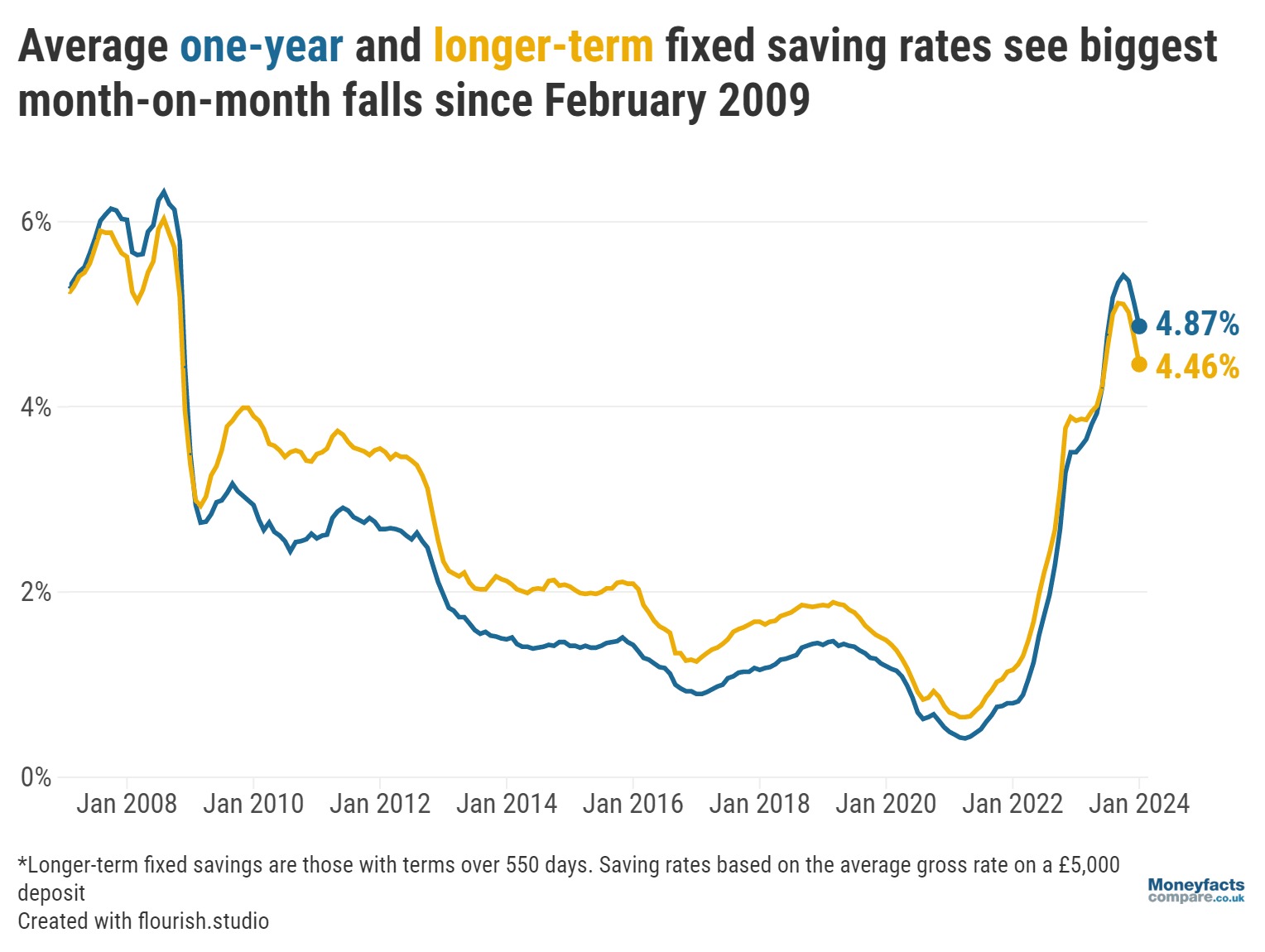

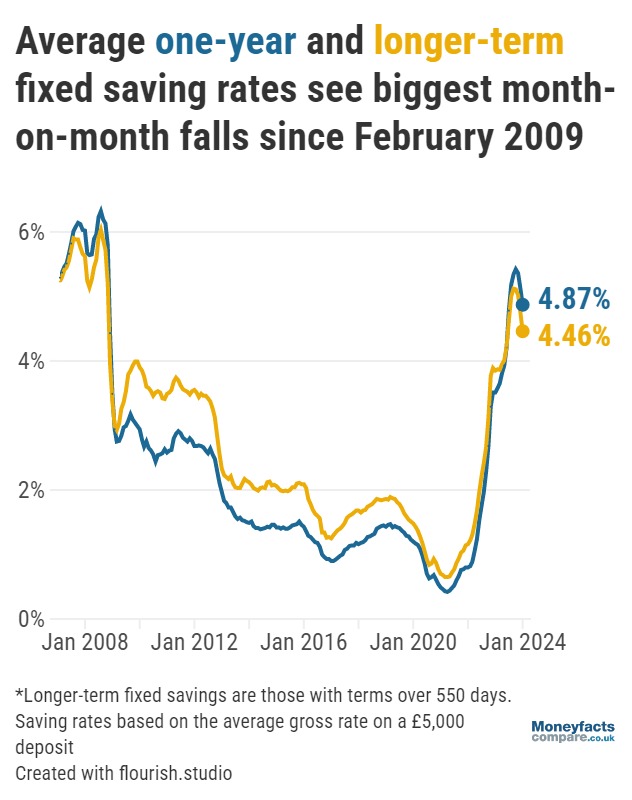

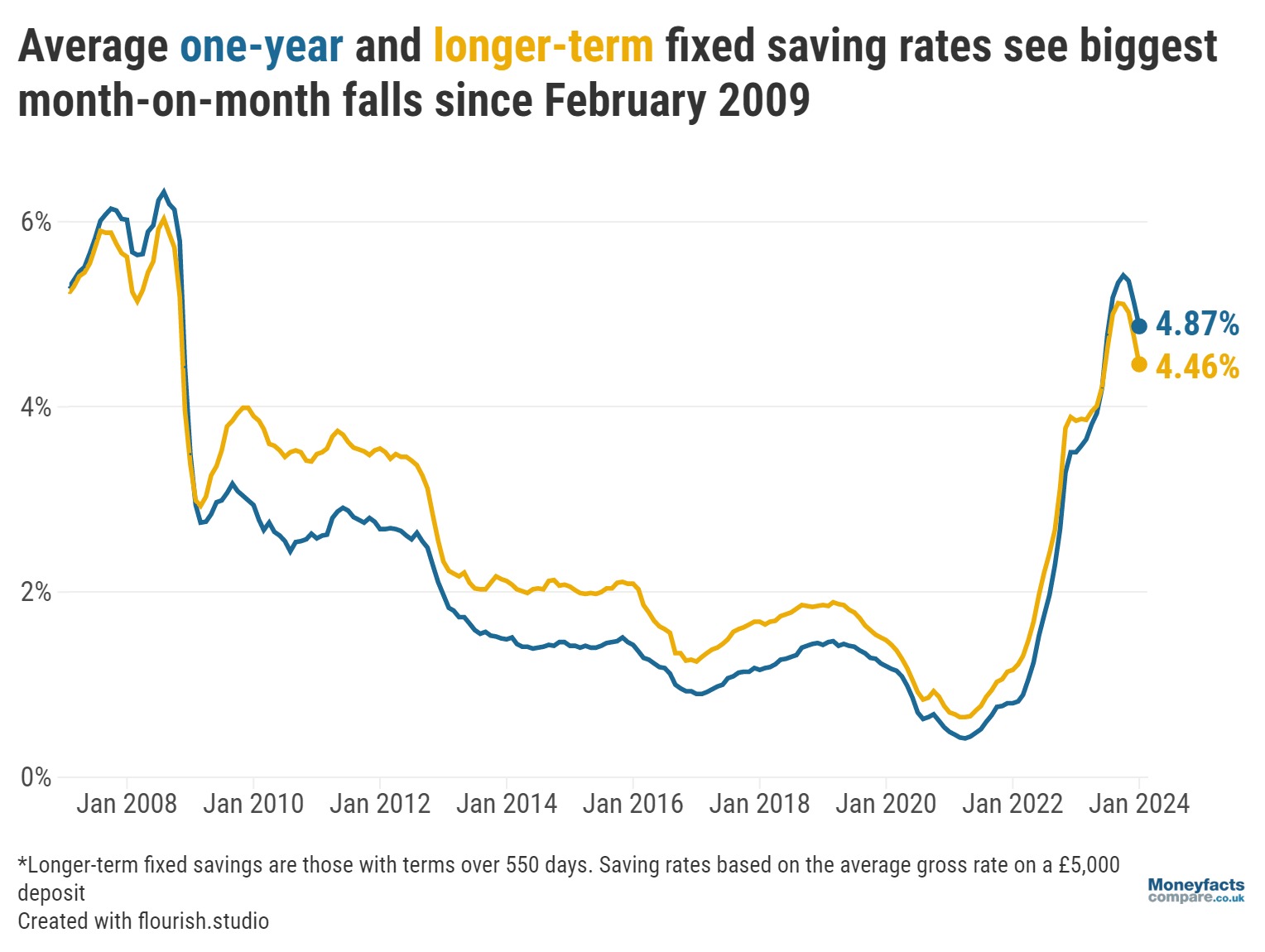

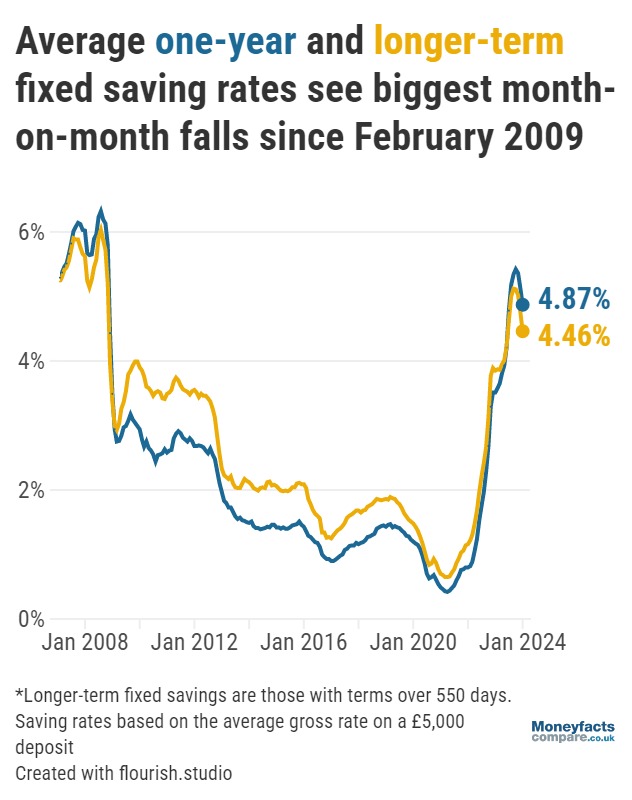

Despite the fall, those now exiting a fixed deal will find average savings rates are higher than at the start of 2023.

Savers may be dismayed to learn average rates for fixed bonds and fixed ISAs experienced the biggest month-on-month cuts in almost 15 years at the start of January.

