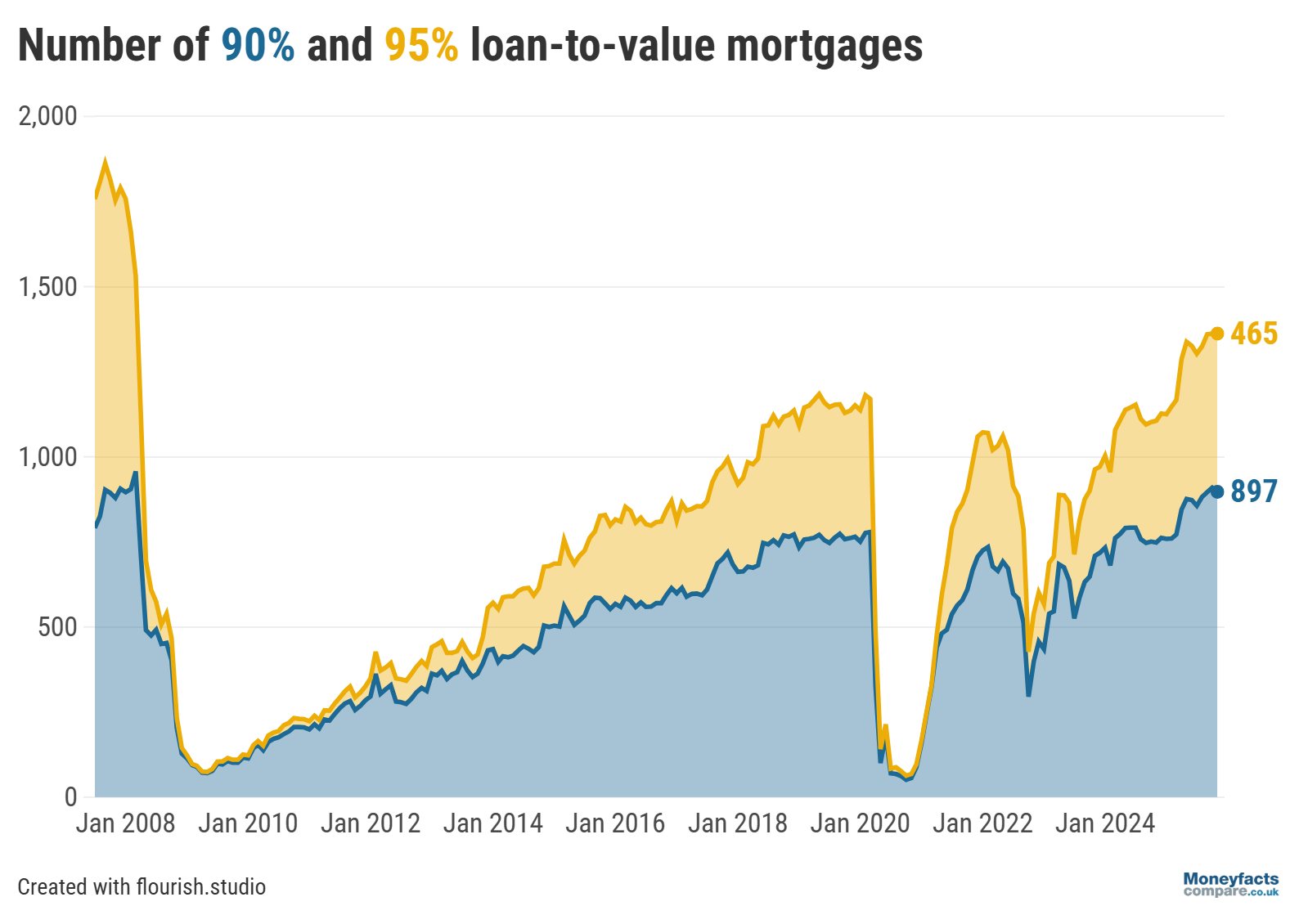

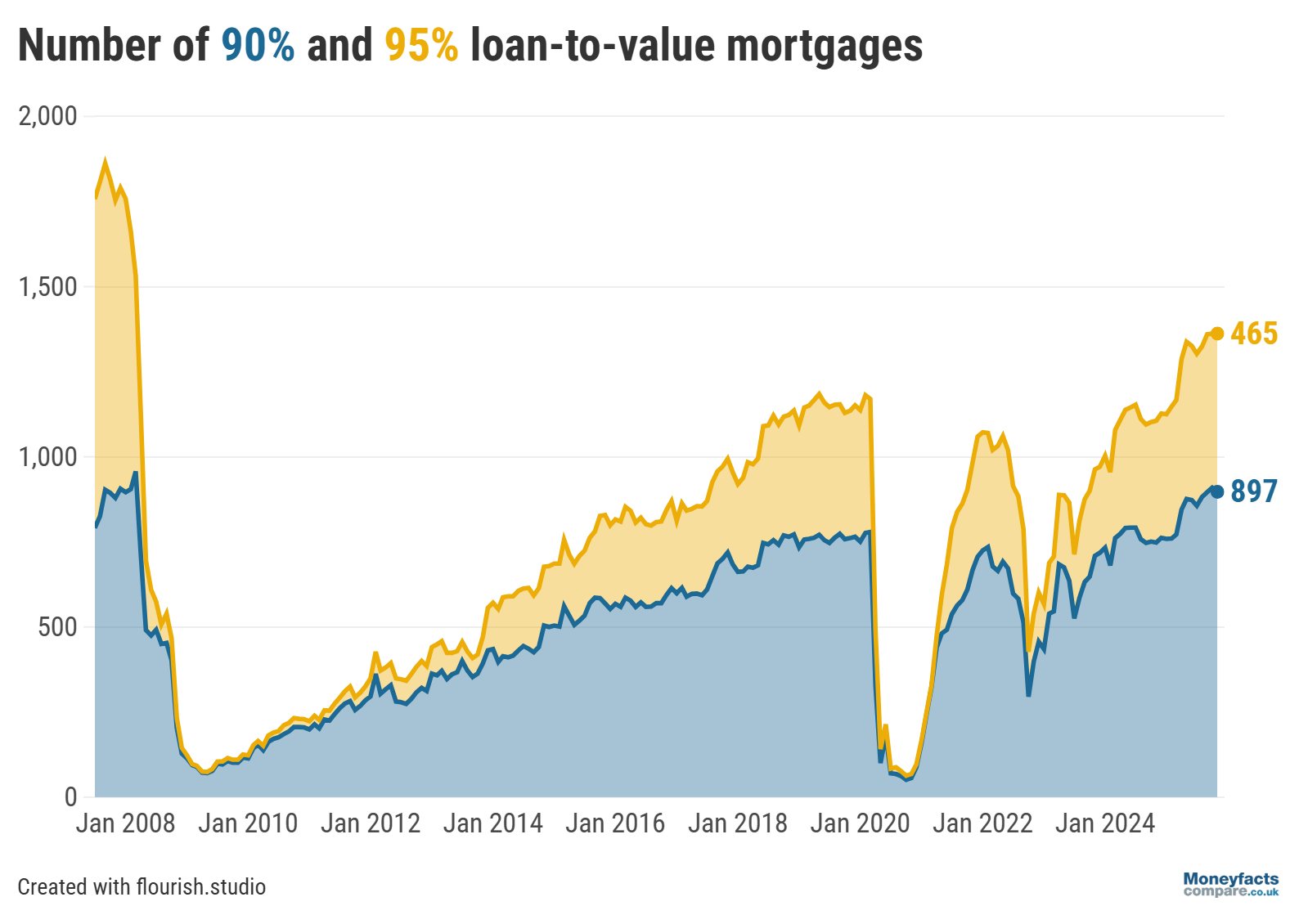

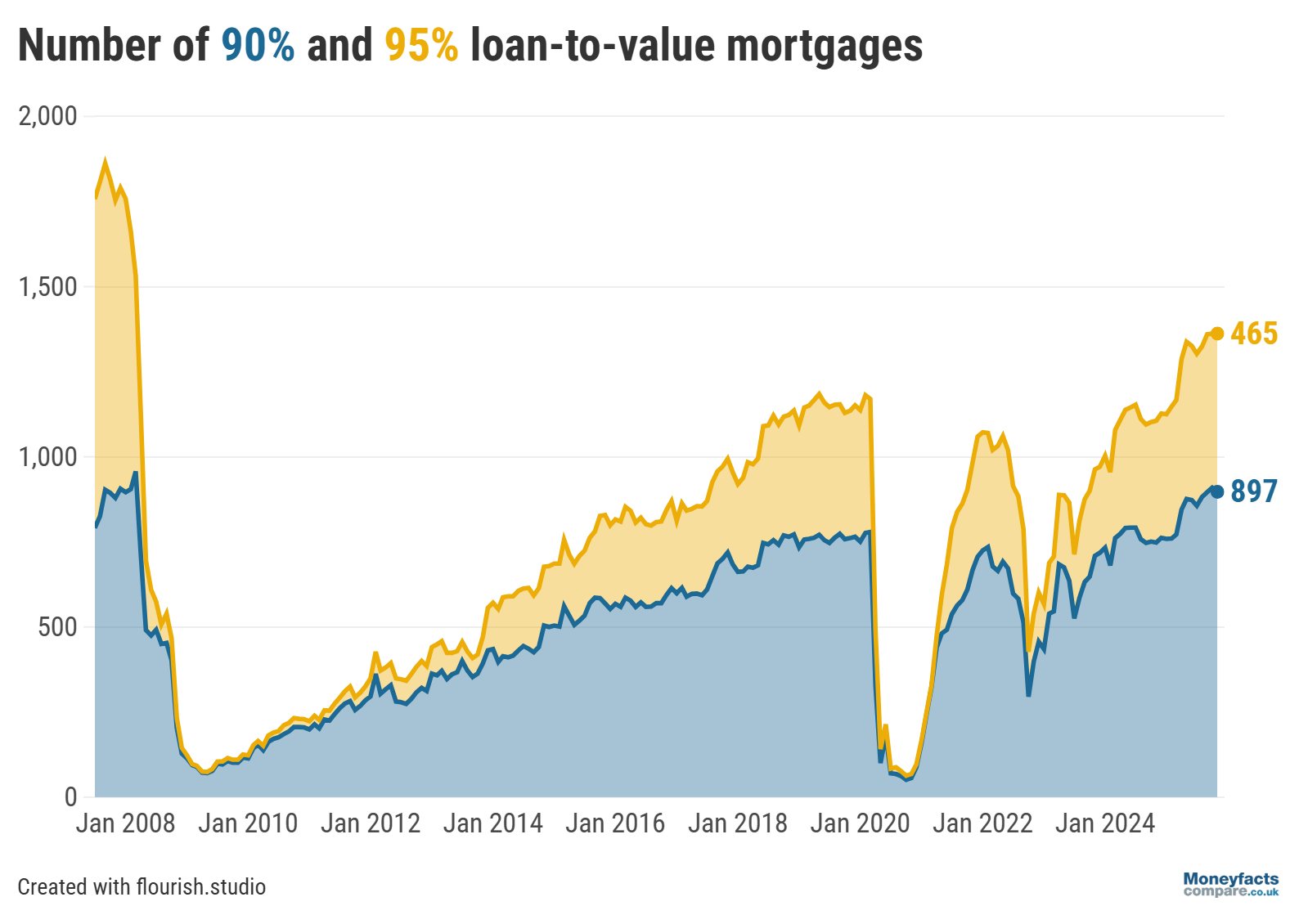

In addition to lower rates, borrowers now have more deals at 90% and 95% loan-to-value (LTV) to choose from.

Borrowers with a small deposit or who own a small amount of equity in their home will be encouraged to see average rates on mortgages at 90% and 95% LTV fall between October and November.

