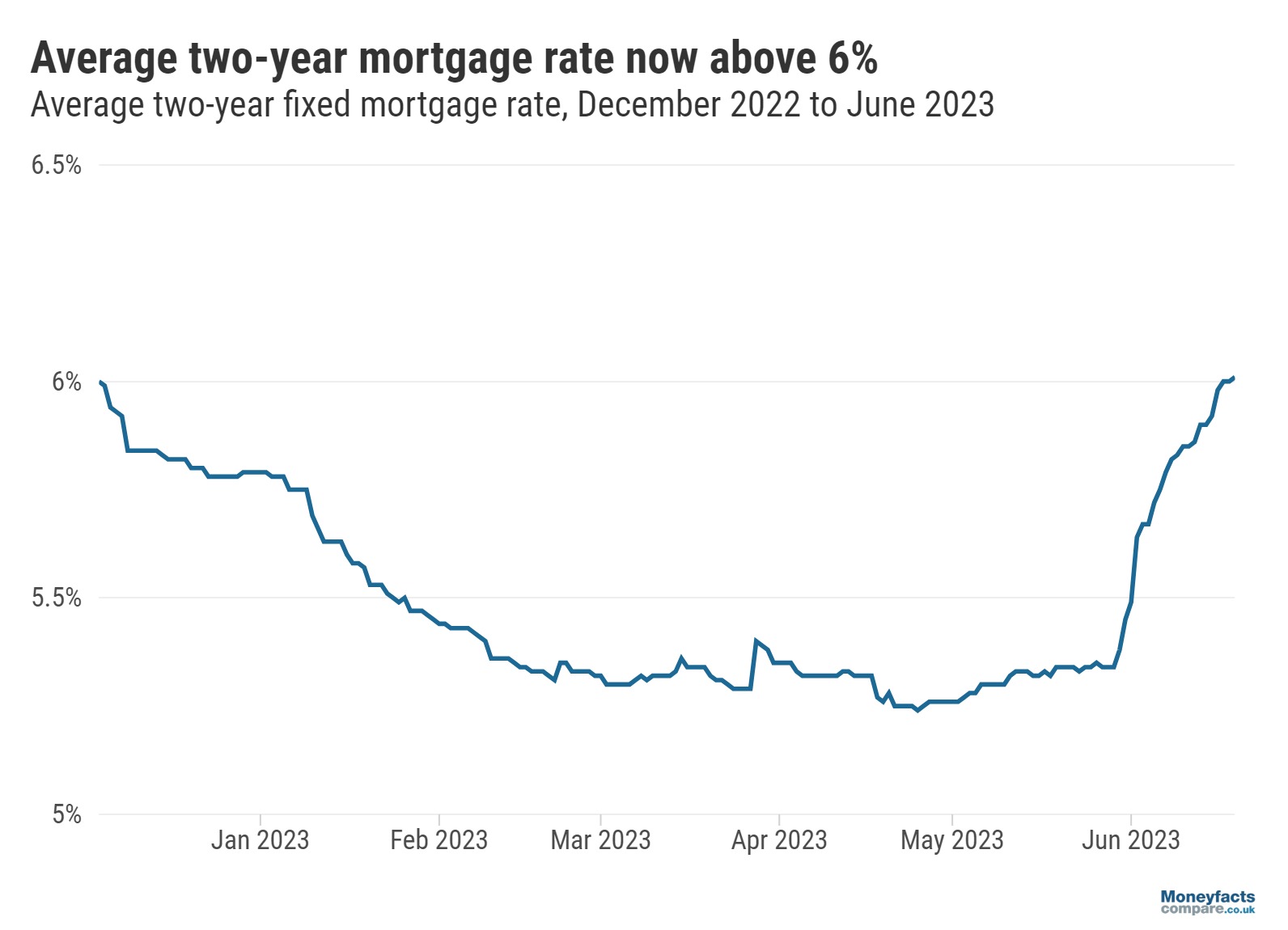

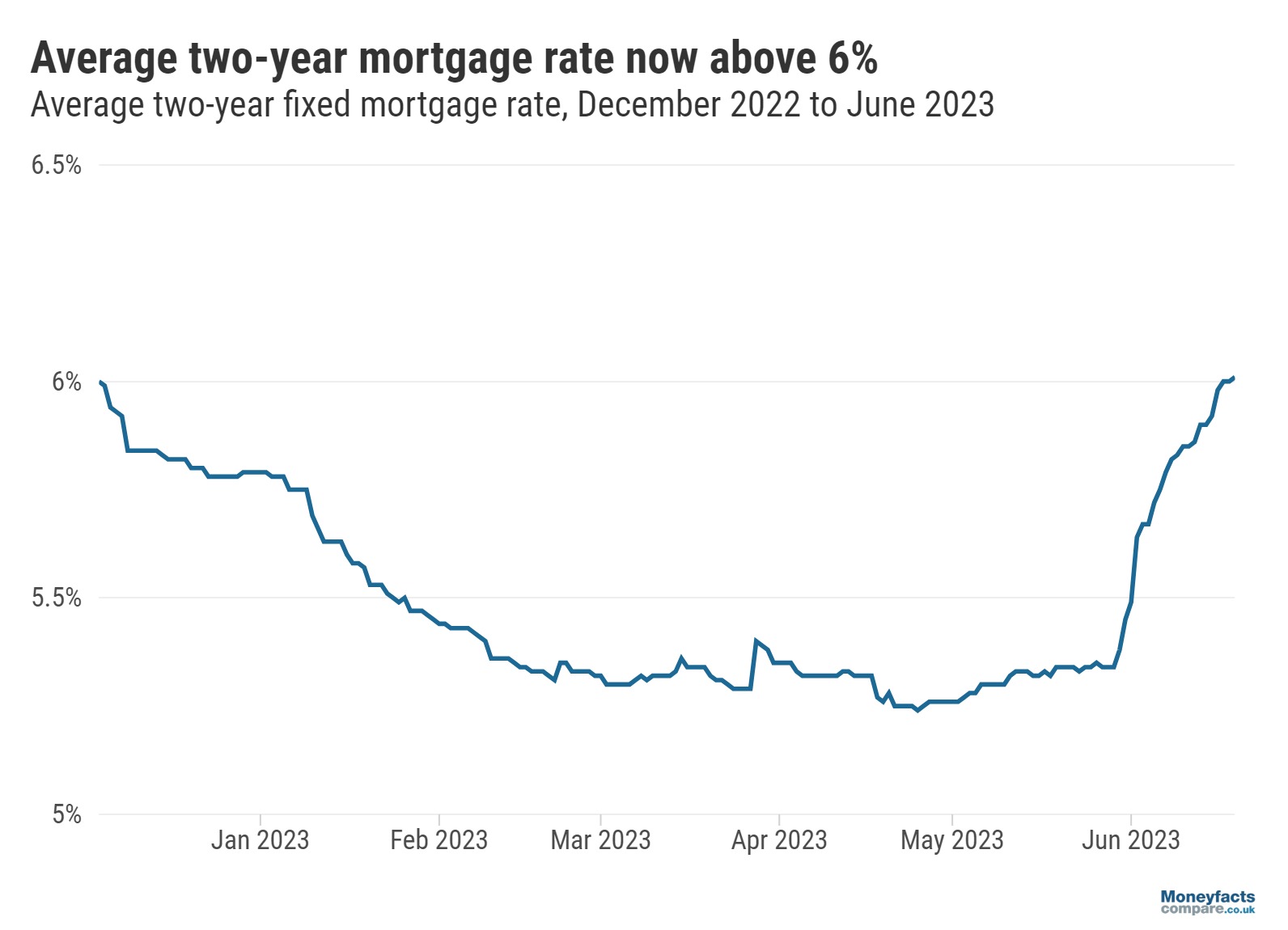

The last time the average two-year fixed rates were higher was December 2022.

The average rate for a two-year fixed mortgage hit 6% Saturday – the highest it’s been since December last year.

This comes as a number of lenders made changes to their fixed rate ranges over recent weeks, factoring in the likelihood of future hikes to the Bank of England base rate.

Caption: Average two year fixed rates fell from 6% in December. They hit a low of 5.24% in April before beginning to rise again. Chart created with flourish.studio

Rates started rising again after April’s inflation figures, published by the Office for National Statistics (ONS), were worse than expected. As a result, there’s a possibility that the Bank of England’s Monetary Policy Committee (MPC) could vote for further increases to the base rate in an attempt to tackle the increasing cost of living. The next time the MPC will meet to vote on the matter is this Thursday.

The last time average two-year fixed rate mortgages breached the 6% threshold was in the wake of last year’s mini-Budget. During this time, the average two-year deal peaked at 6.65% on 20 October 2022, before finally dropping below 6% in December.

On the day before April’s inflation statistics were announced, the average two-year fixed rate stood at 5.33%. With the average two-year deal now reaching 6.01%, according to Moneyfactscompare.co.uk calculations, this translates roughly to an increase of £81 per month for the initial term. This estimate is based on a borrowed sum of £200,000 over 25 years. To personalise your results, you can use the mortgage repayment calculator below.

Meanwhile, the average five-year fixed rate is also on the rise but, at 5.67% today, this is unusually cheaper than the average two-year deal.

However, if you’re after a two-year fixed mortgage, don’t despair. Some of the best two year fixed rates are just over 5%; to find out more you can either visit our charts or read our weekly mortgage roundup.

Otherwise, you can speak to an independent mortgage adviser. Speak to Mortgage Advice Bureau today.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.