This is the fifth cut since August 2024.

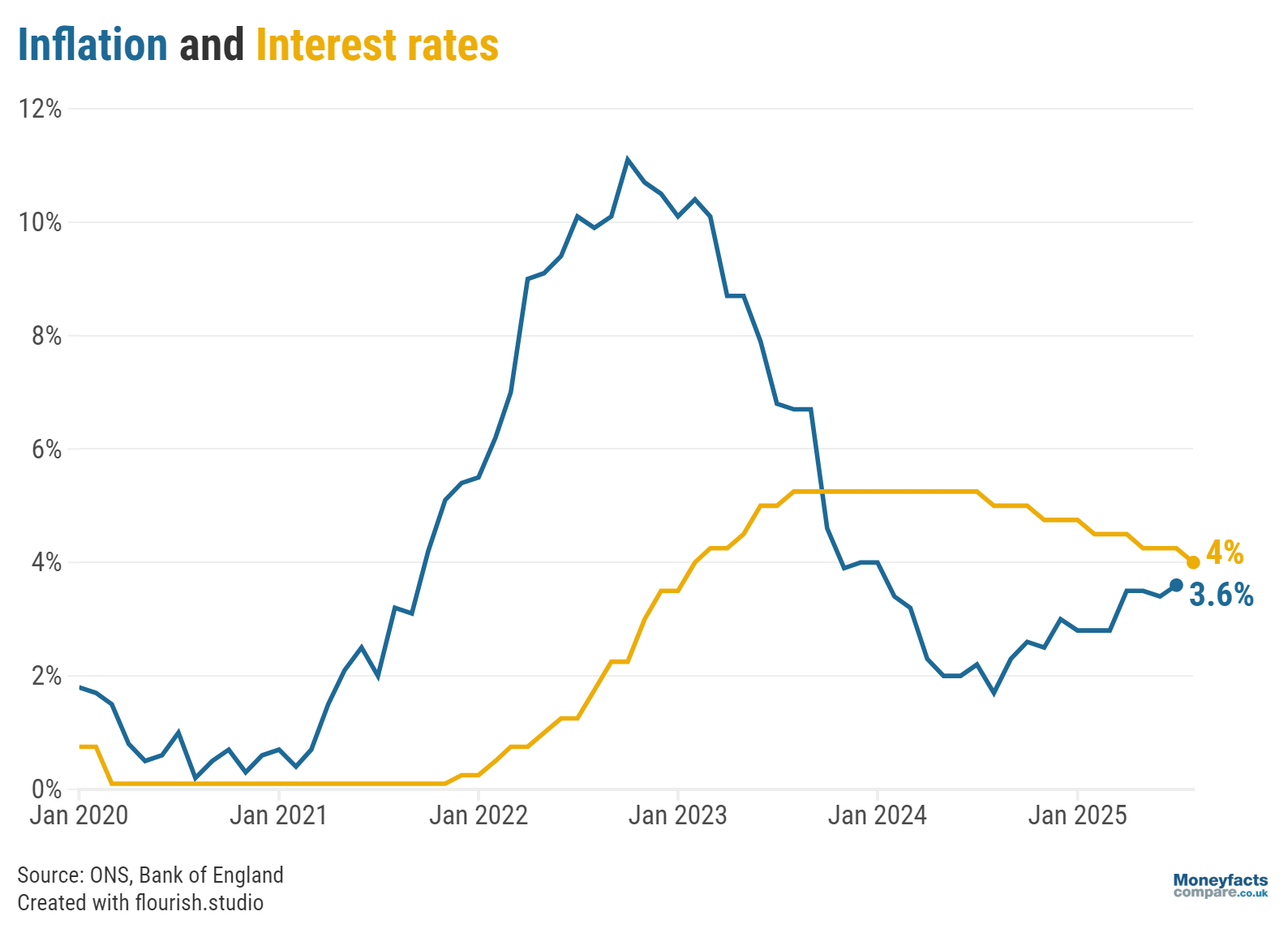

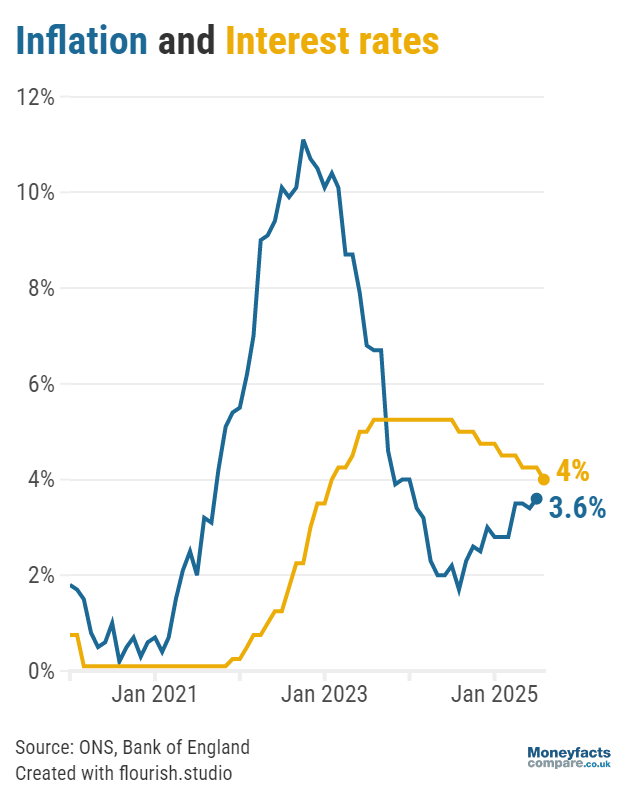

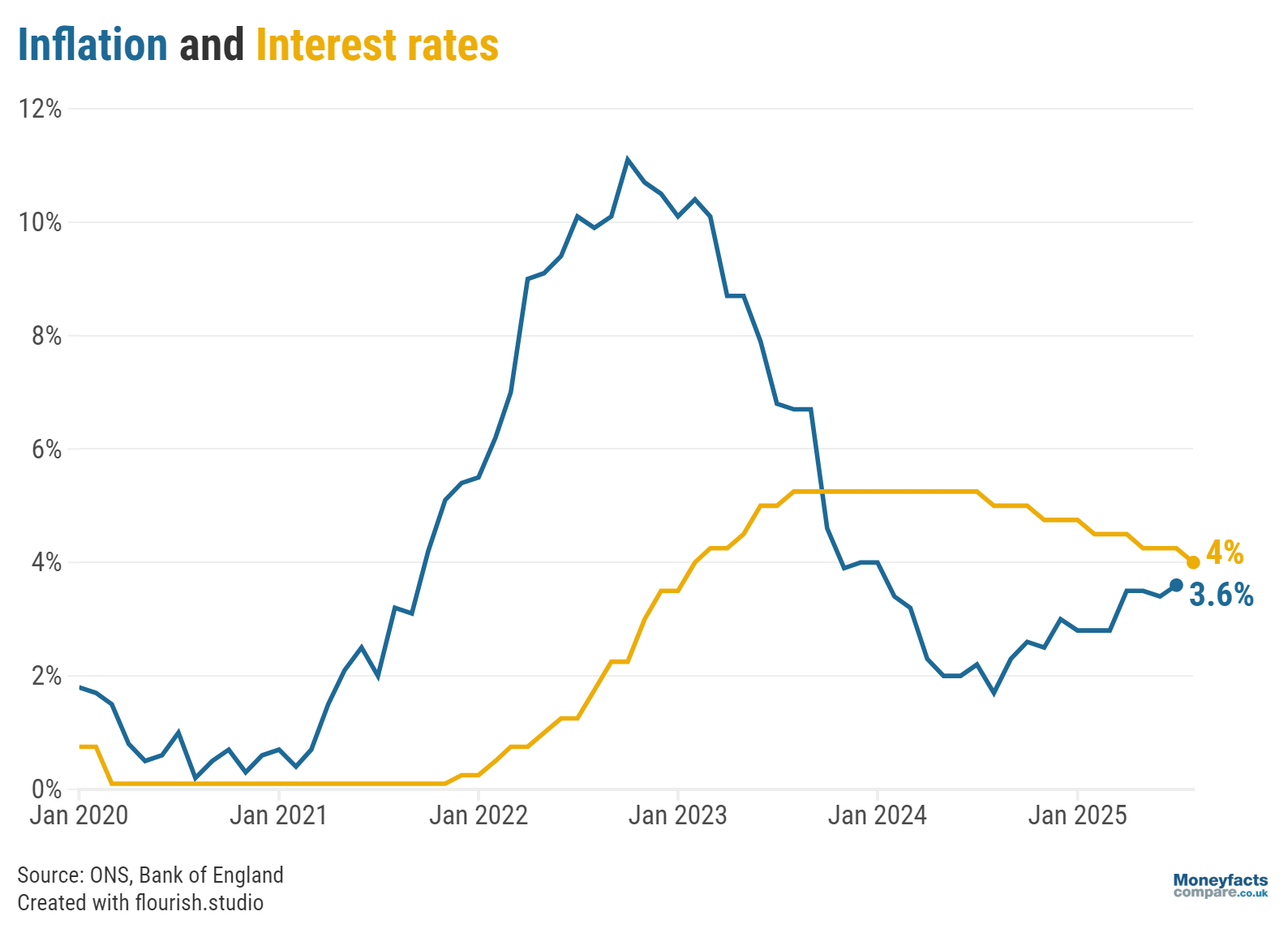

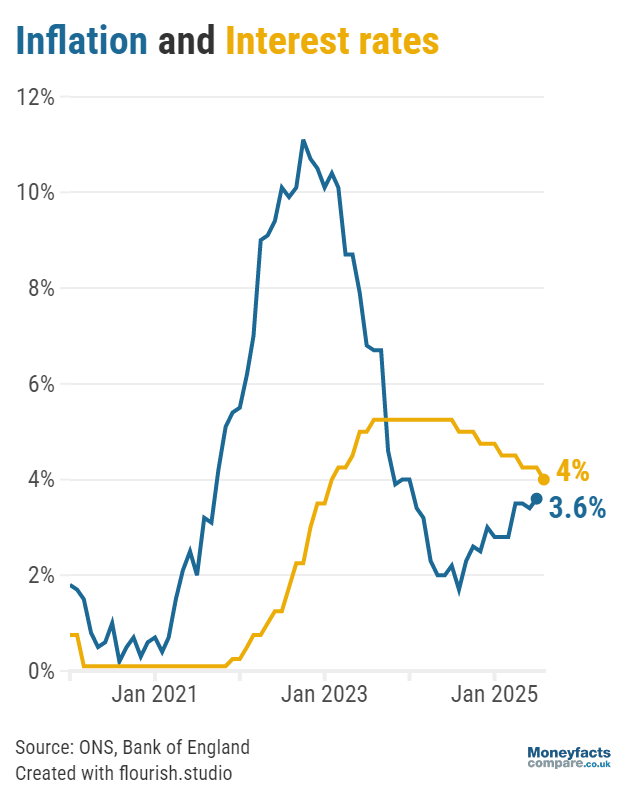

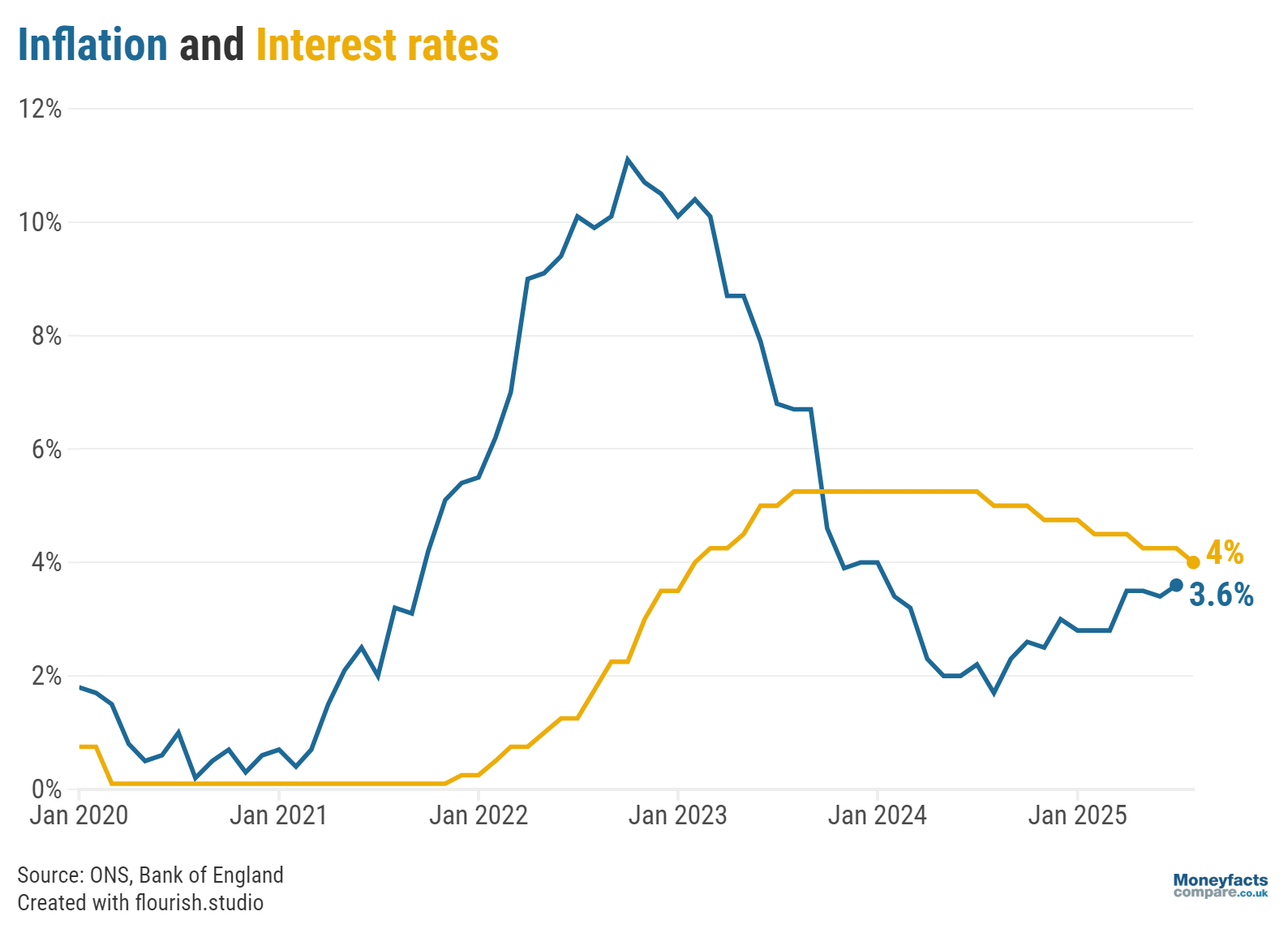

The base rate is now at its lowest point since March 2023 after the Bank of England’s Monetary Policy Committee (MPC) narrowly voted five to four in favour of lowering the UK’s central interest rate to 4.00%. Even though inflation rose to 3.6% in June, many experts had predicted that the MPC would cut the base rate amid a weakening jobs market, which includes slower pay growth, rising unemployment and a declining number of job vacancies.

It is hoped that lowering the base rate will help to boost the economy and encourage growth, with many expecting a further cut later in the year. However, the MPC will need to strike a careful balance between supporting growth and controlling inflation and, if inflation remains at a high level, any future cuts to the base rate may need to wait until it gets closer to the target of 2%.

What is the Bank of England base rate?

The base rate is the UK’s central interest rate. It determines how much banks, building societies and other providers are charged for borrowing, which in turn affects the interest rates these providers offer to consumers. Read more on what the base rate means for you.

This latest cut comes 12 months after the MPC lowered the base rate from 5.25% (where it had been for one year) to 5.00%. And, since August 2024, the MPC has cut the base rate by 0.25 percentage points every three months, including this most recent reduction to 4.00%.

Graph: Bank of England base rate against UK inflation between 2020 and 2025.

