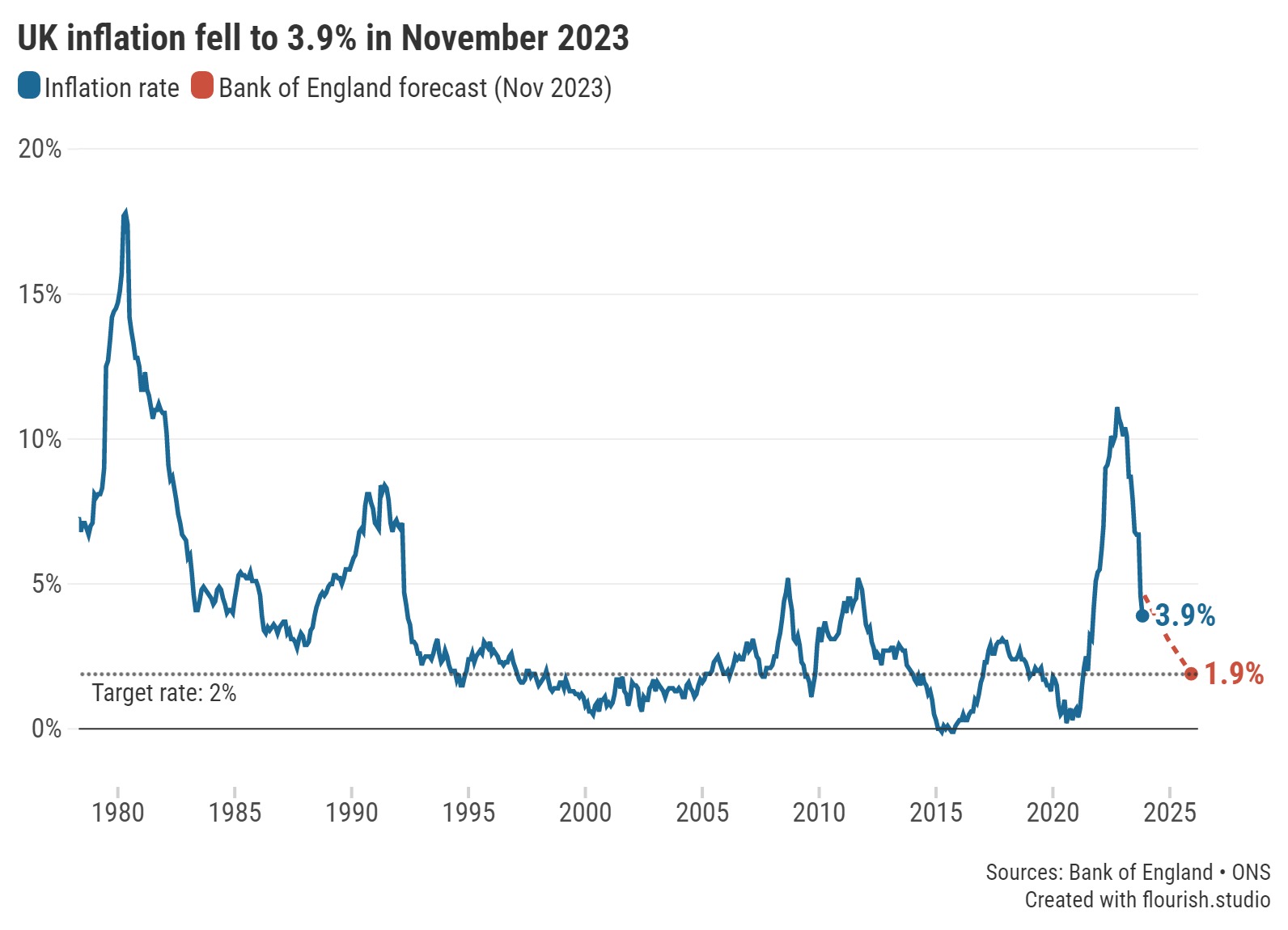

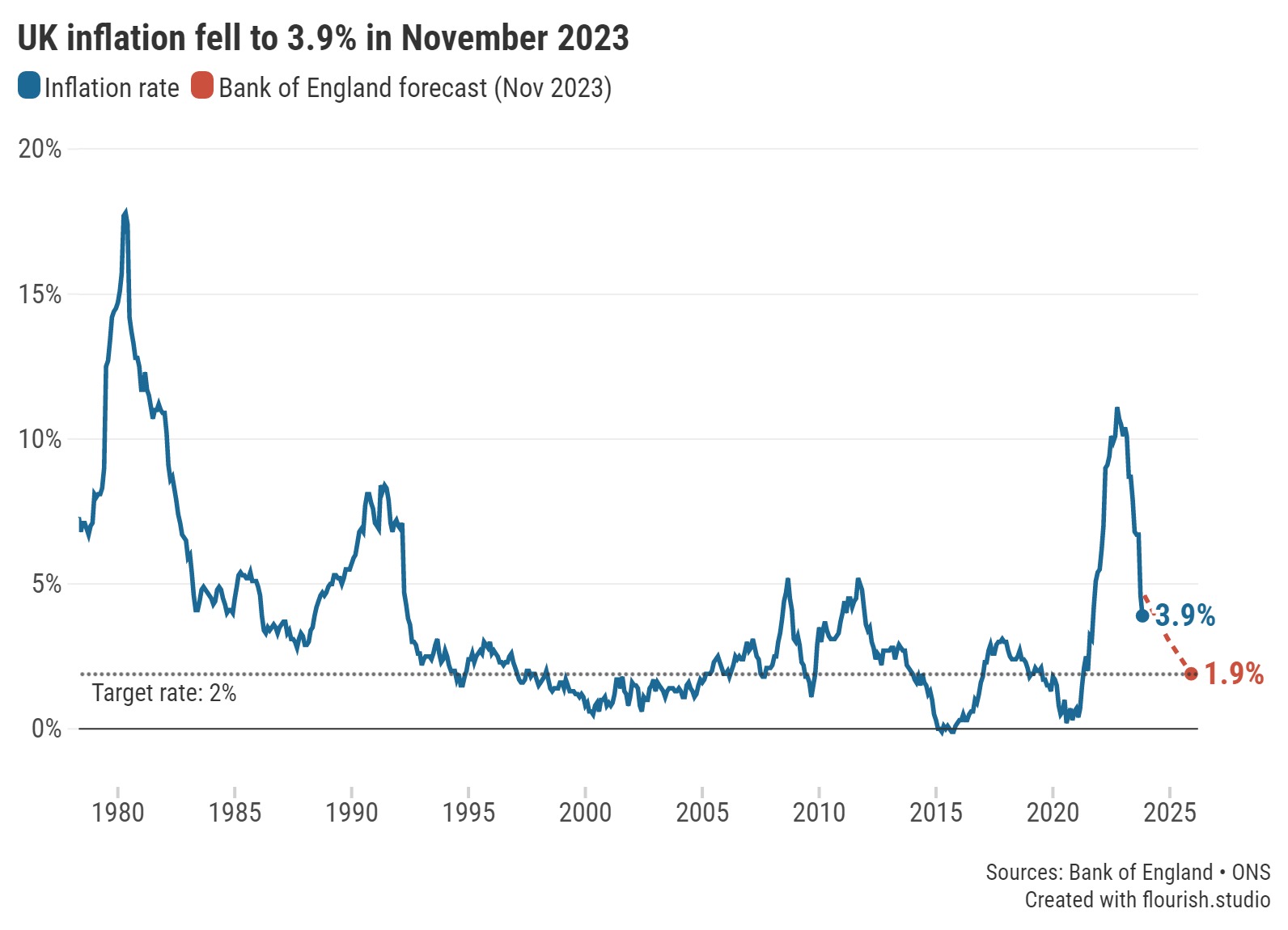

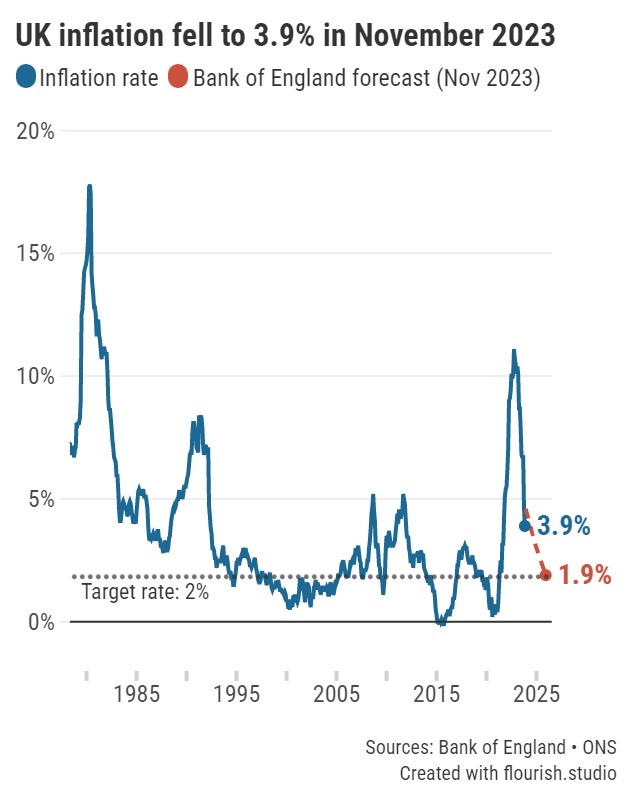

Inflation slows but remains well above the Bank of England’s 2% target.

UK inflation dropped to 3.9% in the year to November, according to today’s announcement from the Office for National Statistics (ONS). This is down from 4.6% the previous month.

Inflation is an important measure which is used to determine how fast the prices of goods and services are rising. While inflation slowed in November, this doesn’t mean prices have got any cheaper, however. Instead, they continued to rise albeit at a slower rate than as last month.

Today’s announcement follows figures from October, which found inflation slowed dramatically from 6.7% to 4.6% - meeting the Government’s pledge to halve inflation by the end of the year. Eyes now turn towards the next milestone: the Bank of England’s 2% target.

Caption: UK inflation dropped to 3.9% in the year to November, but remains well above the Bank of England’s 2% target.

Last month saw the return of inflation-beating savings accounts after two years, and this latest drop in inflation means there are significantly more available now.

Challenger banks continue to dominate the top positions in the charts, with many offering enticing rates to raise capital in a competitive market. However, their readiness to pull popular products once funding targets have been reached can lead to a great deal of variation, and it’s vital that consumers strike while the iron is hot to secure the most favourable deal.

Many flexible accounts from big banks remain well below the market average, which offers a clear incentive for savers to search for switching opportunities. Savers must research prospective new accounts carefully, however, as terms, incentives and accessibility may differ. It remains a worthwhile exercise to consider splitting investments across easy access accounts and fixed bonds. There are also notice accounts to consider, though the best 30-day notice rates currently sit below the best easy access rates.

As we reach the latter days of the year, some may have less disposable income than usual, but there remain some enticing opportunities available for those who wish to explore them.

Our savings charts are regularly updated throughout the day to show you the best rates currently available. Alternatively, you can read our weekly savings and ISA roundups for further details on accounts offering some of the top rates.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.