In the wake of new tariffs announced at the start of last month by US President, Donald Trump, and the widespread market turmoil they generated, the Bank of England’s Monetary Policy Committee (MPC) today voted in favour of lowering the UK base rate to 4.25%.

This outcome was as many anticipated; while latest figures from the Office for National Statistics (ONS) revealed GDP increased by 0.5% in February, there are concerns the new tariffs could discourage spending and stall economic growth.

The base rate (also known as the ‘bank rate’) is the amount of interest the Bank of England charges commercial banks and building societies when lending them money. In turn, it influences the rates these commercial banks pay savers and charge borrowers.

Generally speaking, borrowers benefit from cheaper rates when the base rate is low which can encourage spending and boost the economy.

Related guide: What is the Bank of England base rate and what does it mean for your money?

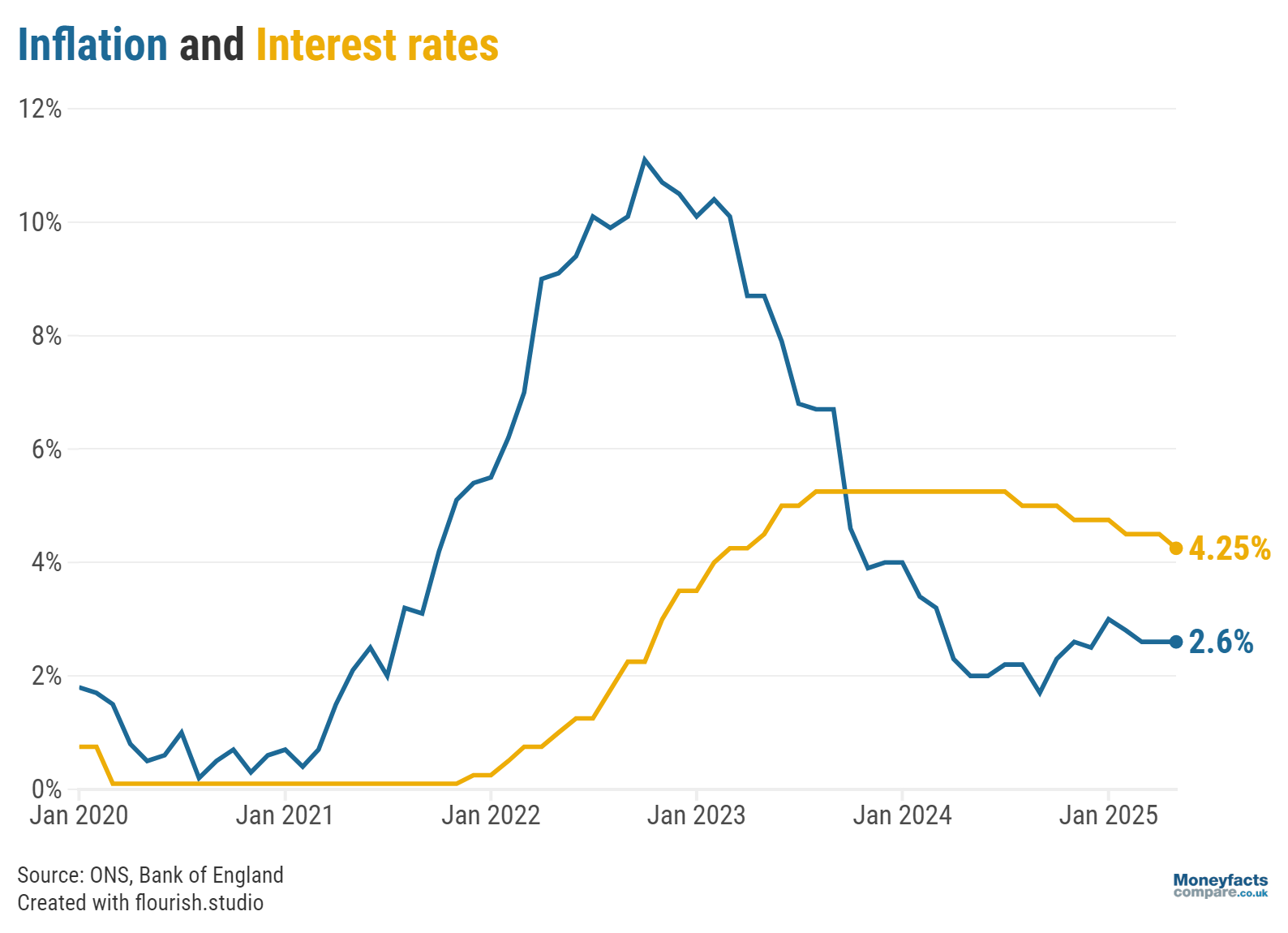

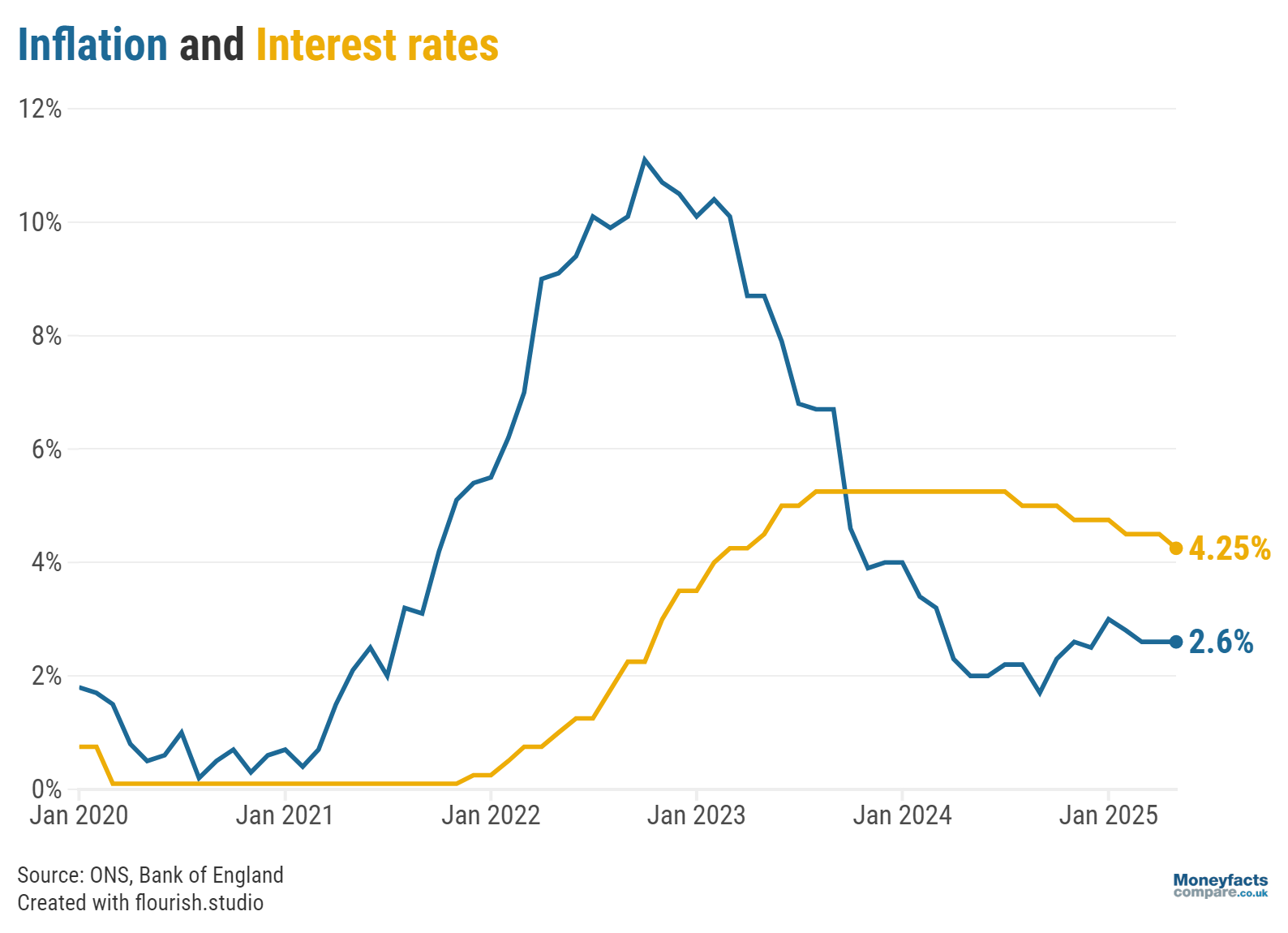

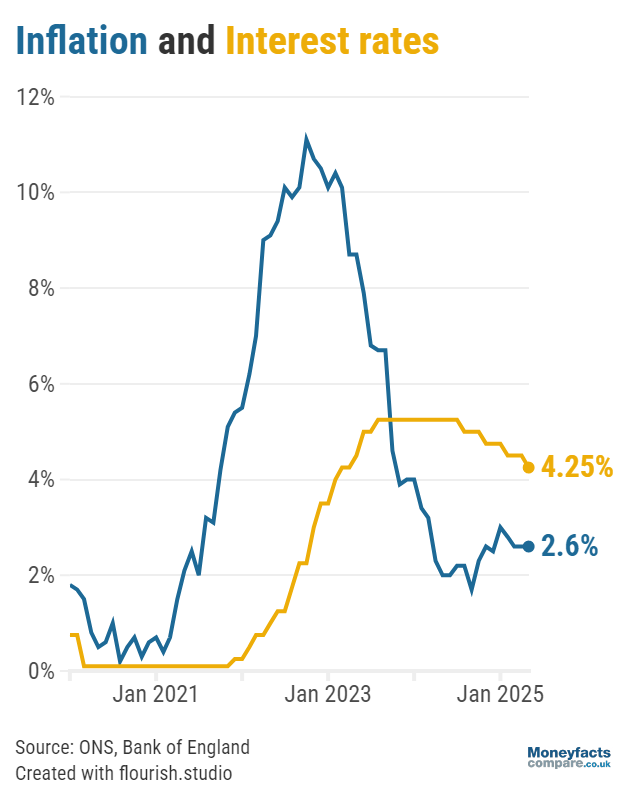

Graph: Bank of England base rate plotted against UK inflation between 2020 and 2025.

