But interest rate cuts threaten to diminish returns.

Savers wanting to make the most of their annual ISA allowance before the tax-year ends have a record number of products to choose from after new accounts hit the market in the month to February.

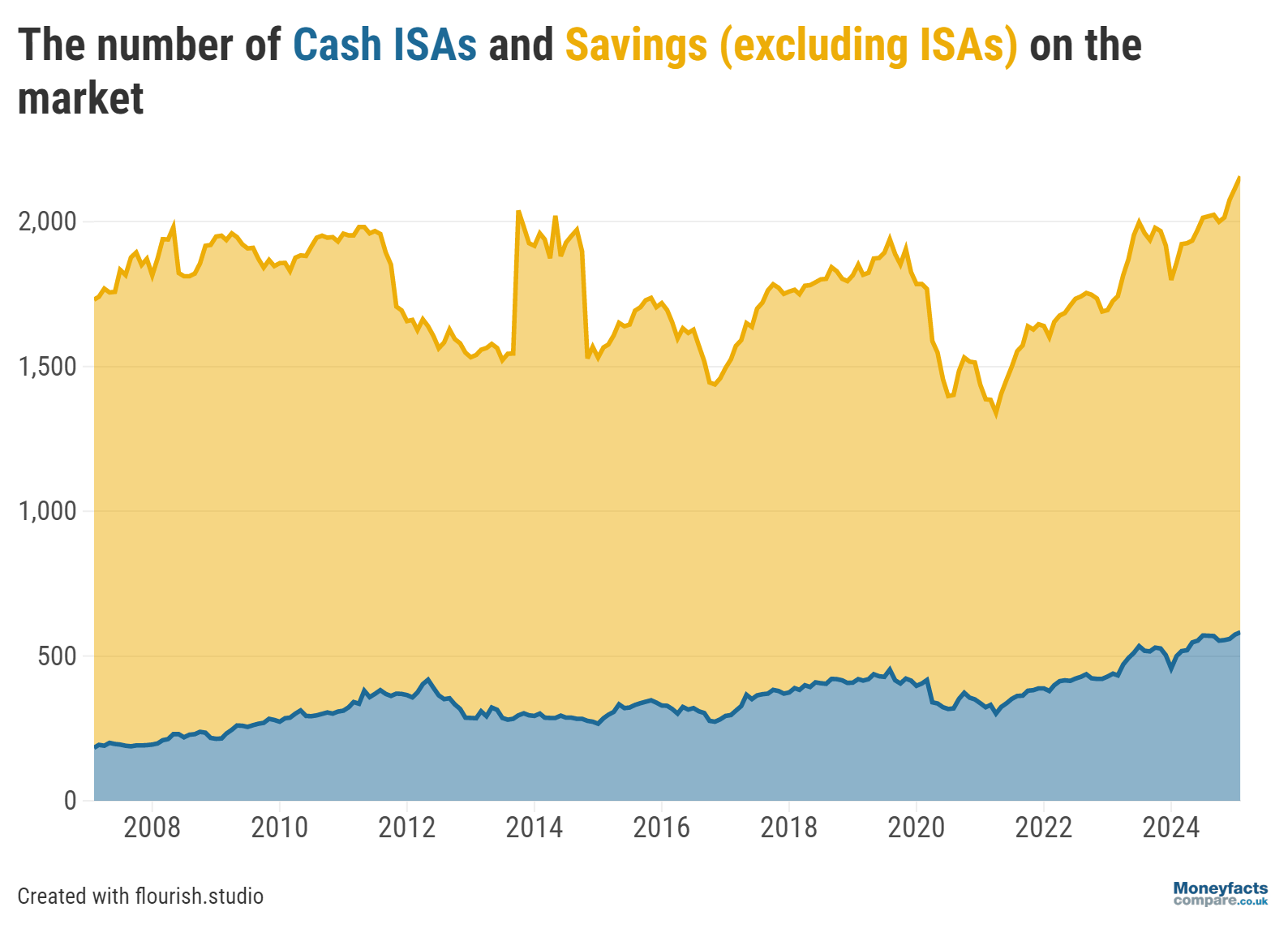

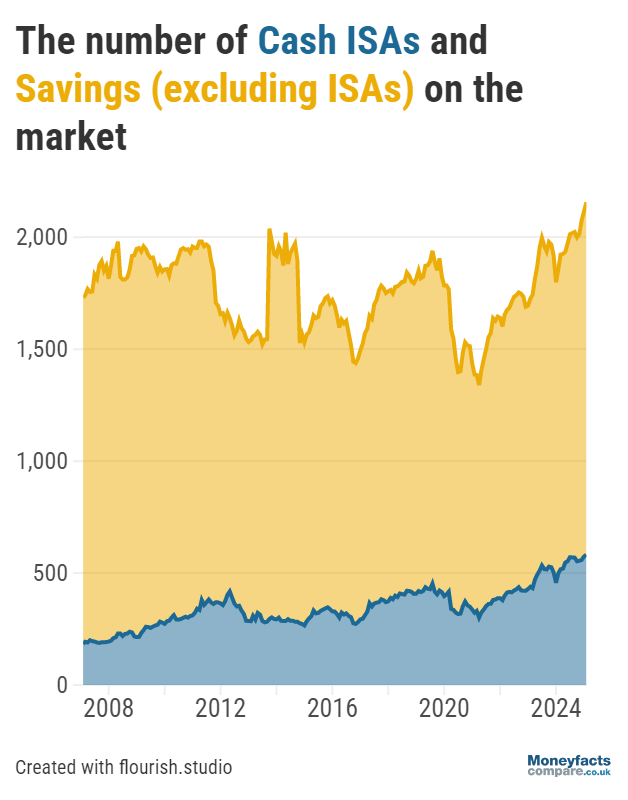

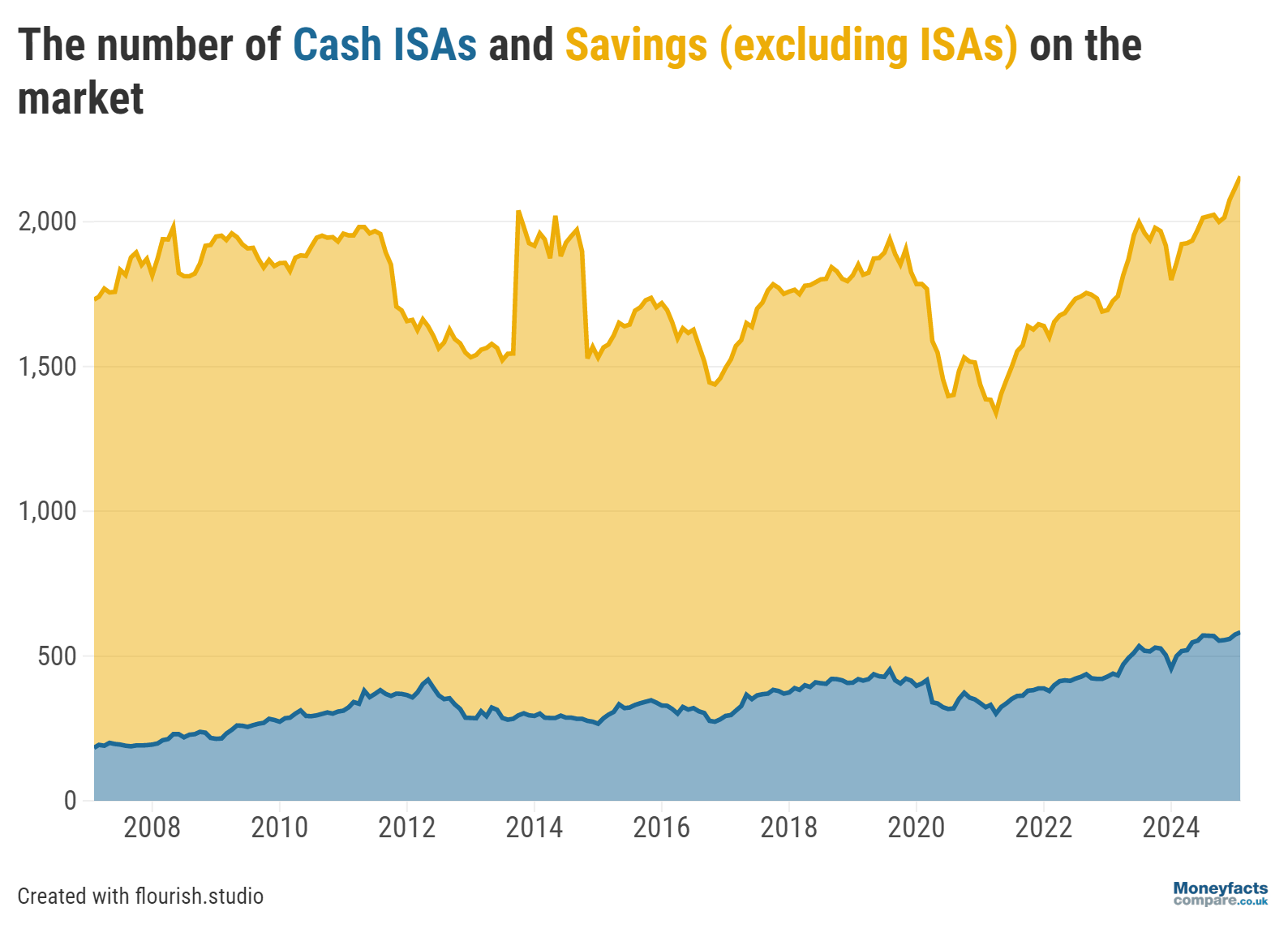

