But the fall-out from the Autumn Budget casts doubt on any future reductions.

As many predicted, the Bank of England’s Monetary Policy Committee (MPC) voted 8 to 1 in favour of cutting the base rate to 4.75%. This is the second reduction this year after the MPC lowered the base rate in August.

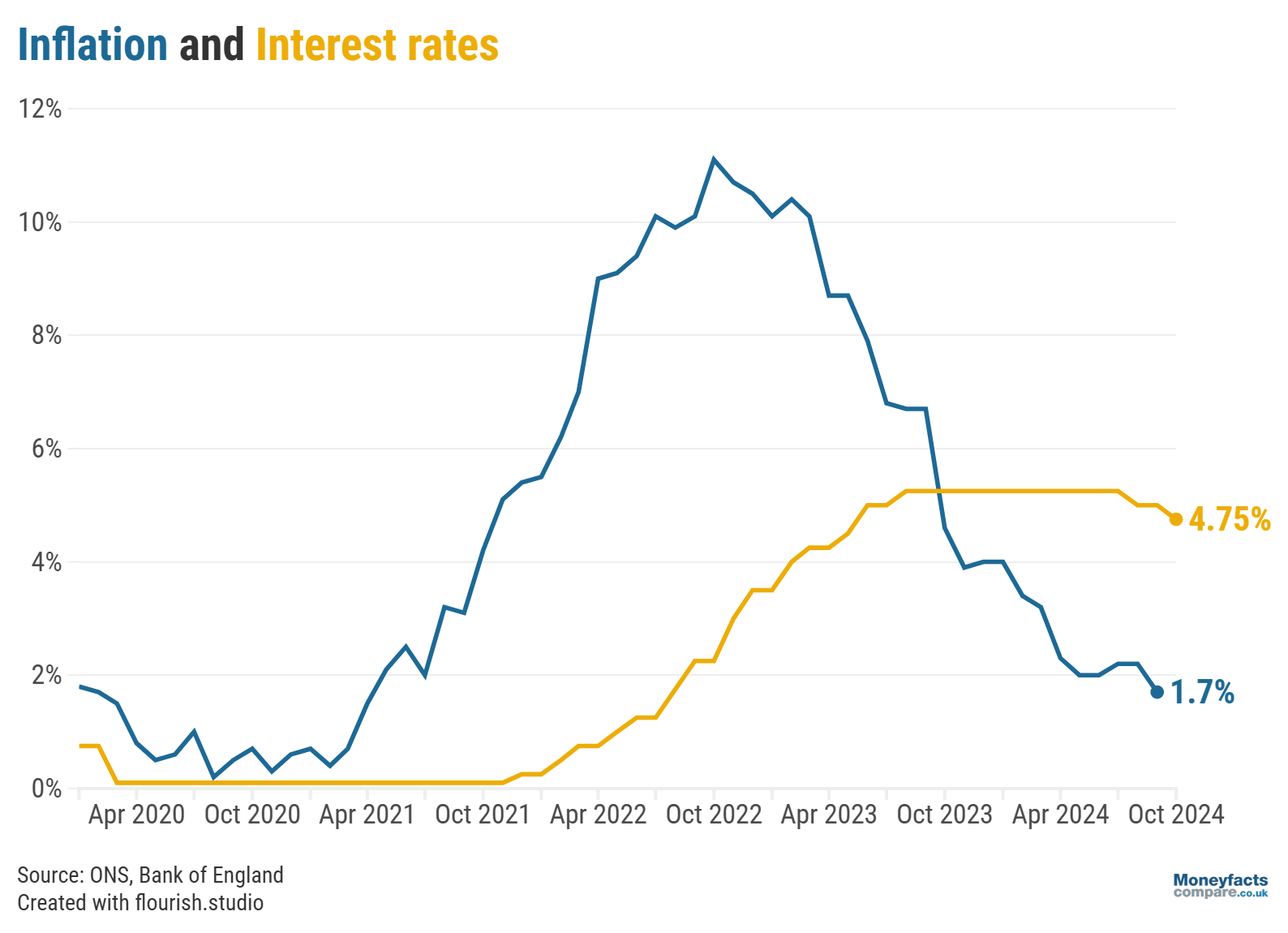

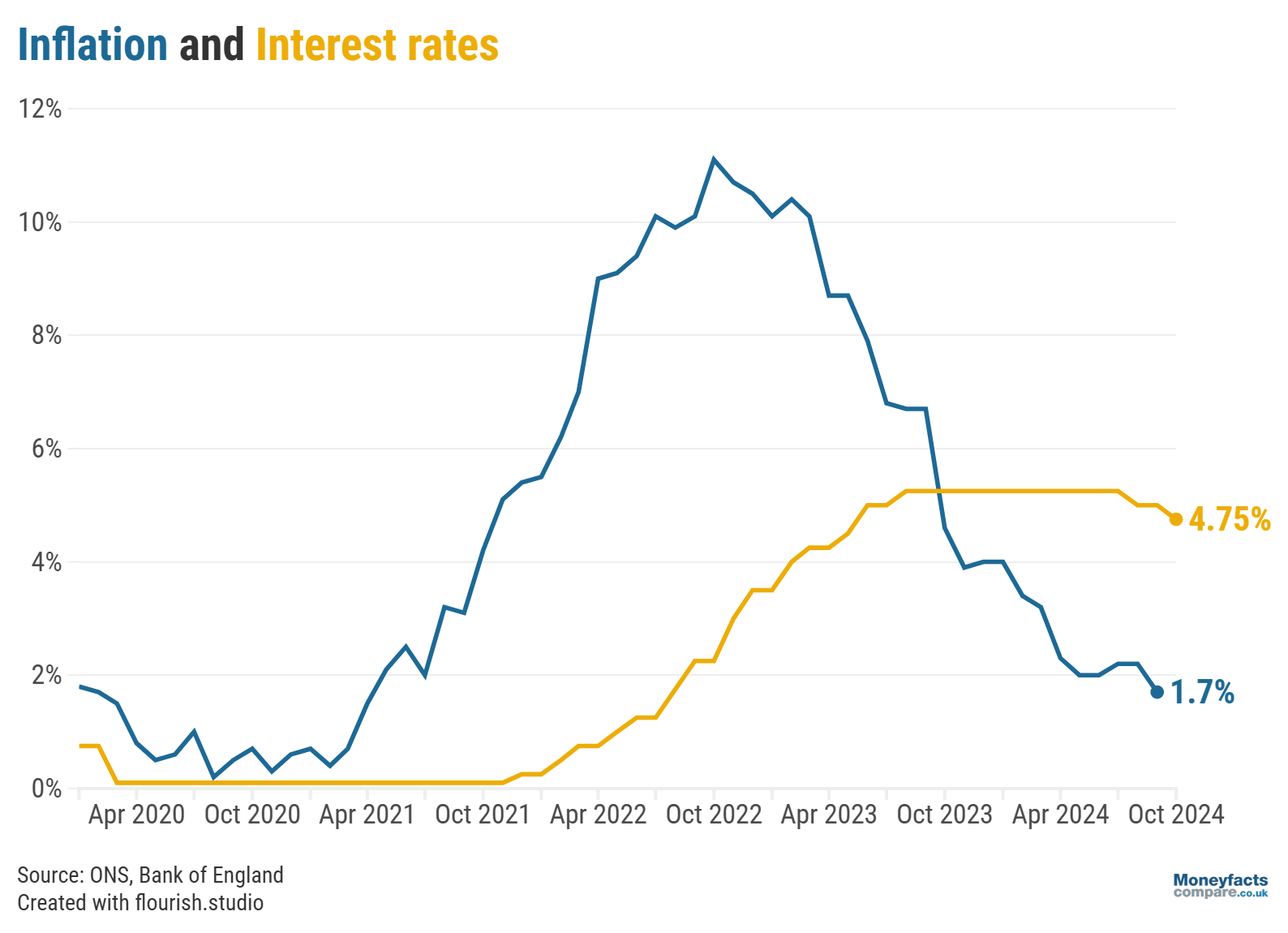

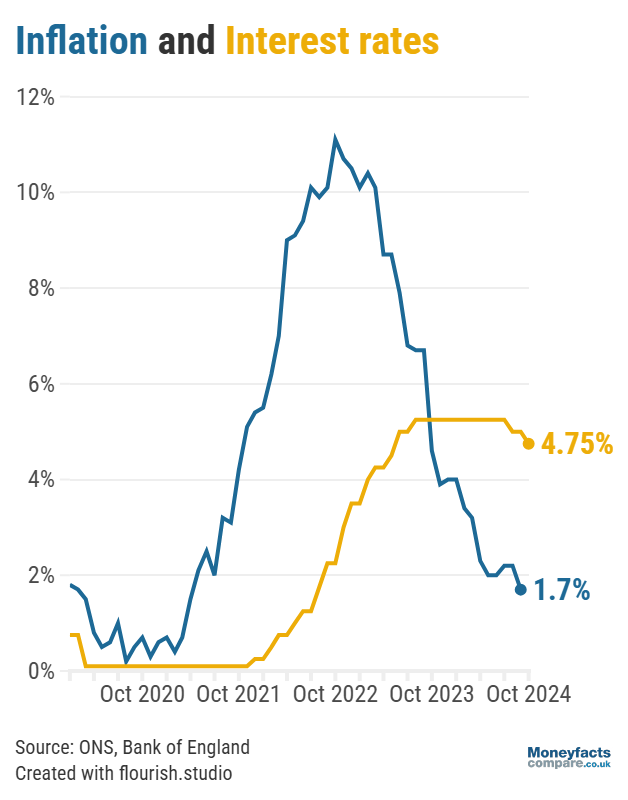

With inflation plummeting to 1.7% in September, falling below the target of 2% for the first time since April 2021, a cut to the base rate was widely expected, even after the announcements made in last week’s Autumn Budget.

The Chancellor of the Exchequer, Rachel Reeves, laid out a range of spending plans and introduced several tax hikes in the Budget, which experts predict could result in higher-than-expected inflation over the coming year. While the MPC still decided to lower the base rate this time around, there are doubts over what this could mean for their next decisions in December and in 2025.

Graph: Interest rates vs inflation between 2020 and 2024.

