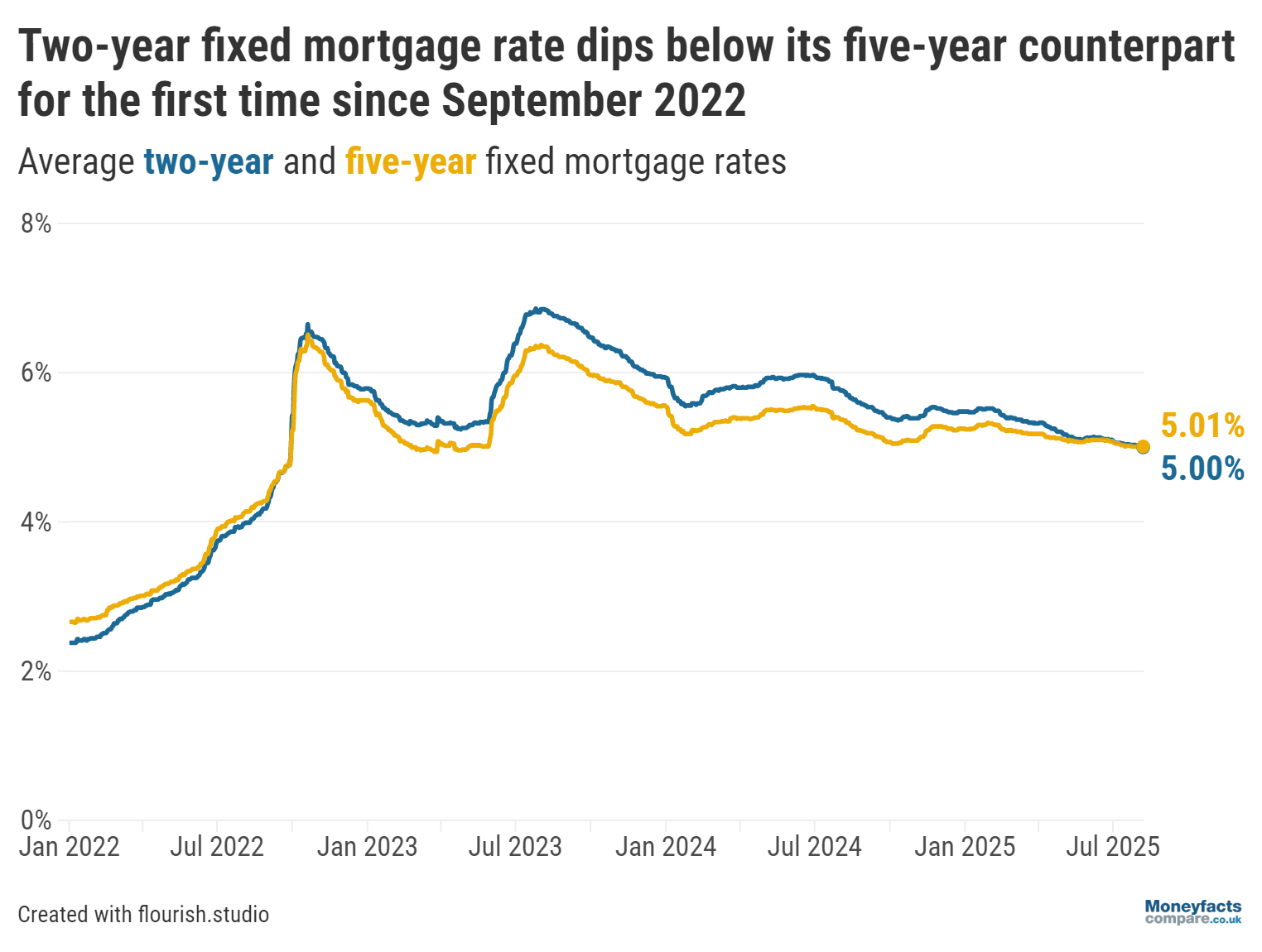

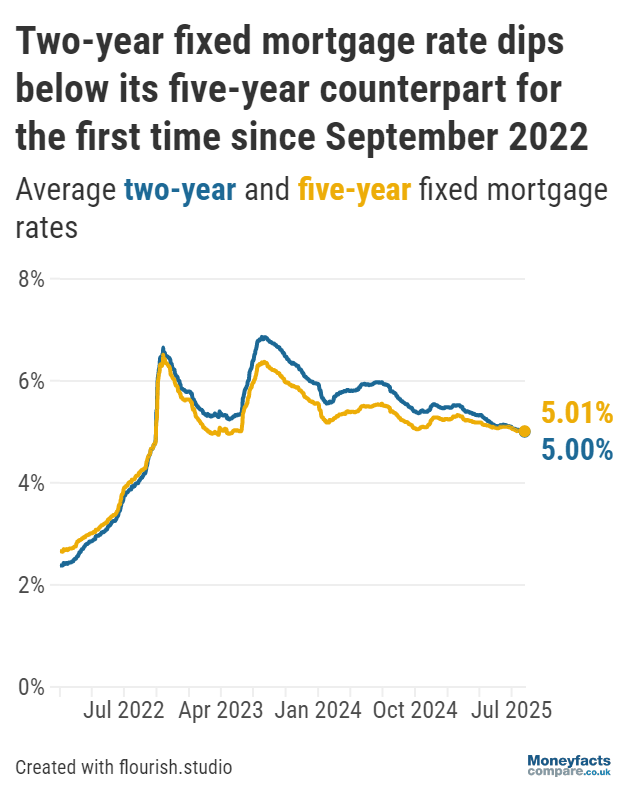