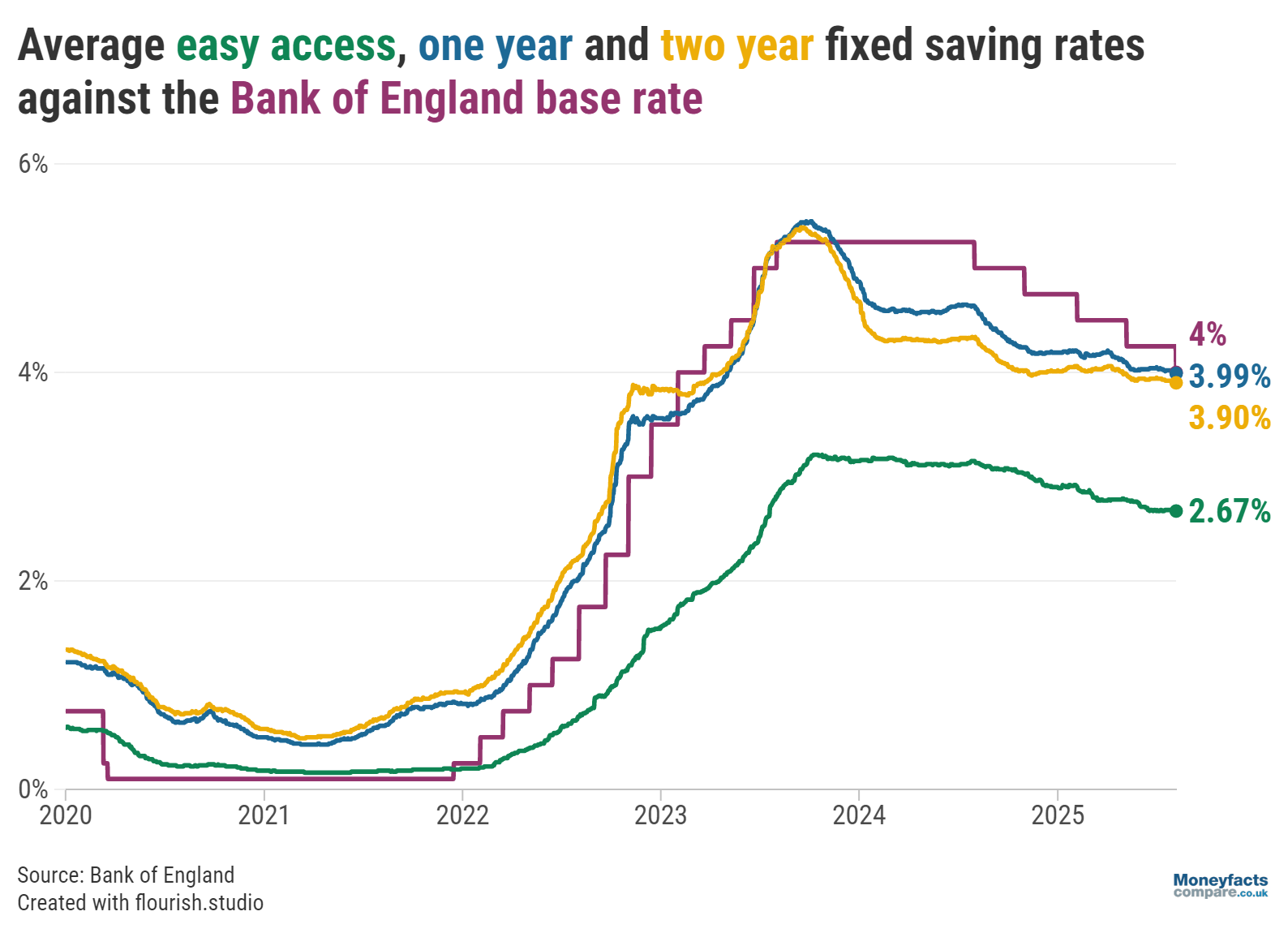

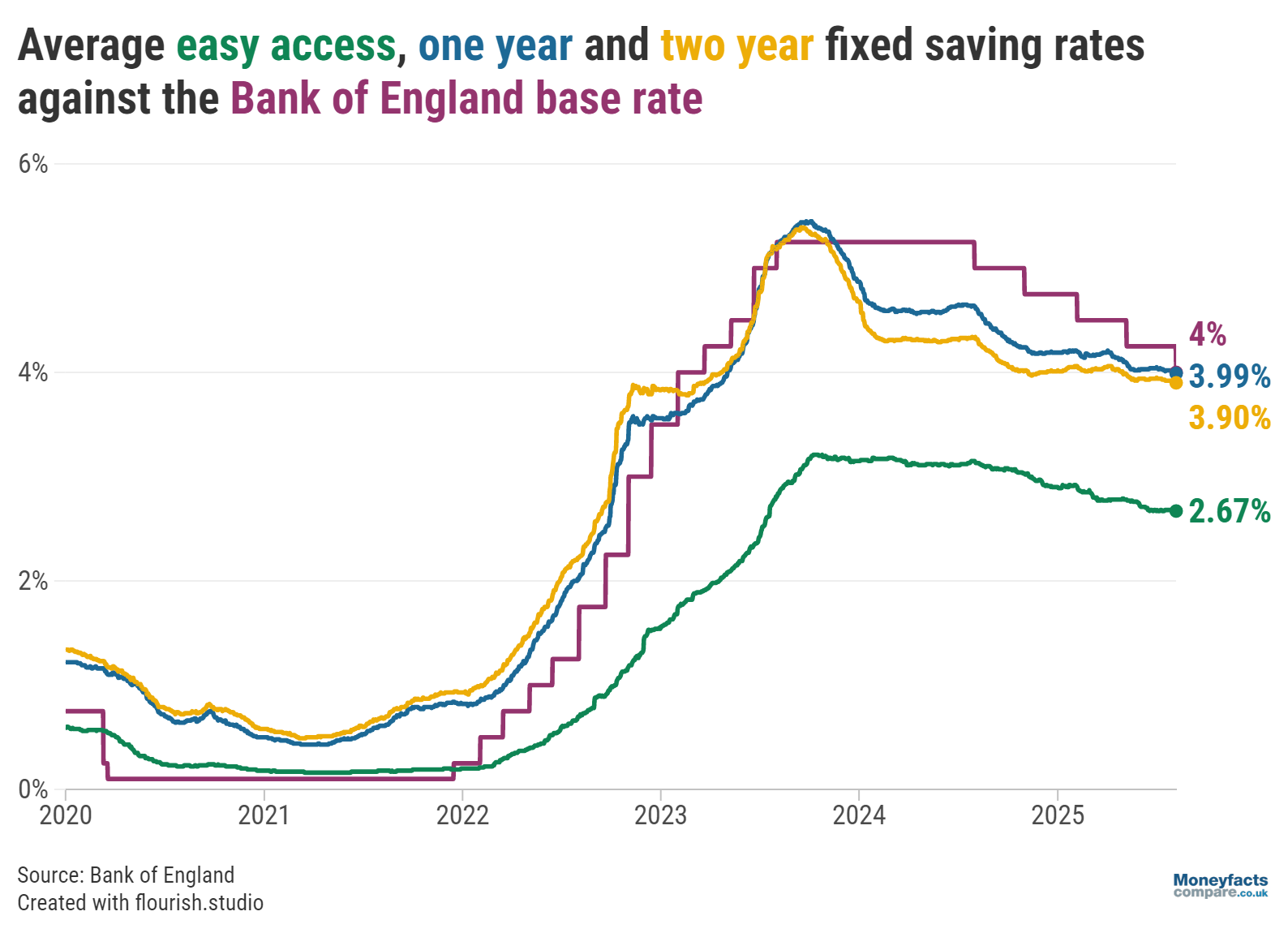

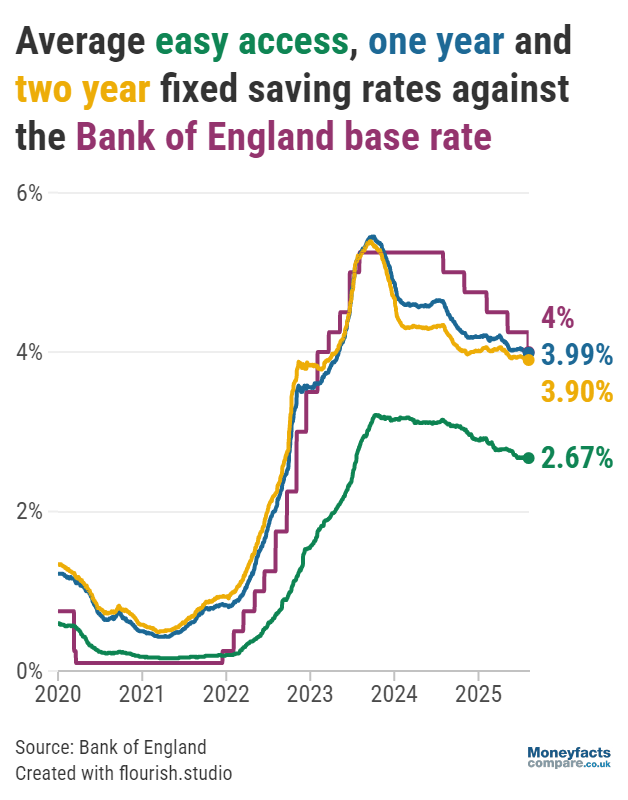

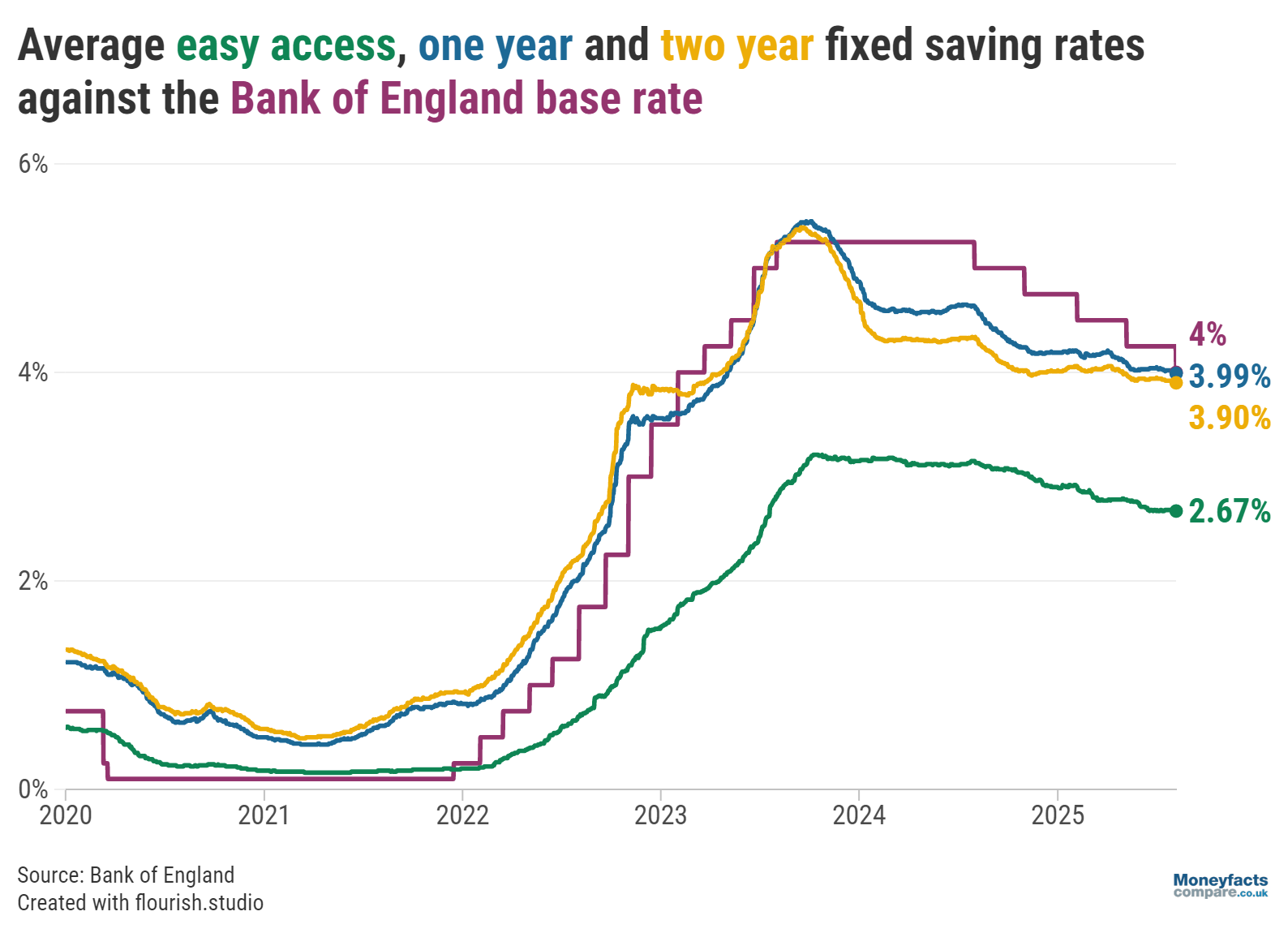

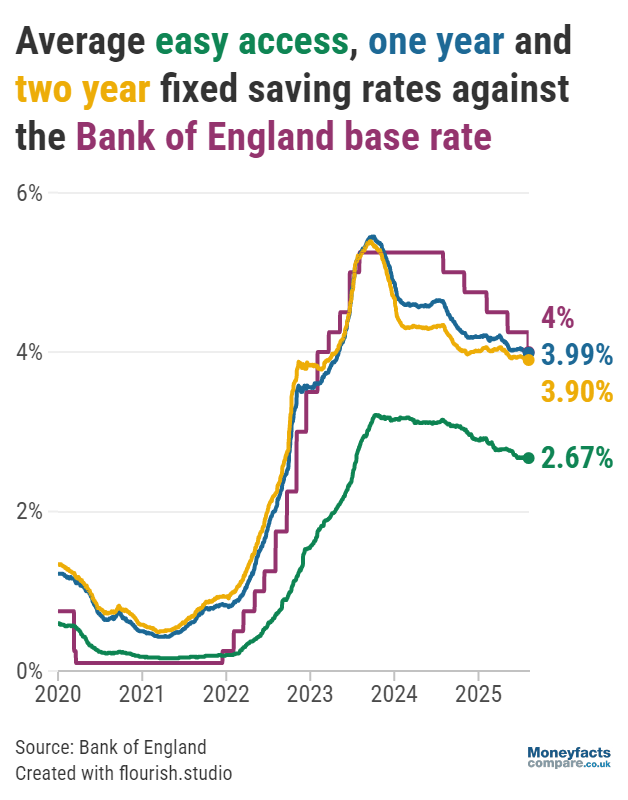

Providers have been passing on previous base rate cuts to savers, with the average easy access savings rate plummeting from 3.15% to 2.68% between the start of August 2024 and August 2025. Similarly, for those wanting to benefit from tax-free returns, the average easy access ISA rate fell from 3.36% to 2.90% over the same period.

While falling rates could make some savers apathetic about moving their money, Rachel Springall, Finance Expert at Moneyfactscompare.co.uk, says this is “a dangerous attitude” to have “when inflation continues to take its toll on pots”. Instead, she explains that “switching savings accounts must become a regular habit to ensure savers are not getting a paltry rate”.

Graph: Bank of England base rate against average easy access, one-year and two-year fixed savings rates between 2020 and 2025.

Being proactive about managing your savings and moving providers is particularly crucial if your money is in an account paying a bonus rate for a limited period. Many of the top easy access savings accounts and easy access ISAs come with a substantial bonus so, once this expires, the rate could plummet leaving you with a below-average return on your money.

