Nevertheless, borrowers now have more choice, but less time, to secure a deal.

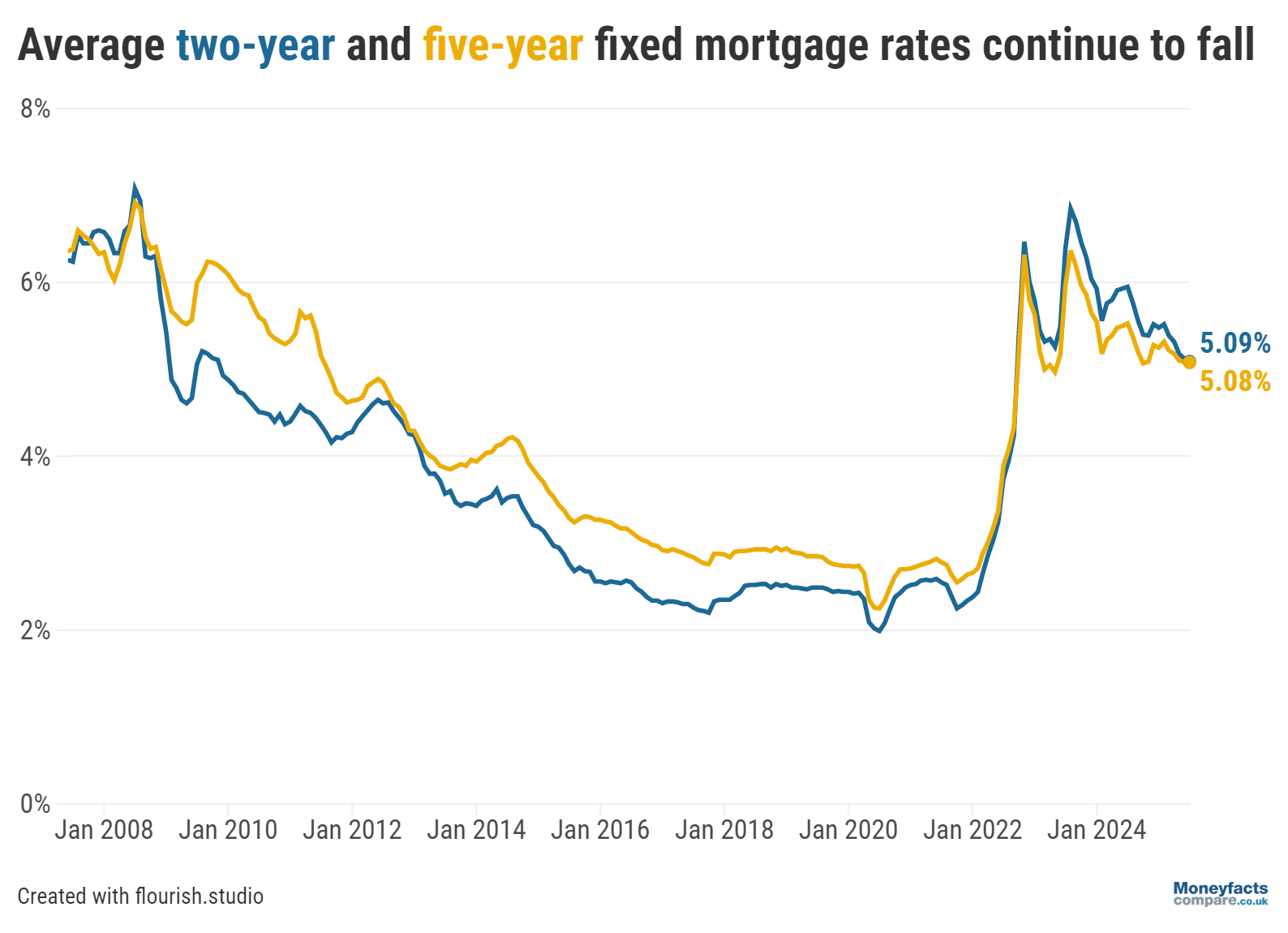

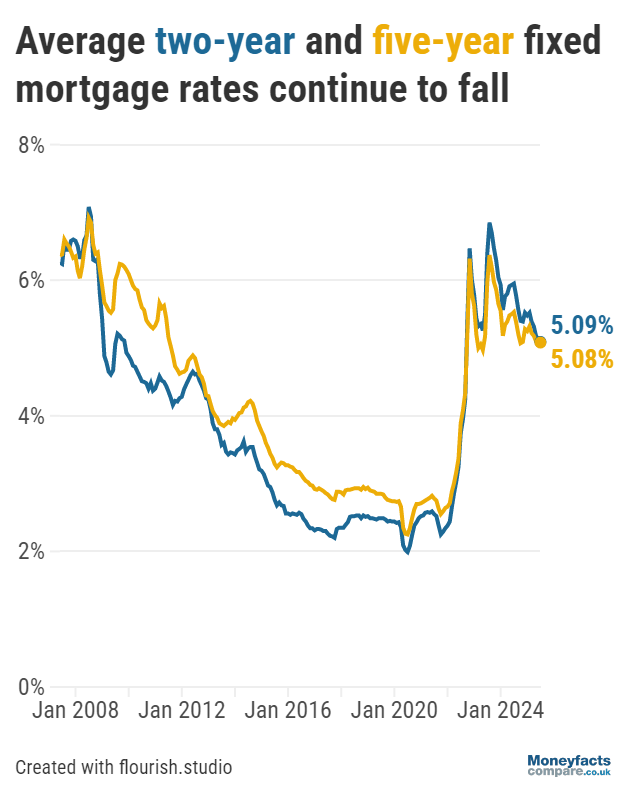

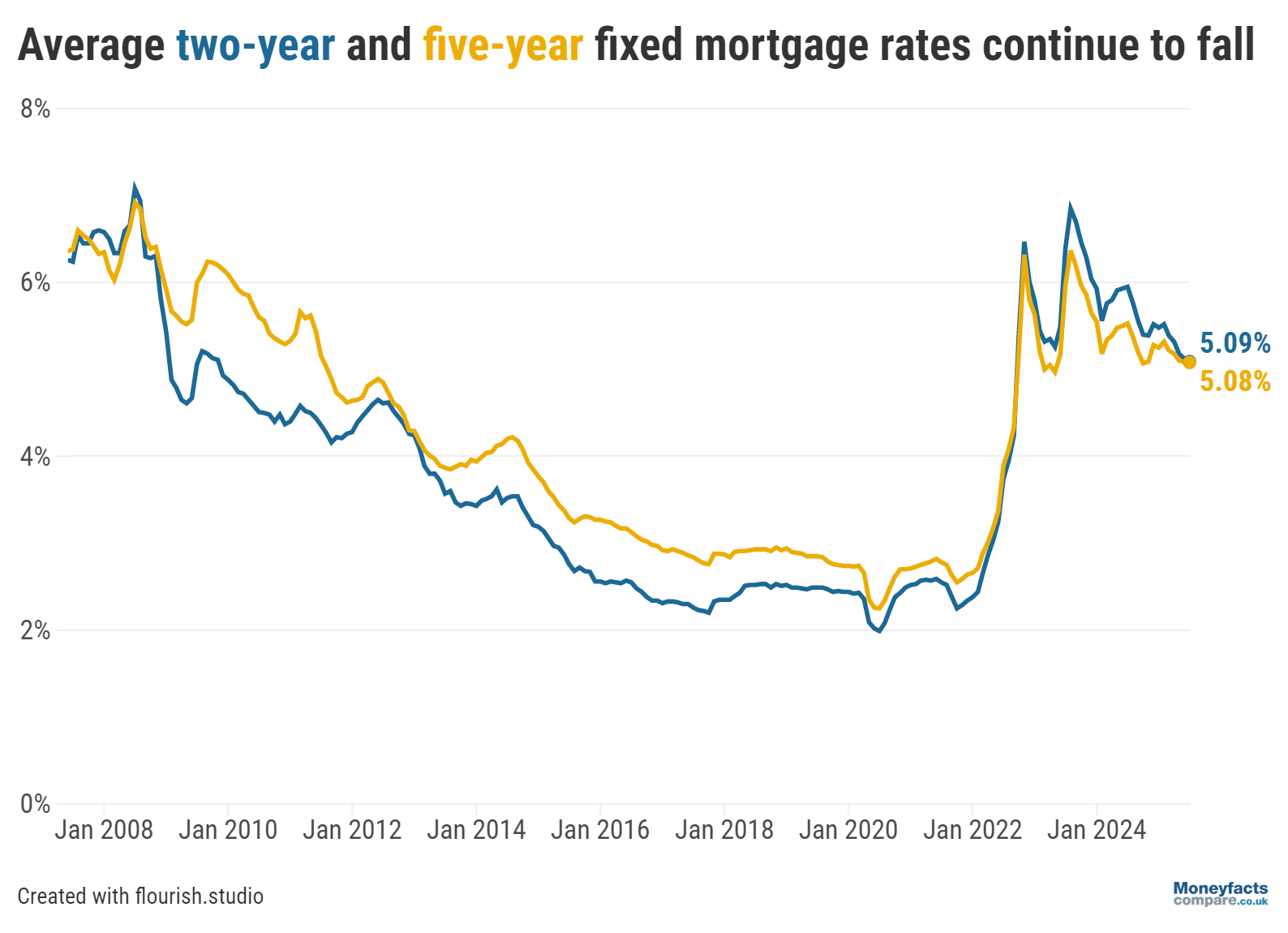

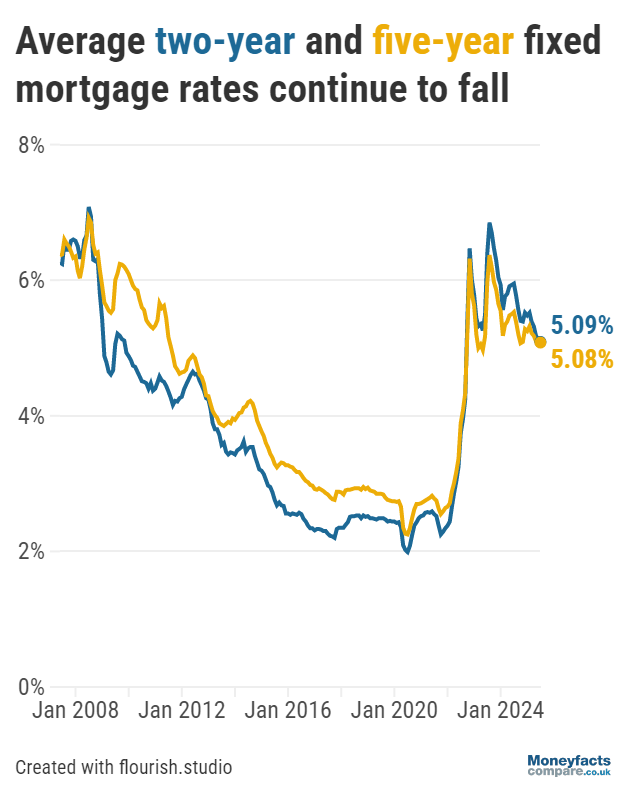

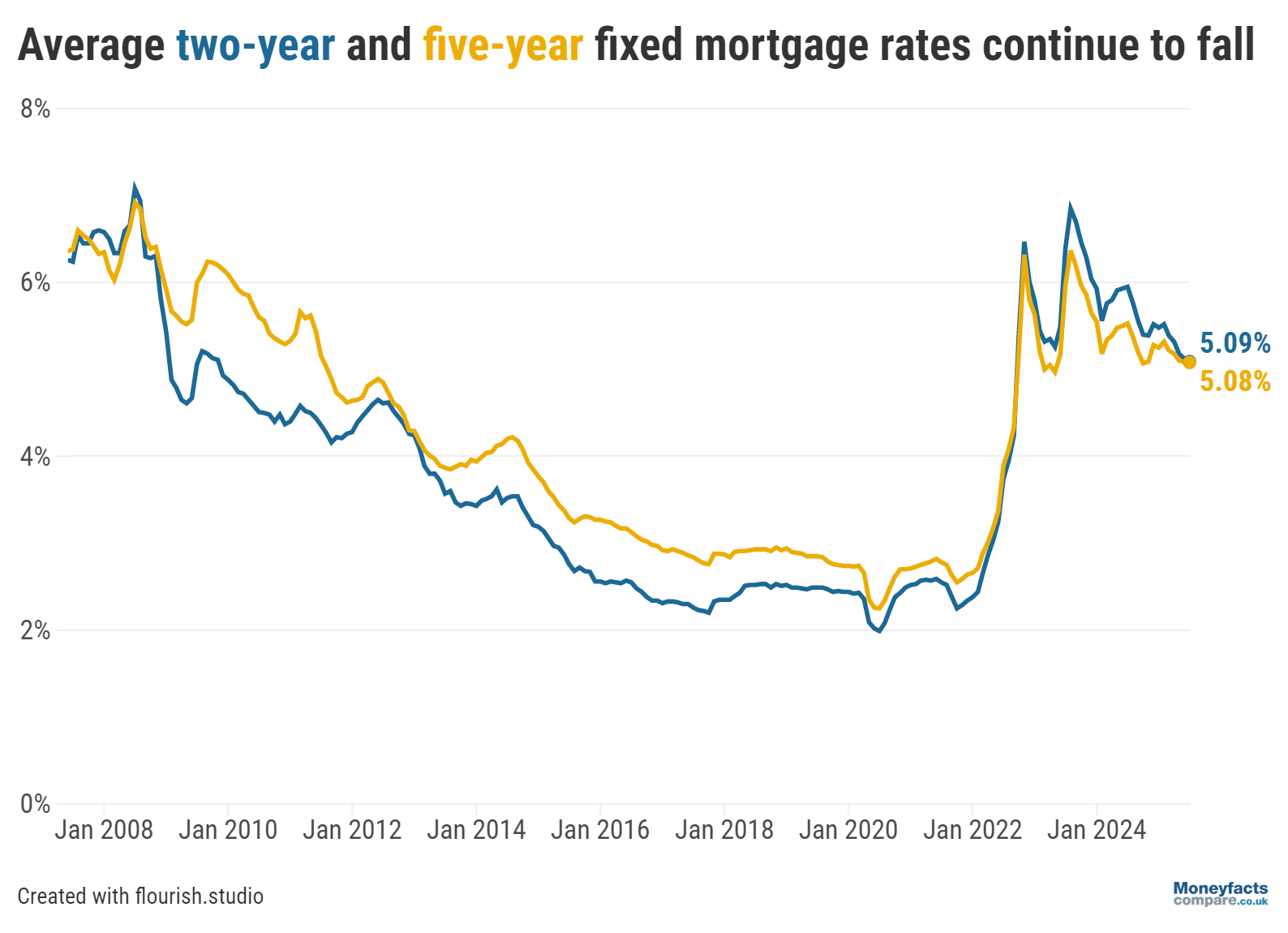

Average fixed mortgage rates fell for the fifth consecutive month at the start of July, according to the latest Moneyfacts UK Mortgage Trends Treasury Report, which may come as welcome news for borrowers in need of a new deal.

The average two-year fixed mortgage dropped to 5.09% during this timeframe, marking its lowest point in almost three years (September 2022), when rates hovered around 4.24%. Similarly, typical five-year fixed prices dipped to 5.08% and were last lower in October 2024 at 5.07%.

However, as was the case when these rates fell a month ago, there are signs of this momentum slowing down – average two- and five-year fixed mortgages only dropped by 0.03 and 0.01 percentage points respectively by 1 July, compared to 0.06 and 0.01 percentage points the month prior.