Indeed, the average two-year fixed rates on these low-deposit deals have plummeted to their lowest points since before the “mini-Budget” in September 2022, falling to 5.24% (90% LTV) and 5.41% (95% LTV) at the start of November. This is according to data from the latest Moneyfacts UK Mortgage Trends Treasury Report.

Average five-year fixed rates on 90% LTV and 95% LTV deals also dropped in the month to November to 5.16% and 5.41% respectively.

Moreover, in addition to lower rates, there were 465 deals at 95% LTV available at the start of November, the highest number available since March 2008.

“The Government has been very vocal that it expects lenders to do more to boost UK growth, so the rise in choice and drop in cost is a healthy step in the right direction,” Rachel Springall, Finance Expert at Moneyfacts, commented.

“However, deals at 95% loan-to-value only represent 7% of the residential mortgage market, so there is more room for improvement,” she noted.

Graph: There were 897 deals at 90% LTV and 465 deals at 95% LTV available at the start of November 2025.

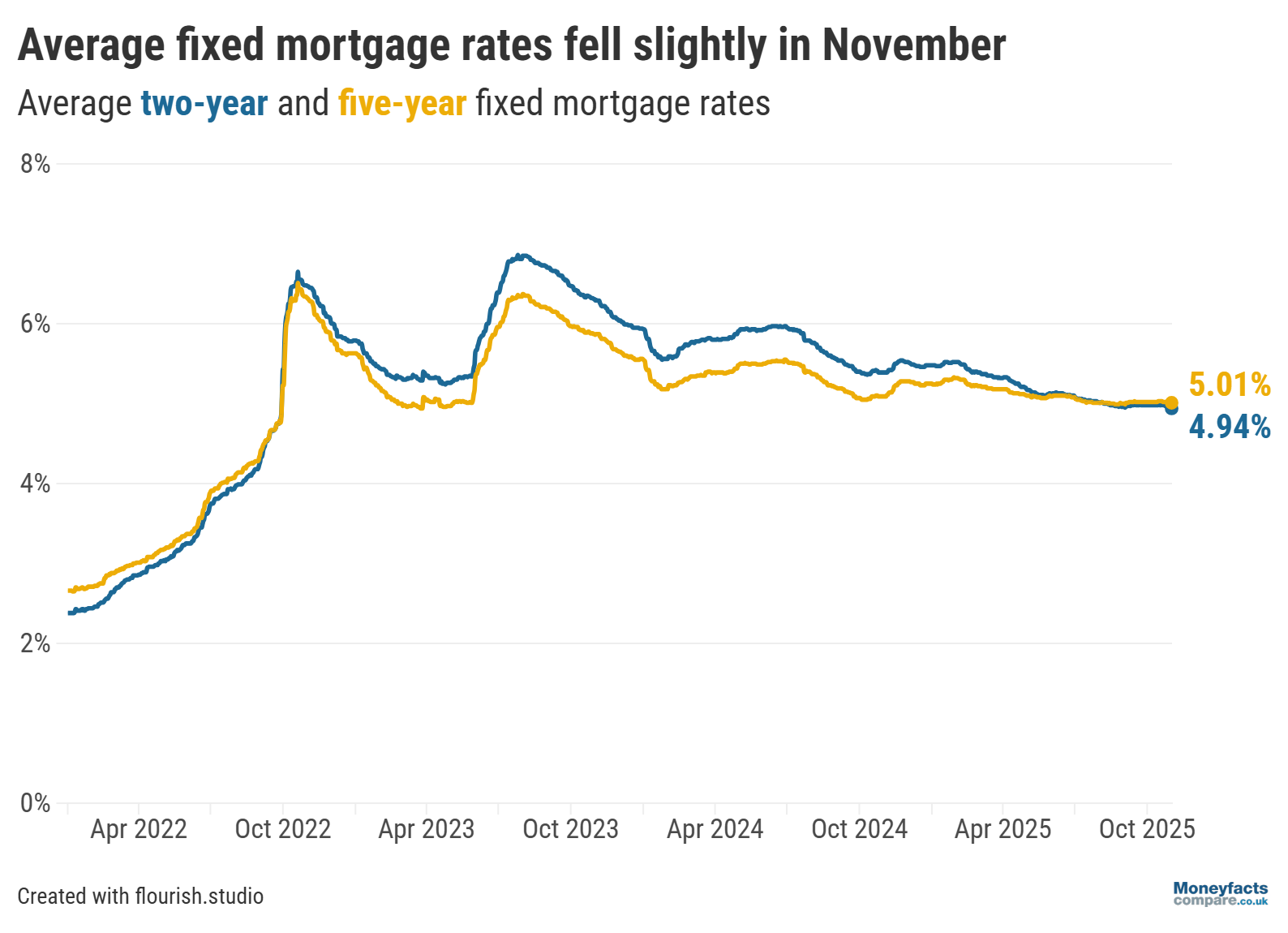

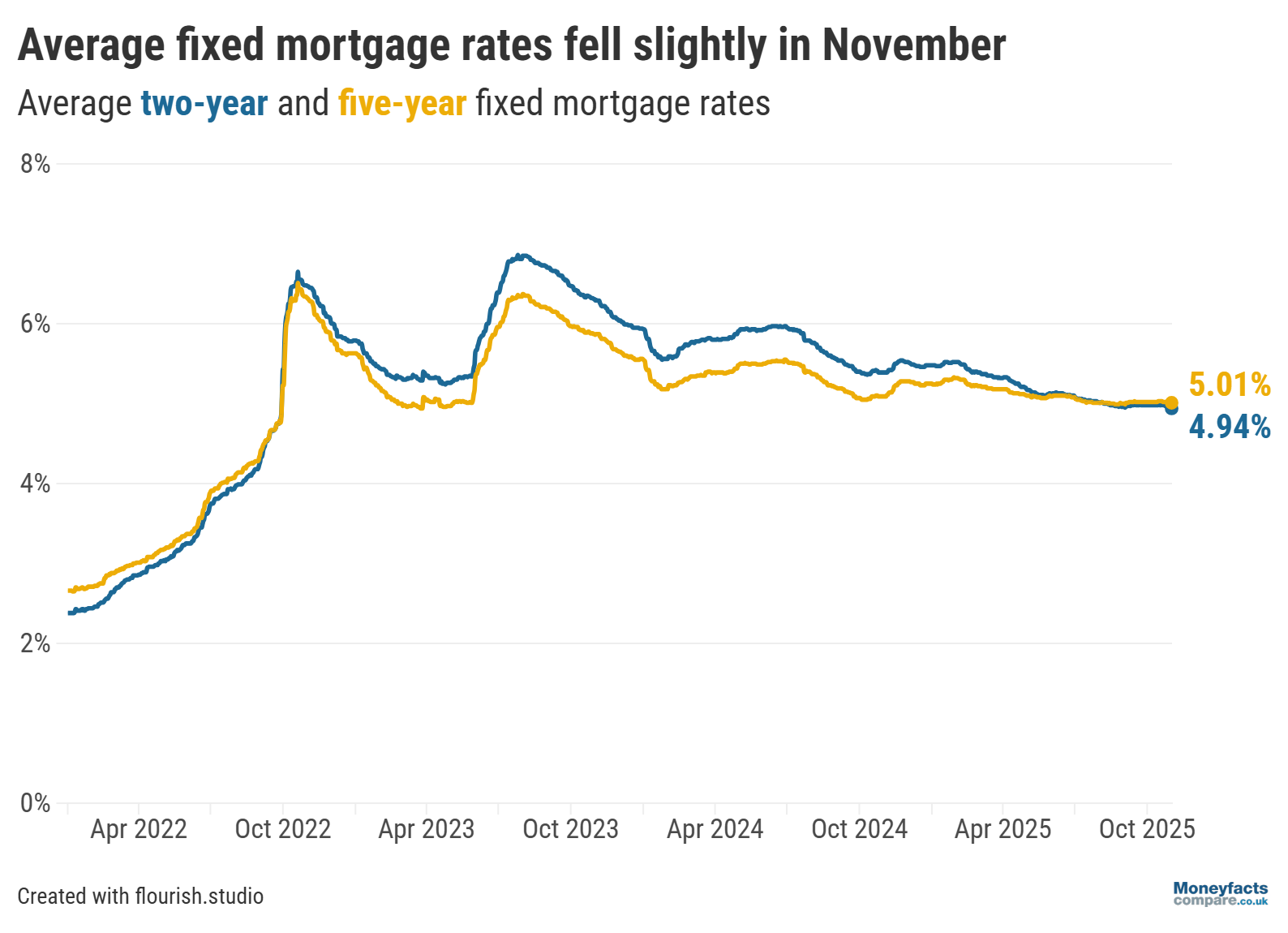

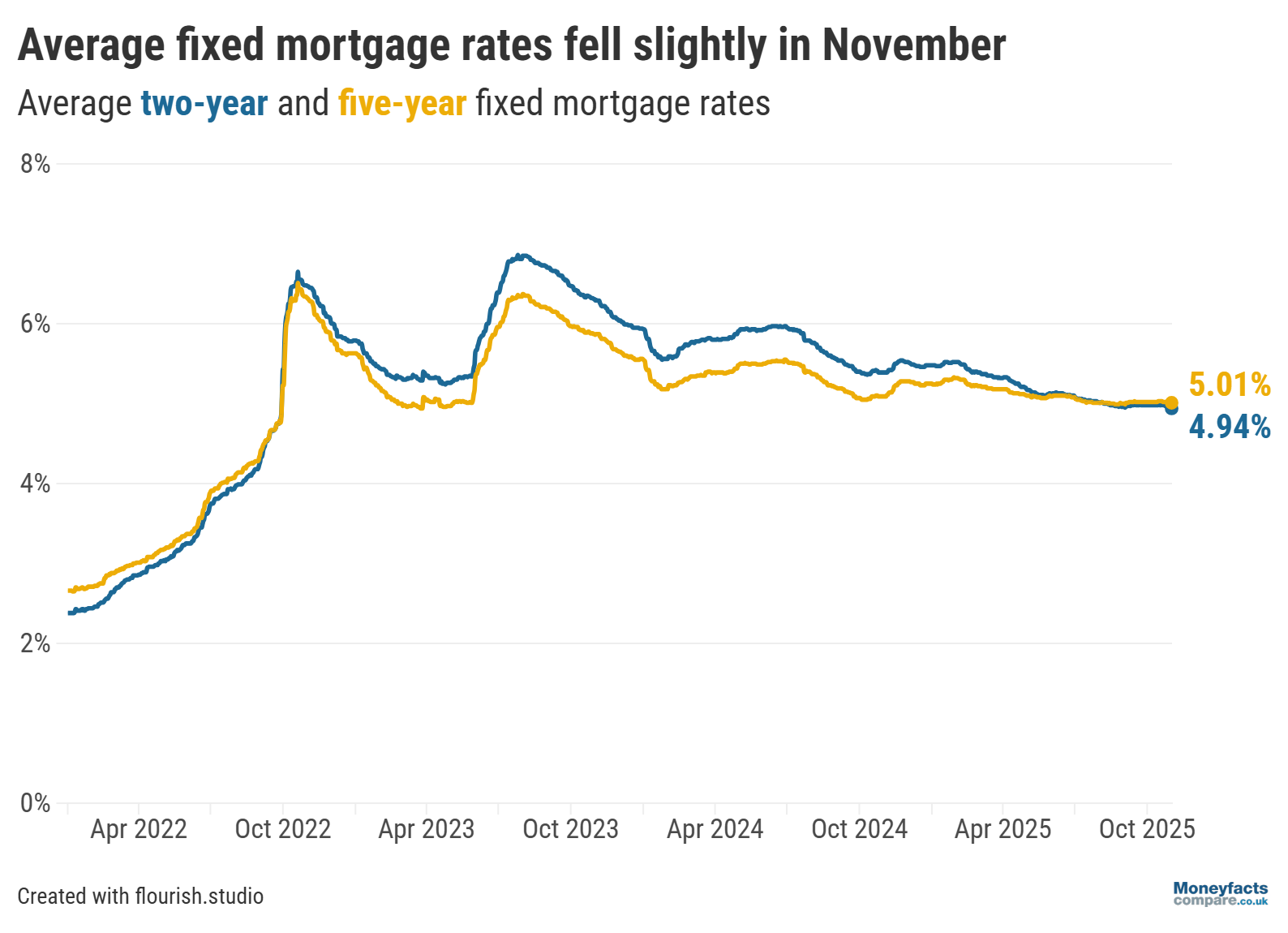

