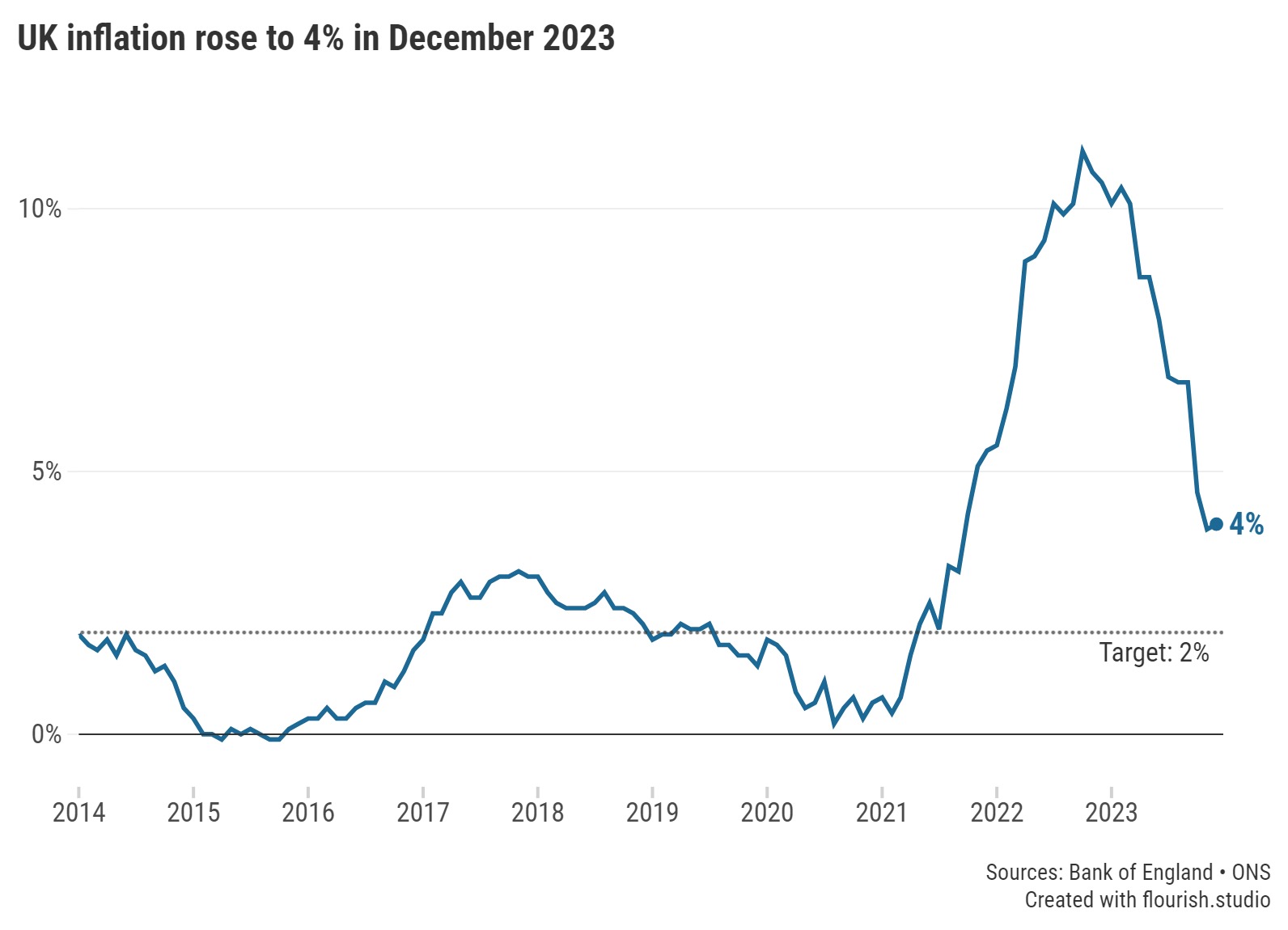

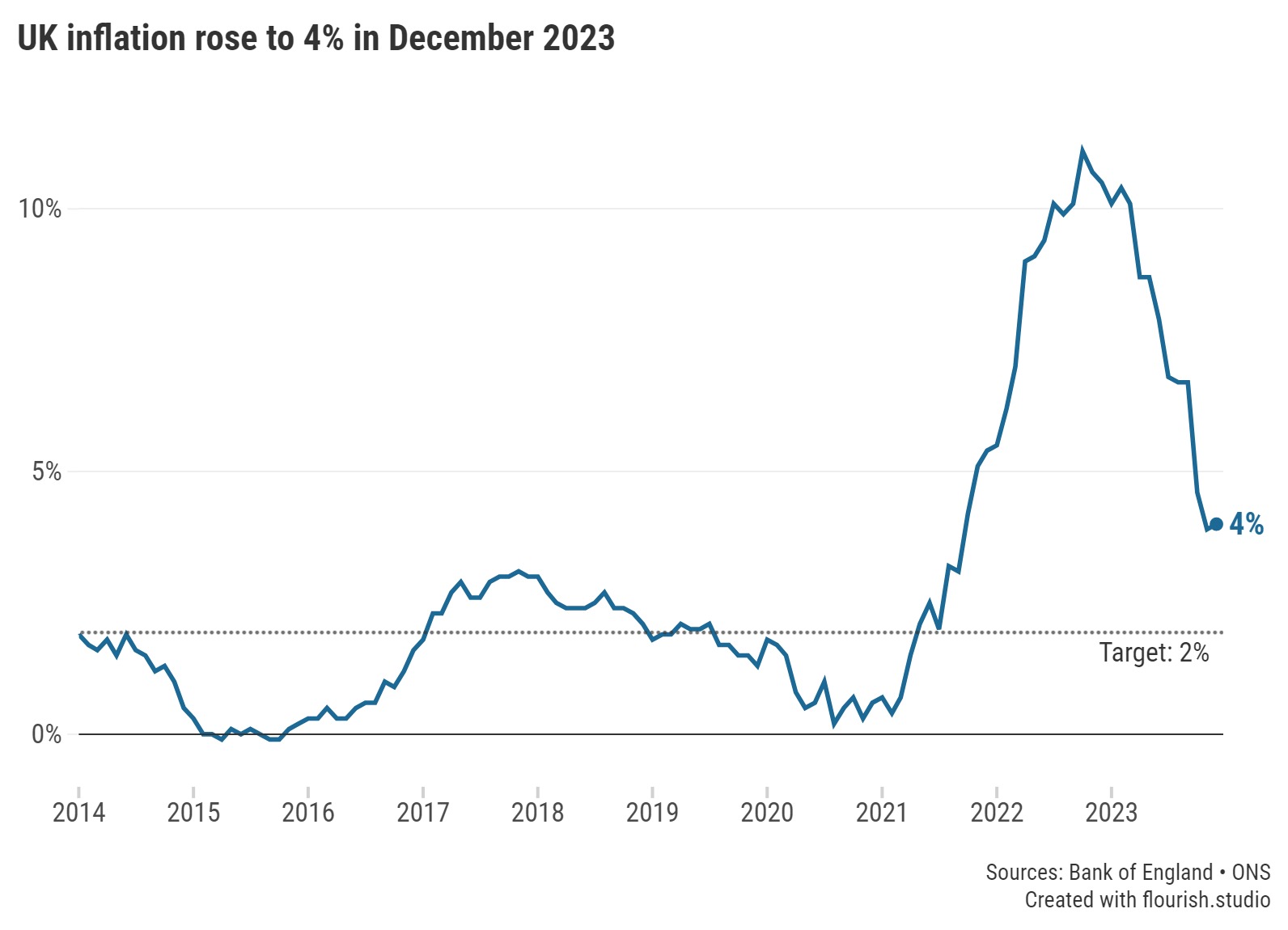

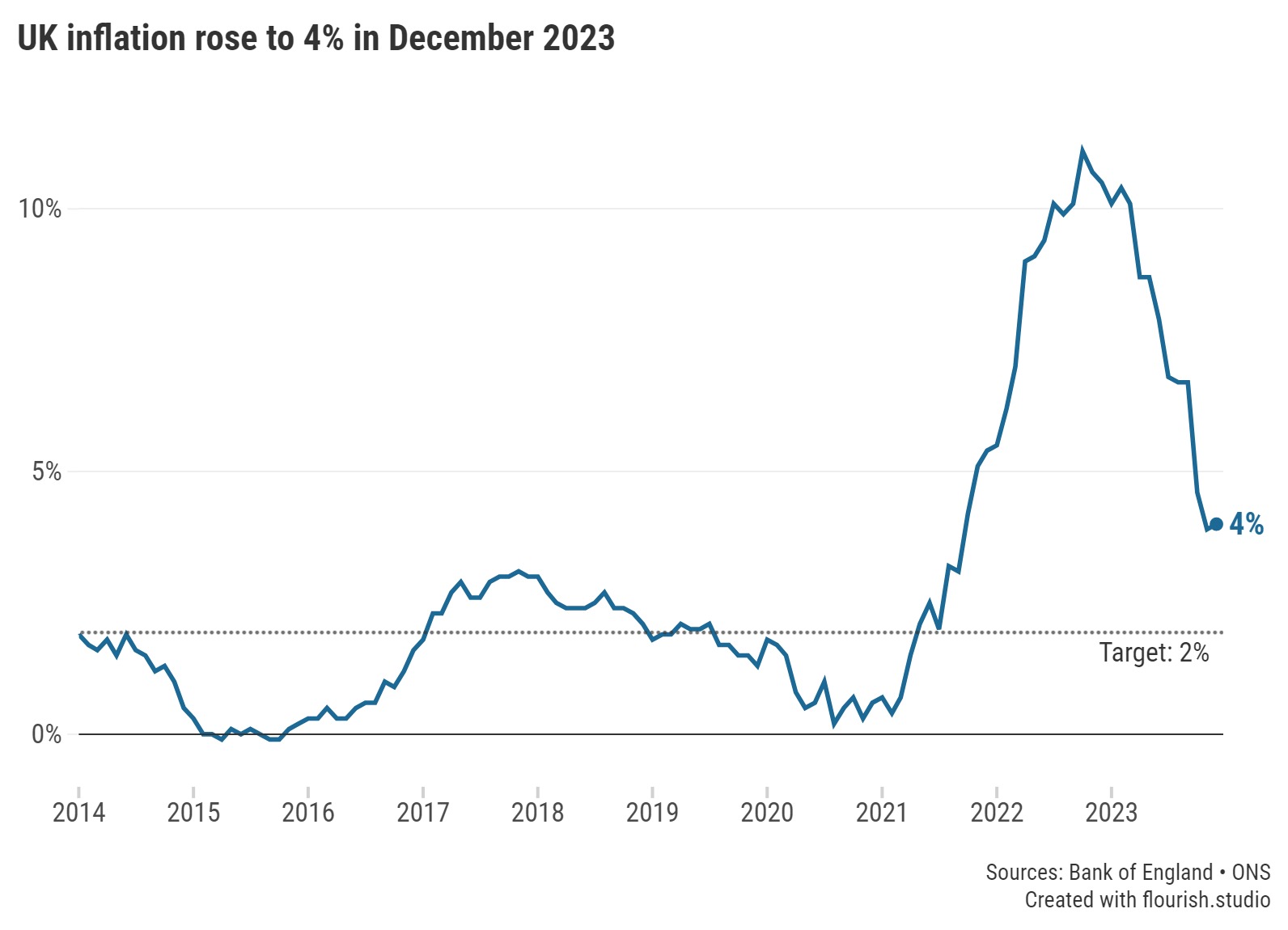

After months of falling inflation, December’s figure unexpectedly rose to 4%.

UK inflation hit 4% in December, according to the latest figures from the Office for National Statistics (ONS).

This is a slight increase compared to November’s inflation figure of 3.9%.

The Consumer Prices Index (CPI), which is the main indicator of inflation, tells us how quickly the prices of everyday goods and services have risen over the course of a year. This latest increase means that, overall, these prices are more expensive than one year ago.

Alcohol and tobacco were two of the main drivers of the increase in inflation, followed by transport and recreation and culture. This comes after the Chancellor of the Exchequer, Jeremy Hunt, announced an increase to tobacco duty as part of his Autumn Statement back in November.

Caption: UK inflation rose to 4% in the year to December

