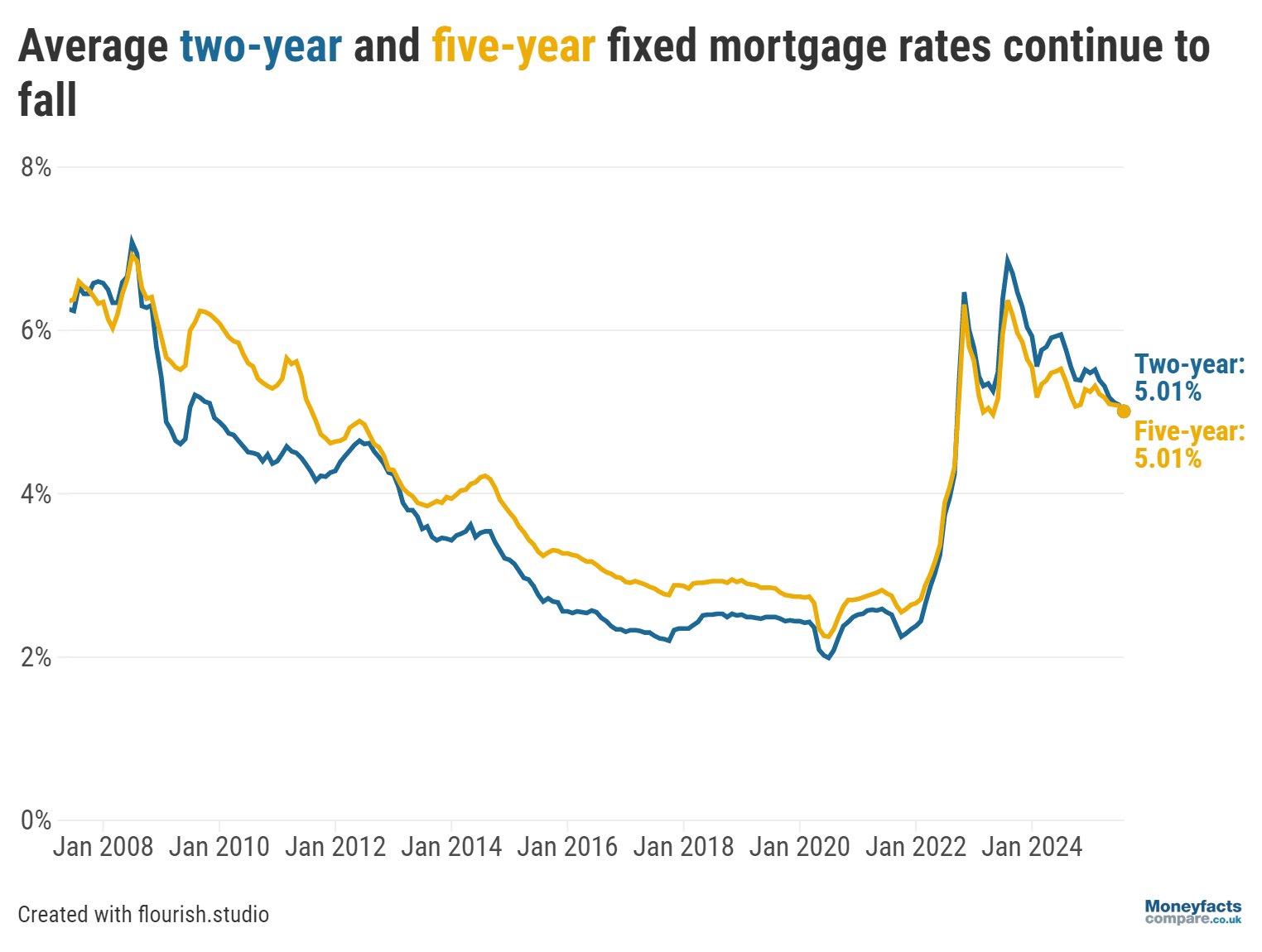

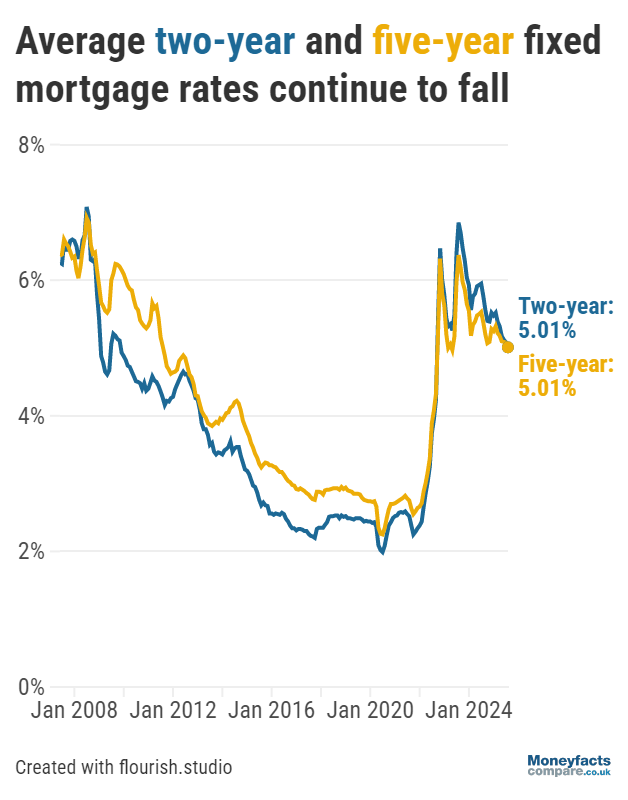

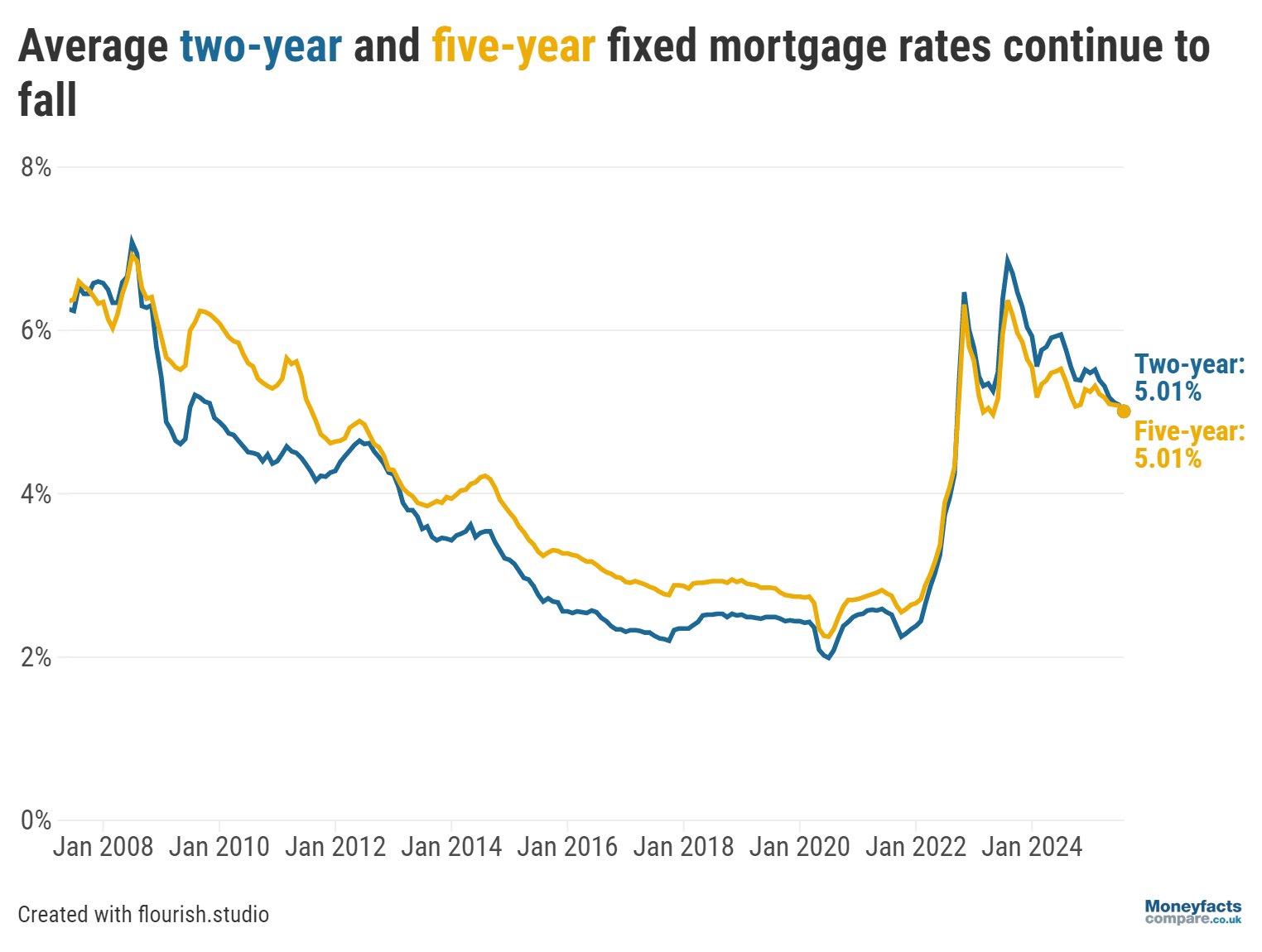

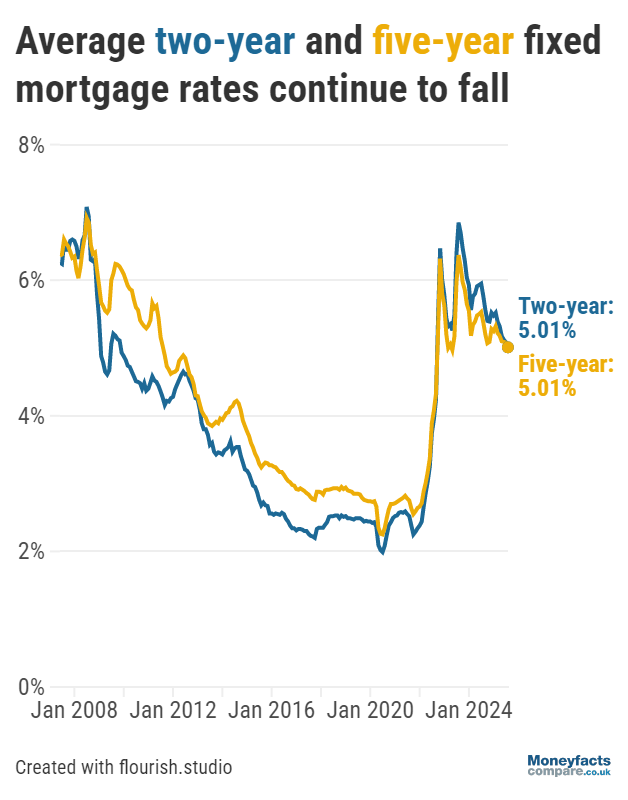

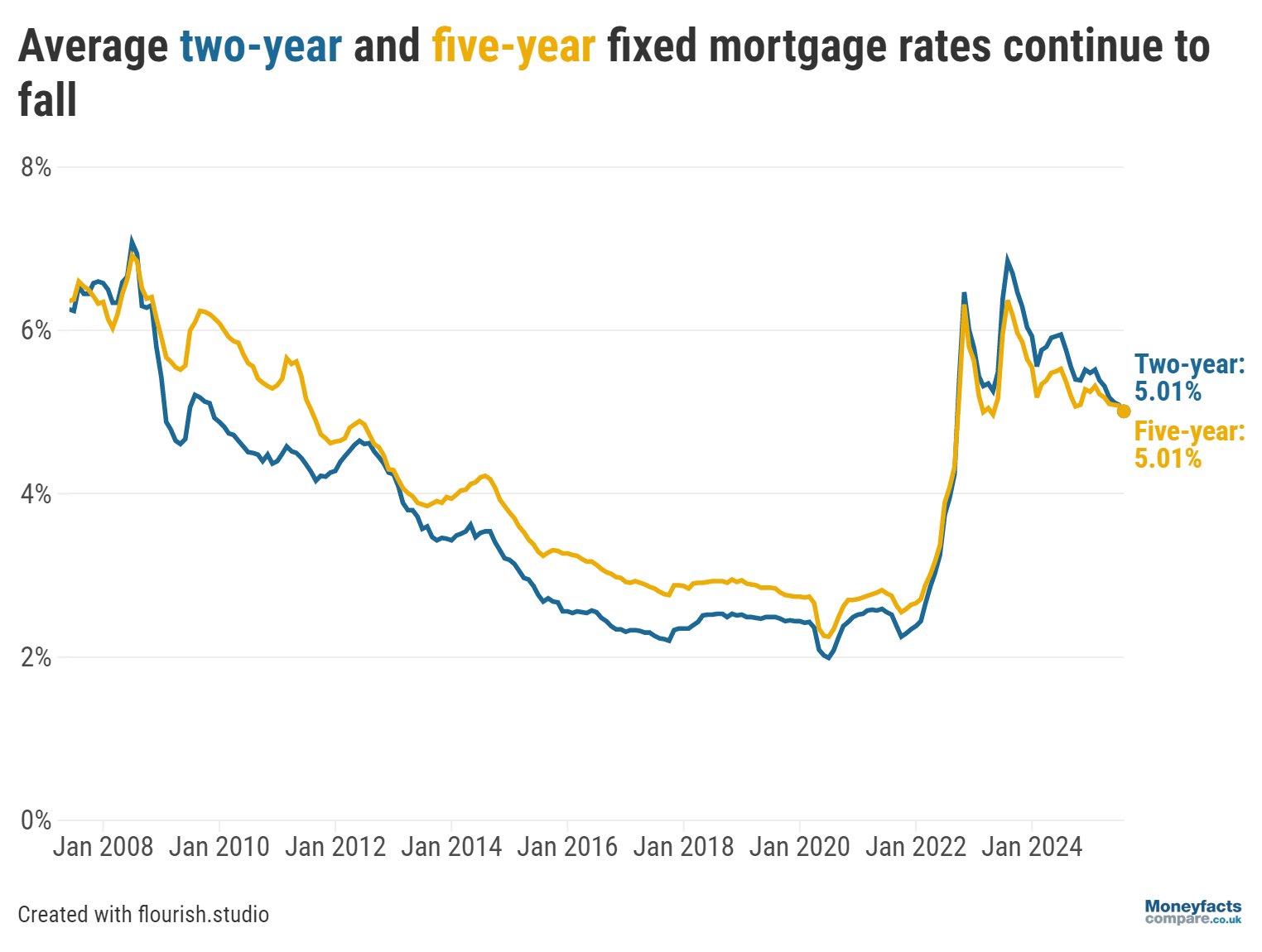

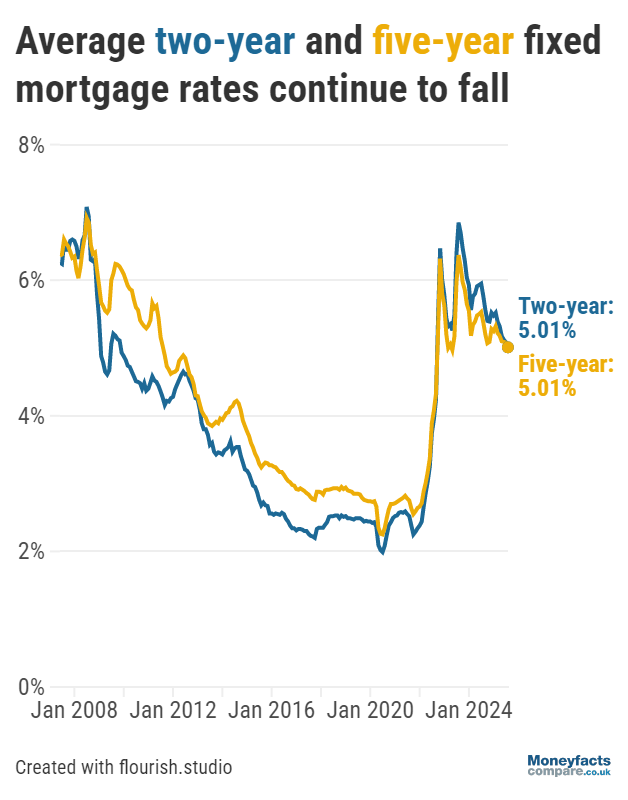

Average two-year rates now sit at an almost three-year low, while typical five-year prices hit their cheapest levels for over two years.

Despite winding down last month, rate-cutting momentum once again accelerated between July and August, the latest Moneyfacts UK Mortgage Trends Treasury Report found.

As a result, typical prices for both two- and five-year deals across all loan-to-values (LTVs) stood at 5.01% as of 1 August, having fallen by 0.08 and 0.07 percentage points respectively since the start of July. This likely comes as a relief to borrowers, especially after the same average prices fell by a paltry 0.03 and 0.01 percentage points respectively the month prior.

Graph: Average two- and five-year fixed mortgage rates on a monthly basis between 2008 and August 2025.