Graph: Average two- and five-year fixed mortgage rates on a monthly basis between 2008 and July 2025.

This slowdown comes amid expectations for fixed rate cuts to “heat up” during the summer, which Rachel Springall, Finance Expert at Moneyfactscompare.co.uk, attributes to recent swap market volatility.

Yet, inflation remains stubbornly above the Government’s 2% target, despite falling marginally to 3.4% in May, which in turn pressures the Bank of England’s Monetary Policy Committee (MPC) to be more gradual in its approach to lowering the base rate. Indeed, many lenders may have been deterred from slashing prices after the MPC elected to hold the UK’s central interest rate at 4.25% in June.

Some sectors even saw prices head in the opposite direction, with the average rate for a five-year fixed deal at 60% loan-to-value (LTV), bucking the downward trend by rising from 4.65% to 4.68% month-on-month.

You can find out more about how the base rate influences mortgage rates by reading our guide.

With the average two-year fixed mortgage now sitting only 0.01 percentage points above its five-year counterpart, these latest cuts see the gap between the two sectors at its narrowest since the market first inverted back in October 2022.

Traditionally, five-year fixed mortgages were priced higher than two-year products to account for the added risk providers faced for lending for longer periods; however, this was turned on its head after the now infamous ‘mini-Budget’ caused chaos across the market when it was announced in September of that year.

With rates now on the brink of reverting to pre-2022 levels, this could be a positive sign for borrowers, particularly for those looking to lock in rates for longer with their new deal.

Check out our regularly updated mortgage charts to see the latest deals on the market, including those charging the lowest two- and five-year fixed rates.

Our weekly mortgage roundup can also show more information on some of the cheapest-priced deals available, as well as Moneyfacts Best Buy alternatives.