UK inflation has been falling over the course of 2023, after reaching a high of 11.1% in October 2022, and many experts had expected this trend to continue. However, several other countries also saw a small uptick in inflation in December, including France and the United States, so it’s perhaps not surprising that the UK has seen a similar change.

The Bank of England will be paying close attention to news of this latest increase as inflation is one of the key factors that determines the base rate. The increases to the base rate during the past couple of years were an attempt by the Bank of England to get inflation under control and closer to its target of 2%.

Attention will now turn to 1 February, when the Bank of England’s Monetary Policy Committee (MPC) will vote on the base rate for the first time in 2024.

Following significant falls in inflation in October and November, this time last month there were over 1,100 inflation-beating savings deals available. Despite today’s slight CPI rise and recent rate reductions, there remain just under 1,000 available that can trump inflation.

“We recently saw the highest month-on-month drop to fixed savings rates in 15 years, but variable rates have remained fairly steady despite the fluctuation of other factors,” said James Hyde, Spokesperson for Moneyfactscompare.co.uk.

“With some no notice accounts still paying over 5% interest, their instant accessibility may be a tempting factor for those not wishing to lock money away for a defined period,” Hyde added.

Despite many providers across the sector significantly cutting rates in recent weeks, challenger banks continue to occupy the top positions in our charts. These providers are often able to offer competitive deals, however, their readiness to pull top rates once targets have been hit means it’s imperative to strike while the iron is hot to secure the best deal.

Our savings charts are regularly updated throughout the day to show you the best rates currently available. Alternatively, you can read our weekly savings and ISA roundups for further details on accounts offering some of the top rates.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.