These latest figures also mark the lowest these sectors have been since September 2022 and May 2023 respectively, helping to bring the Moneyfacts Average Mortgage Rate closer to the 5% threshold at 5.04%.

“Breaking down into fixed rate moves over the past six months shows where the bigger margins are being shaved off by lenders,” explained Rachel Springall, Finance Expert at Moneyfactscompare.co.uk. Over this timeframe, the average two-year rate dropped by 0.51% compared to just 0.31% being taken off the five-year rate, as the market slowly returned to a more traditional arrangement.

Although these cuts will be welcomed by borrowers nearing the end of their fixed terms, Springall suggests lenders may still “consider a more low and slow approach” to lowering prices over the coming weeks, not least because of last week’s “knife-edge base rate decision”.

The Bank of England’s Monetary Policy Committee (MPC) narrowly voted five to four in favour of lowering the central interest rate to 4.00% on 7 August, although this was still a widely anticipated decision that helped drive average rates down in the lead-up to the announcement.

As of today (12 August), the average two-year rate has since inched lower to 5.00% while the equivalent five-year rate remains at 5.01%, as some lenders reactively repriced their deals, though it was likely the case that overall, reductions were already priced into the expected base rate cut.

This was further demonstrated by the fact that the average two-year variable tracker, which would typically feel any initial effects of a base rate cut, held yet again at 4.91% for the second consecutive month at the beginning of August. This rate previously fell from 5.16% in the month to June when the base rate was previously cut.

As Springall points out, lenders may now be waiting to see if “inflation gets out of control or economic uncertainties spike”, as well as how the market could react to the looming Autumn Budget.

Meanwhile, the churn of products as lenders slashed prices also had an impact on the number of deals on the market, and for how long they remained available to borrowers. The report revealed that the total mortgage product count fell by 66 to 6,842 in the month to August, frustrating news for borrowers considering this number rose to its second highest point in 17 years the previous month. Despite this, shelf-life managed to increase, albeit marginally, to 17 days, slightly alleviating pressure to grab a competitive deal before it’s too late.