In the wider mortgage market, average rates resumed their downwards trend after seeing a slight uptick between September and October.

The average two-year fixed rate fell by 0.04 percentage points to reach 4.94% in the month to November, while the average five-year fixed rate saw a slightly smaller drop of 0.01 percentage points to 5.01% over the same period.

Graph: The average two- and five-year fixed mortgage rates fell in November 2025.

And many lenders have continued to make cuts to their fixed mortgage rates in the first week of November, including major brands such as Nationwide BS, which caused the Moneyfacts Average Mortgage Rate to fall below 5%.

“It may be a relief for borrowers to see fixed mortgage rates moving downwards once more,” Springall commented, adding that it may be particularly “positive news to those refinancing”.

The average two-year fixed rate in November 2023 was 6.29% compared to 4.94% now, which equates to a difference of approximately £203 per month in repayments (on a £250,000 mortgage with a 25-year term). As a result, anyone coming off a two-year fixed mortgage may find they are able to secure a deal at a lower rate and with cheaper monthly repayments than before.

On the other hand, anyone who took out a five-year fixed mortgage in 2020 when rates were low is likely to see their monthly payments increase, as rates are significantly higher than they were five years ago.

Lenders can change their range of mortgage products at any time so, to see the latest rates and deals available, visit our mortgage charts.

Alternatively, our weekly mortgage roundup summarises the lowest rates available, as well as some Moneyfacts Best Buy alternatives that could offer better value based on their overall true cost.

While the drop in rates is encouraging for those planning to take out a mortgage, the upcoming Budget on 26 November may be causing some potential borrowers to “wait and see” how any announcements could affect them.

There have been several rumours of policy changes which could affect borrowers, including the abolition of Stamp Duty Land Tax (SDLT) in its current form and the introduction of a new form of property tax instead.

Springall notes that this “could work in favour of first-time buyers, saving them thousands of pounds upfront”.

However, she points out that it could be a “double-edged sword” as a property tax that puts more of a burden on sellers could lead to some homeowners deciding not to move, which could subsequently impact the supply of properties on the market.

“It is essential borrowers seek advice before they make any quick decisions and not feel rushed because of the Budget rumour mill,” Springall urged.

Mortgage brokers remove a lot of the paperwork and hassle of getting a mortgage, as well as helping you access exclusive products and rates that aren’t available to the public. Mortgage brokers are regulated by the Financial Conduct Authority (FCA) and are required to pass specific qualifications before they can give you advice.

Get friendly, expert advice free of charge as a visitor of Moneyfactscompare.co.uk

Mortgage Advice Bureau have 1,600 UK advisers with 200 awards between them.

Speak to an award-winning mortgage broker today.

Call 0808 149 9177 or request a callback

Mortgage Advice Bureau offers fee free mortgage advice for MoneyfactsCompare visitors that call on 0808 149 9177. If you contact Mortgage Advice Bureau outside of these channels you may incur a fee of up to 1%. Lines are open Monday to Friday 8am to 8pm and Saturday 9am to 1pm excluding bank holidays. Calls may be recorded.

Your home may be repossessed if you do not keep up repayments on your mortgage.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.