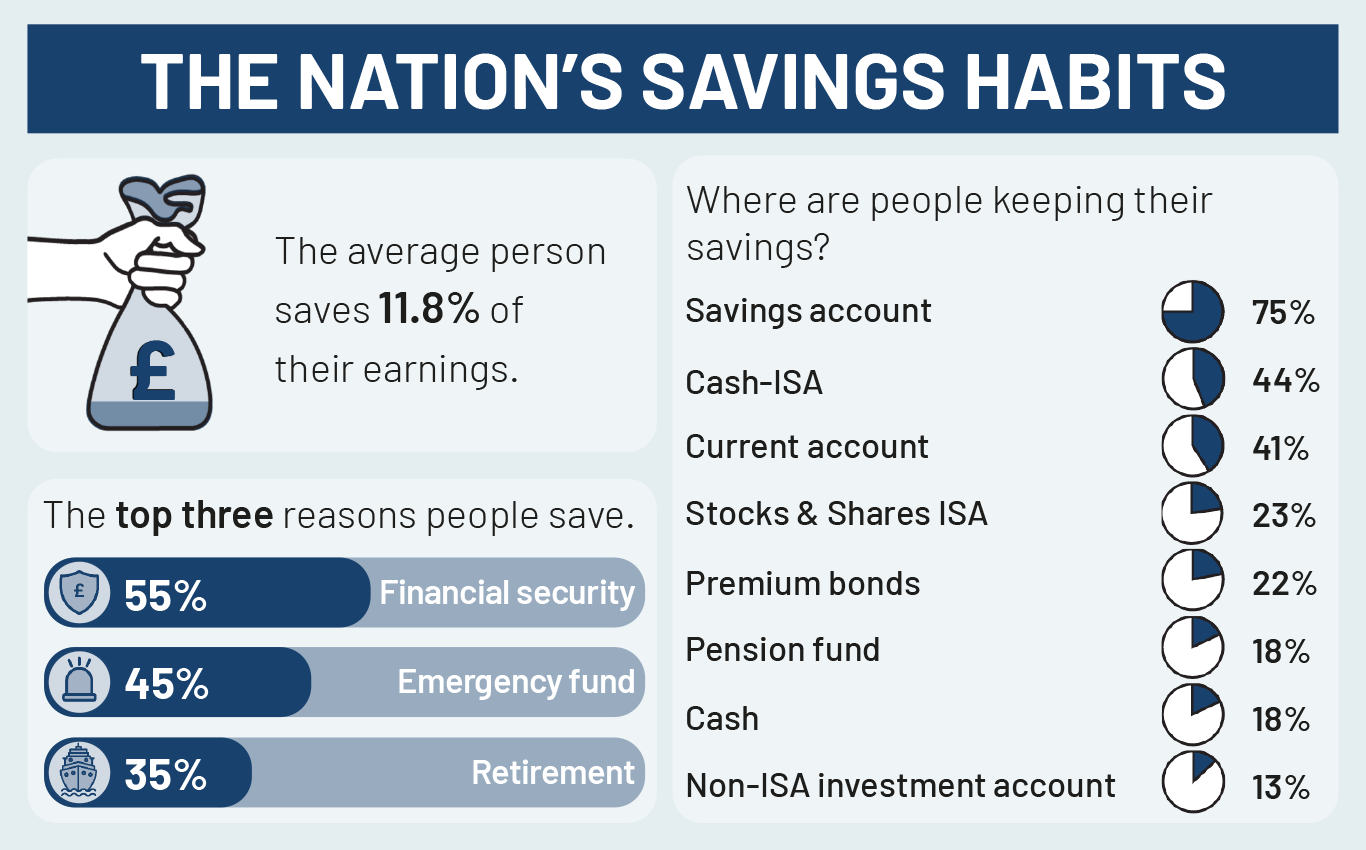

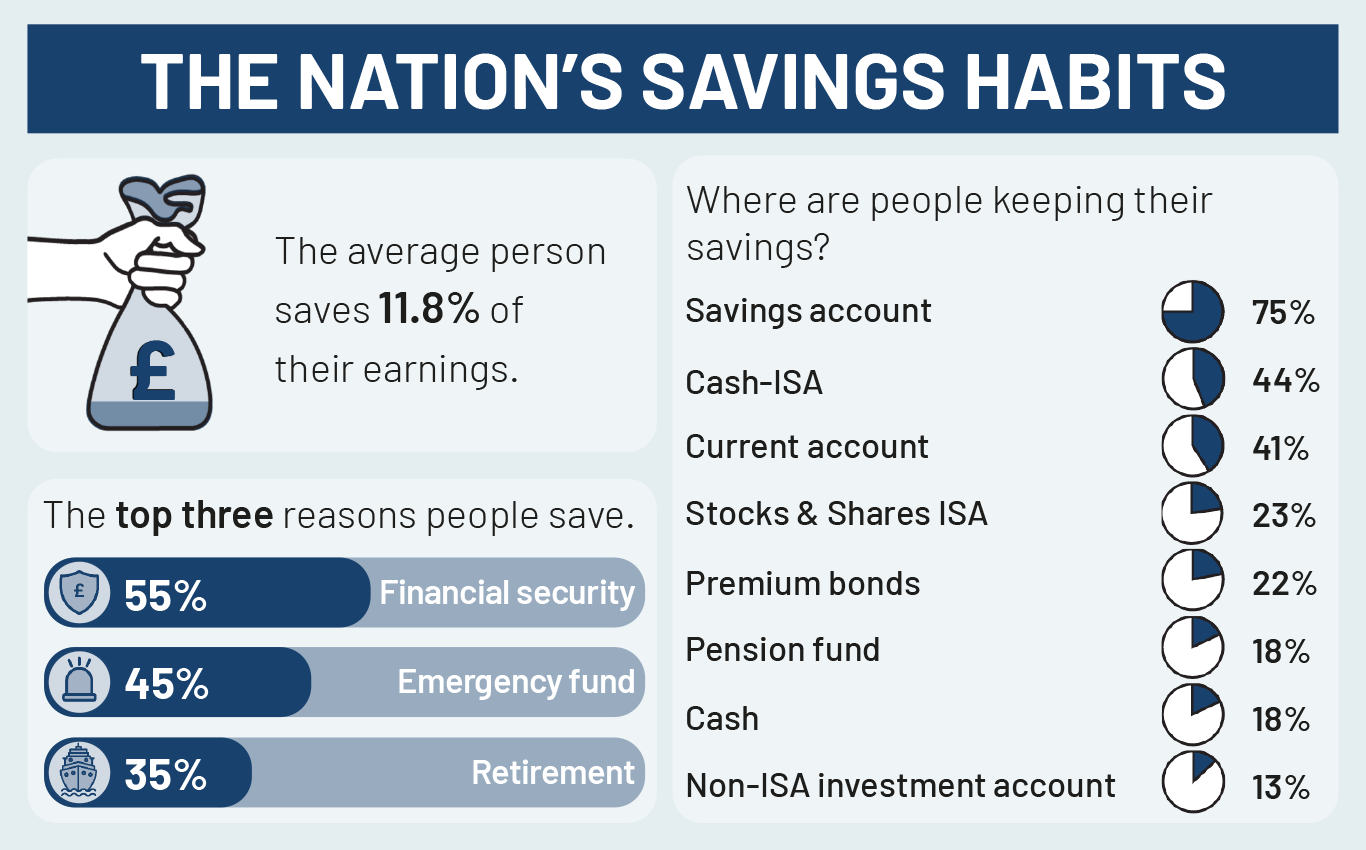

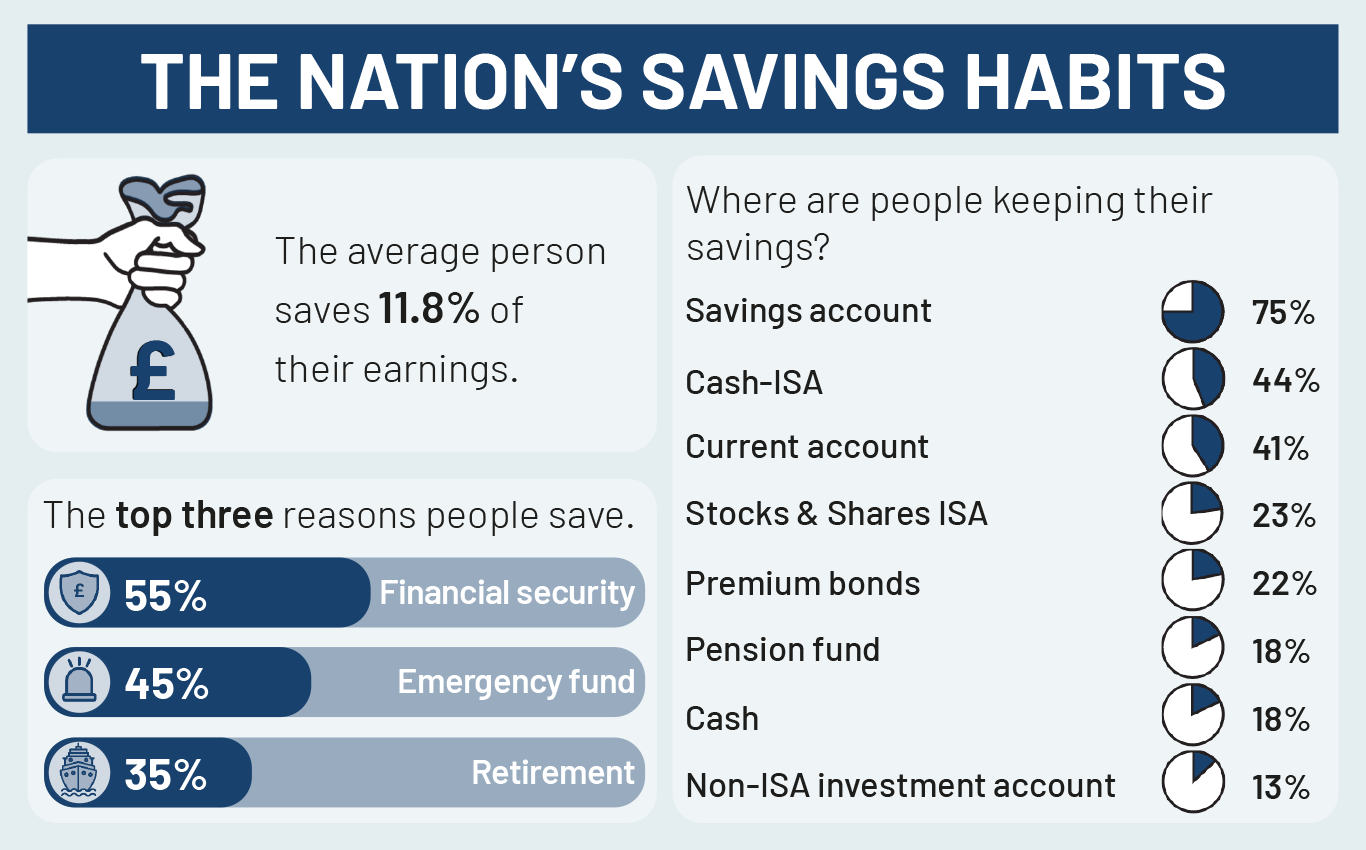

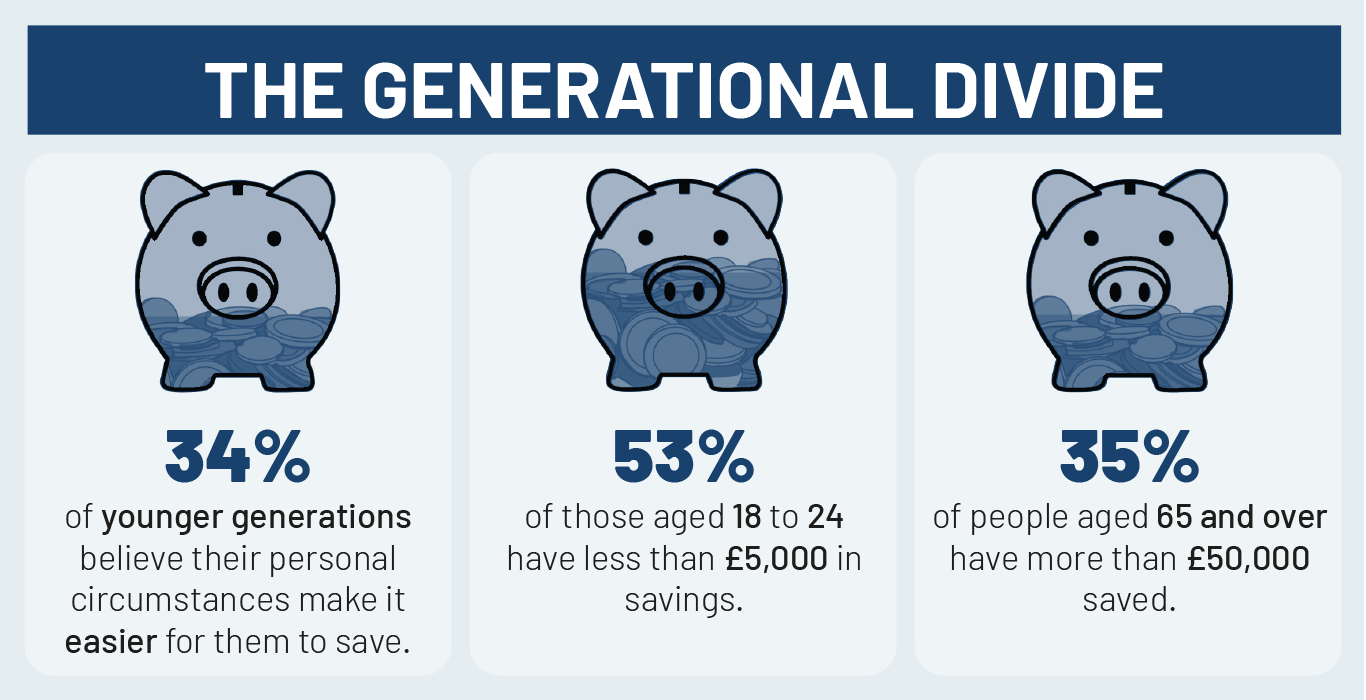