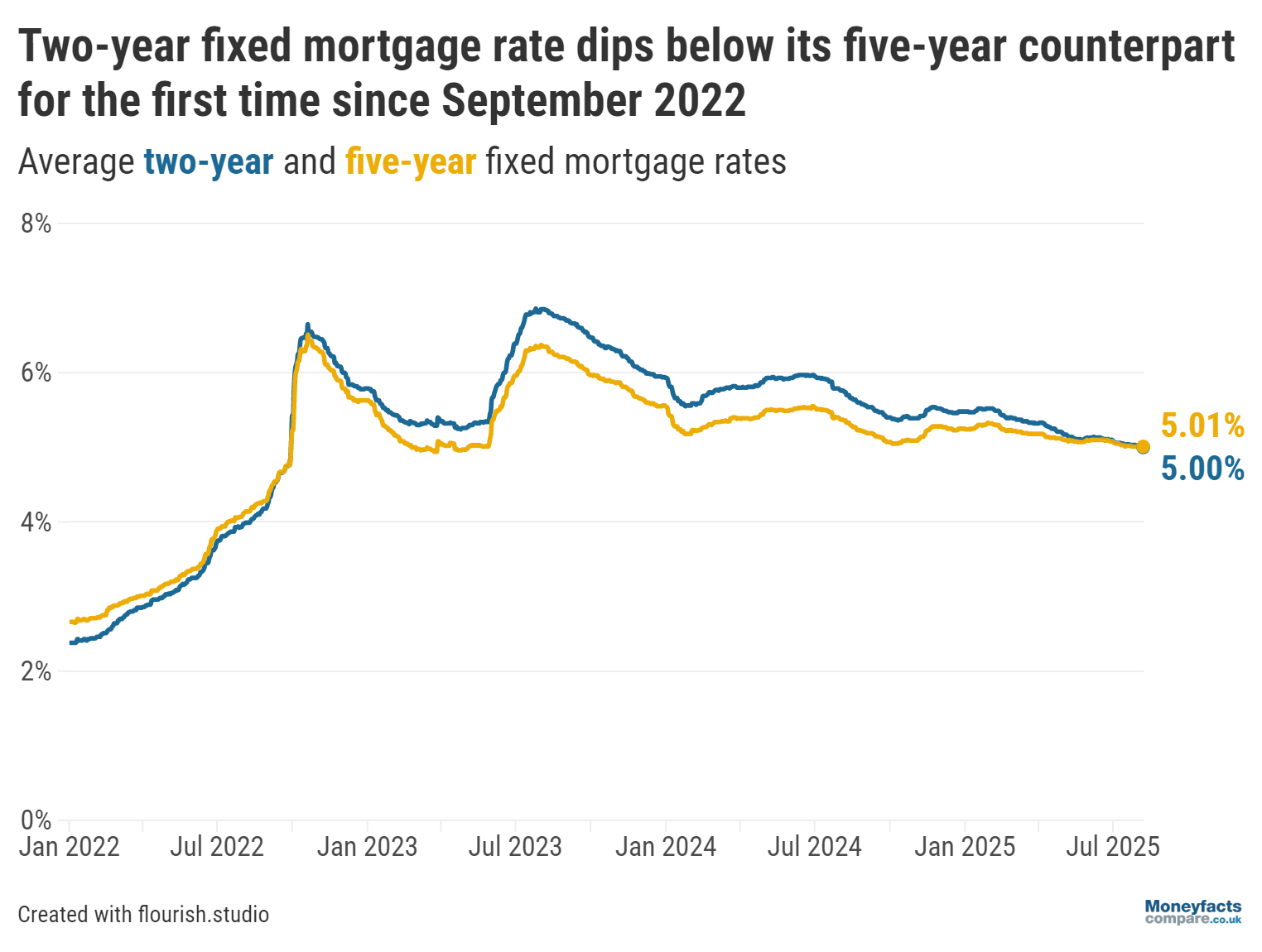

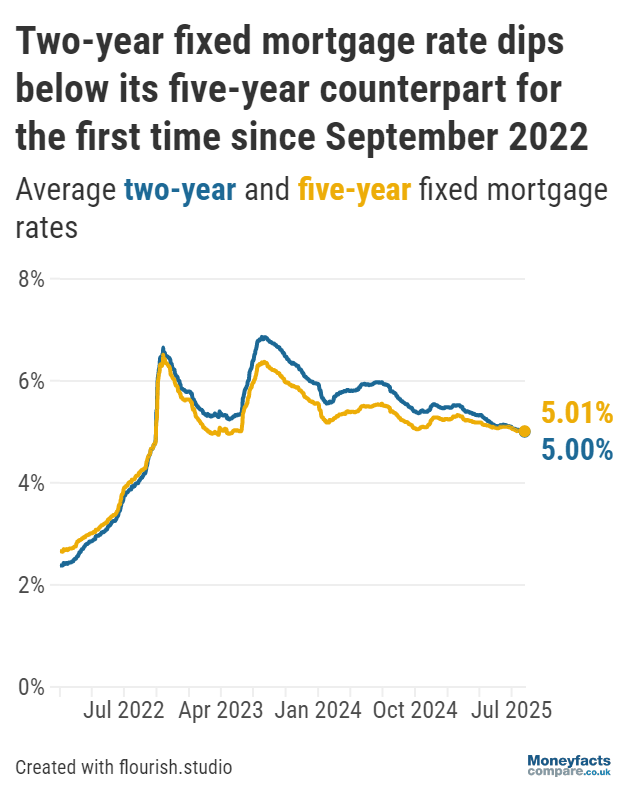