Savers who keep their money with a major high street bank are particularly at risk of their money losing value in real terms, as these big banks pay an average of just 1.54%* across their easy access accounts, 1.14 percentage points lower than the market average. Instead, it’s worth considering building societies or lesser-known brands that may offer higher interest rates and provide the same protection under the Financial Services Compensation Scheme (FSCS) as the major banks.

Our savings charts are regularly updated throughout the day to show the top accounts and interest rates currently available. Discover the easy access accounts and fixed rate accounts that can help your money grow in real terms by offering inflation-beating rates.

Or, if you want to earn tax-free returns, visit our ISA charts.

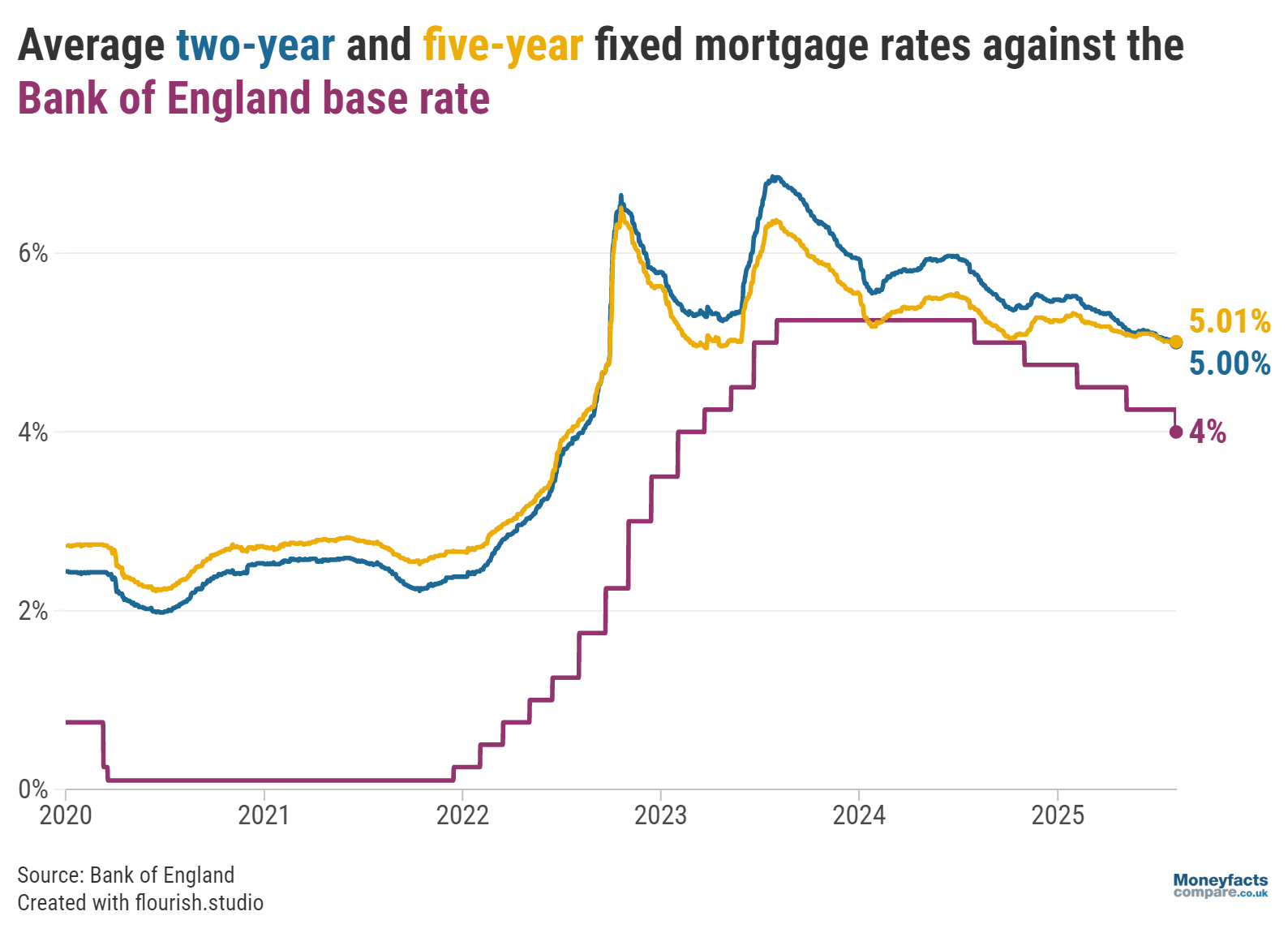

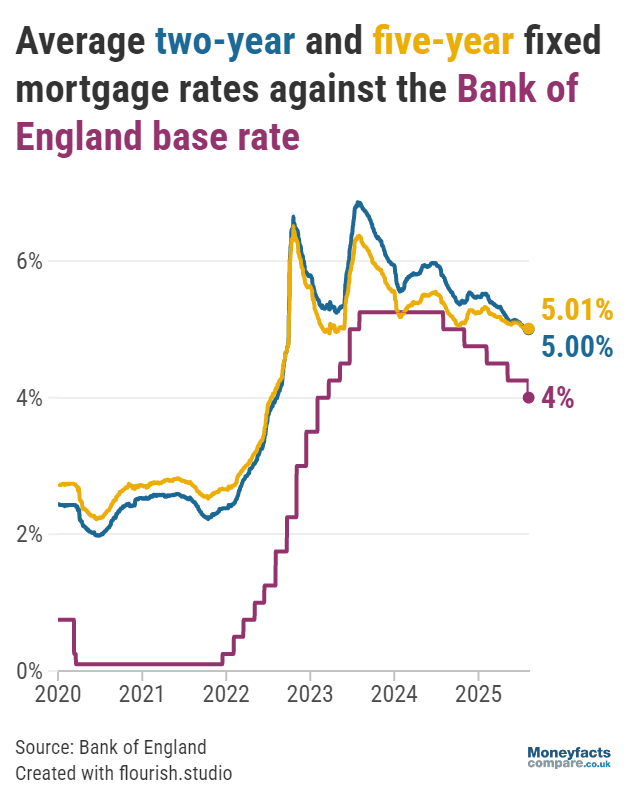

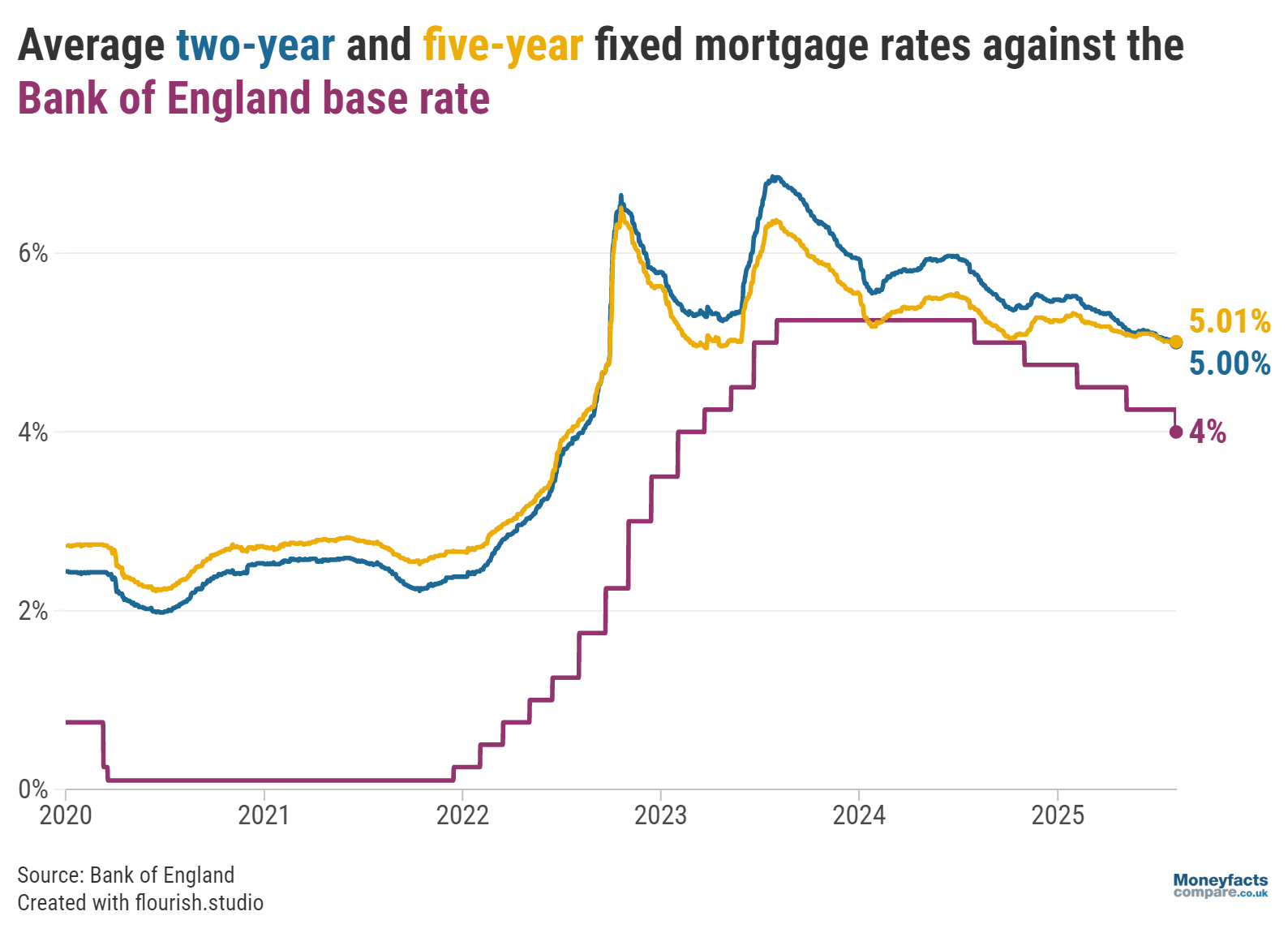

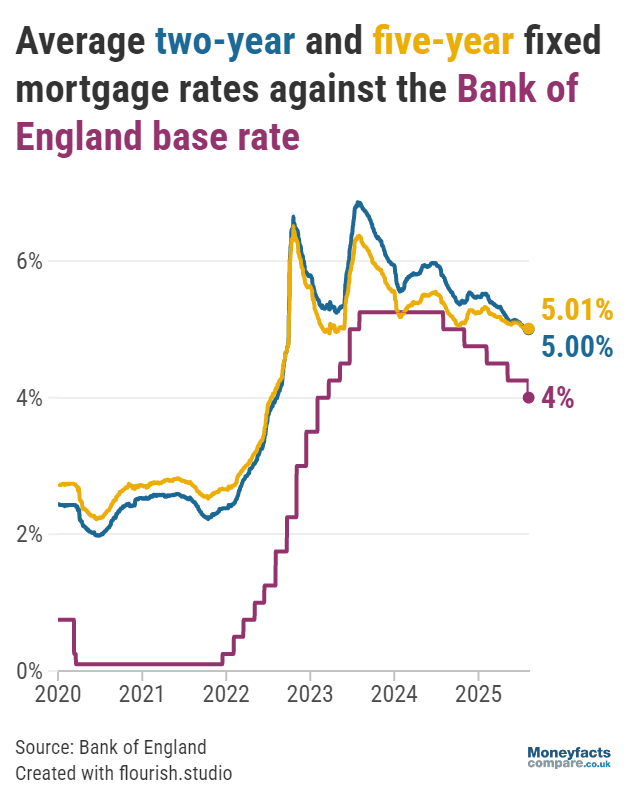

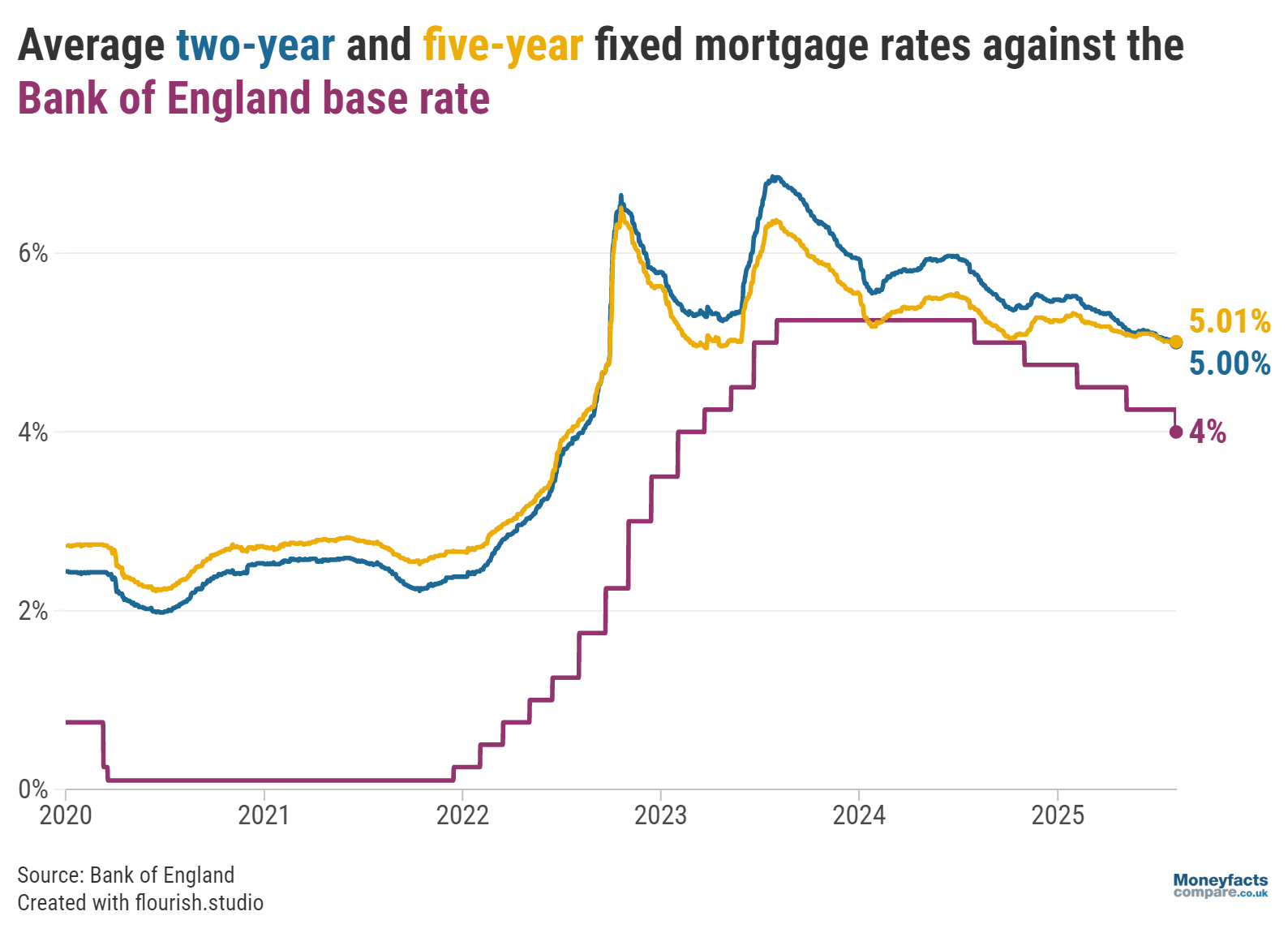

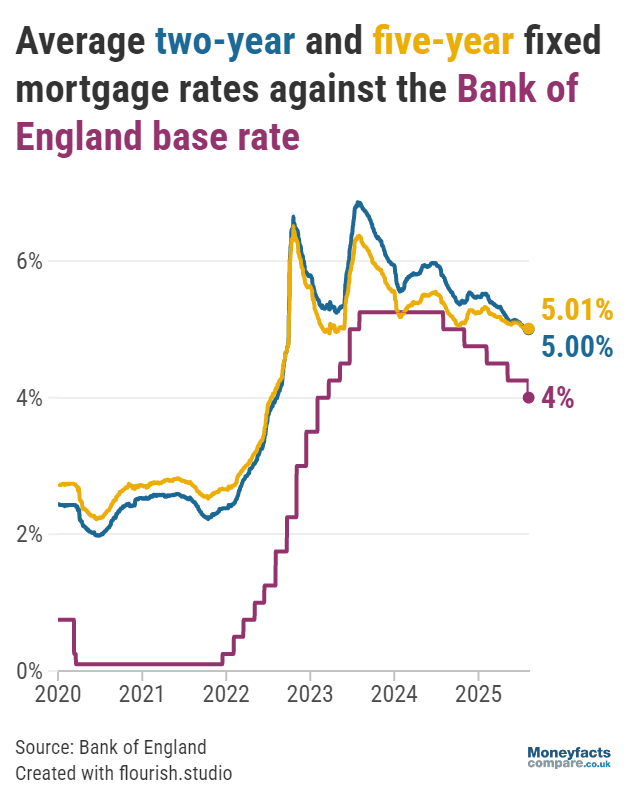