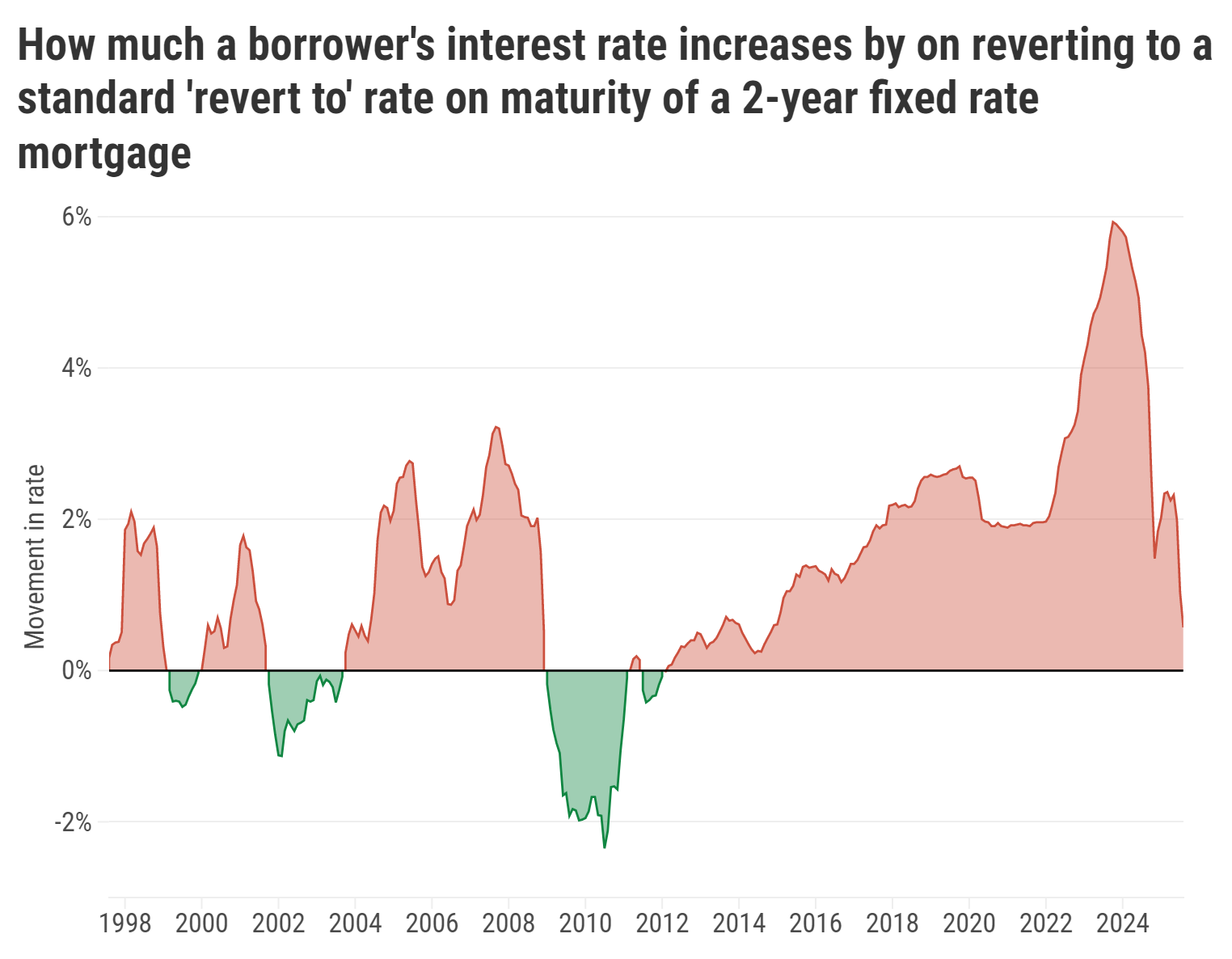

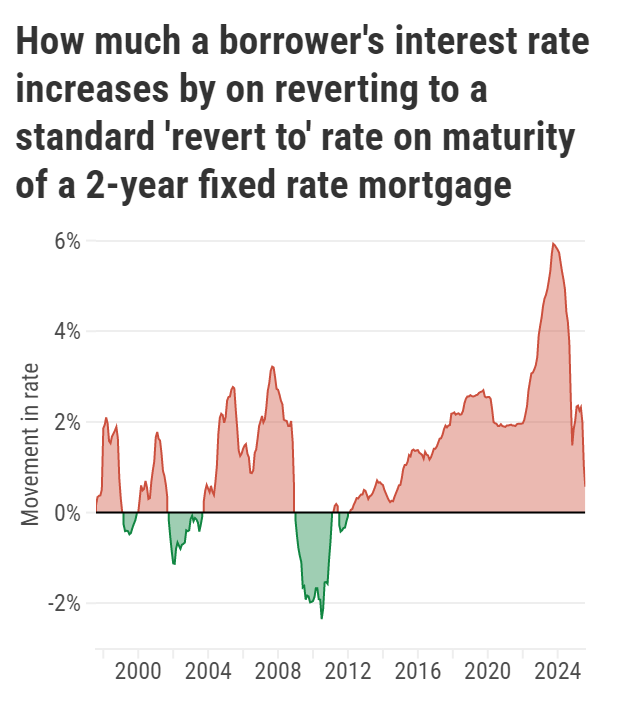

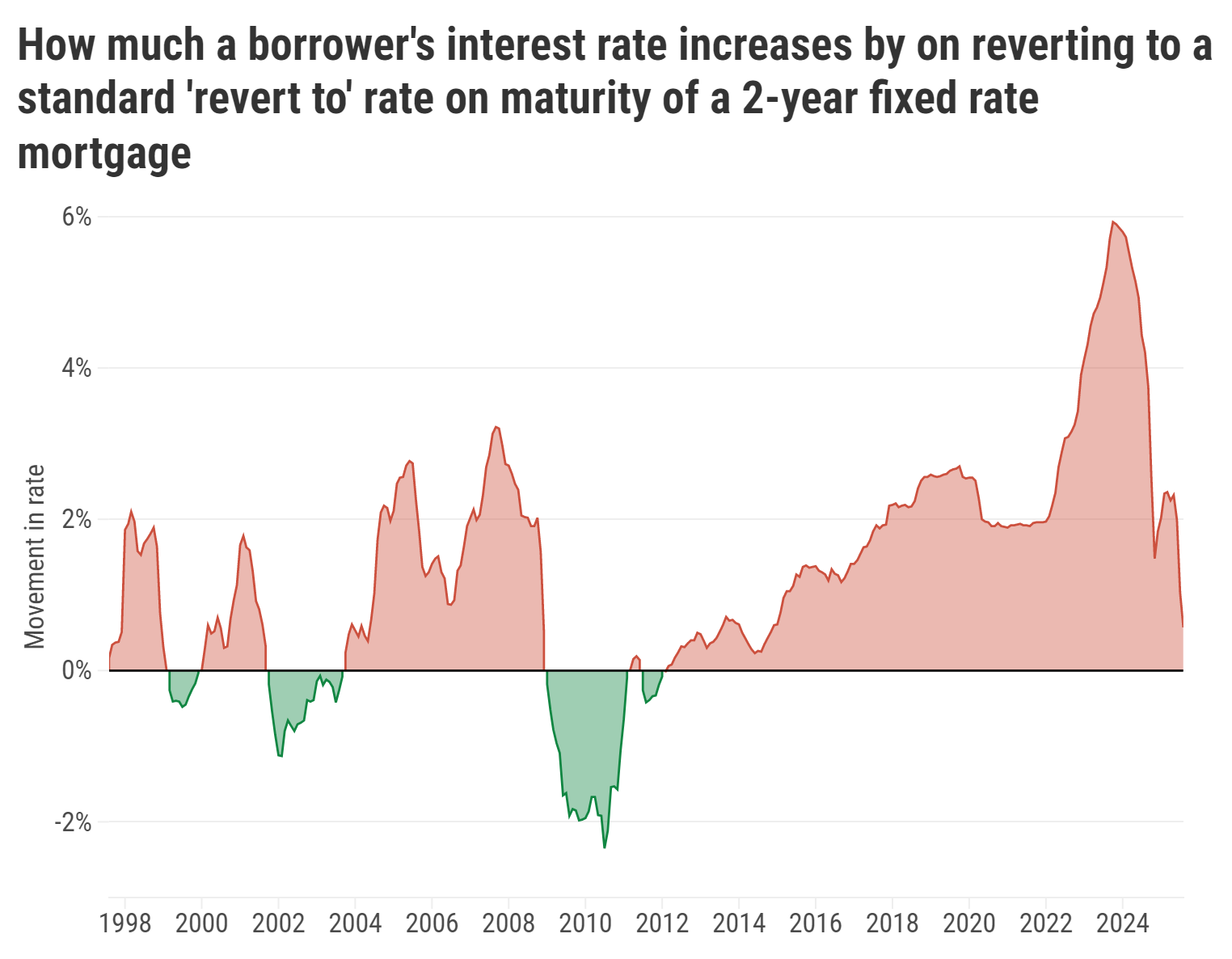

And yet, Springall urges borrowers to remain vigilant when refinancing onto a fixed deal, particularly for those at risk of paying their lender’s costly Standard Variable Rate (SVR).

“There is now a significant difference of more than 2% to escape a revert rate, compared to just 1% back in August 2023, based on the average two-year fixed rate versus the average Standard Variable Rate (SVR),” commented Springall.

Graph: Difference in interest rates when reverting from the average two-year fixed mortgage rate to the average Standard Variable Rate (SVR).

Indeed, while the average SVR dropped from 7.85% to 7.42% during this period, the average two-year rate saw a much steeper decline of 1.84 percentage points. As a result, borrowers failing to find a new fixed deal could see their monthly repayments jump up dramatically.

As a result, it could be worth seeking professional advice to explore all of your options before moving forward.

Mortgage brokers remove a lot of the paperwork and hassle of getting a mortgage, as well as helping you access exclusive products and rates that aren’t available to the public. Mortgage brokers are regulated by the Financial Conduct Authority (FCA) and are required to pass specific qualifications before they can give you advice.

Get friendly, expert advice free of charge as a visitor of Moneyfactscompare.co.uk

Mortgage Advice Bureau have 1,600 UK advisers with 200 awards between them.

Speak to an award-winning mortgage broker today.

Call 0808 149 9177 or request a callback

Mortgage Advice Bureau offers fee free mortgage advice for MoneyfactsCompare visitors that call on 0808 149 9177. If you contact Mortgage Advice Bureau outside of these channels you may incur a fee of up to 1%. Lines are open Monday to Friday 8am to 8pm and Saturday 9am to 1pm excluding bank holidays. Calls may be recorded.

Your home may be repossessed if you do not keep up repayments on your mortgage.

Be sure to check out our regularly updated mortgage charts to compare the latest deals on the market, including those charging the lowest two- and five-year fixed rates.

Our weekly mortgage roundup can also show more information on some of the cheapest-priced deals available.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.