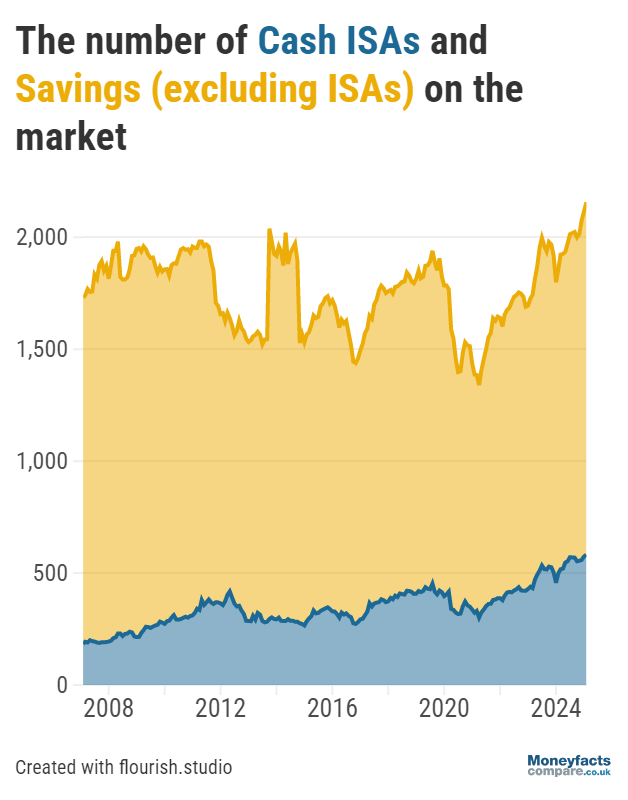

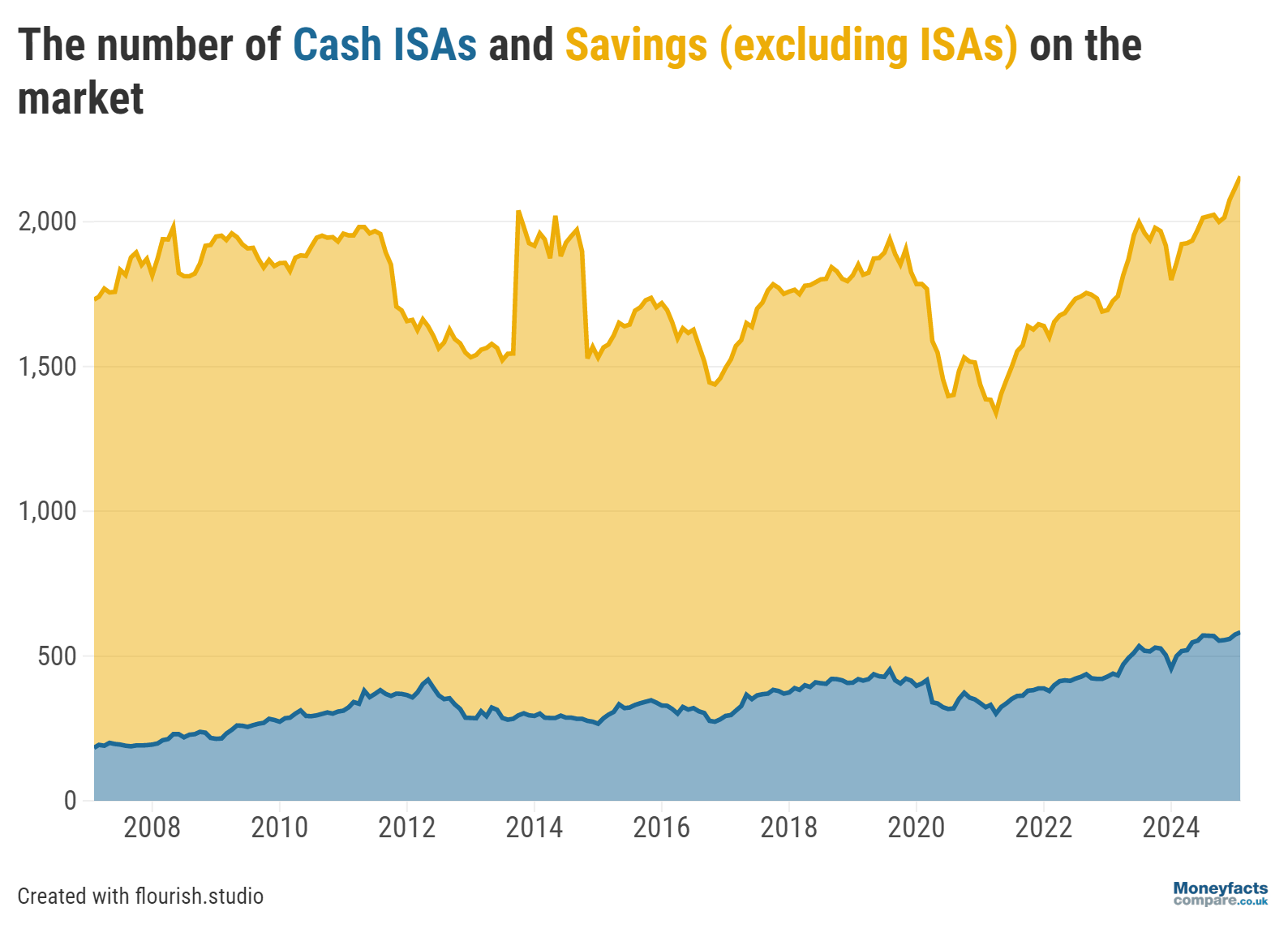

This is according to the latest Moneyfacts UK Savings Trends Treasury Report, which revealed the total number of cash ISAs rose to 582 by the start of this month – its highest count since Moneyfacts’ records began in 2007 and a considerable uplift from the 500 available in February 2024.

Graph: The number of cash ISAs and savings accounts on the market in February 2025.

Individual Savings Accounts, more commonly known as ISAs, are a popular way of sheltering returns on savings from the taxman.

Although the Personal Savings Allowance (PSA) enables basic-rate taxpayers to earn up to £1,000 in interest per fiscal year before being taxed, many are finding themselves dragged into higher tax brackets due to frozen Income Tax bands and are seeing their allowance slashed.

Depending on the size of the balance held in your savings account, moving to a higher-paying alternative could put you at risk of exceeding your allowance and having to pay tax on your returns; this is when saving into an ISA could prove beneficial.