The gradual lowering of the base rate over the past year has helped fixed mortgage rates to drop, which will have been a relief to those buying a home and homeowners looking to remortgage. For example, the average two-year fixed rate dropped from 5.77% to 5.01% between the beginning of August 2024 and August 2025 while the average five-year fixed rate saw a slightly smaller fall from 5.38% to 5.01% over the same period.

Even though the average standard variable rate (SVR) has also dropped by a substantial 0.74 percentage points since August 2024, Springall explains there’s “a clear financial gain for borrowers to shift from a variable rate mortgage onto a cheaper fixed rate”. She points out that borrowers who are charged the average SVR of 7.42% “would be paying £372 more per month, compared to a typical two-year fixed rate”. Calculations based on a £250,000 mortgage over a 25-year term on a repayment basis.

Graph: Bank of England base rate against the average two- and five-year fixed mortgage rates between 2020 and 2025.

As well as this latest base rate cut, several lenders have recently relaxed their stress tests which could further help borrowers afford a mortgage. And, with the potential for another base rate cut this year, there are several reasons for prospective borrowers to feel optimistic.

“It’s encouraging that the Bank of England has taken decisive action to boost the economy, and we hope today’s reduction inspires lenders to reduce their interest rates,” commented Oliver Dack, Spokesperson at Mortgage Advice Bureau.

“Today’s reduction, alongside initiatives aimed at supporting homeownership, such as the new, permanent Mortgage Guarantee Scheme launched last month, will hopefully instil more confidence in first-time buyers,” he added.

Visit our charts for an up-to-date list of the lowest mortgage rates currently available. However, bear in mind that the cheapest-priced deal may not always be the most cost-effective for your circumstances.

Our weekly mortgage roundup provides more information about deals charging the lowest rates and also features some Moneyfacts Best Buy alternatives (based on their overall true cost). Alternatively, speak to a mortgage broker for personalised advice.

*High street banks include Bank of Scotland, Barclays Bank, Halifax, HSBC, Lloyds Bank, NatWest, Royal Bank of Scotland and Santander. Averages collected from gross interest rates paid across all live easy access accounts with these brands based on a £10,000 deposit, latest rates as at 5 August 2025.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.