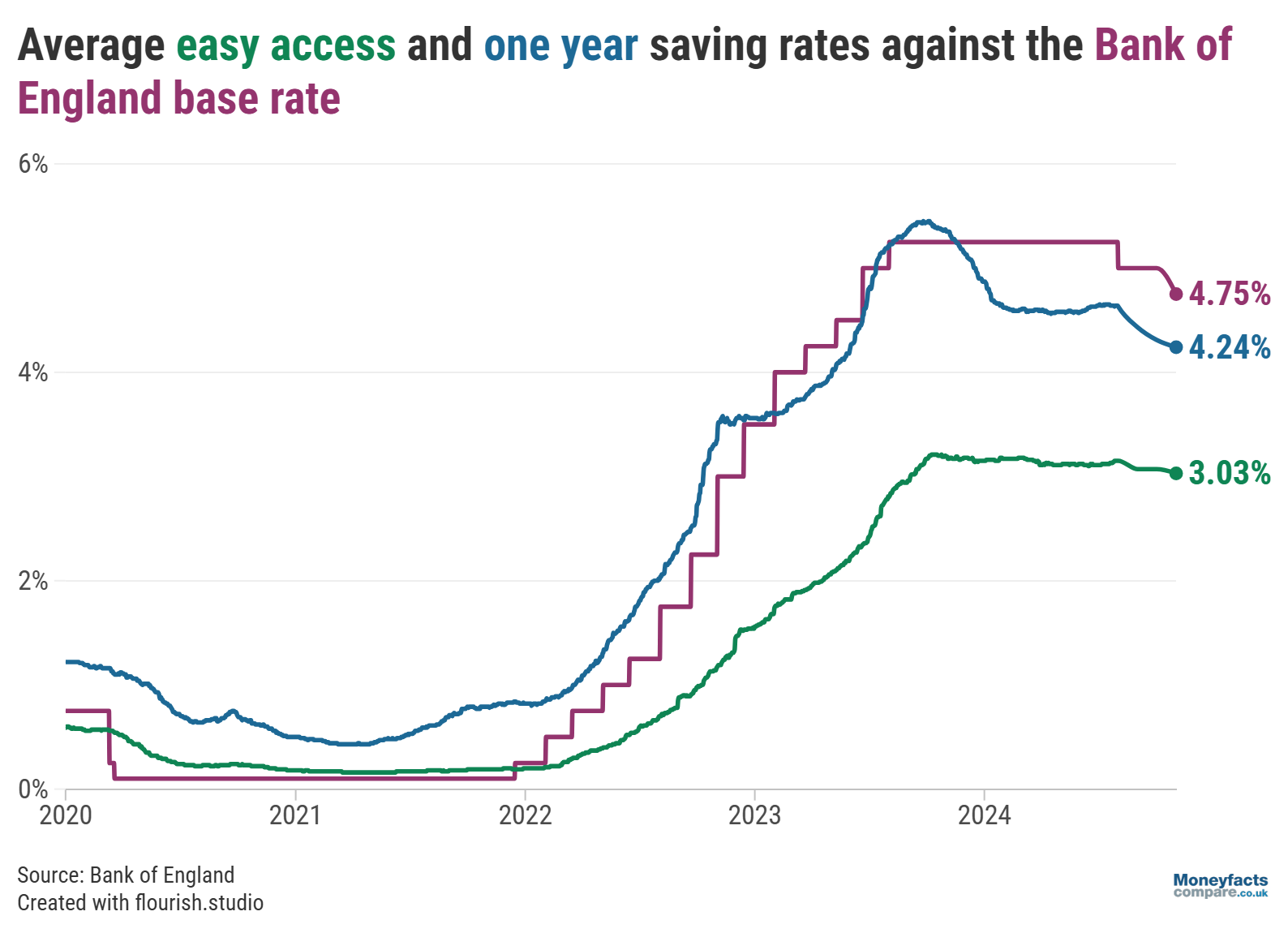

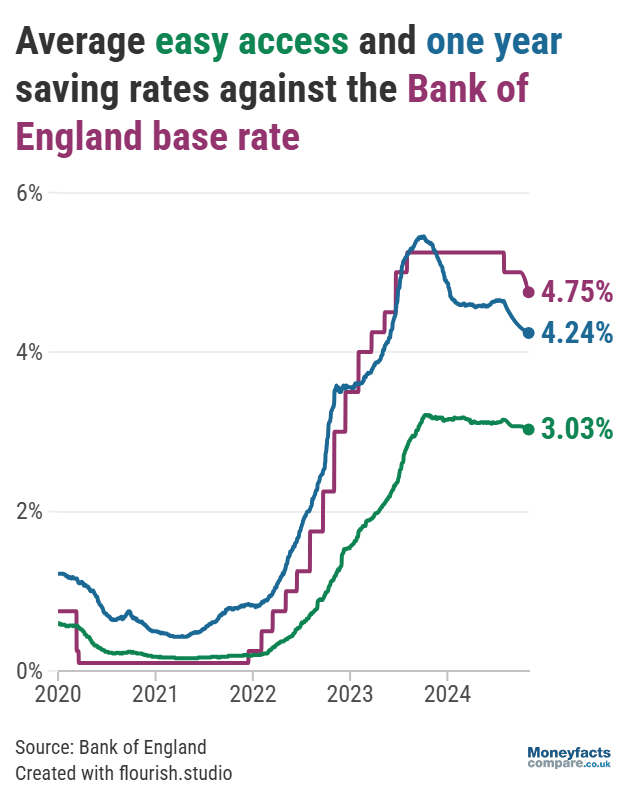

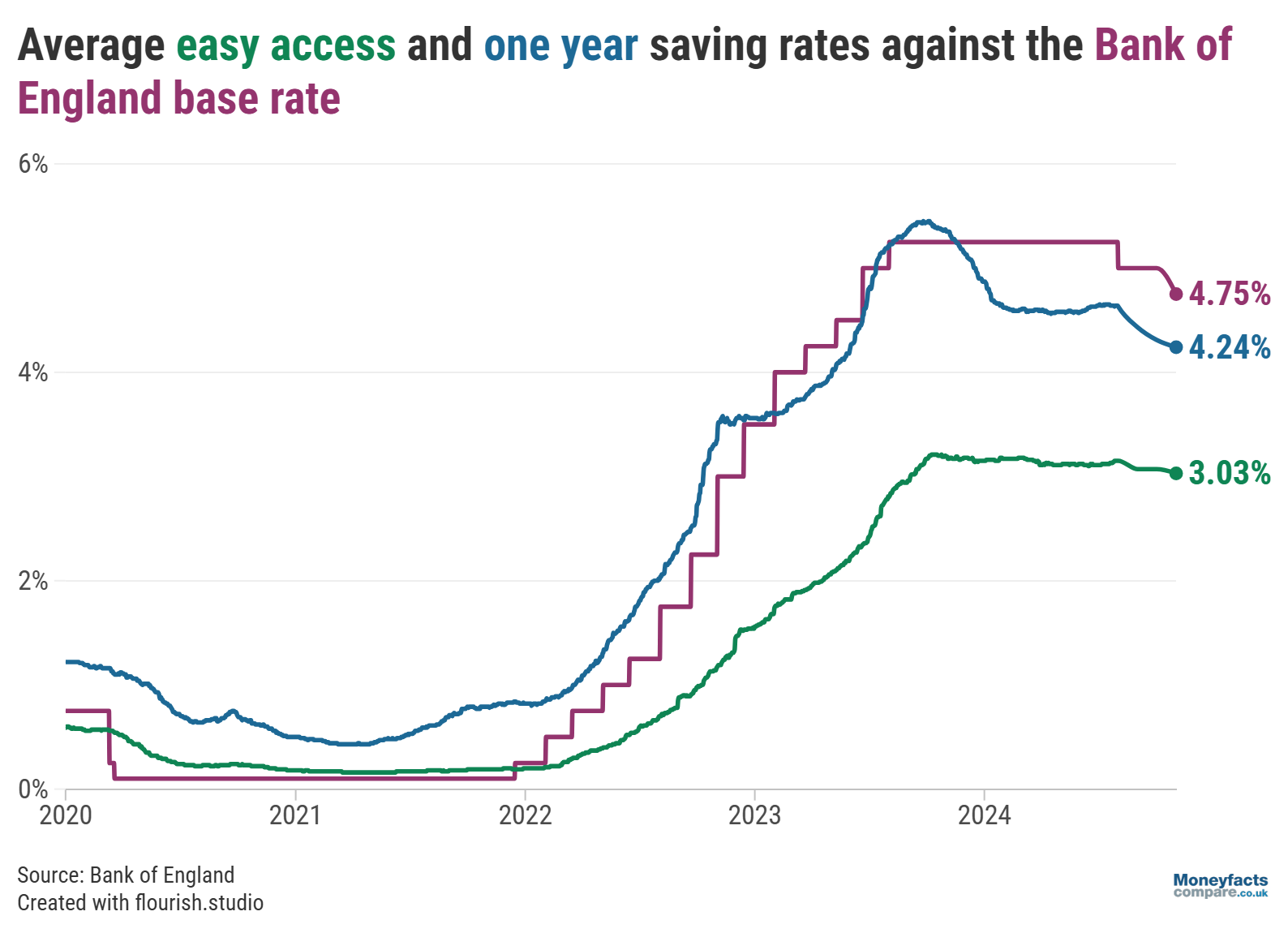

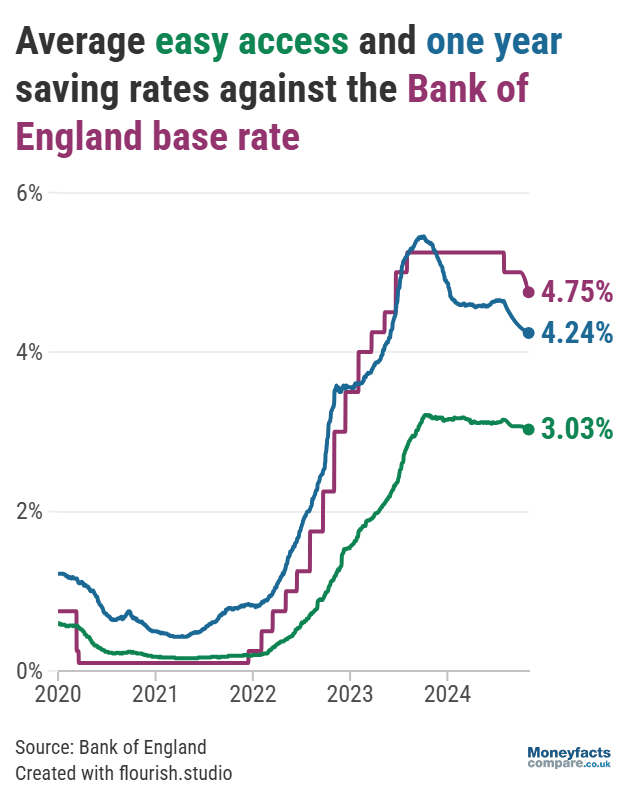

This cut to the base rate will be a further blow to savers, who have seen savings rates fall significantly since the earlier base rate cut at the start of August. For example, the average easy access savings rate fell from 3.15% at the start of August to 3.03% at the start of November, while the average easy access ISA rate fell from 3.36% to 3.24% over the same period.

Graph: Average easy access and one-year fixed savings rates between 2020 and 2024.

“Savers are the ones who feel the force of cuts to interest rates, and to add insult to injury, will see no rise to any personal tax or savings allowances in the short-term, making cash ISAs increasingly attractive,” commented Rachel Springall, Finance Expert at Moneyfactscompare.co.uk.

In the wake of the Bank of England’s decision, providers may start to reduce the rates on their variable accounts. As a result, savers should act sooner rather than later if they want to secure a competitive rate. Any savers with funds that they don’t need to access can protect their savings from any potential future falls in interest rates by locking them away into a fixed rate bond.

It’s worth noting that loyalty isn’t necessarily rewarded if you choose to save with your current account provider. “Where some consumers may well get a promotional product as a new customer for a limited time, others who keep their cash stashed for convenience with the high street banks will be getting pitiful returns,” Springall noted. This is why it’s so important for savers to compare accounts and consider switching to providers that can offer higher returns on their money.

For an up-to-date list of the top easy access, notice and fixed rates, see our savings charts.

Alternatively, see our ISA charts if you want to make the most of your tax-free ISA allowance.