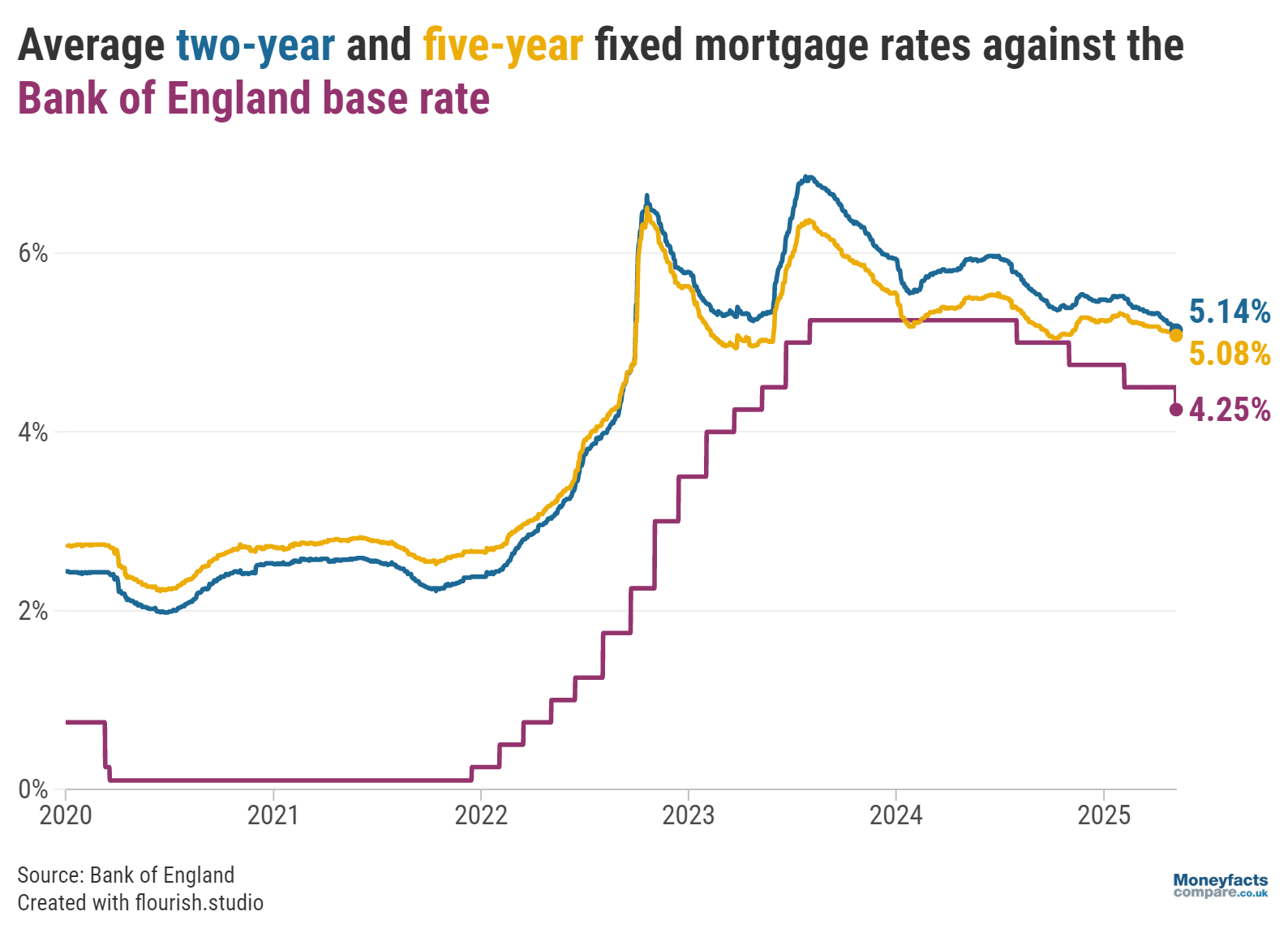

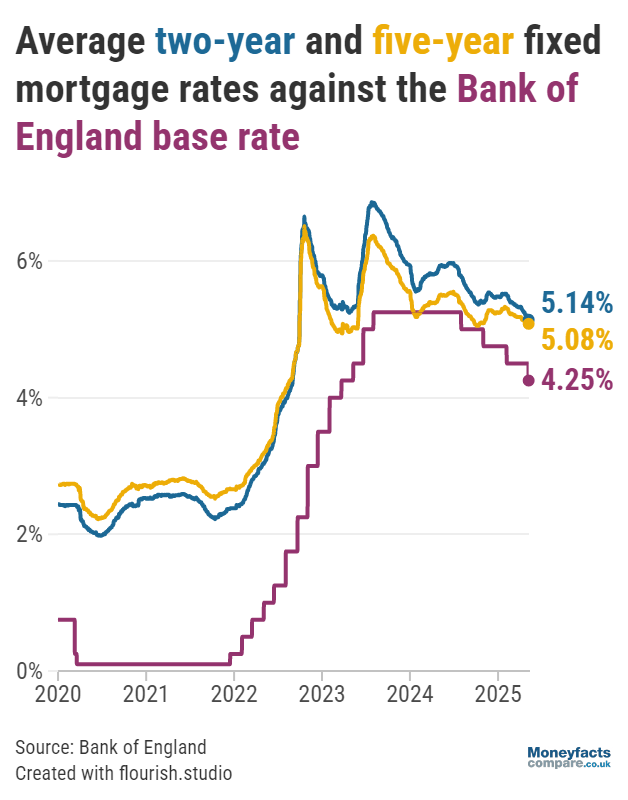

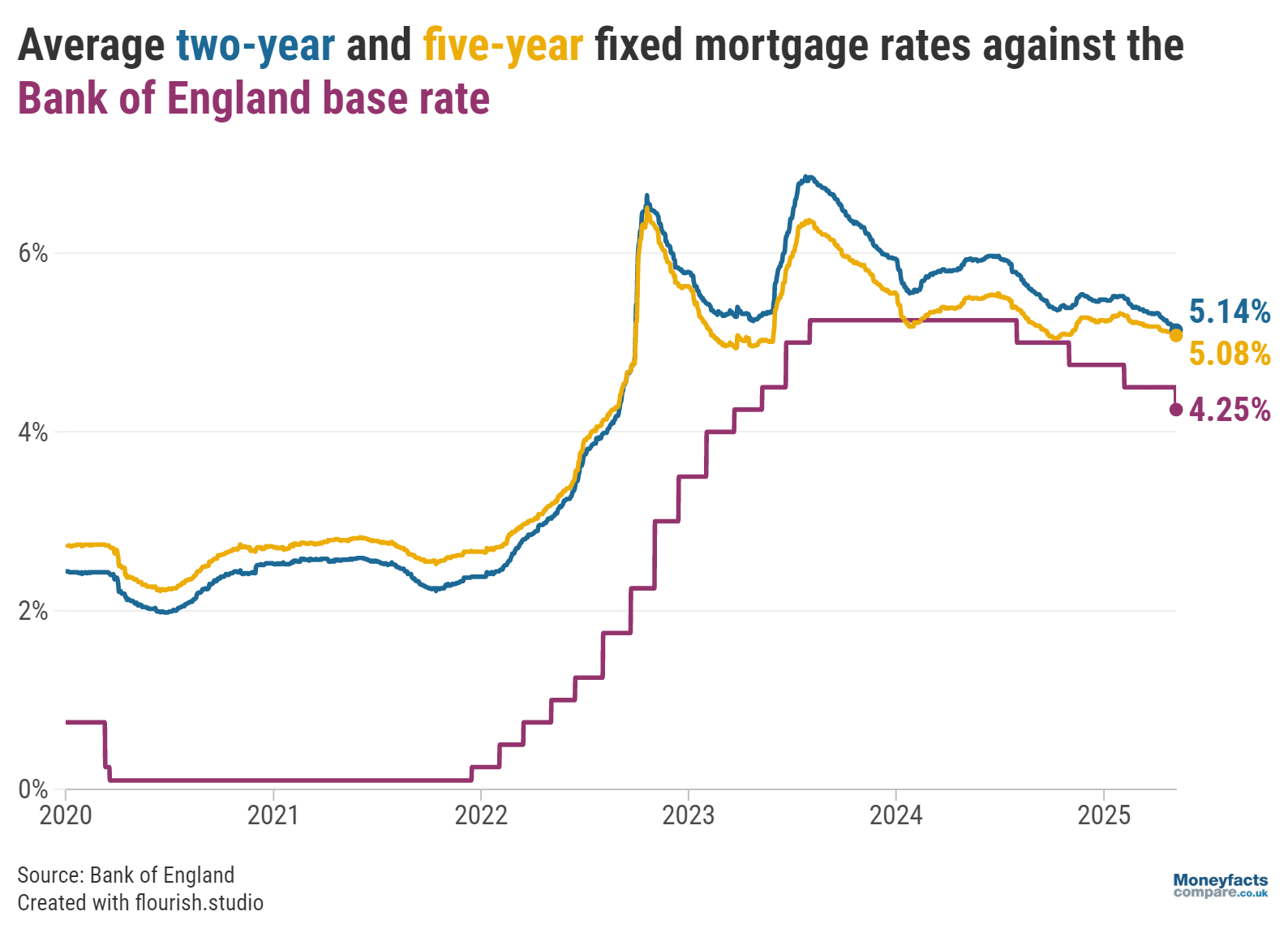

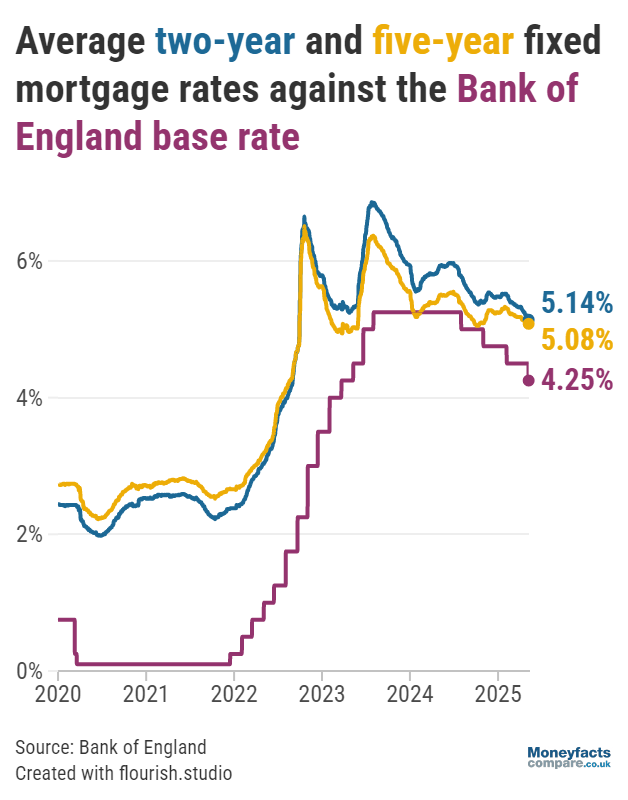

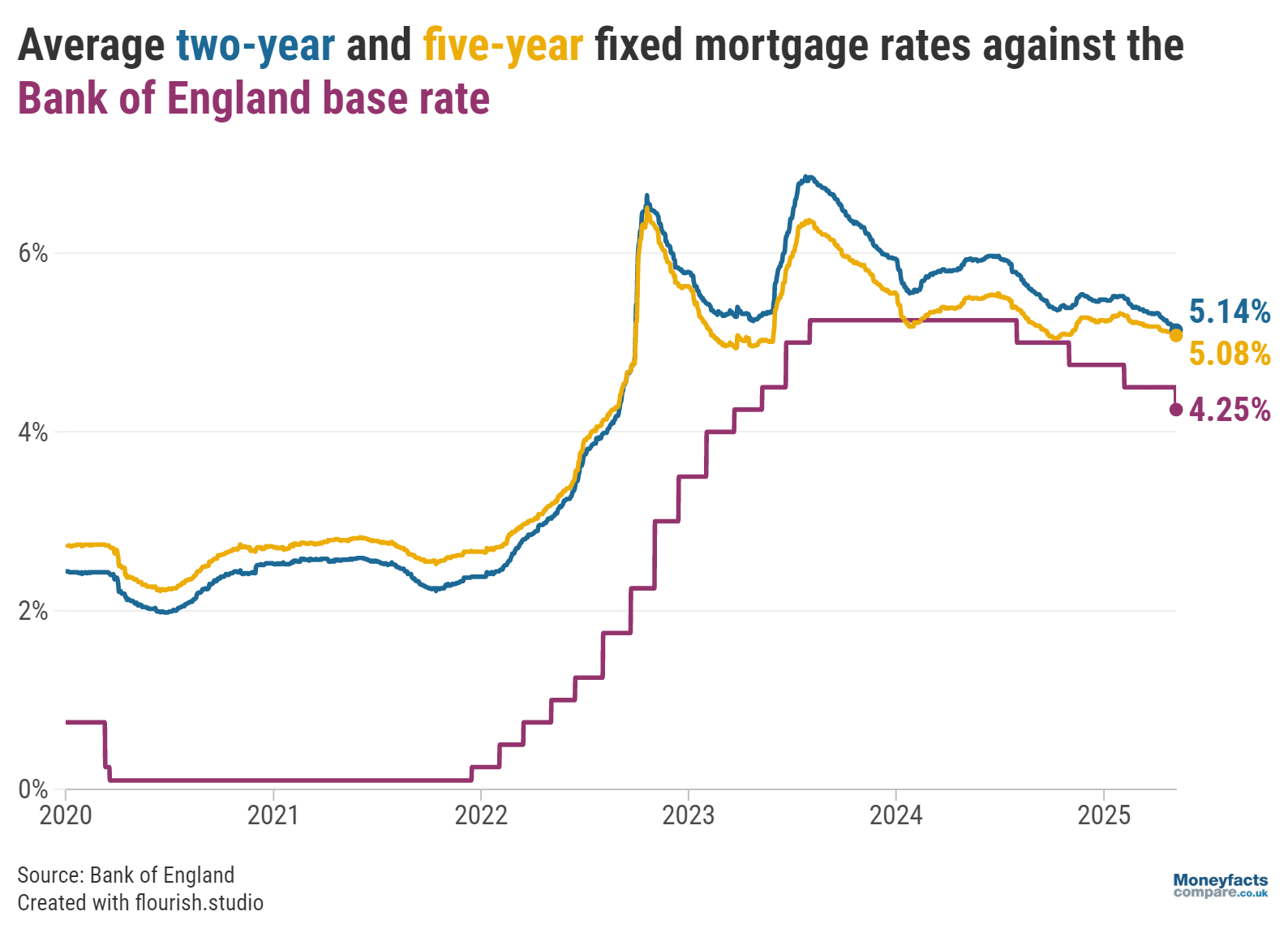

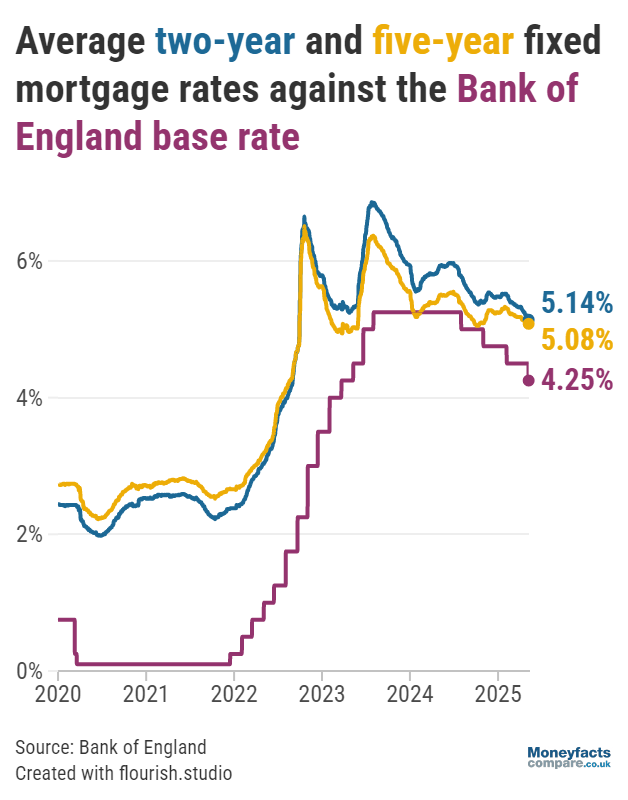

Fortunately for mortgage borrowers, swap market volatility and expectations for future base rate reductions presented lenders with an opportunity to make cuts to their ranges. As a result, the average two-year fixed mortgage rate fell from 5.32% to 5.18% between April and May – its lowest in more than two years. Meanwhile, the average rate charged by a five-year fixed deal dropped from 5.18% to 5.10% over the same period.

Graph: Bank of England base rate plotted against average two- and five-year fixed mortgage rates between 2020 and 2025.

It’s not just declining rates borrowers stand to benefit from; Oliver Dack, Spokesperson at Mortgage Advice Bureau, added that “a more competitive mortgage market tends to drive innovation and can see lenders more willing to stretch their multiples” which could help first-time buyers achieve their dream of homeownership.