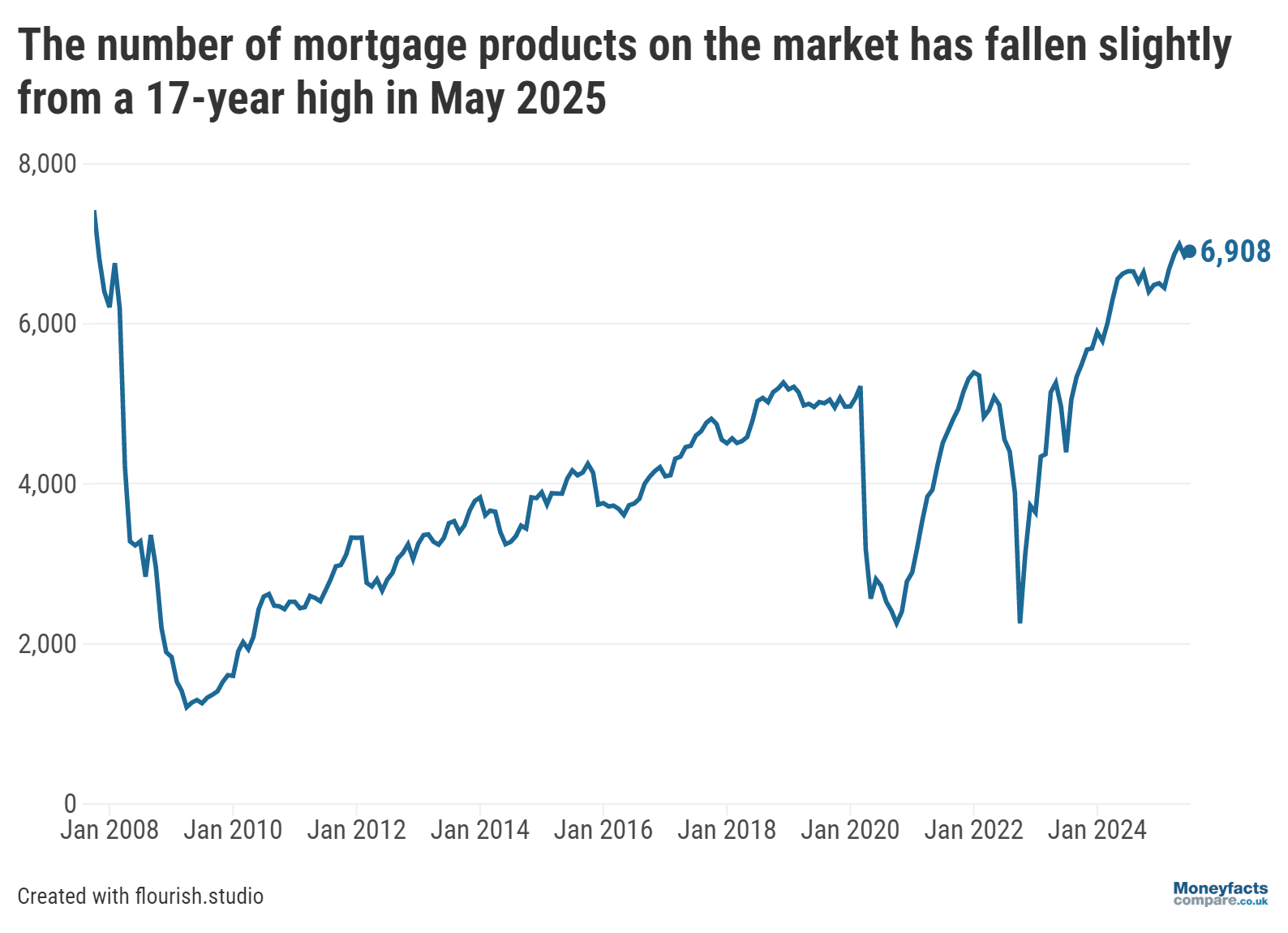

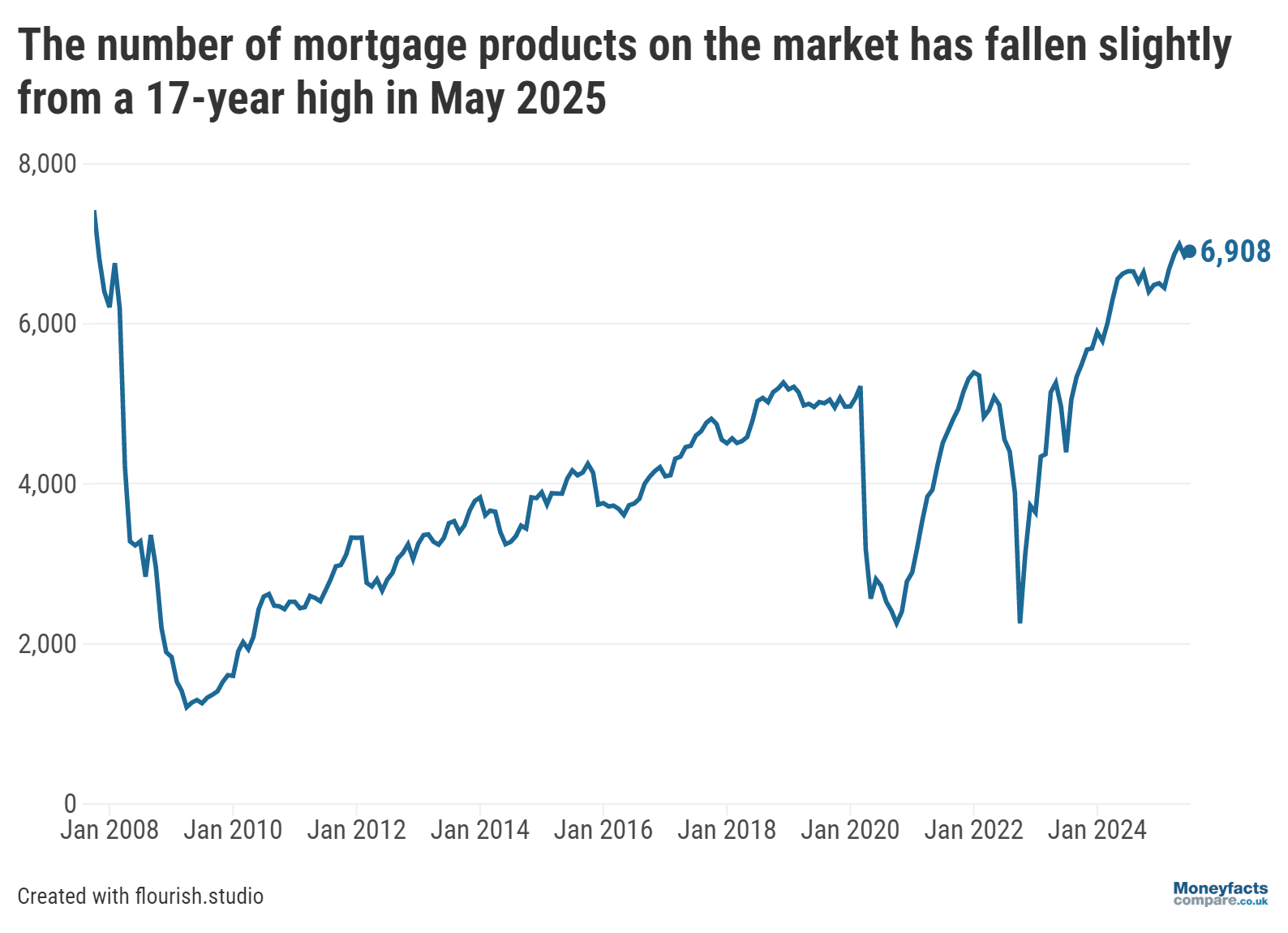

As well as lower average rates, borrowers now have more deals to choose from, with the total product count now standing at 6,908 mortgages available across the market. This marks the second highest this figure has been in over 17 years, when the number of deals peaked at 7,421, only besting the 6,993 mortgages available to borrowers in May 2025.

Graph: Total number of mortgage deals on the market from 2008 to July 2025.

Of course, the combination of lenders slashing prices and introducing new deals had a knock-on effect on the average mortgage shelf-life, which unfortunately fell to a four-month low of 16 days at the start of July, down from 17 days in June.

However, this remains far above the 12-day average shelf-life seen just two years ago, showing how far the market has recovered, especially considering how prices have also greatly improved for borrowers. A typical two-year fixed deal during July 2023, for instance, would have cost 6.41%, compared to the current price of 5.09% (as of 1 July 2025), which Springall calculates to be a difference of “£199 per month in repayments on a £250,000 mortgage over 25 years”.

Meanwhile, in response to calls for lenders to do more, many have also relaxed their stress testing criteria – designed to assess whether borrowers can afford their mortgage for the full term. These changes could see affordability boosted even further, particularly among those attempting to get on the property ladder for the first time, though Springall was quick to add that “more progress to support first-time buyers” was needed. With this in mind, it may be worth speaking to a mortgage broker to explore all your options before applying, whether you’re a first-time buyer, a homemover or are looking to remortgage.

Mortgage brokers remove a lot of the paperwork and hassle of getting a mortgage, as well as helping you access exclusive products and rates that aren’t available to the public. Mortgage brokers are regulated by the Financial Conduct Authority (FCA) and are required to pass specific qualifications before they can give you advice.

Get friendly, expert advice free of charge as a visitor of Moneyfactscompare.co.uk

Mortgage Advice Bureau have 1,600 UK advisers with 200 awards between them.

Speak to an award-winning mortgage broker today.

Call 0808 149 9177 or request a callback

Mortgage Advice Bureau offers fee free mortgage advice for MoneyfactsCompare visitors that call on 0808 149 9177. If you contact Mortgage Advice Bureau outside of these channels you may incur a fee of up to 1%. Lines are open Monday to Friday 8am to 8pm and Saturday 9am to 1pm excluding bank holidays. Calls may be recorded.

Your home may be repossessed if you do not keep up repayments on your mortgage.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.