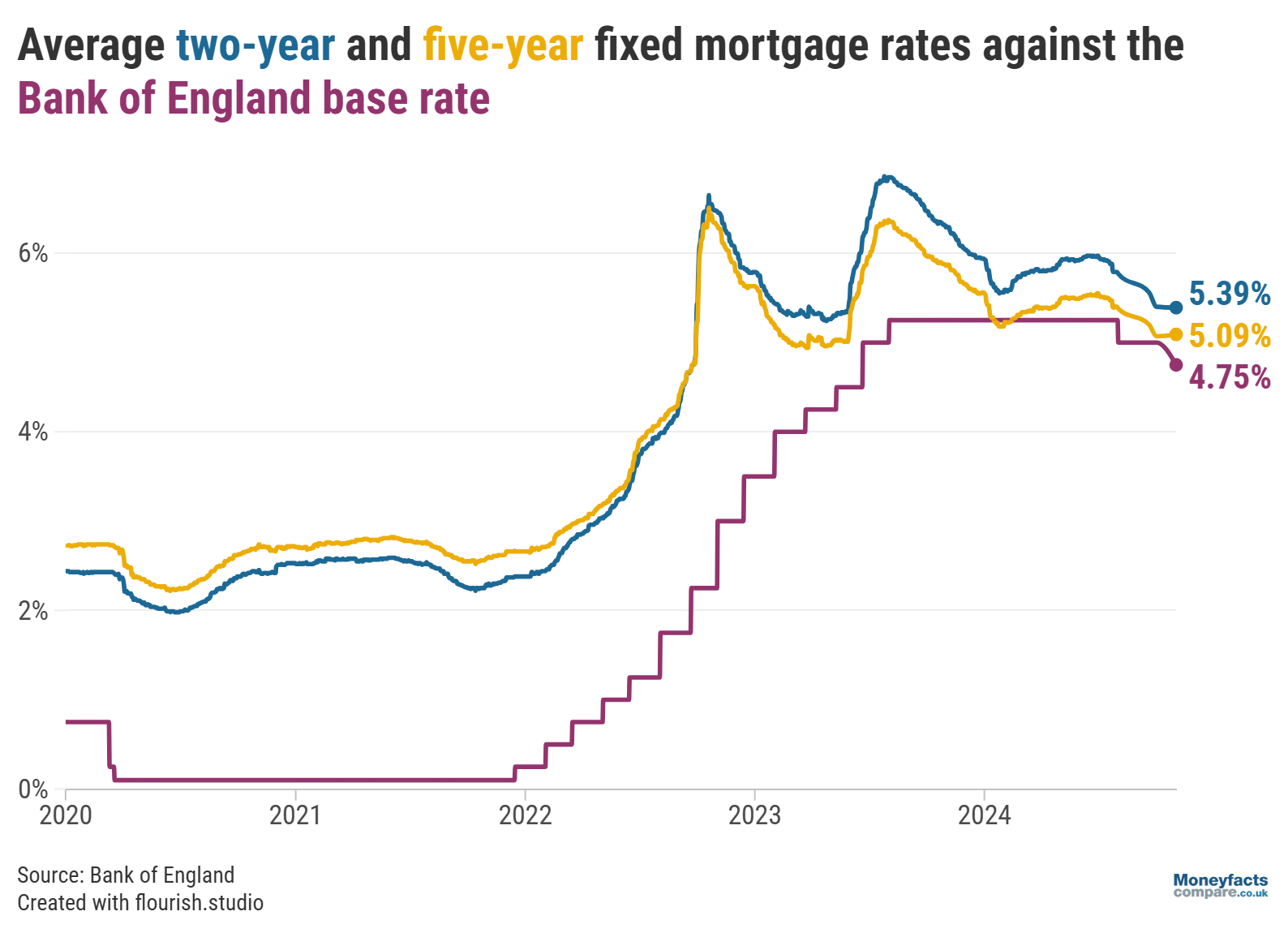

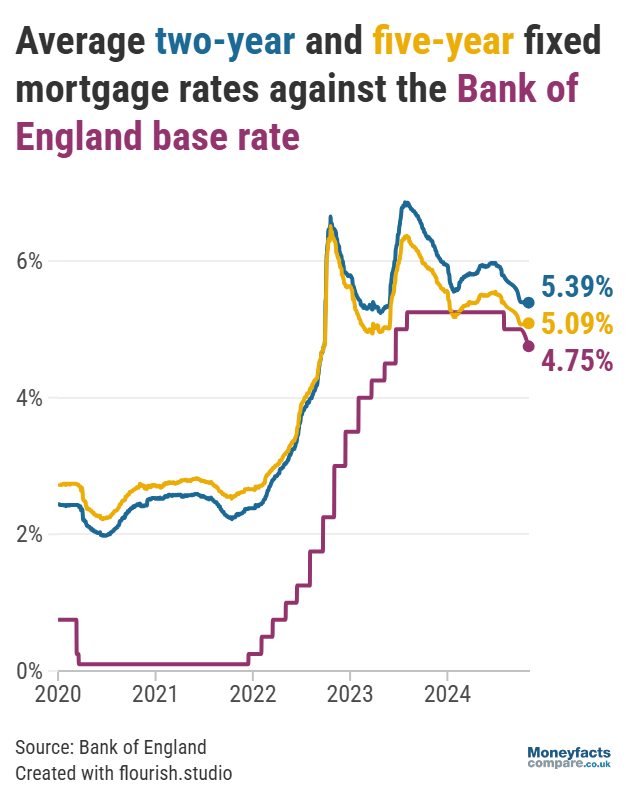

In contrast to savers, anyone planning to take out a mortgage in the near future will be pleased to see a lowering of the base rate in the hope that this will cause mortgage rates to fall. However, while this cut is likely to see lenders reduce the rates on their variable and tracker deals, lenders may have already factored in a lowering of the base rate when pricing their fixed deals.