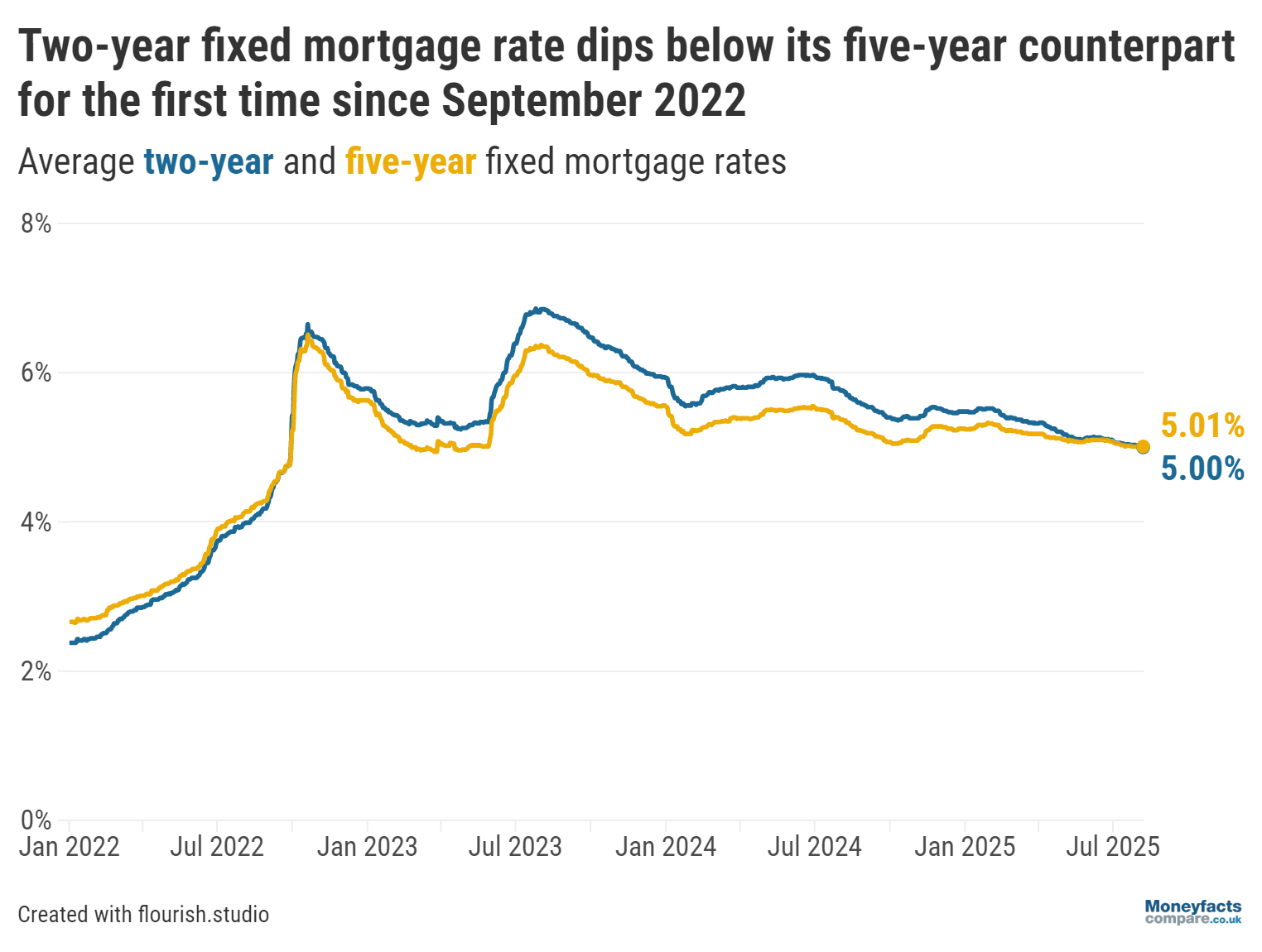

