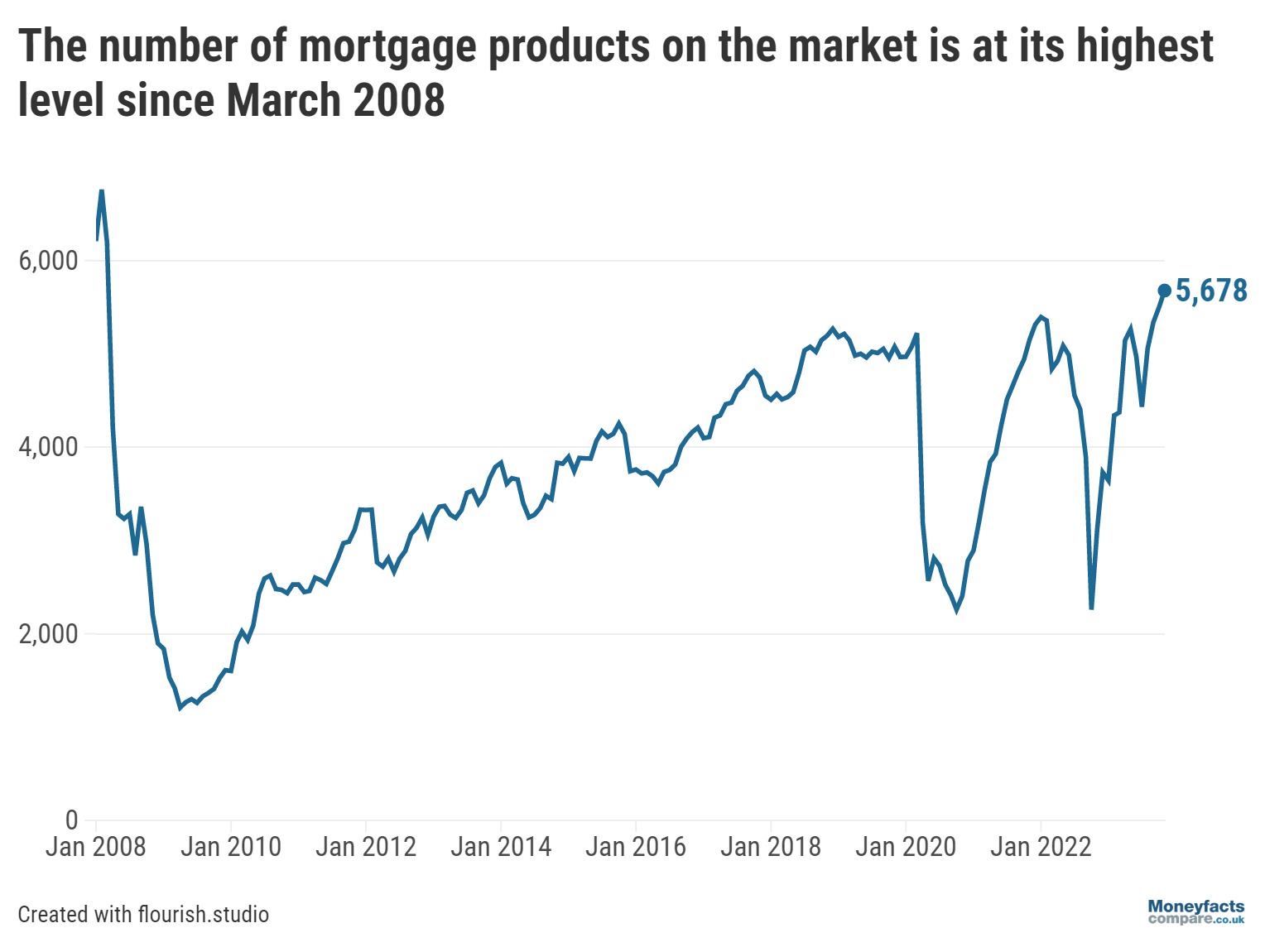

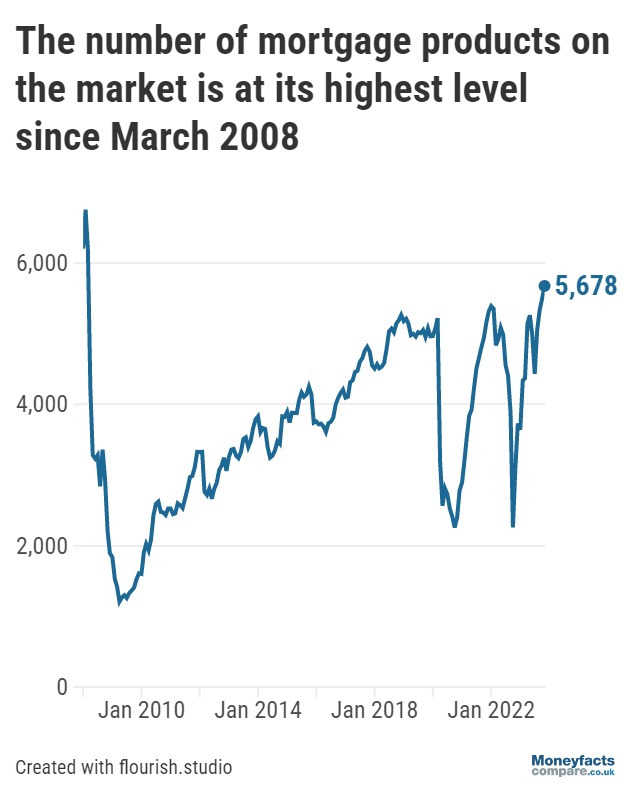

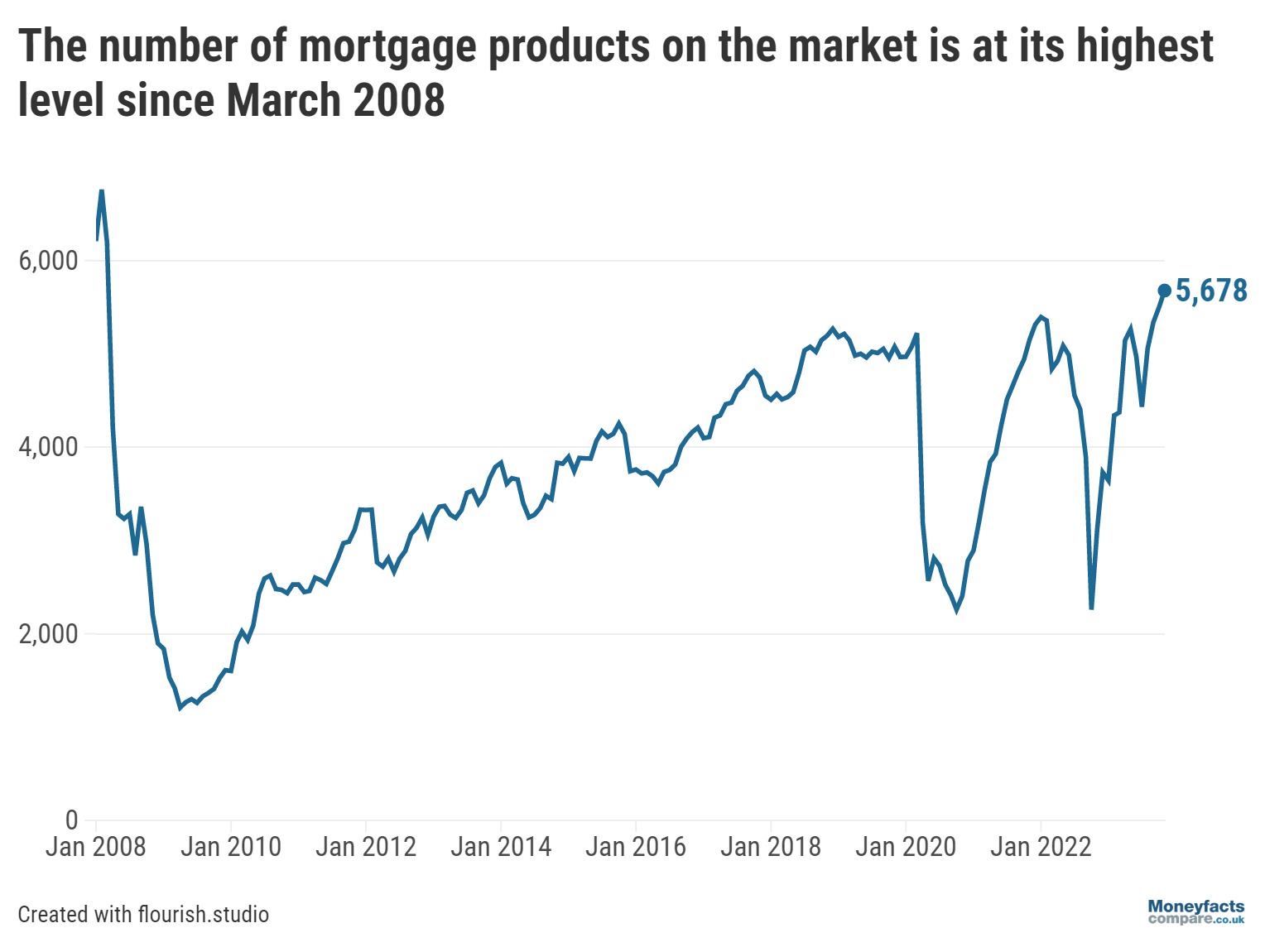

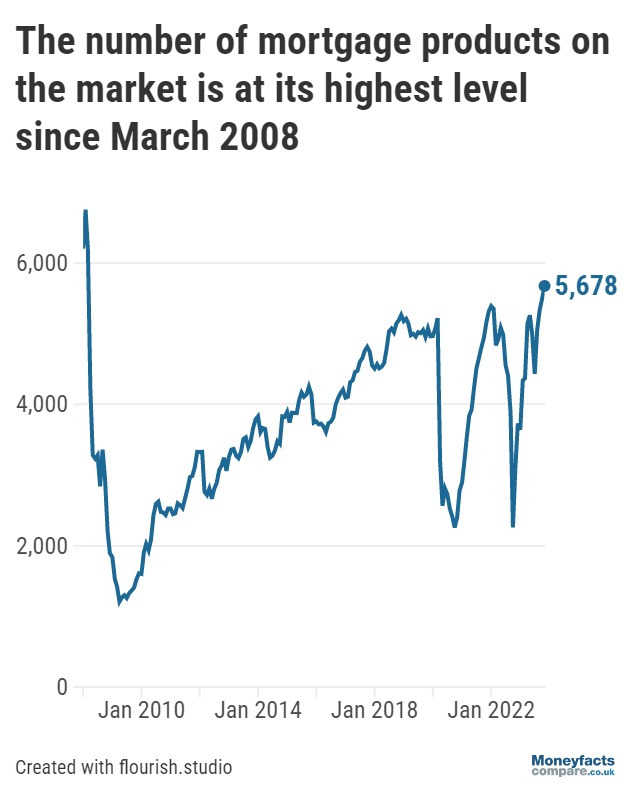

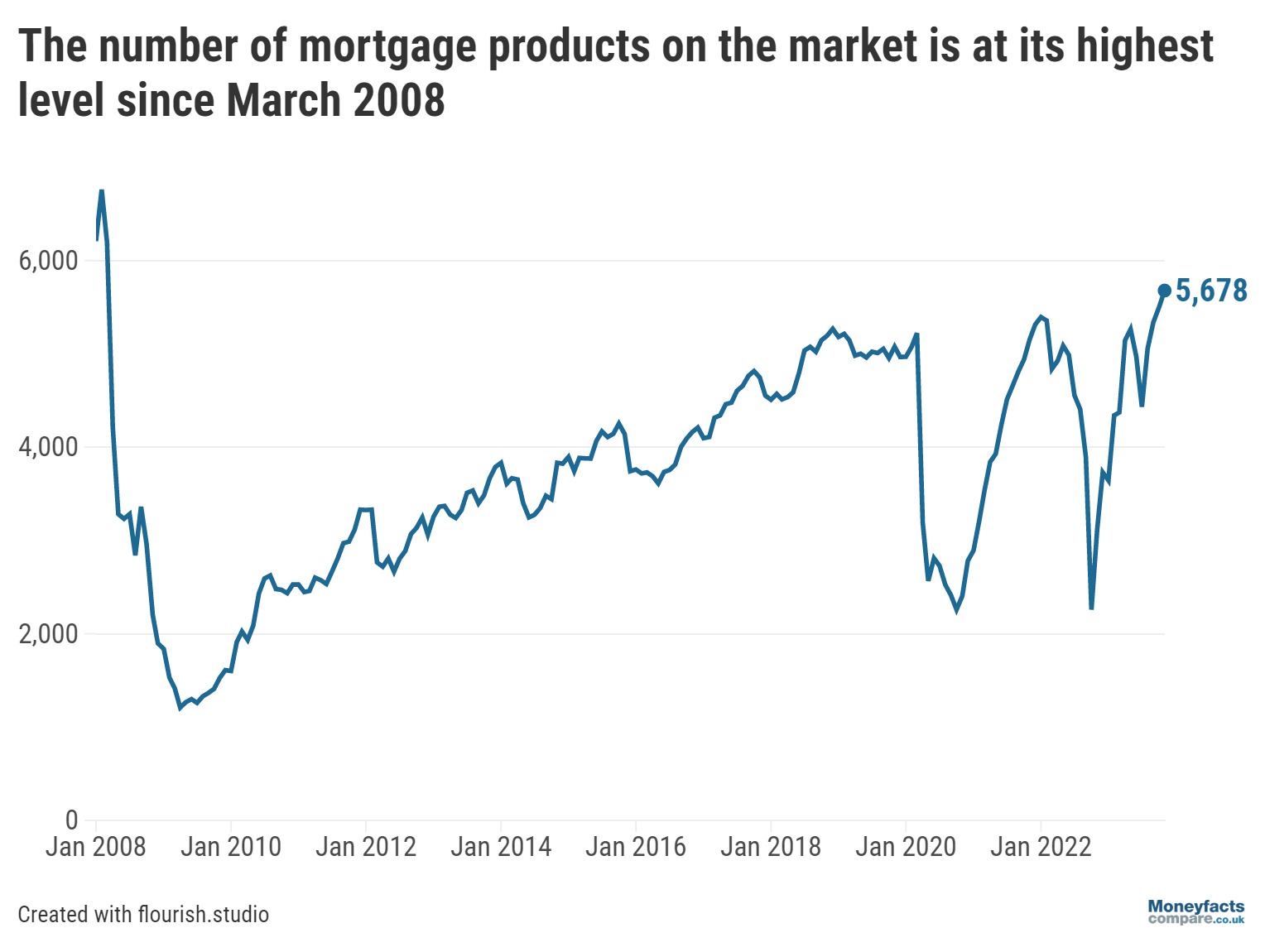

Alongside falling fixed rates and a longer average shelf-life, increased product availability demonstrates a buoyant period in the mortgage market.

The end of the year sees a particularly buoyant period in the mortgage market, with product choice rising month-on-month for the fourth consecutive time. Standing at 5,678 at the start of this month, the last time there were more deals available was March 2008, Moneyfacts UK Mortgage Trends Treasury Report data finds.

Furthermore, the report found average rates for both a two-year and five-year fixed deal fell for a third consecutive month at the start of November. The average two-year fixed rate stood at 6.29%, down from 6.47% in October. Meanwhile, the average five-year fixed rate fell to 5.86% from 5.97% during the same period.

Caption: The number of mortgage products on the market is at its highest level since March 2008.