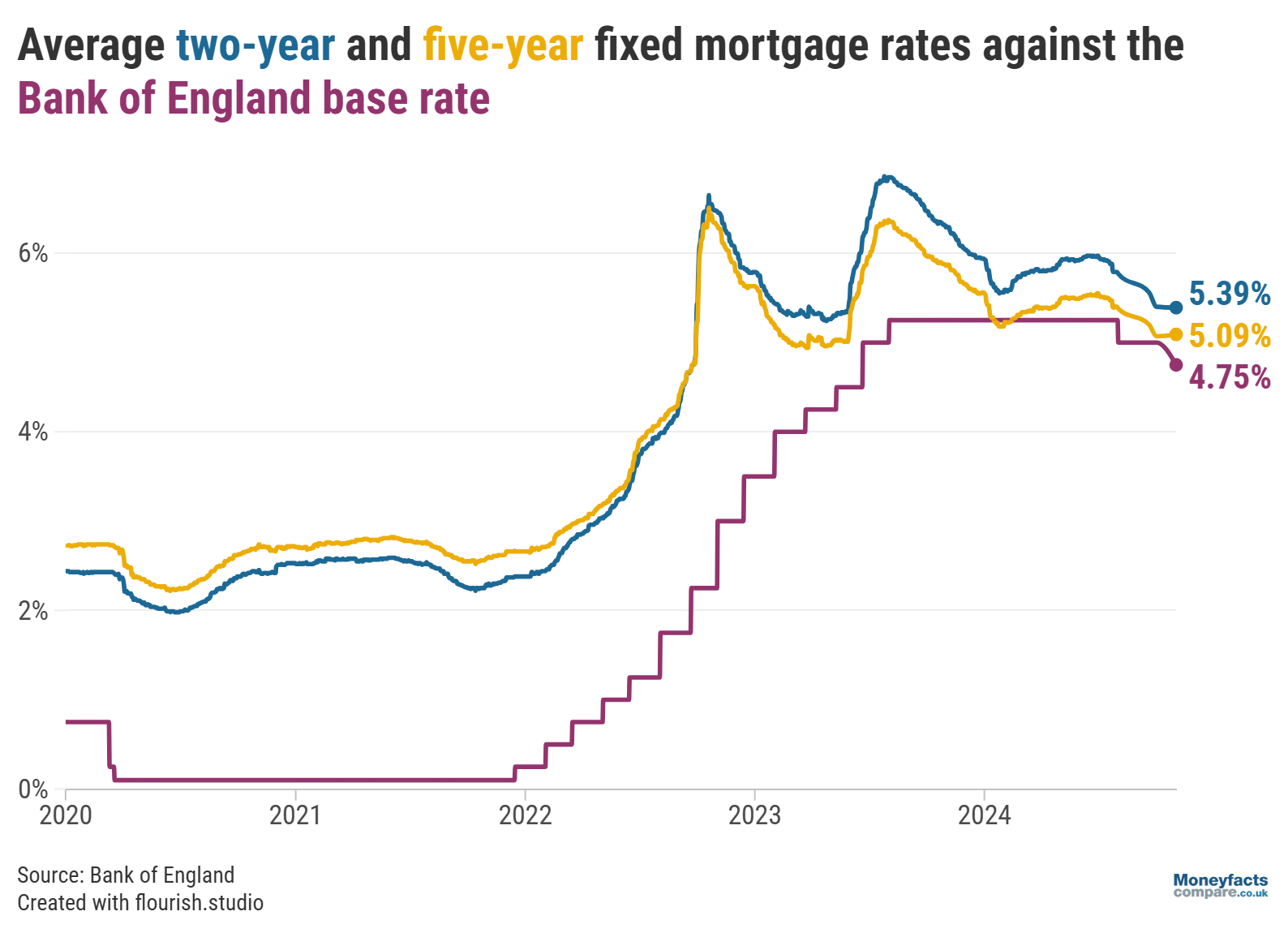

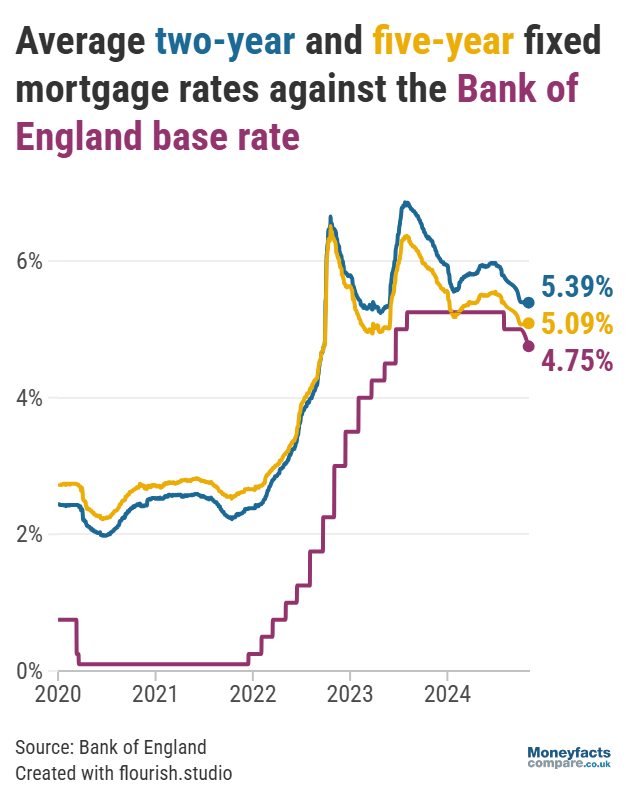

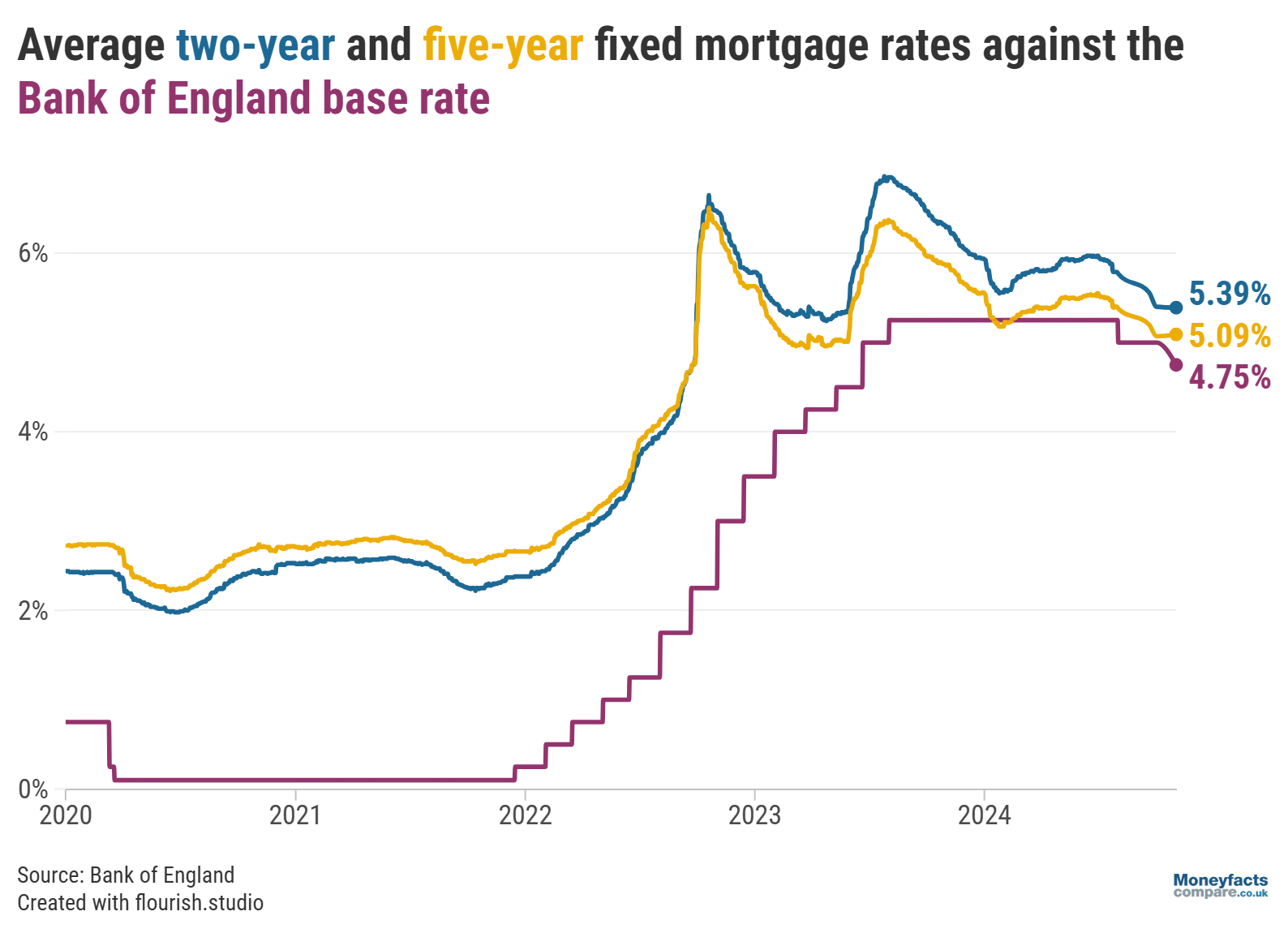

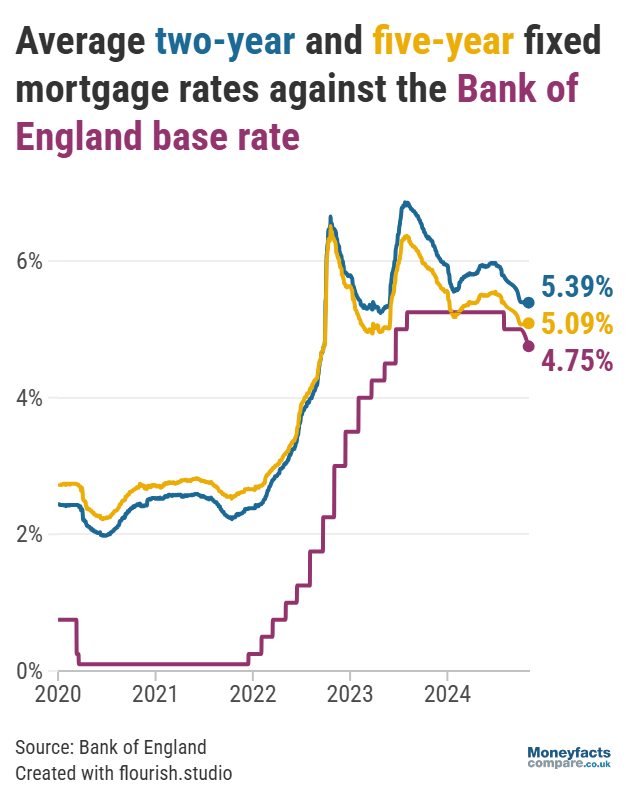

Furthermore, swap rates, which typically reflect what interest rates could do in the future, increased after the Autumn Budget, so a drop in mortgage rates isn’t guaranteed, even after this base rate decision. Nevertheless, borrowers can still take heart that mortgage rates are significantly lower than they were one year ago, with the average two-year fix falling from 6.29% in November 2023 to 5.39% this November, and the average five-year fix dropping from 5.86% to 5.09%.

Graph: Average two and five-year fixed mortgage rates between 2020 and 2024.

Even though borrowers may be holding out for a further reduction in mortgage rates before fixing, with the average Standard Variable Rate (SVR) sitting at 7.95% at the start of the month, there is still an incentive to lock into a fixed deal.

As well as mortgage rates, any prospective buyers also need to bear in mind that Stamp Duty thresholds will fall from April 2025 after the Government decided not to extend the relief. This means many buyers may try to get their property purchase finalised as soon as possible to avoid paying more of this tax, but it’s important to make sure you’re doing what’s right for you.

“We’ve been encouraging borrowers to tune out scrutiny of the Budget itself and instead focus on their own circumstances; in most cases, those looking to move home or refinance can continue as planned but should consider seeking advice if they have any concerns,” explained Oliver Dack, Spokesperson for Mortgage Advice Bureau.

See our regularly-updated mortgage charts for the latest rates on offer.

However, bear in mind that the lowest priced deal may not be the most cost-effective or suitable deal for your circumstances. Our weekly mortgage roundup provides more information on products offering the lowest rates and includes some Moneyfacts Best Buy alternatives which are chosen based on their overall true cost.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.