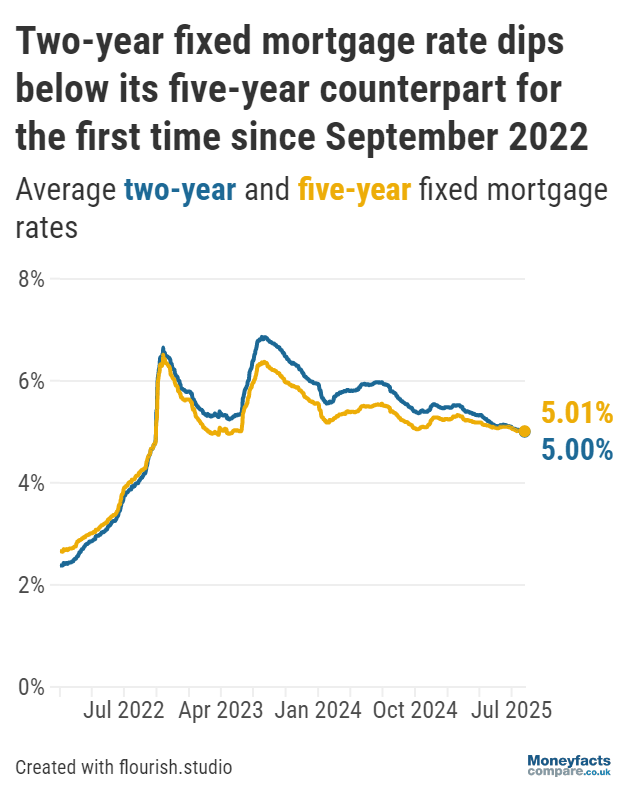

This reverses the trend seen since September 2022.

