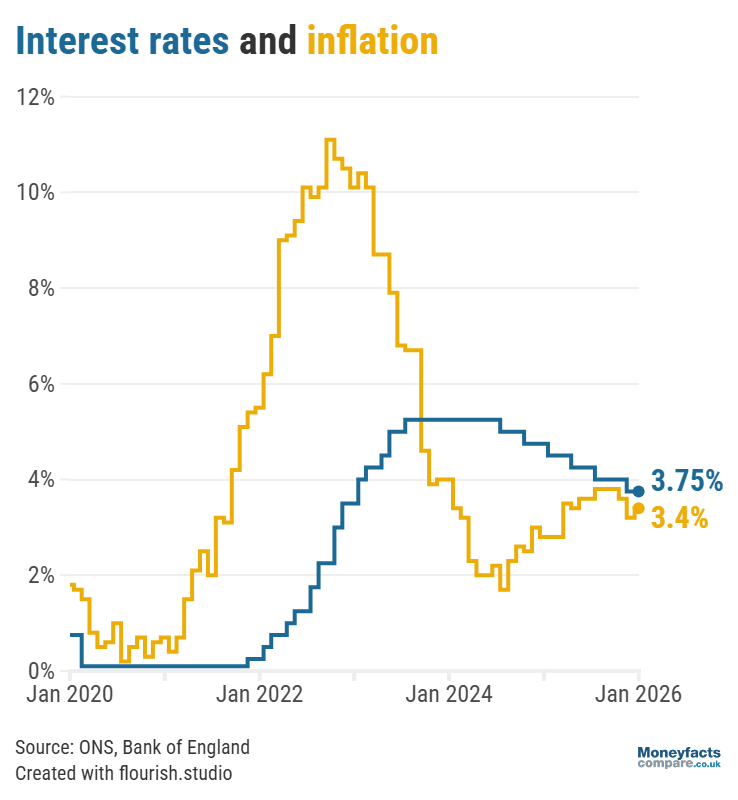

UK Finance Trends: The Bank of England base rate vs the rate of UK inflation since 2020.

The alcohol and tobacco sector was one of the key areas that pushed up the annual rate of inflation, with prices rising by 5.2% in the 12 months to December compared to 4.0% one month earlier. Much of this is likely to be explained by the increase in tobacco duty that came into effect on 26 November 2025.

Elsewhere, the annual rate of inflation in the transport sector rose from 3.7% in November to 4.0% in December, largely driven by air fares. The cost of air travel typically increases in December but, this year, prices were 28.6% higher than the previous month.

When looking at everyday costs that are likely to affect more consumers, car owners may be relieved to learn that the price of petrol and diesel only saw a marginal rise of 0.9% in the 12 months to December.

However, over the same period, the overall cost of food and non-alcoholic drinks increased by an average of 4.5%, compared to 4.2% in the year to November 2025. Bread and cereals saw a particularly noticeable increase in prices, while the cost of vegetables also rose slightly.

“January is the ideal time for savers to set new financial goals and to check if their savings are working as hard as they can,” Eastell commented.

UK Savings Trends: UK inflation vs the Moneyfacts Average Savings Rate since 2013. After cuts, the Moneyfacts Average Savings Rate now sits below the current level of inflation.

“While there has been a promising jump to short-term fixed bonds, this doesn’t follow the trend as most of the top rates have dropped month-on-month, so it is crucial that savers are fast to react to attractive deals, otherwise they face missing out,” she continued.

With the higher level of inflation, it’s crucial that savers shop around to ensure they are getting a real return on their savings.

At the time of the announcement, 1,406 savings accounts and ISAs paid interest above 3.4%, giving savers plenty of opportunity to secure a competitive rate. This includes easy access accounts and fixed bonds, as well as easy access cash ISAs and fixed rate ISAs.

See our charts to discover the latest rates and secure an inflation-beating return on your money.

Fixed mortgage rates dropped significantly in 2025, as the average two-year fixed rate fell from 5.48% to 4.83% while the five-year equivalent fell from 5.25% to 4.91%.

“Last year was a notable time for the mortgage market, with lenders taking a renewed focus on their affordability restraints,” Eastell noted.

“Hopefully this positive momentum can carry on long into the new year,” she added, although she cautioned that “sticky inflation may limit the pace at which the Bank of England can make cuts”.

Get friendly, expert advice free of charge as a visitor of Moneyfactscompare.co.uk

Mortgage Advice Bureau have 1,600 UK advisers with 200 awards between them.

Speak to an award-winning mortgage broker today.

Call 0800 031 8553 or request a callback

Mortgage Advice Bureau offers fee free mortgage advice for Moneyfactscompare.co.uk visitors that call on 0800 031 8553. If you contact Mortgage Advice Bureau outside of these channels you may incur a fee of up to 1%. Lines are open Monday to Friday 8am to 8pm and Saturday 9am to 1pm excluding bank holidays. Calls may be recorded.

Your home may be repossessed if you do not keep up repayments on your mortgage.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.