Meanwhile, mass repricing caused product choice and shelf-life to dip.

Mortgage rates declined throughout May for a fourth consecutive month, data from the latest Moneyfacts UK Mortgage Trends Treasury Report revealed. Although undoubtedly a relief for the millions of borrowers with fixed deals set to end this year, lenders appeared to adopt a more cautious approach when repricing their fixed products, as average rates dropped by a smaller margin than seen in previous months.

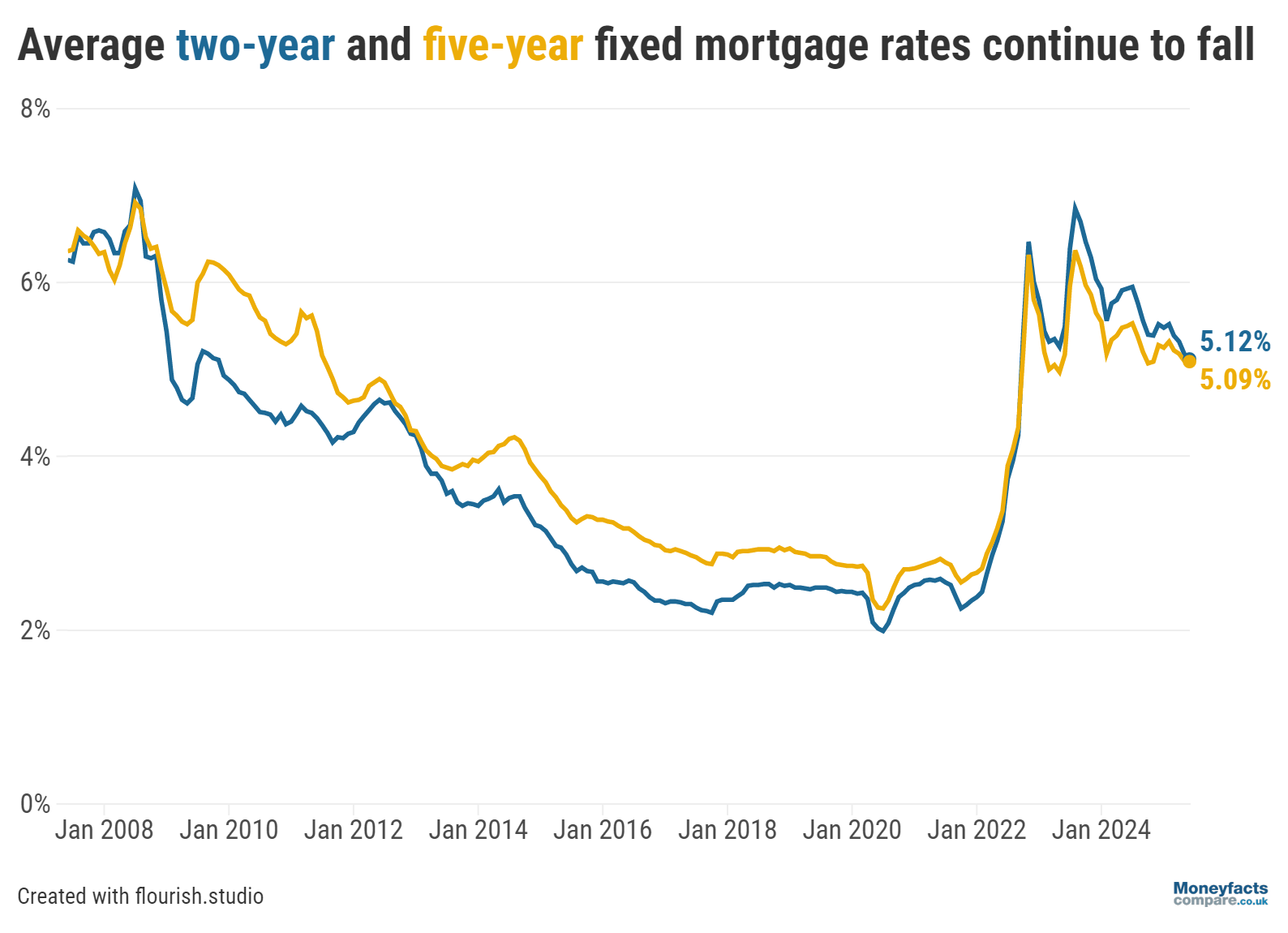

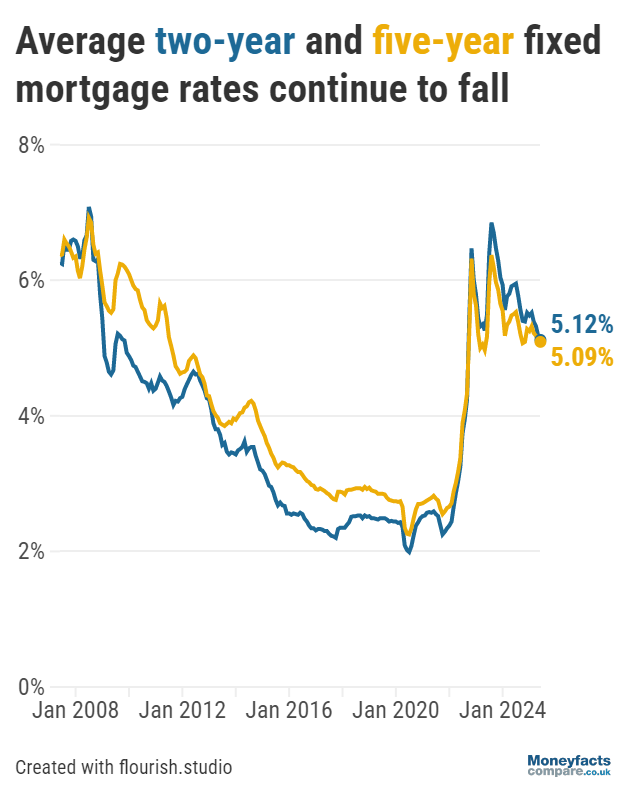

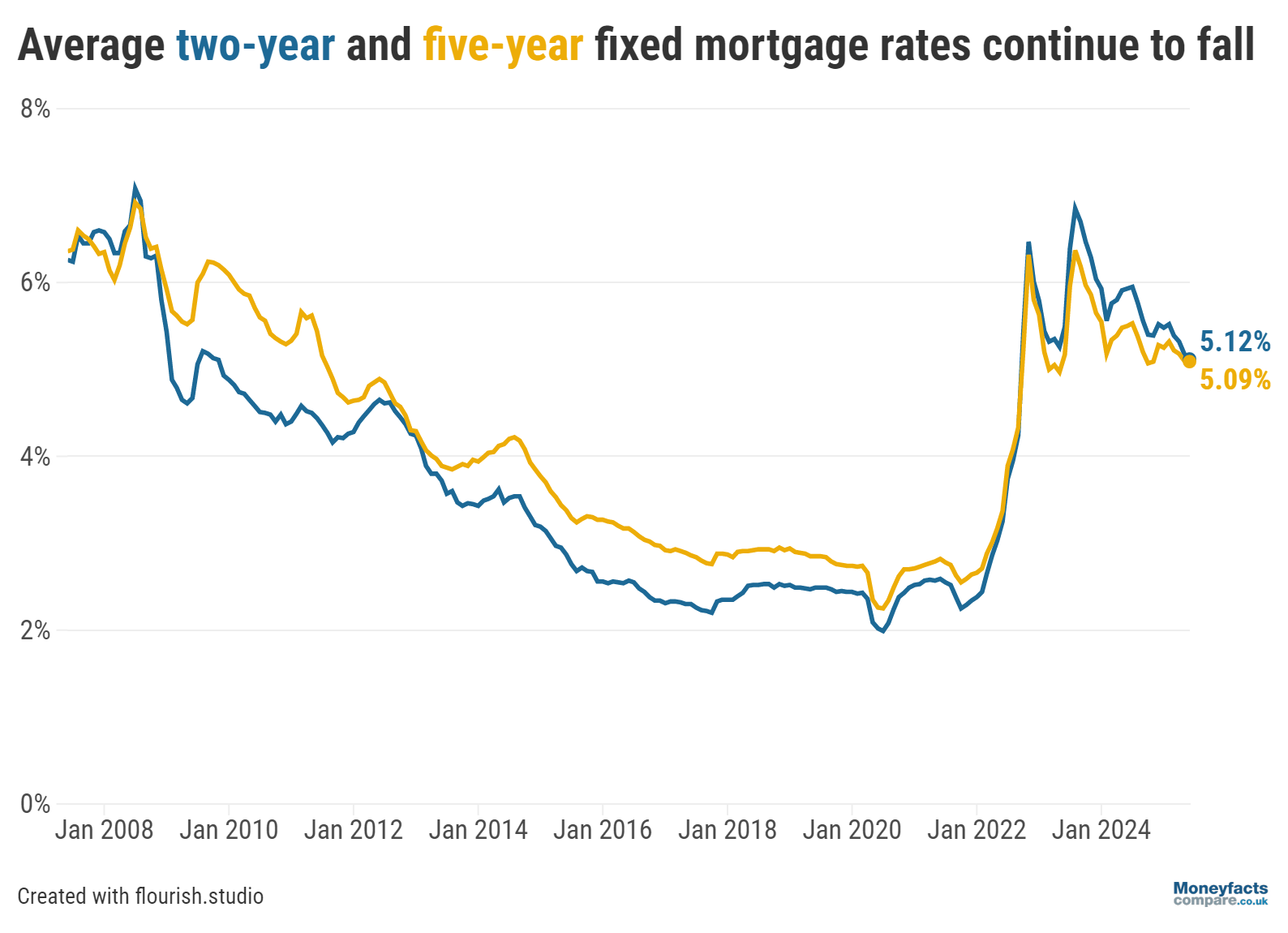

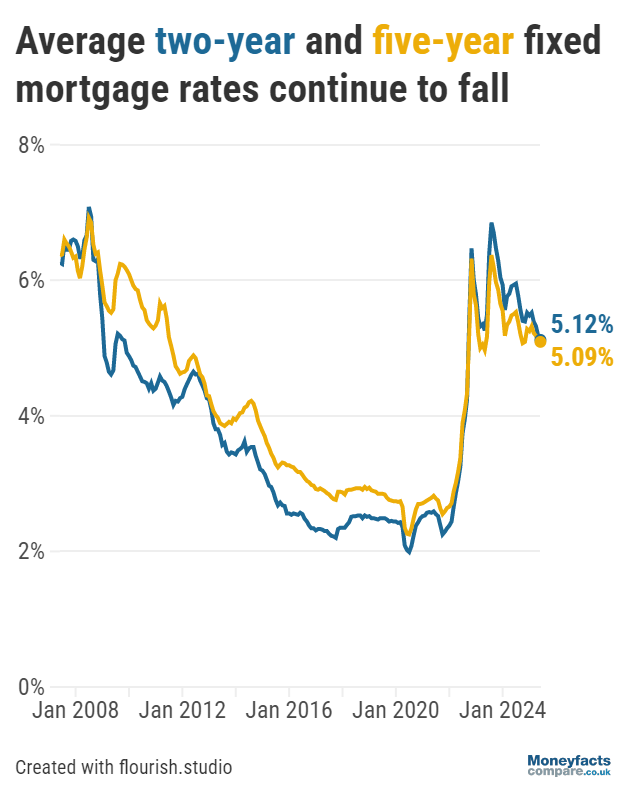

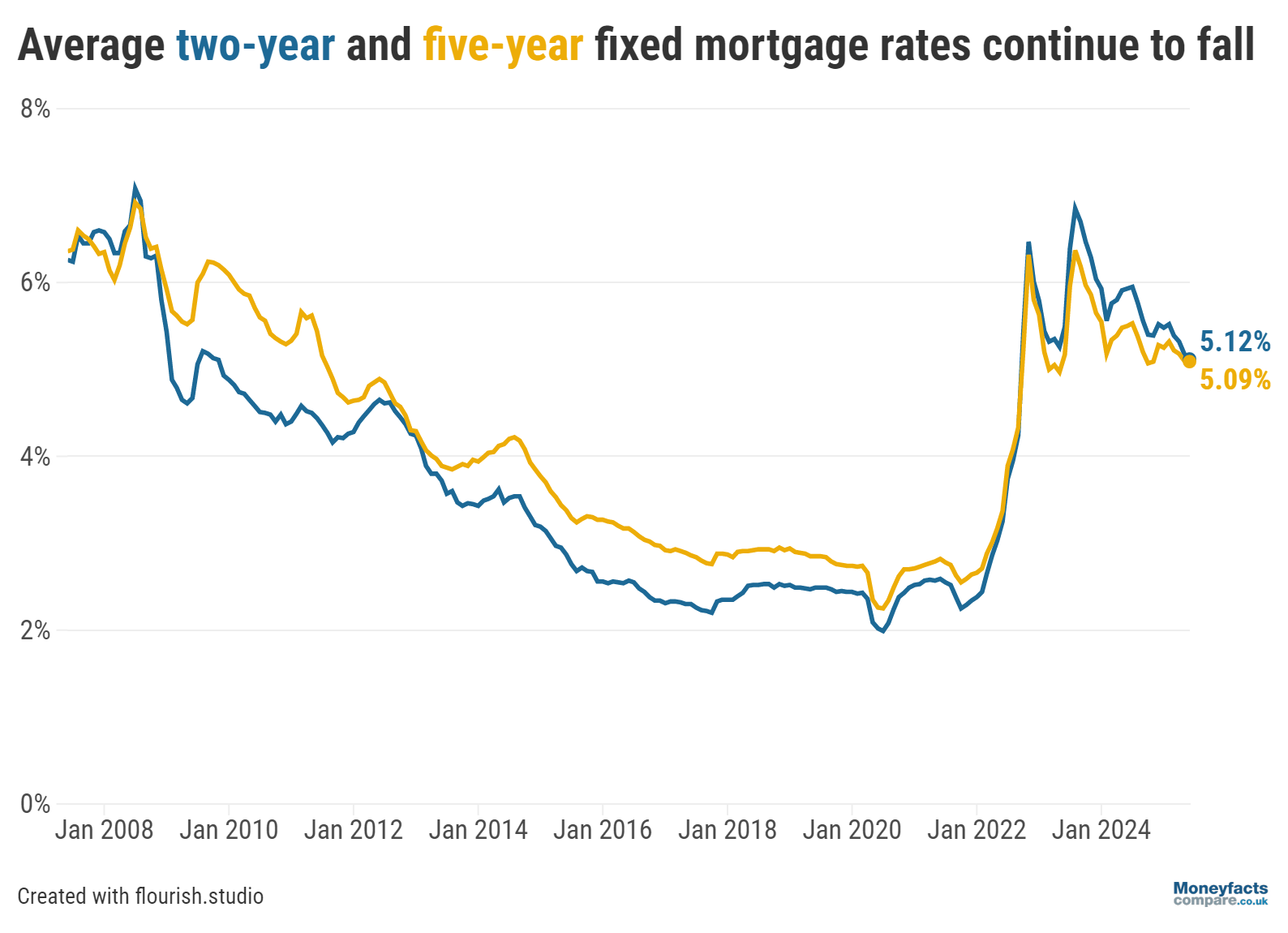

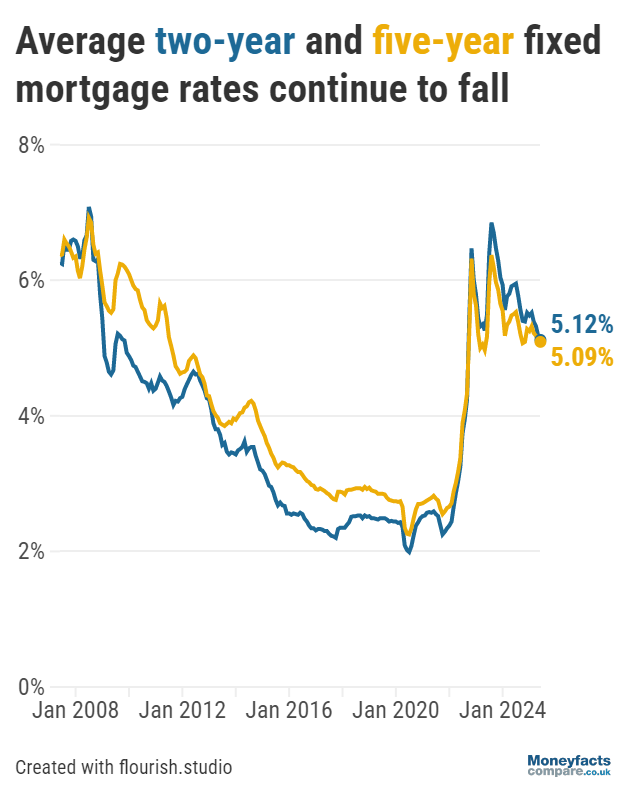

Graph: Average two- and five-year fixed mortgage rates on a monthly basis between 2008 and 2025.

The typical rate charged by a two-year fixed deal, for instance, fell by 0.06 percentage points between the start of May and June to sit at 5.12%. Meanwhile, the average five-year fixed mortgage rate dropped just 0.01 percentage point to reach 5.09% over the same timeframe.

By comparison, average two- and five-year fixed rates fell more steeply by 0.14 and 0.08 percentage points, respectively, in the month to May.

Some borrowers may have hoped mortgage rates would fall rapidly in response to the Bank of England’s Monetary Policy Committee (MPC) lowering the base rate to 4.25% in early May. However, it’s often the case any changes to the UK’s central interest rate affect variable deals most acutely, as lenders often price market forecasts into their fixed mortgages months in advance.

Indeed, the average two-year variable tracker rate dipped below 5.00% at the start of June for the first time since March 2023 after falling by a considerable 0.25 percentage points month-on-month to reach 4.91%.

In contrast, inflation reaccelerating to 3.5% in April cast fresh doubt over if and when the Bank of England base rate would be reduced further and might have prompted lenders to act more conservatively when cutting their fixed deals.

This was further compounded by recent swap market volatility which Rachel Springall, Finance Expert at Moneyfactscompare.co.uk, explained could have the opposite effect in driving rates back up.

Those looking for a new deal would therefore be wise to compare rates often and could consider speaking with a broker for help navigating the ever-changing mortgage market.