Some normality has returned to the mortgage market as the average two-year fixed mortgage rate has fallen to 5.00%, finally dipping below the average five-year fixed rate of 5.01%.

The gap between these rates had narrowed in recent weeks, but today (7 August) is the first time since September 2022 that the average two-year fix is cheaper than the five-year fixed rate.

Traditionally, two-year fixed mortgages were cheaper than their longer-term equivalents as short-term fixed rates are usually less risky for the lender. The longer the term, the more things could change in the mortgage market, the economy and the borrower’s individual situation, which is a greater risk for the lender.

But, in the volatility that followed the ‘mini-Budget’ in September 2022, two-year fixed mortgage rates became more expensive than five-year deals. The uncertainty in the market, along with the regular increases to the base rate over the following years, prompted many lenders to price their two-year fixed mortgages higher. Meanwhile, as lenders expected the market to settle down and rates to fall after a few years, five-year deals were often priced lower.

“The end of the inversion in the two- and five-year fixed rates, if sustained moving onward, will bring borrowers back to a more traditional mortgage market, where it’s more expensive to secure a longer-term fixed mortgage,” explained Rachel Springall, Finance Expert at Moneyfactscompare.co.uk.

Graph: The average two-year fixed mortgage rate dips below the average five-year fixed mortgage rate for the first time since September 2022.

Approximately 2.5 million mortgage accounts are expected to see their payments decrease between June 2025 and the second quarter of 2028, according to the Bank of England’s latest Financial Stability Report.

Indeed, borrowers who took out a two-year fix in August 2023 at the average rate of 6.85% could see their monthly payments fall by around £280 if they refinance on another two-year fix at the current average rate of 5.00% (based on a £250,000 repayment mortgage over a 25-year term).

“Millions of borrowers coming off a fixed rate deal this year will be delighted to see fixed mortgage rates on the downward trend,” Springall commented.

After a challenging couple of years for mortgage borrowers, she notes that “time is a healer, with lower rates, much more market stability and a relaxation in stress testing”.

For an up-to-date list of the lowest rates available, see our mortgage charts. However, it's important to bear in mind that the deal with the lowest interest rate may not always be the most cost-effective for your circumstances.

Our weekly mortgage roundup highlights the lowest fixed mortgage rates, as well as some Moneyfacts Best Buy alternatives.

With two-year fixed mortgages now cheaper than five-year fixed deals, on average, those planning to take out a mortgage may be wondering what length term to opt for. However, there’s no straightforward answer to this question as it will depend on your unique situation and individual preferences.

See our guide for more information on the pros and cons of shorter- and longer-term fixed mortgages, to help you work out how long to fix your mortgage for.

But, while two- and five-year fixed terms are particularly common, borrowers could also consider the middle ground of a three-year fixed term.

“Those torn between the flexibility of a shorter-term initial fixed term and the security of a longer-term fix could explore a three-year fixed mortgage; this is a corner of the market we’re seeing become all the more competitive,” noted Oliver Dack, Spokesperson at Mortgage Advice Bureau.

Speaking to a mortgage broker can be beneficial for many borrowers. Brokers can navigate the deals available on the market and offer support and guidance throughout the mortgage process to help you secure the best deal for your situation.

Get friendly, expert advice free of charge as a visitor of Moneyfactscompare.co.uk

Mortgage Advice Bureau have 1,600 UK advisers with 200 awards between them.

Speak to an award-winning mortgage broker today.

Call 0808 149 9177 or request a callback

Mortgage Advice Bureau offers fee free mortgage advice for MoneyfactsCompare visitors that call on 0808 149 9177. If you contact Mortgage Advice Bureau outside of these channels you may incur a fee of up to 1%. Lines are open Monday to Friday 8am to 8pm and Saturday 9am to 1pm excluding bank holidays. Calls may be recorded.

Your home may be repossessed if you do not keep up repayments on your mortgage.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.