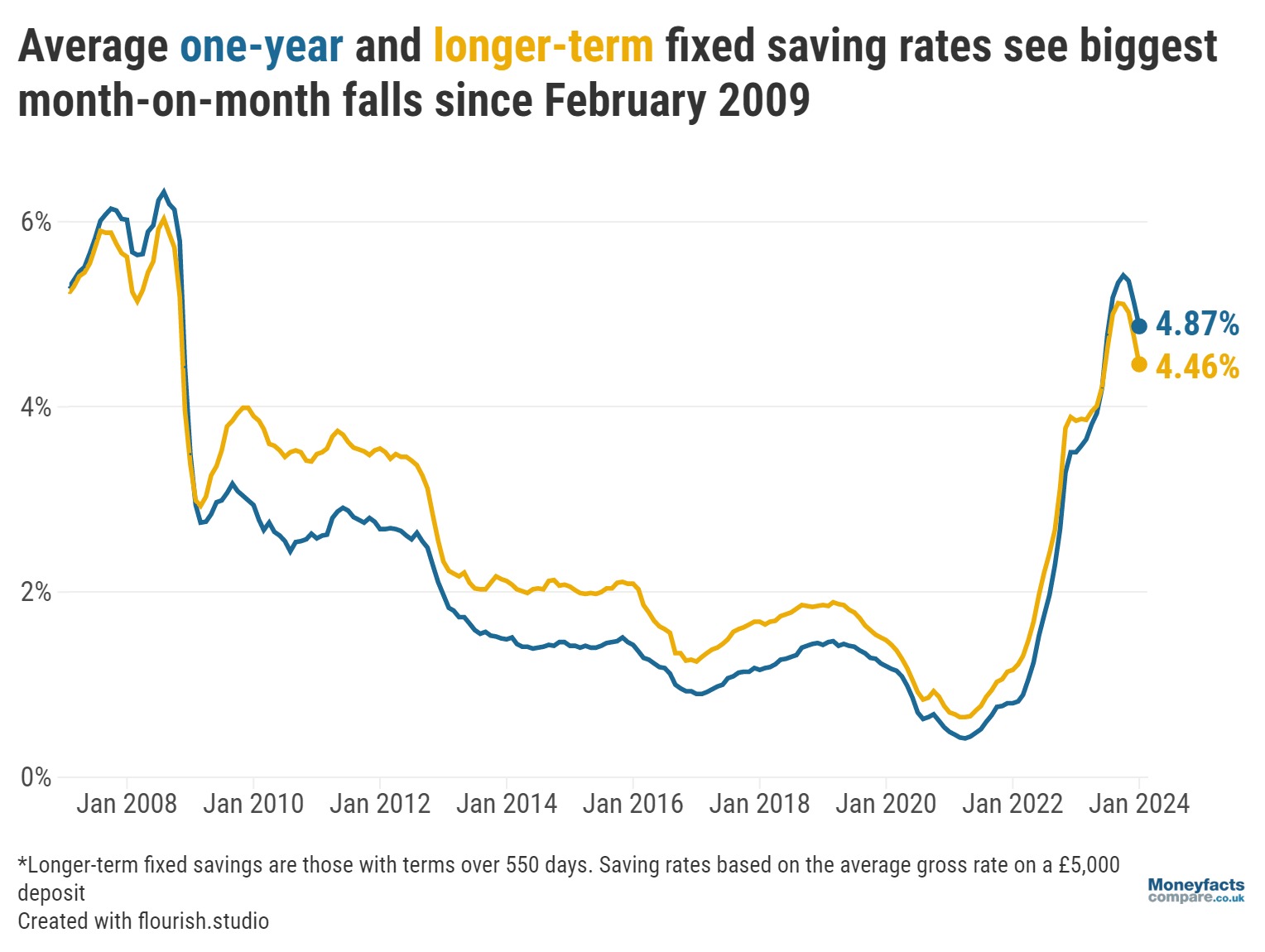

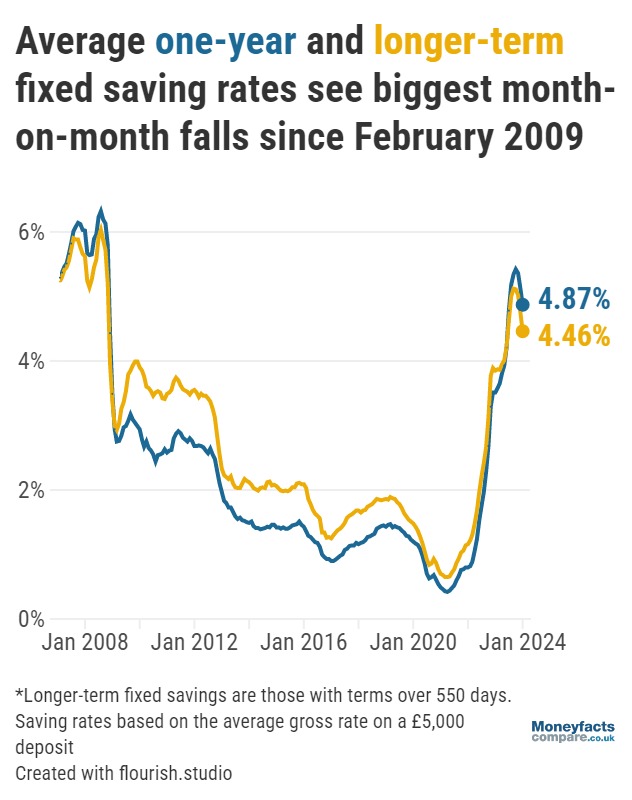

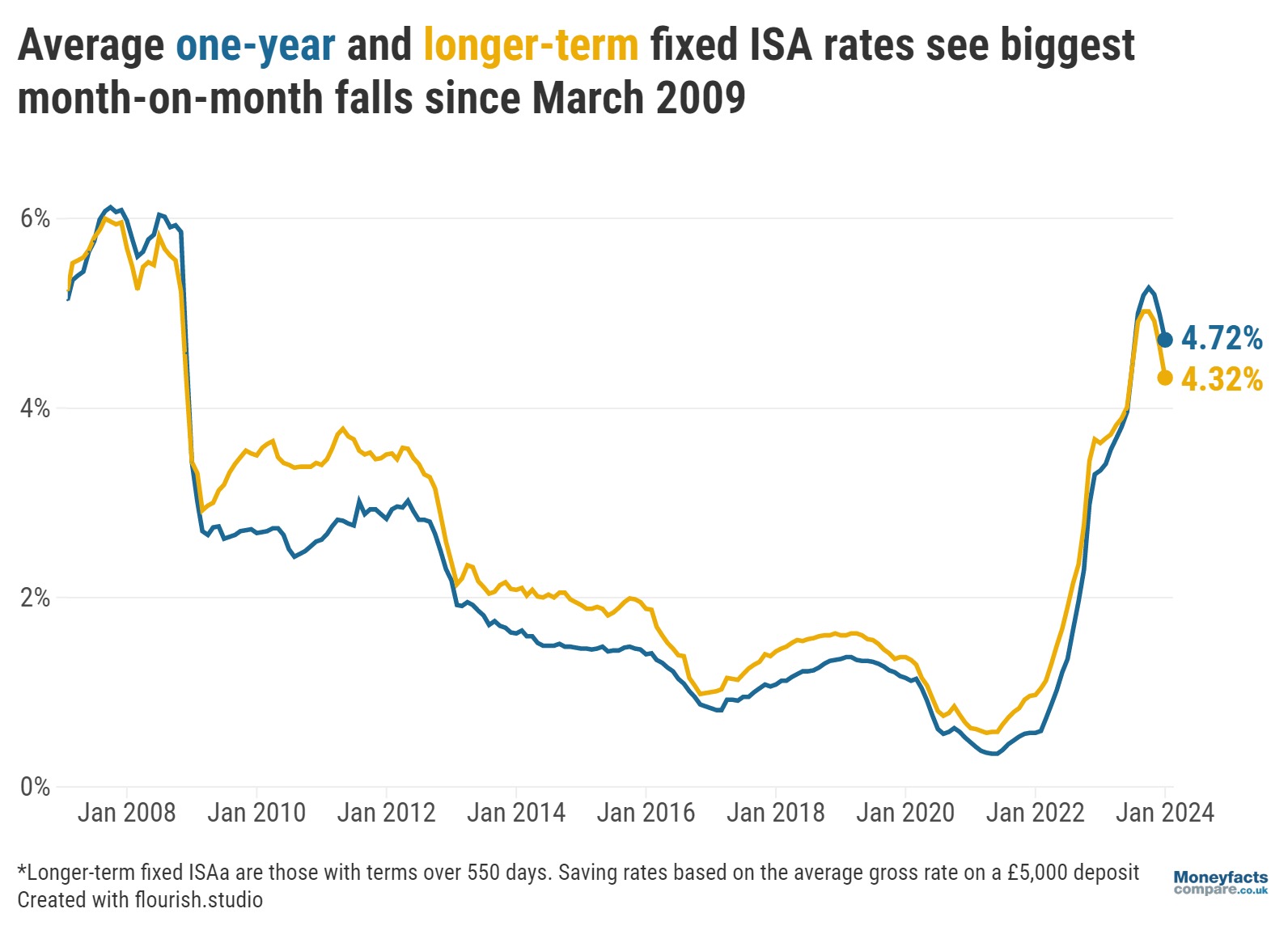

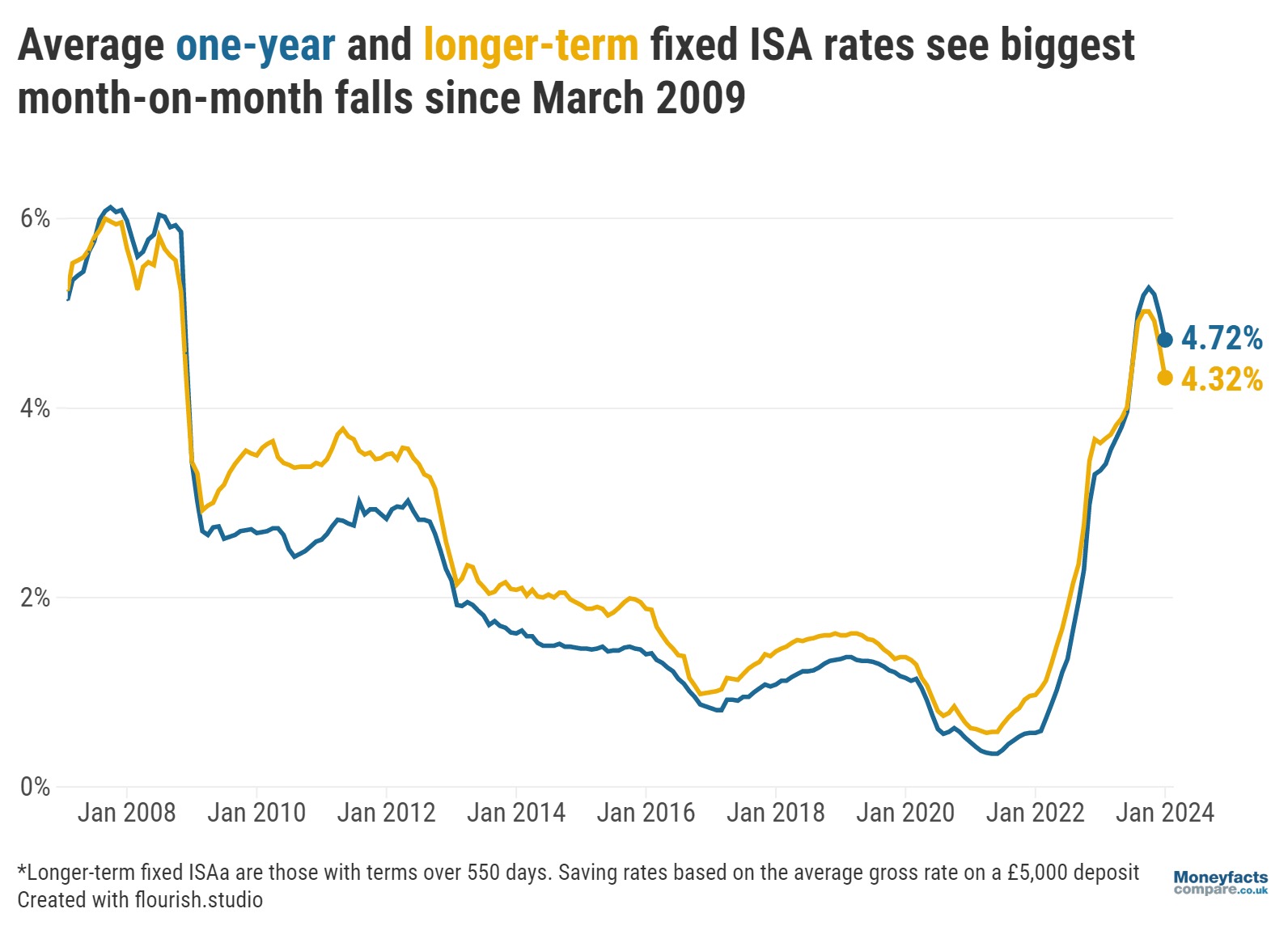

The average rate paid by a one-year fixed bond fell for the third consecutive month to 4.87%, down from 5.13% in December 2023. This is the first time this rate has dipped below 5% since July 2023.

Meanwhile, the average longer-term fixed bond (with terms over 550 days) dropped to 4.46% from 4.76% the previous month – falling for the fourth consecutive month. In both instances, this was the largest month-on-month fall since February 2009.

Caption: Graph showing average one-year and longer-term fixed savings rates saw their biggest month-on-month falls since February 2009.