However, Rachel Springall, Finance Expert at Moneyfactscompare.co.uk, reminded would-be borrowers they must “feel comfortable with their mortgage and understand the implications of missing any repayments”. She also cautioned lenders that “any relaxation to stress tests must be deployed with care and not to the detriment of borrowers later down the line”.

As for those already on the property ladder, Dack continued to encourage borrowers coming to the end of an initial fixed term to book a new deal early.

“Although it’s possible rates could fall further in the weeks and months ahead, there’s no knowing how long it will be until we see significant movements in pricing. In the meantime, borrowers determined to wait it out while sitting on a lender’s Standard Variable Rate (SVR) risk much higher monthly repayments,” he explained.

Currently, those charged the average SVR of 7.58% are paying £373 more per month than if they locked in a typical two-year fixed deal (based on a £250,000 mortgage repaid over 25 years).

“It’s understandable some may be worried about potentially missing out on more favourable rates, but this shouldn’t deter borrowers from securing a new deal. Instead, they should check their broker is monitoring rates on a regular basis and concentrate on finding the best mortgage for their current needs”, Dack concluded.

Our mortgage charts are regularly updated throughout the day to show the lowest rates currently available. However, it’s important to remember the cheapest-priced deal may not be the most cost-effective for your circumstances. It may be wise to speak to a mortgage broker for help finding the best options for your needs.

Alternatively, find out more information about deals charging some of the lowest fixed rates (as well as some Moneyfacts Best Buy options) in our weekly mortgage roundup.