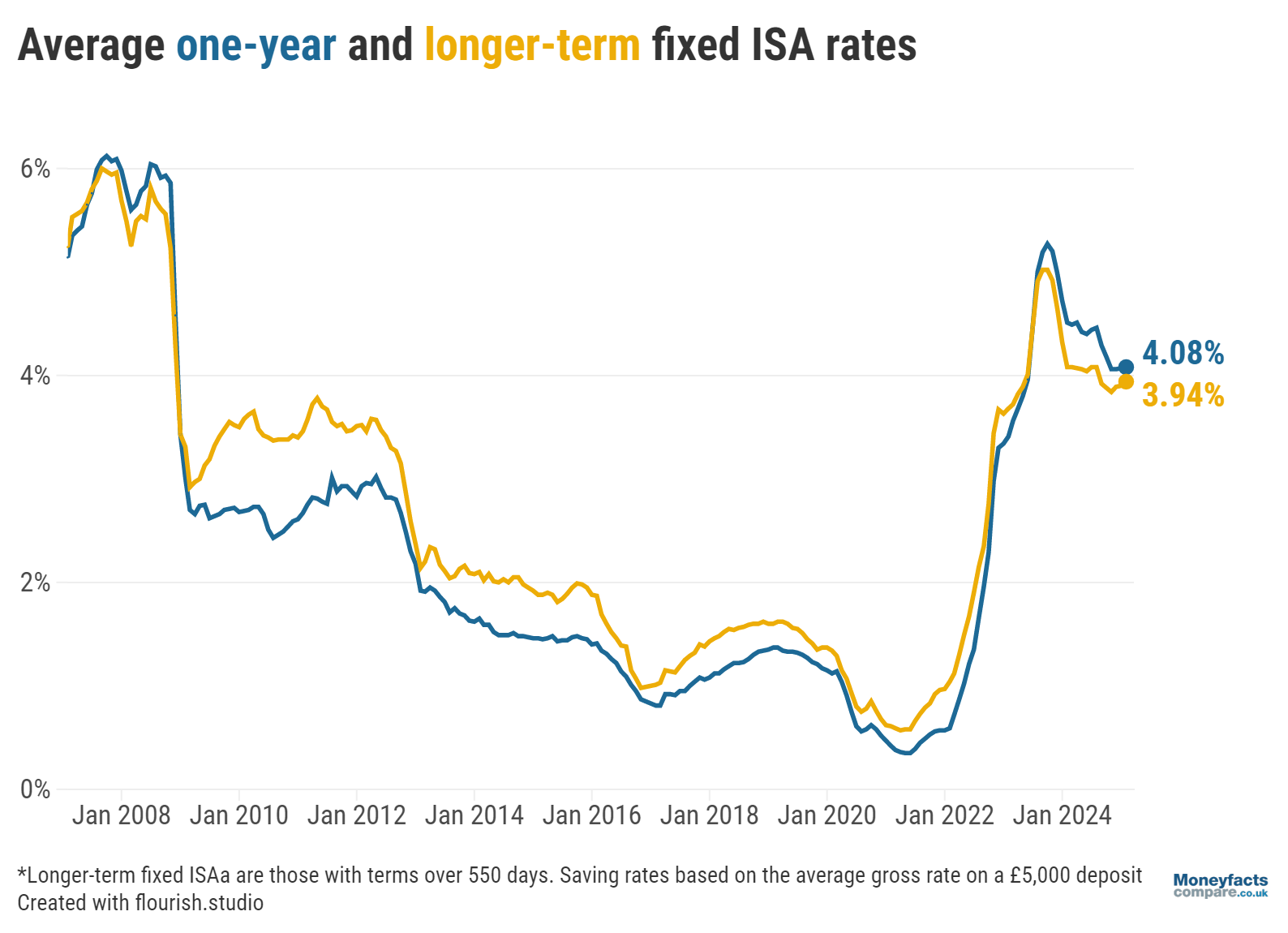

Two cuts to the Bank of England base rate in the latter half of last year caused savings rates to suffer.

Nevertheless, returns on ISAs made a slight recovery at the start of this year, with the average rate paid by an easy access ISA rising from 3.03% to 3.05% between January and February.