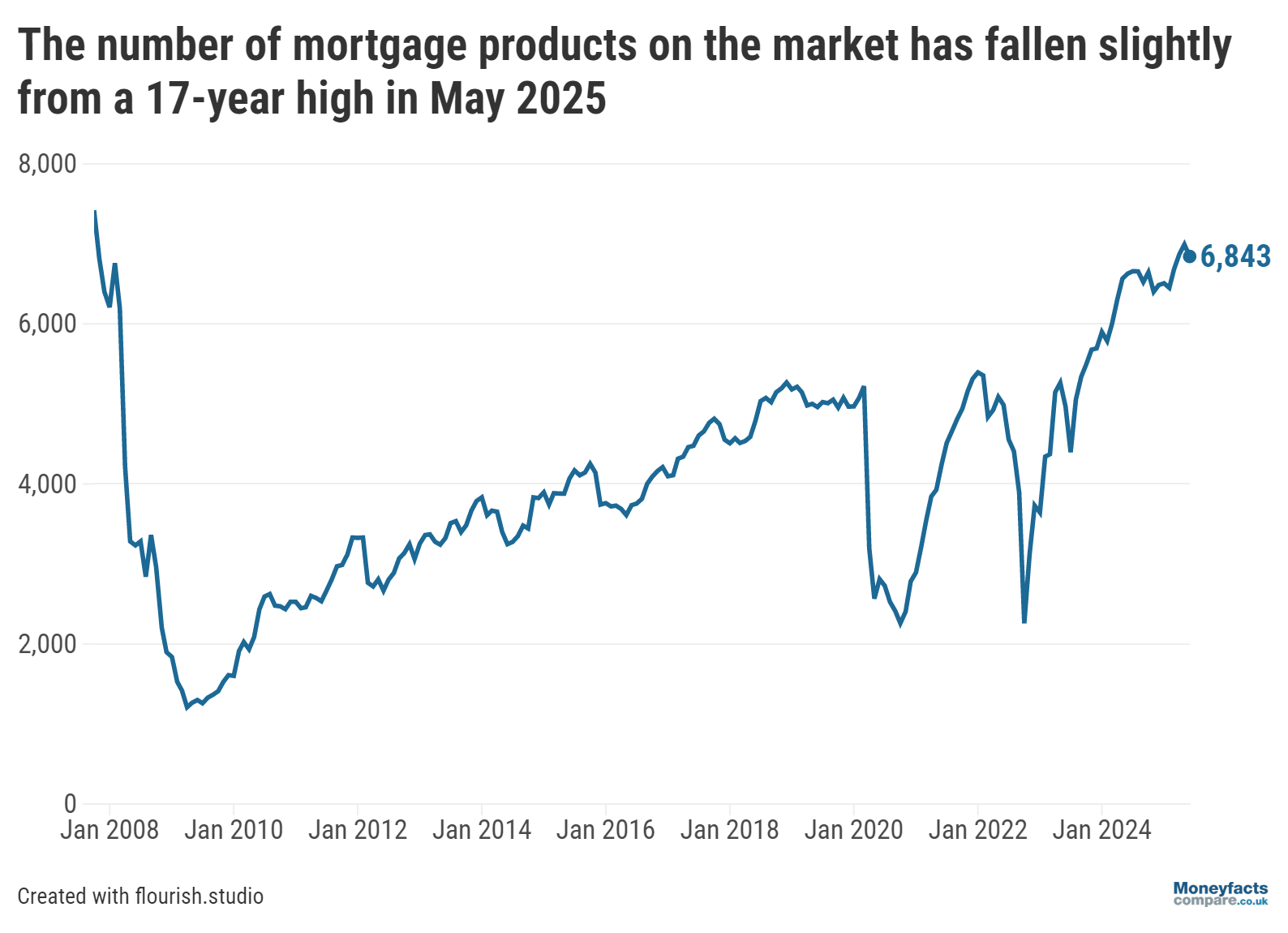

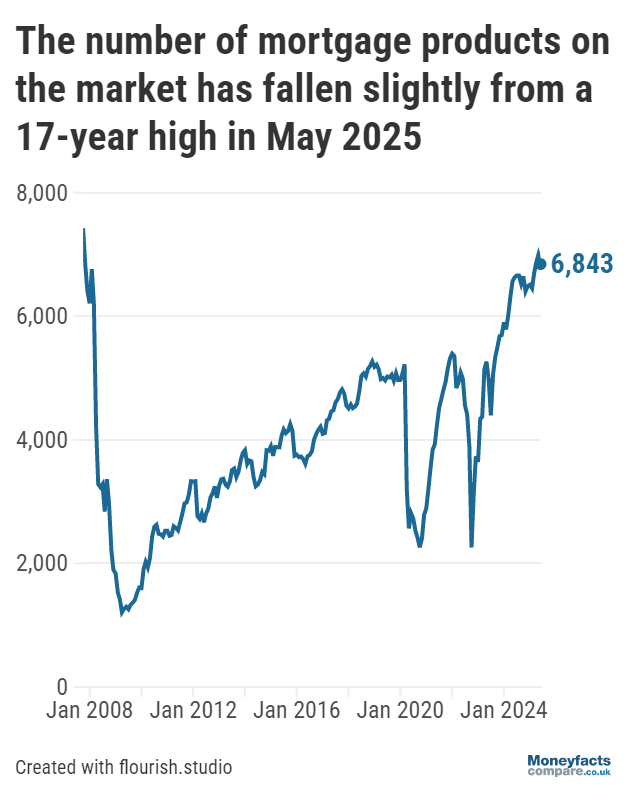

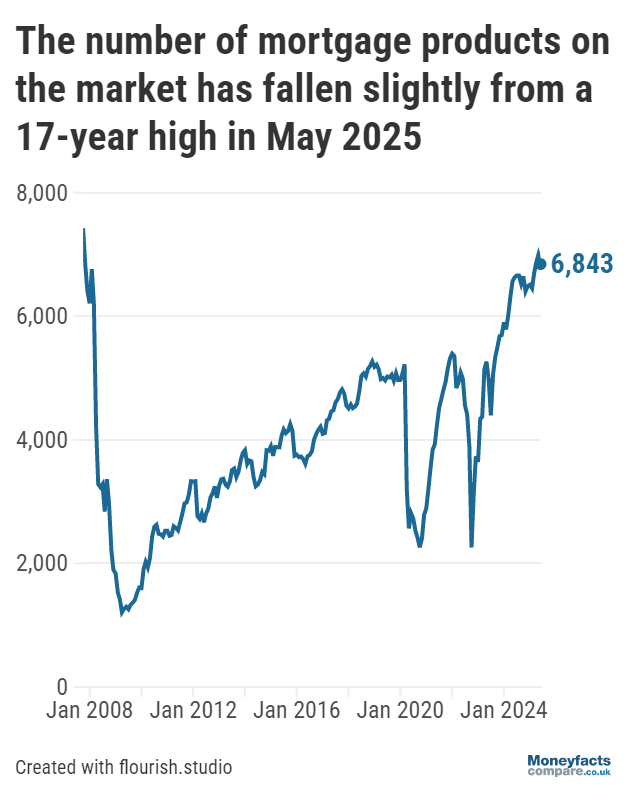

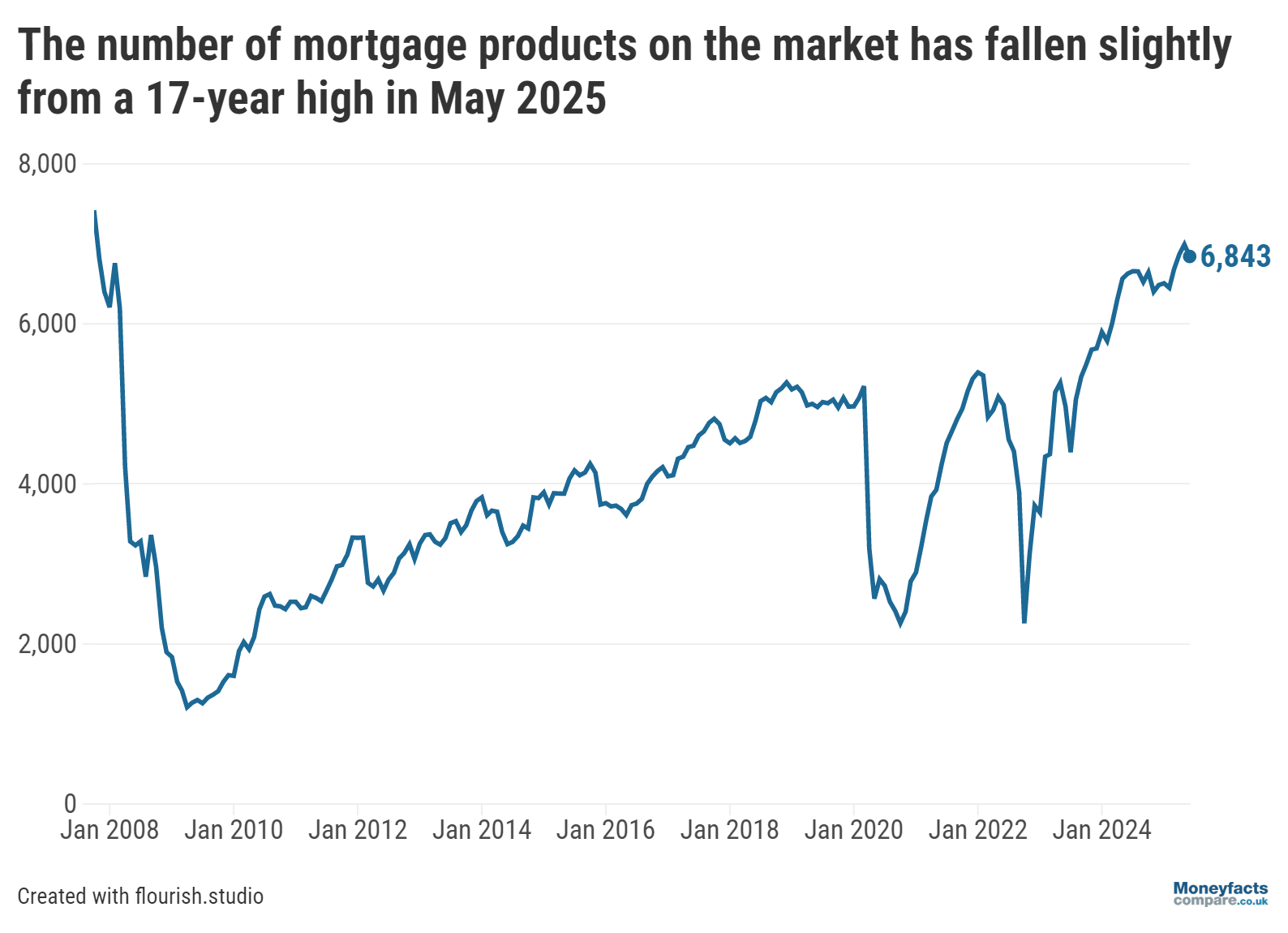

Borrowers currently have fewer mortgage deals to choose from, with the Moneyfacts UK Mortgage Trends Treasury Report finding product count dipped from just below 7,000 in May to 6,843 by the start of this month. Nevertheless, “the drop was relatively modest” and “choice overall is higher than at the start of 2025”, Springall reassured.

Graph: Mortgage product counts between 2008 and 2025.

“This churn of mortgage deals can occur if lenders pull and replace deals to cope with interest rate moves and borrower demand,” she explained.

“The flow of changes led to a drop in the average shelf-life of a deal to 17 days, now at its lowest point in three months. This may further prompt the millions of borrowers due to refinance this year to seek advice and secure a new deal,” she added.