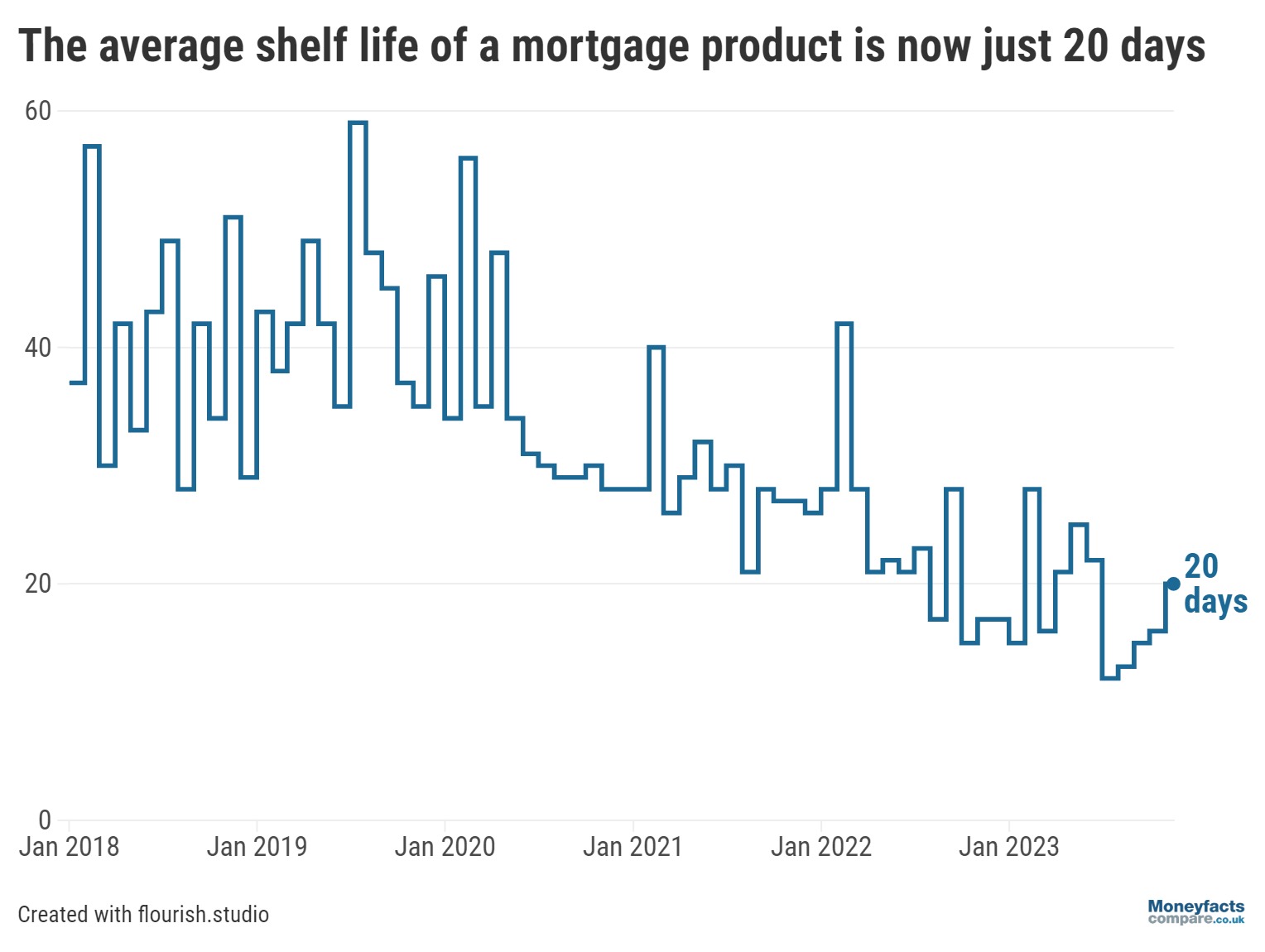

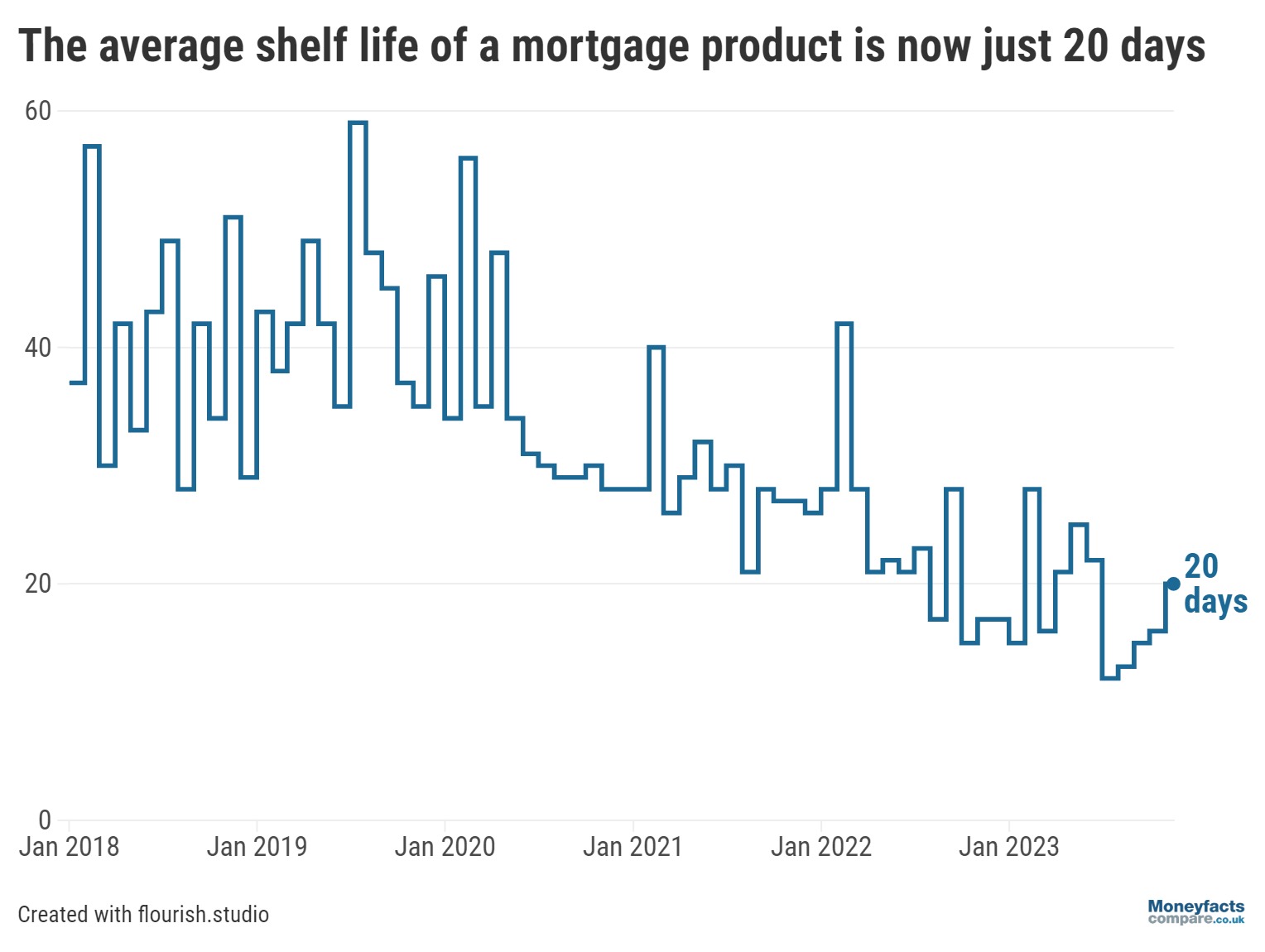

Alongside the average shelf-life of mortgage deals rising to 20 days in November, Rachel Springall, Finance Expert at Moneyfactscompare.co.uk, said these are “promising signs” the market is settling.

Caption: Average shelf-life of a mortgage product rose to 20 days in November 2023

Mortgage borrowers with a smaller deposit or less equity in their property may be especially pleased to learn product choice in this corner of the market is thriving.

The number of deals available that can finance a loan-to-value (LTV) of 95% rose to 254 – the highest availability since before the fiscal announcement in September 2022.

As for the number of options that can finance 90% LTV, this rose month-on-month to stand at 709 – its highest count since February 2022.

While shelf-life continues to improve month-on-month, edging away from the record low of 12 days in July, there’s no telling how long this may last.

Growing expectations for fixed rates to fall further could impact the shelf-life of competitively priced deals, explained Springall.

“Year-on-year, the market has seen substantial recovery when it comes to choice, but there is still more room for improvement for those borrowers waiting for fixed rates to fall further before they secure a new deal,” she added.

Nevertheless, Katie Rampling, Spokesperson at Mortgage Advice Bureau, revealed that compared to six months ago, they are seeing “more confidence in the market because rates are getting cheaper”.

“Cheaper rates from lenders means better affordability for our clients in regard to how much they can borrow and how much their repayments are on a monthly basis,” Rampling went on to add.

Borrowers weighing up their options may want to consider seeking independent advice to help them navigate the mortgage market.

Get friendly, expert advice free of charge as a visitor of MoneyfactsCompare

Mortgage Advice Bureau have 1,600 UK advisers with 200 awards between them.

Speak to an award-winning mortgage broker today.

Call 0808 149 9177 or request a callback

Mortgage Advice Bureau offers fee free mortgage advice for MoneyfactsCompare visitors that call on 0808 149 9177. If you contact Mortgage Advice Bureau outside of these channels you may incur a fee of up to 1%. Lines are open Monday to Friday 8am to 8pm and Saturday 9am to 1pm excluding bank holidays. Calls may be recorded.

Your home may be repossessed if you do not keep up repayments on your mortgage.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.