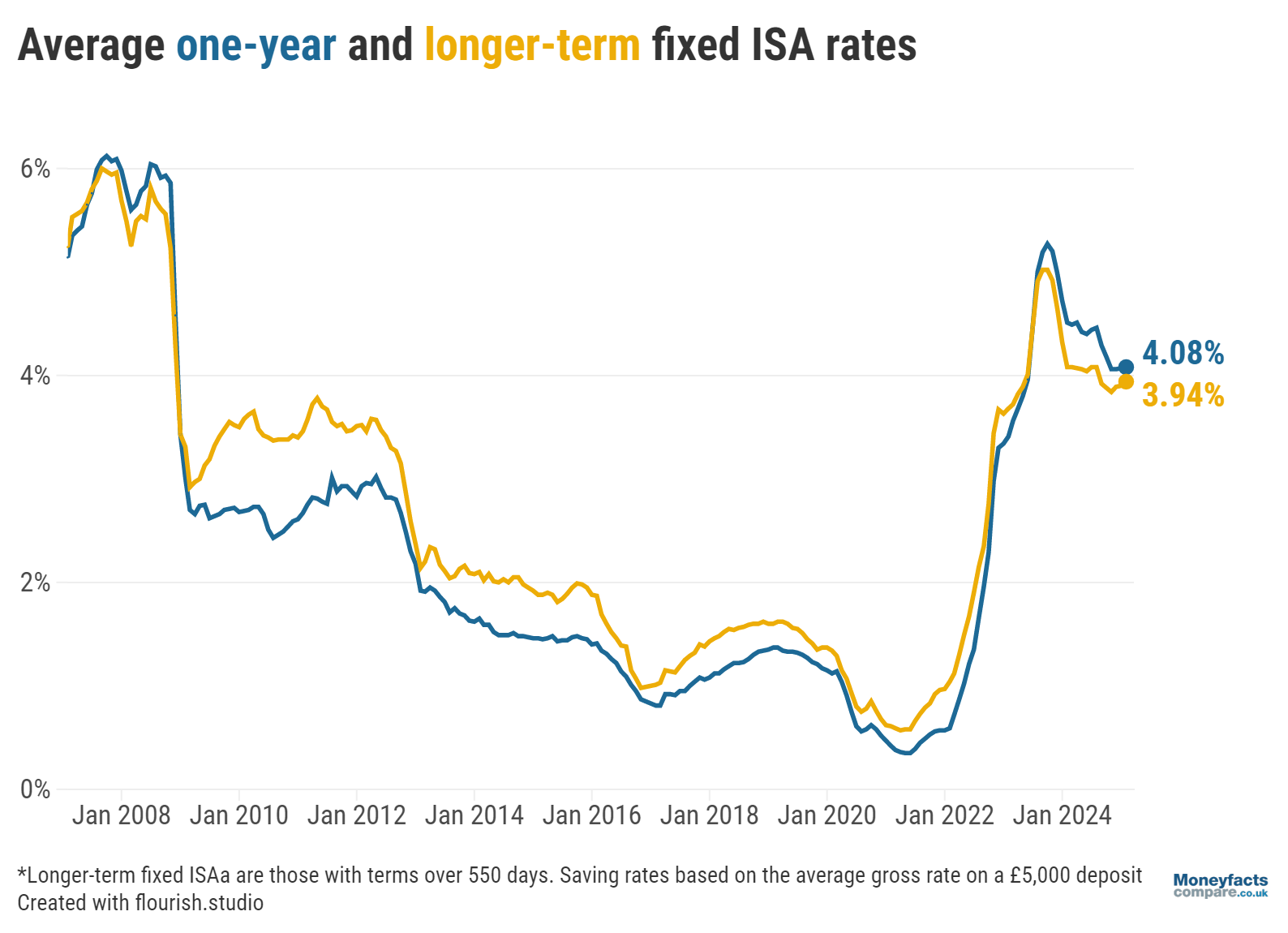

Likewise, the average returns on a one-year fixed ISA increased marginally from 4.07% to 4.08%, and the rate paid by a typical longer-term fixed ISA from 3.90% to 3.94%, over the same timeframe.

Graph: Average one-year and longer-term ISA rates since 2008

By comparison, the average rate paid by an easy access savings account also improved month-on month but stands at a slightly lower 2.90%, while the average returns on a one-year and longer-term fixed bond rose to 4.19% and 3.97%, respectively.

Although “encouraging” to see rates trending upwards, Rachel Springall, Finance Expert at Moneyfactscompare.co.uk, warned “any swift celebration will be dampened by anticipated savings rate cuts” after the UK’s central interest rate was lowered again earlier this month and swap rates began to fall.

Savers concerned about declining returns may feel compelled to lock in a competitive fixed rate quickly; this sense of urgency is compounded by the fast-approaching deadline to utilise this year’s £20,000 ISA allowance before it automatically resets at the start of the new tax-year.

Increased competition in both the savings and ISA markets should benefit consumers as new arrivals and lesser-known brands tend to offer more attractive rates to entice customers and garner publicity.

However, Springall said the months ahead pose a challenge for providers and it will be difficult for them to “keep ahead of their peers” while also “adjusting their rates as interest rates are expected to fall”.

Whichever account they choose, she encouraged savers to regularly review their pots to make sure they’re seeing “a real return against the eroding impact of inflation”, which is expected to rise further this year.

Whether you need the flexibility of an easy access account, want to secure guaranteed returns with a fixed bond or are looking to make use of your ISA allowance, our savings charts are regularly updated throughout the day to show you the best rates.

Alternatively, read our weekly savings and ISA roundups for more information on accounts offering the most competitive returns.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.