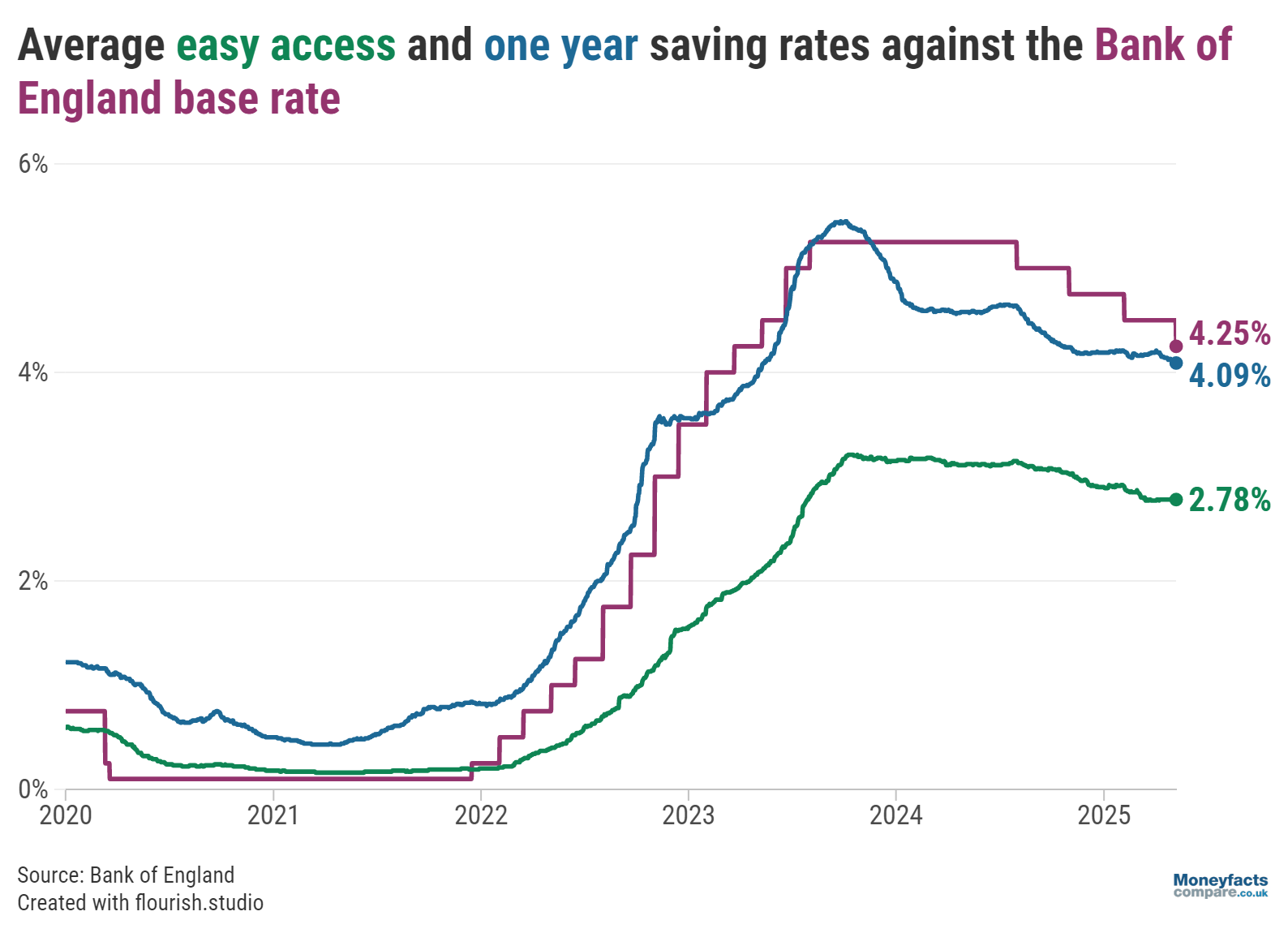

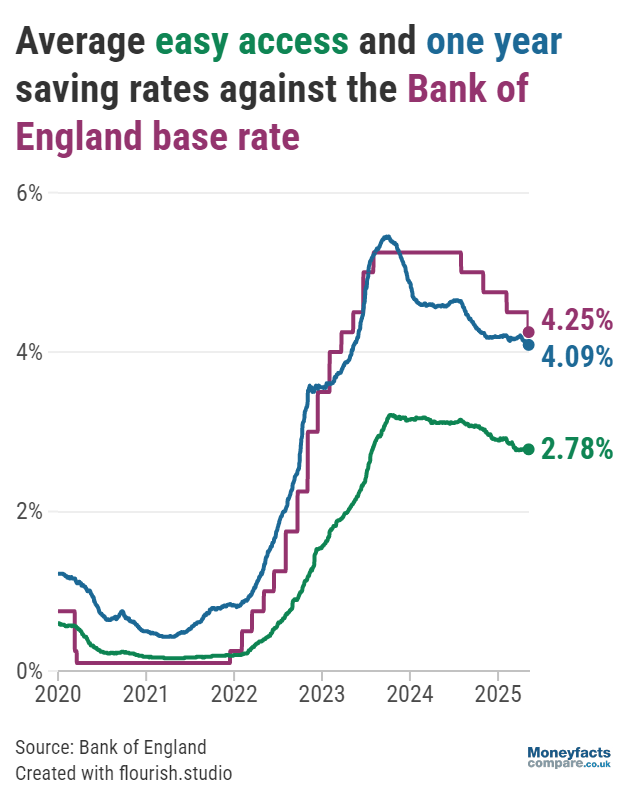

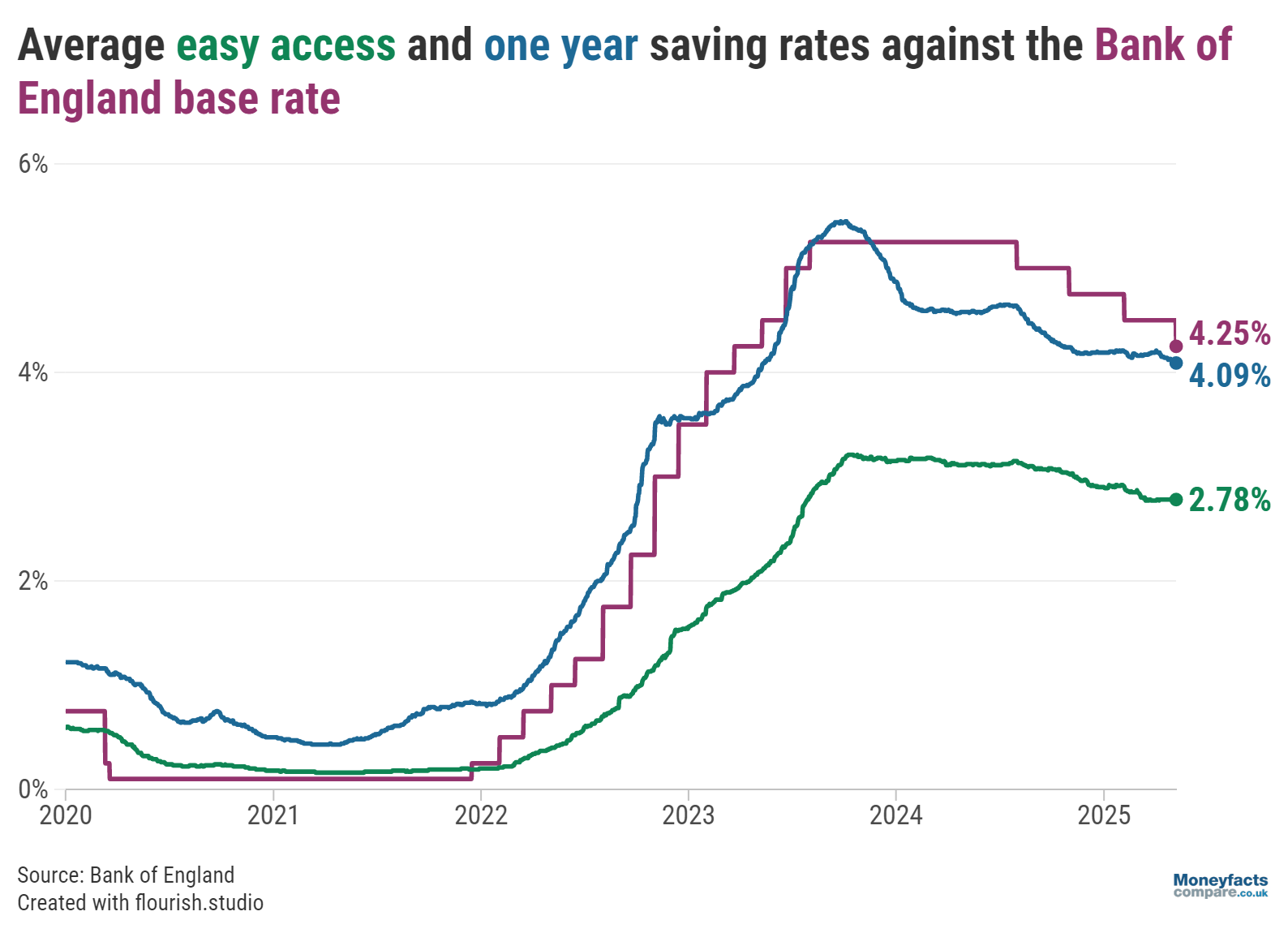

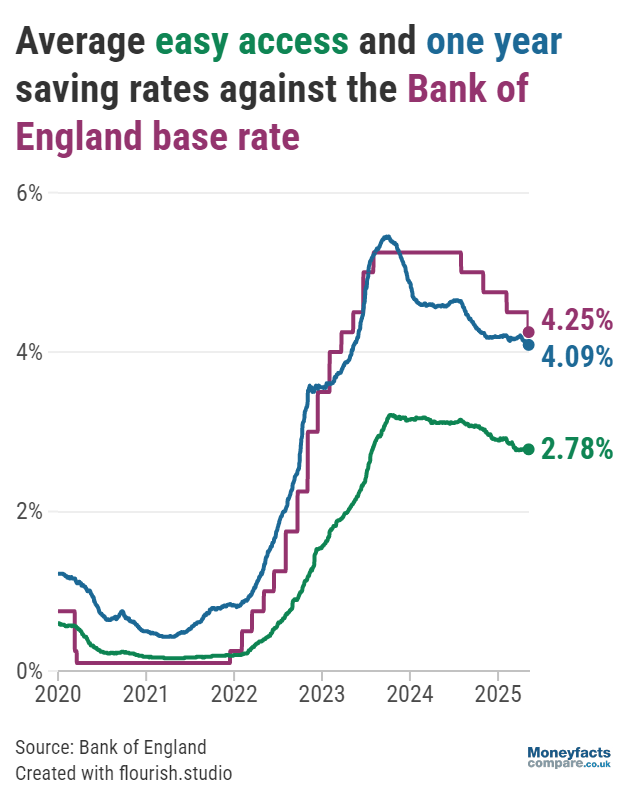

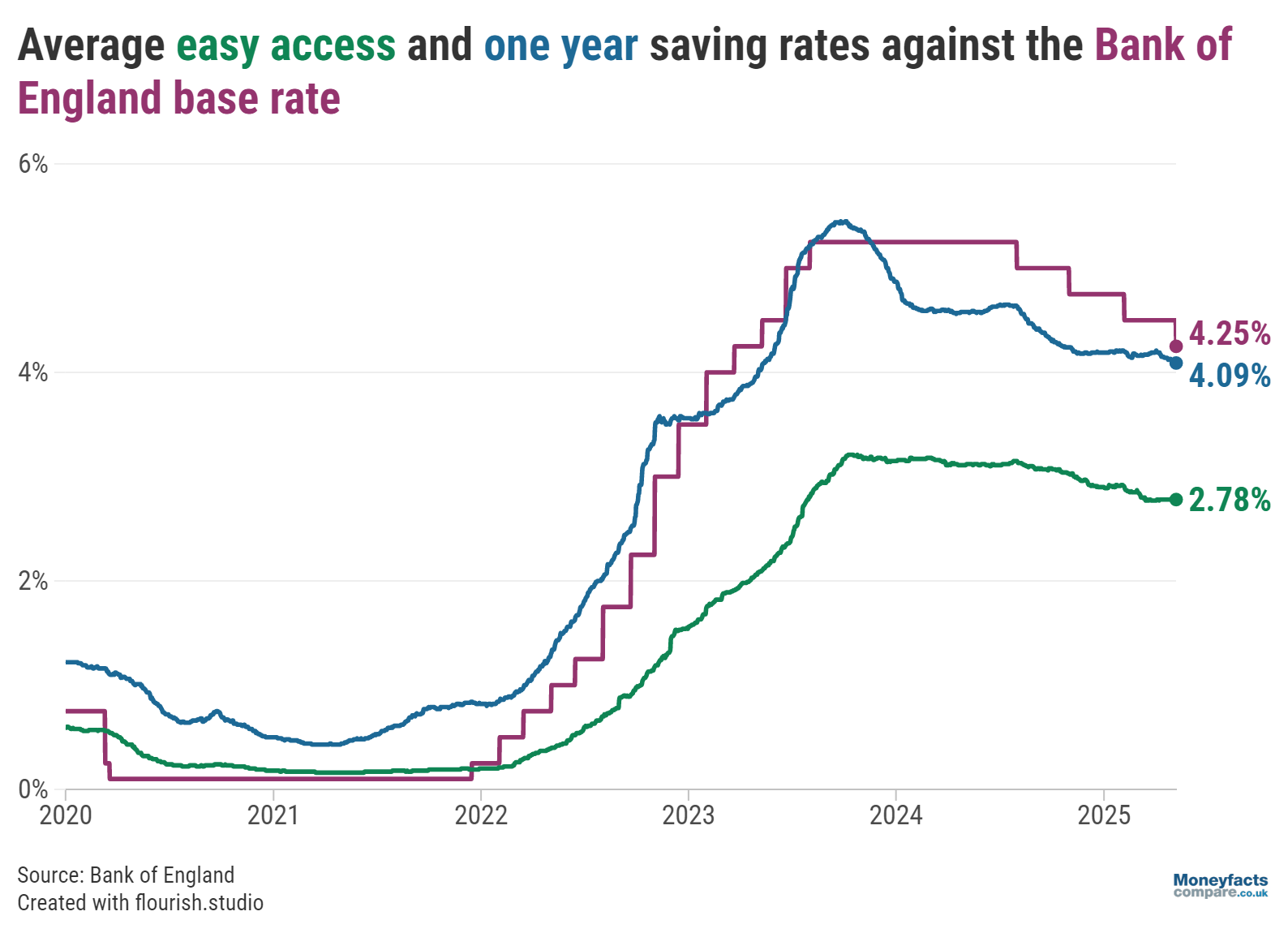

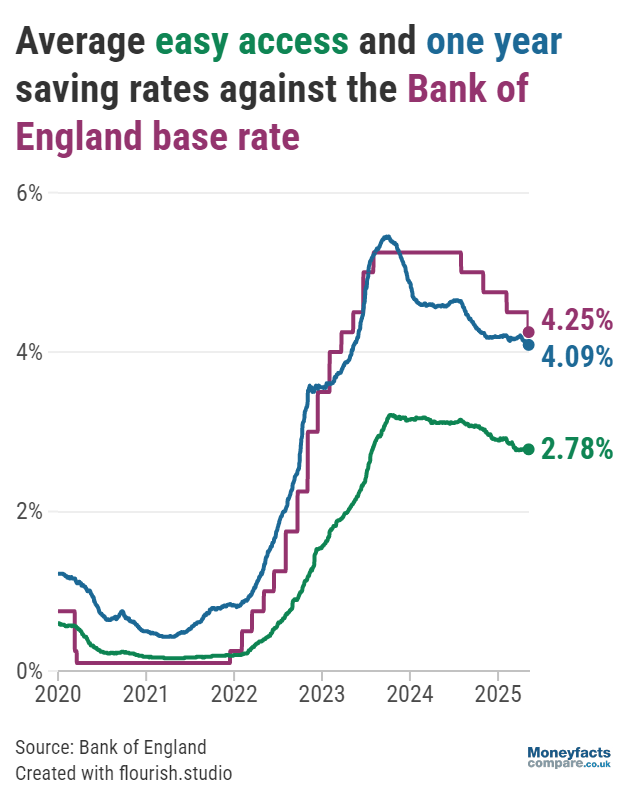

Savers, meanwhile, must be vigilant in the coming weeks as providers are often quick to pass on base rate reductions to their variable products. Three previous cuts to the UK’s central interest rate over the past year, for instance, saw the average rate paid by an easy access savings account tumble from 3.11% in May 2024 to 2.79% by the start of this month.

Graph: Bank of England base rate plotted against average easy access and one-year fixed savings rates between 2020 and 2025.

There’s also a risk new US tariffs could further diminish returns in real terms by fuelling a rise in the costs of goods and services. “Inflation sits above its 2% target and the