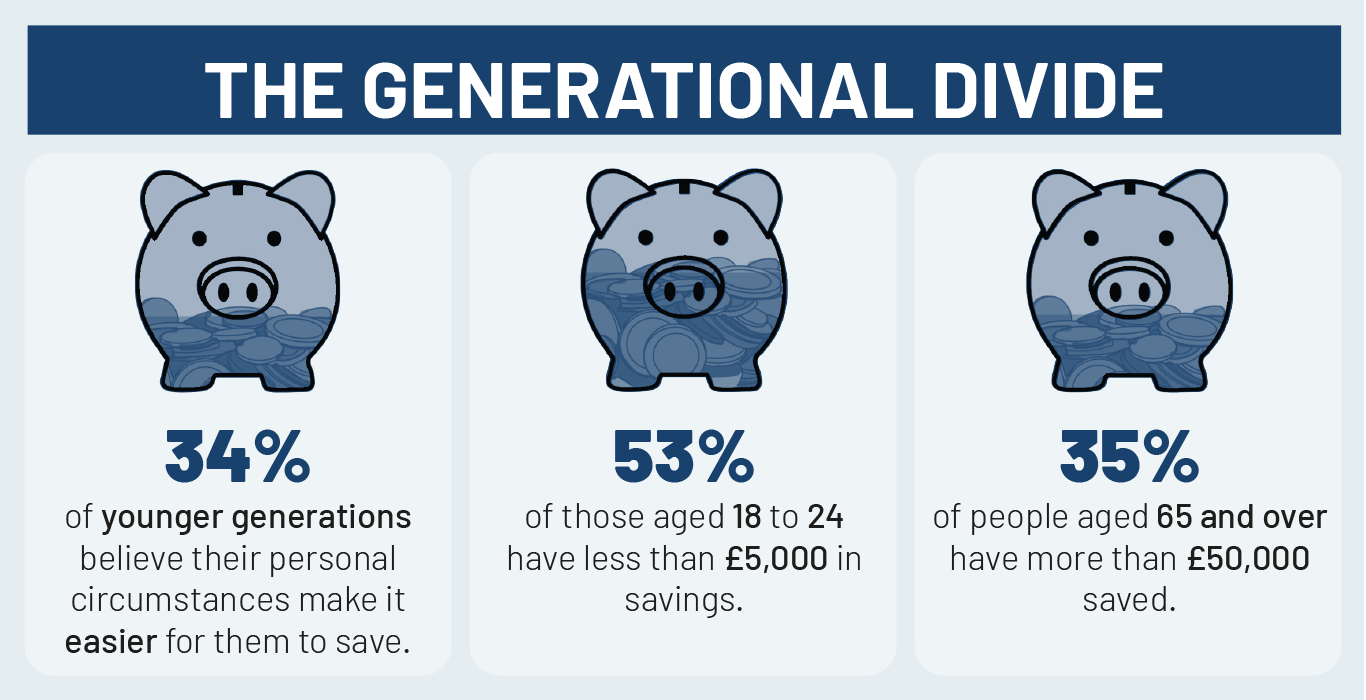

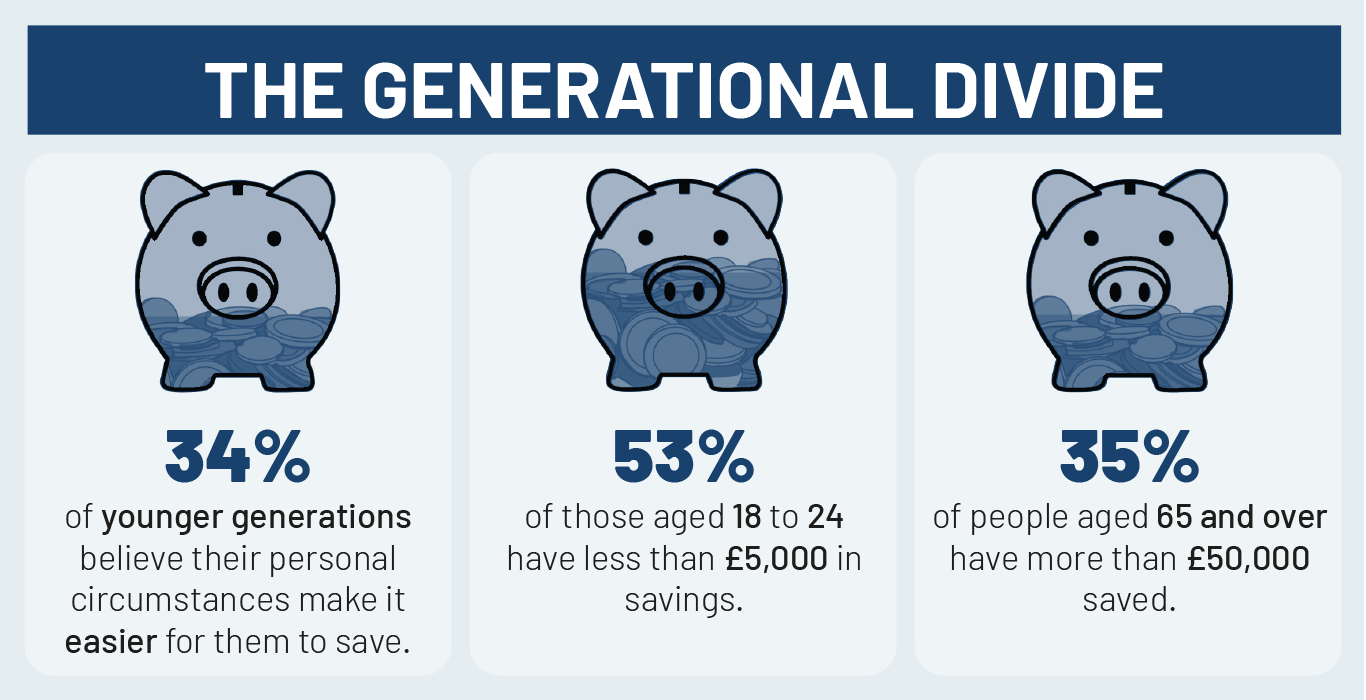

Survey of 2,000 nationally representative UK adults carried out by OnePoll on behalf of Moneyfacts between 1 and 3 September 2025.

At Moneyfactscompare.co.uk, our savings charts are regularly updated throughout the day and include accounts from across the whole of the market so you can easily find and compare the best rates.

You can also read our weekly savings and ISA roundups for more information on the most competitive accounts, and subscribe for free to our Savers Friend newsletter which provides weekly updates on recent rate changes and product launches.