Our mortgage charts are regularly updated throughout the day to show the lowest rates currently available.

That being said, it’s important to keep in mind the cheapest-priced deal might not be the most cost-effective depending on your circumstances. Instead, a mortgage broker could help you find the best option for your needs.

Alternatively, you can discover more information about deals charging some of the lowest fixed rates (as well as some Moneyfacts Best Buy options) in our weekly mortgage roundup.

Mortgage brokers remove a lot of the paperwork and hassle of getting a mortgage, as well as helping you access exclusive products and rates that aren’t available to the public. Mortgage brokers are regulated by the Financial Conduct Authority (FCA) and are required to pass specific qualifications before they can give you advice.

Get friendly, expert advice free of charge as a visitor of Moneyfactscompare.co.uk

Mortgage Advice Bureau have 1,600 UK advisers with 200 awards between them.

Speak to an award-winning mortgage broker today.

Call 0808 149 9177 or request a callback

Mortgage Advice Bureau offers fee free mortgage advice for MoneyfactsCompare visitors that call on 0808 149 9177. If you contact Mortgage Advice Bureau outside of these channels you may incur a fee of up to 1%. Lines are open Monday to Friday 8am to 8pm and Saturday 9am to 1pm excluding bank holidays. Calls may be recorded.

Your home may be repossessed if you do not keep up repayments on your mortgage.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.