biggest high street banks pay an average of 1.63%* across easy access accounts,” said Springall, adding “convenience comes at a cost if savers are not prepared to shop around and switch their pots”.

By contrast, the best easy access accounts pay well in excess of 4.00% AER - many of which are offered by lesser-known challenger banks. That being said, Springall urged savers to “check the terms of these accounts before they invest” as some impose restrictions on withdrawals.

Alternatively, with the Office for Budget Responsibility (OBR) estimating around 2.5 million people will pay higher-rate tax this year and be eligible to earn just £500 in tax-free interest from their savings, those concerned about exceeding this amount may want to consider an ISA.

Offering more than 5.00% AER, many of the best easy access ISAs outperform their traditional counterparts. What’s more, with the 2025/26 tax-year getting underway a little over a month ago, savers have a renewed £20,000 ISA allowance to utilise.

Whether you want the flexibility of an easy access account or guaranteed returns with a fixed bond, our savings charts are regularly updated throughout the day so you can compare the best rates currently available.

Those wanting to make the most of their recently refreshed ISA allowance can also find the best ISA rates on our dedicated chart.

Or, for more information on accounts offering the most competitive returns, be sure to read our weekly savings and ISA roundups.

*High street banks include Bank of Scotland, Barclays Bank, Halifax, HSBC, Lloyds Bank, NatWest, Royal Bank of Scotland and Santander. Averages collected from gross interest rates paid across all live easy access accounts with these brands based on a £10,000 deposit, latest rates as at 1 May 2025.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.