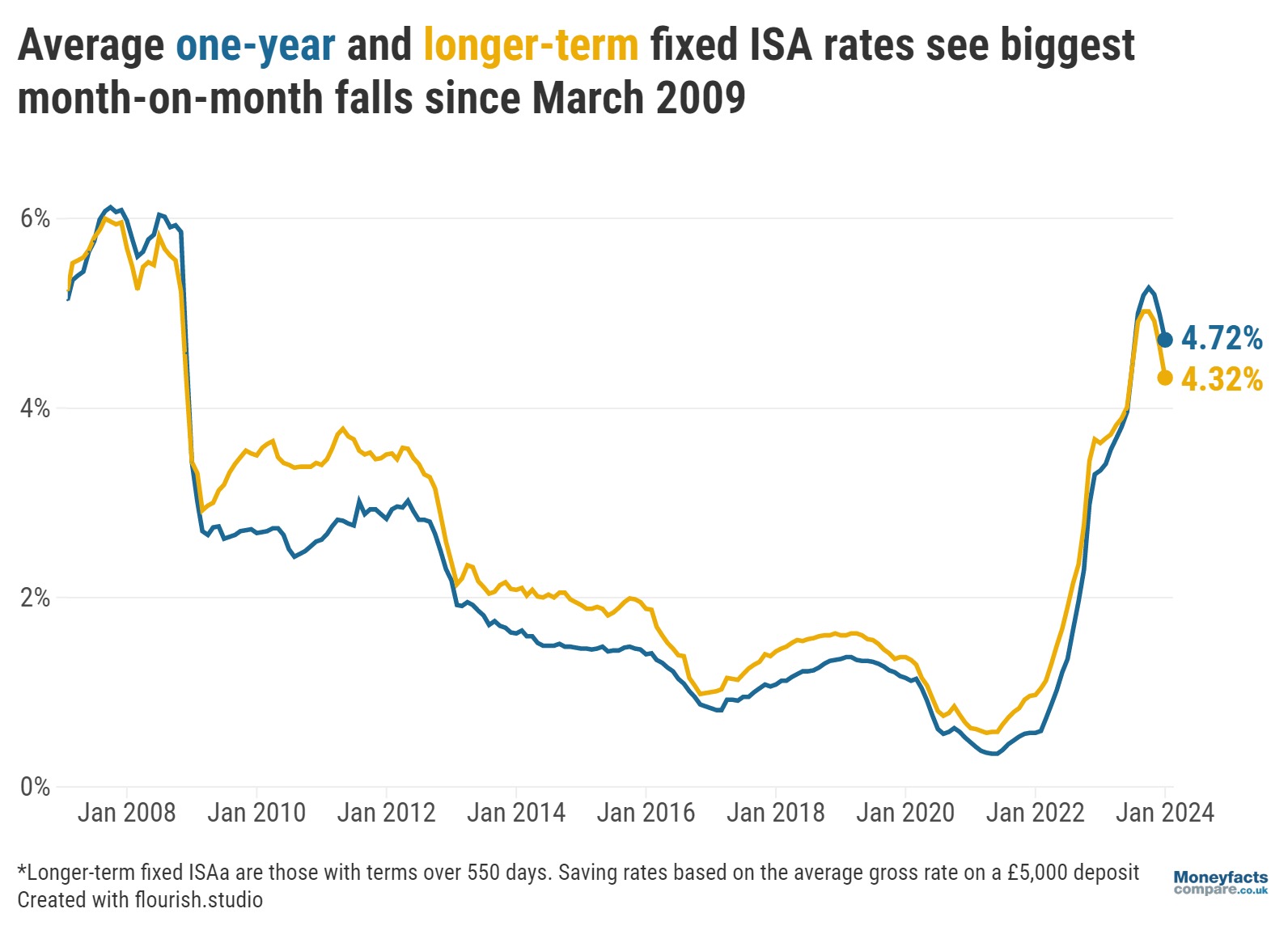

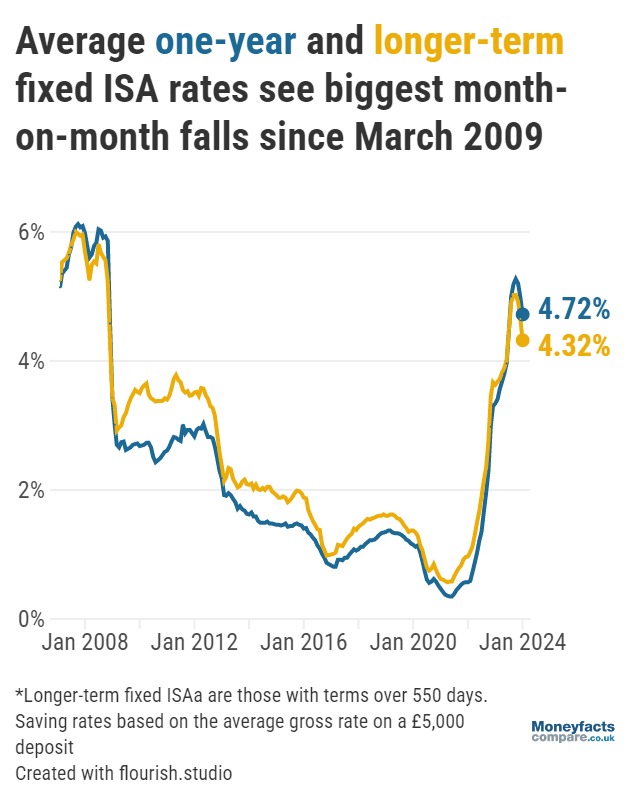

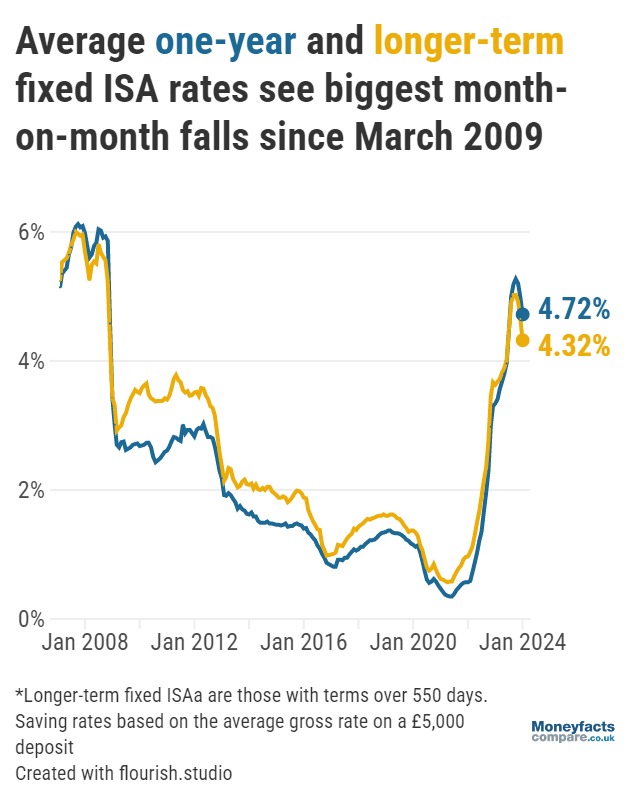

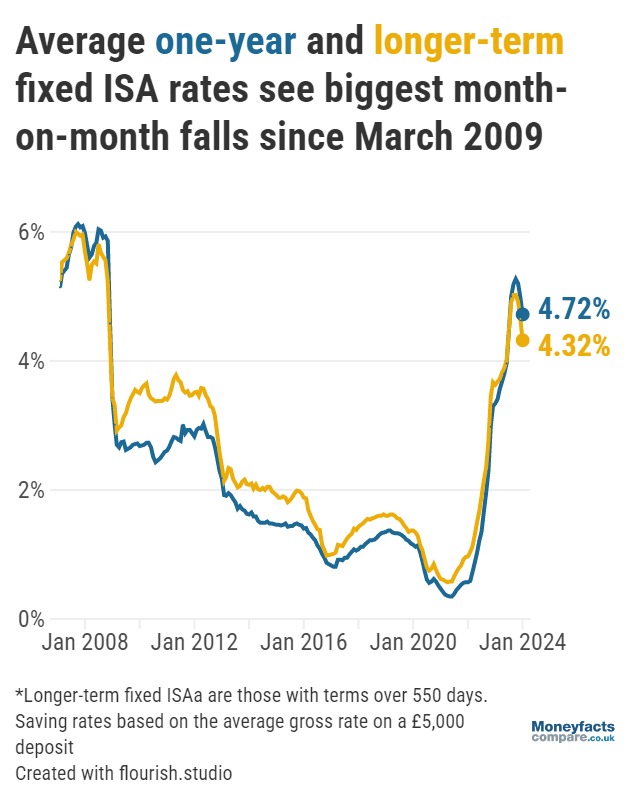

It’s a similar picture within the fixed ISA market, where average fixed rates experienced their biggest monthly drop since March 2009. The average one-year fixed ISA now pays 4.72% on a first of month basis – down from 4.99% in December. As for the average rate paid by a longer-term fixed ISA, this fell to 4.32% from 4.65% within the same period.

“This will no doubt come as a shock for savers who use these accounts to earn a guaranteed return on their hard-earned cash,” commented Rachel Springall, Finance Expert at Moneyfactscompare.co.uk.

However, Springall was quick to highlight that, despite the falls, “average rates are higher than they were at the start of 2023” so many coming off a fixed rate will find better returns available compared to this time last year.

Caption: Graph showing average one-year and longer-term fixed ISA rates saw their biggest month-on-month falls since March 2009.

Average rates are a good indicator of whether you’re receiving competitive returns on your savings. They can also provide an overview of how the market is performing. If your account is paying a below-average rate, it may be time to compare other savings options.

Variable accounts weren’t exempt from the drop in rates. The average easy access rate fell for a consecutive month to 3.15%, while the rate paid by the average easy access ISA dropped to 3.25%.

Likewise, the average notice rate experienced its first month-on-month fall since February 2022 to sit at 4.38%, while the average rate for a notice ISA fell to 4.18%.

Nevertheless, like their fixed counterparts, rates in these markets remain much higher than they were a year ago.

Savings rates rose gradually last year in response to the Bank of England’s Monetary Policy Committee (MPC) voting for consecutive increases to the base rate as it attempted to tackle chronically high inflation.

With the rate of inflation lessening significantly towards the end of 2023, the MPC voted three times in favour of maintaining the base rate where it currently stands, at 5.25%. As a result, savings rates have seen a steady decline.

As some experts anticipate a cut to the base rate in the not-too-distant future, it could be that savings rates remain on a downward trajectory.

“Savings providers will no doubt be aware of the ongoing murmuring of the Bank of England base rate coming down in 2024, but even if this doesn’t occur for the next few months, variable rates can still change,” said Springall.

“Providers will be looking closely both at their interest margins, the swap market and their own position in the top rate tables against their peers. Swift movement can take place if they are sitting way ahead of their competition or if they are drawing in too much in deposits.”

However, with a new ISA season fast approaching and ISA reforms coming into effect from the new tax-year, the savings market may still see a flurry of activity. Therefore, it’s important savers regularly review top rates.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.