As product availability rose, the average shelf-life of a mortgage deal dropped.

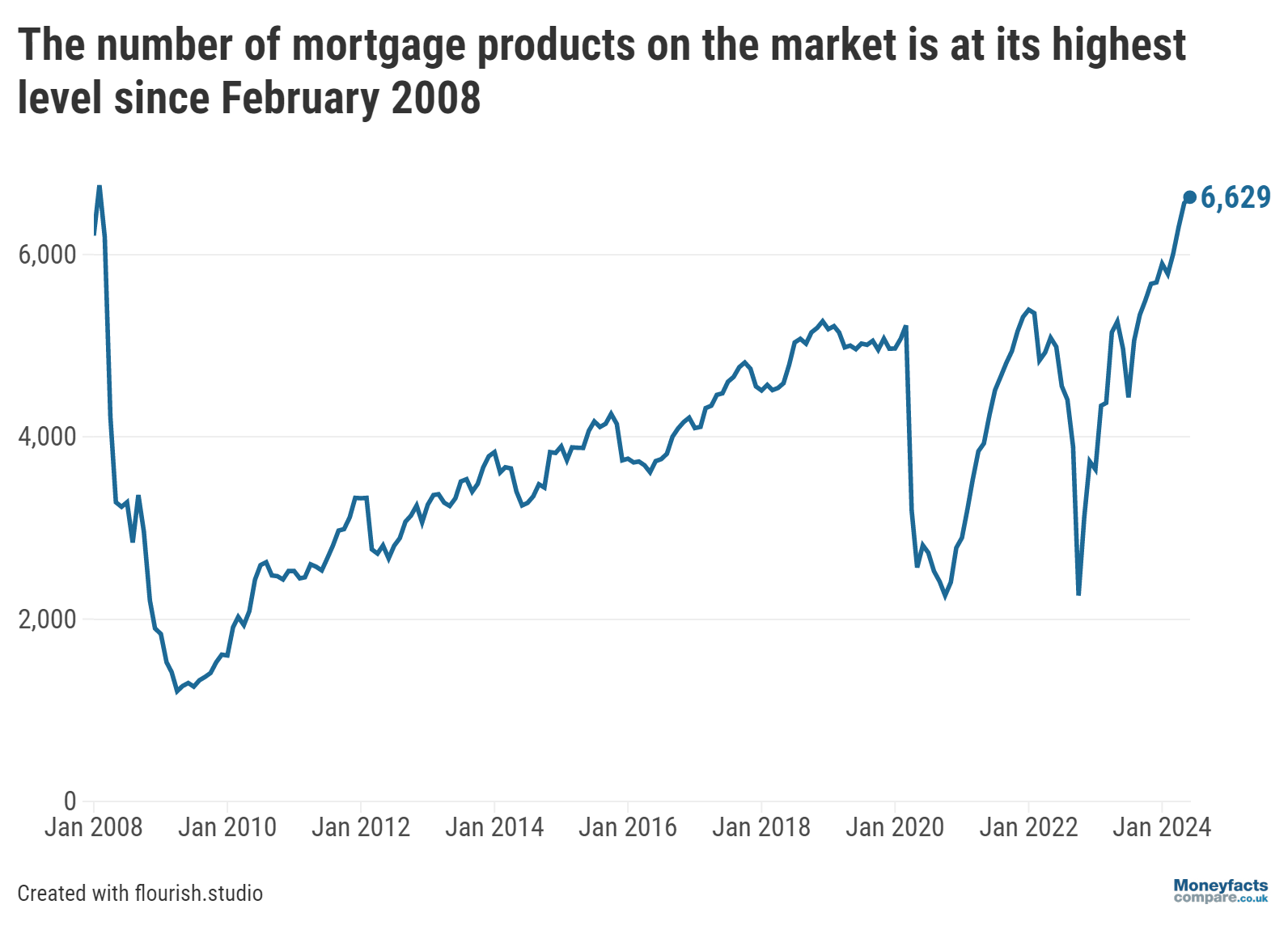

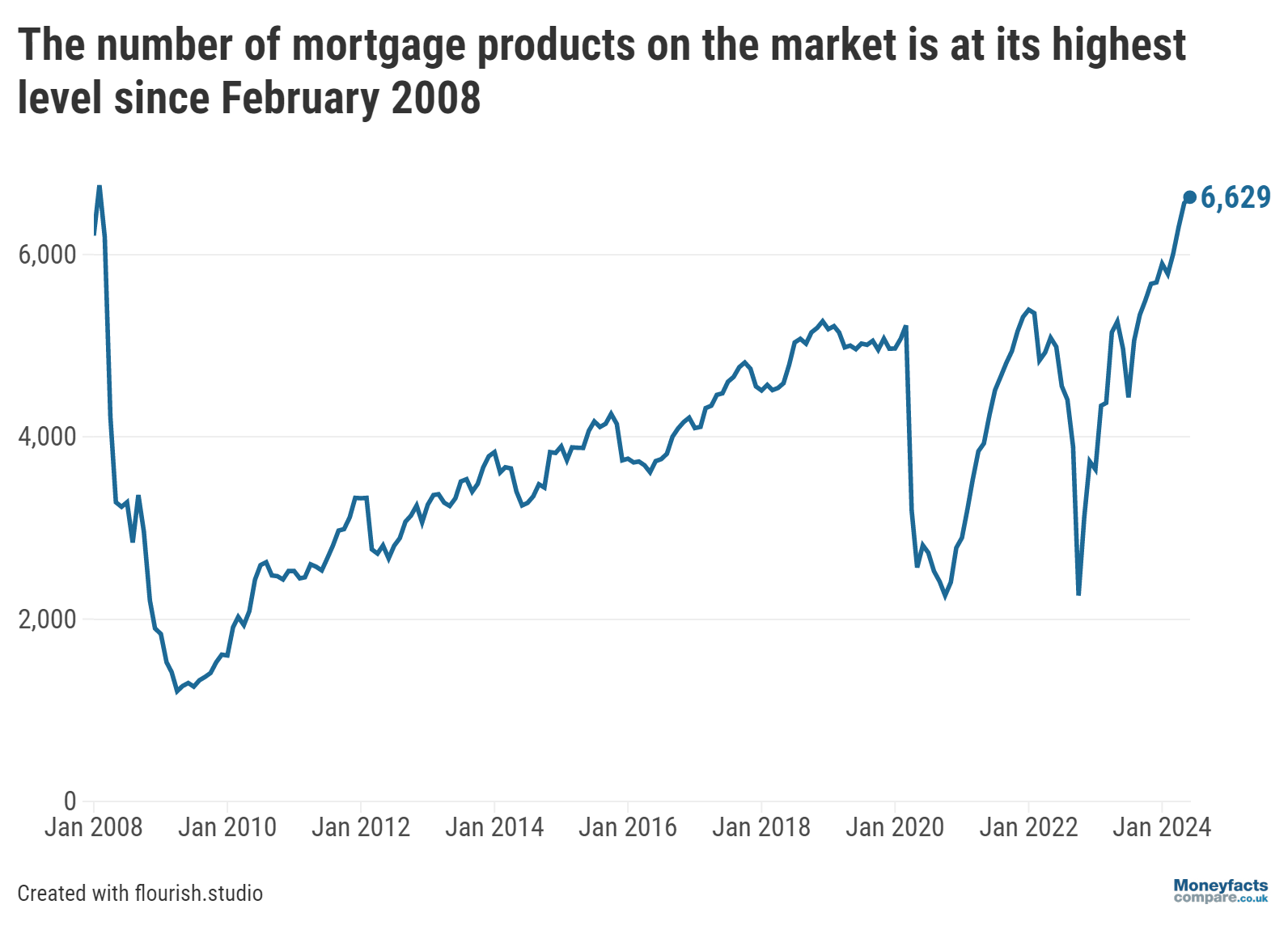

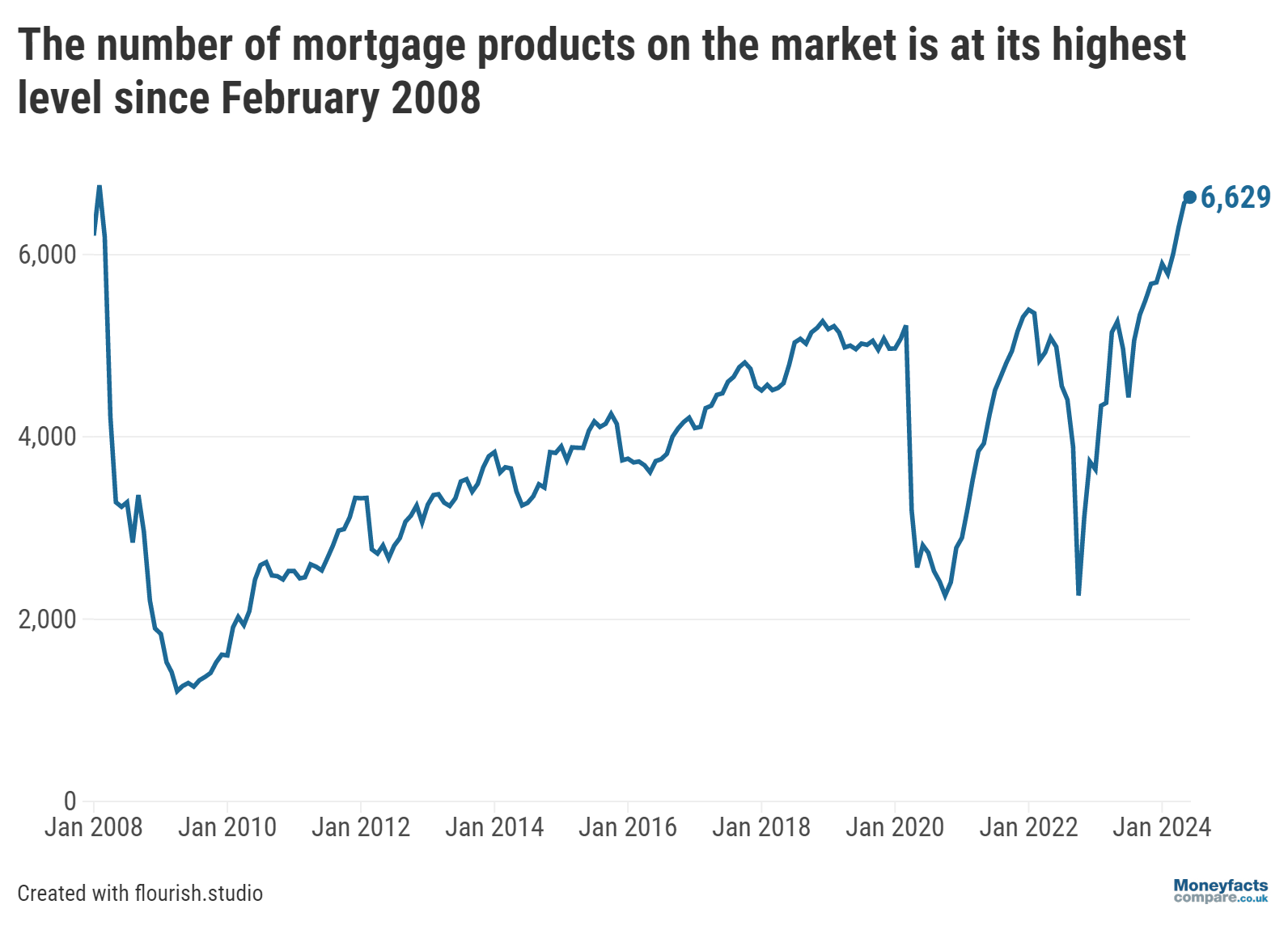

Borrowers had 6,629 mortgage deals to choose from at the start of June, the largest number available since February 2008, according to data from the Moneyfacts UK Mortgage Trends Treasury Report.

This is an increase of 1,662 compared to June 2023, when there were just 4,967 mortgage deals on offer.

Caption: The number of mortgage products available rose to 6,629 in June, its highest level since 2008.

While the wider choice of mortgage products is a positive sign for borrowers, they will need to act promptly if they want to secure a deal as the average shelf-life of a product almost halved to 15 days, compared to 28 days the previous month.

“Lenders spent the first few weeks of May repricing, in reaction to a volatile swap rate market, but the latter end of the month was more subdued, around the time the Government announced there would be a General Election in July,” explained Rachel Springall, Finance Expert at Moneyfacts.

“As lenders reviewed their ranges, which included repricing, launches and withdrawals, the moves led to the average shelf-life of a mortgage plummeting to 15 days, down from 28 days at the start of May,” she continued.

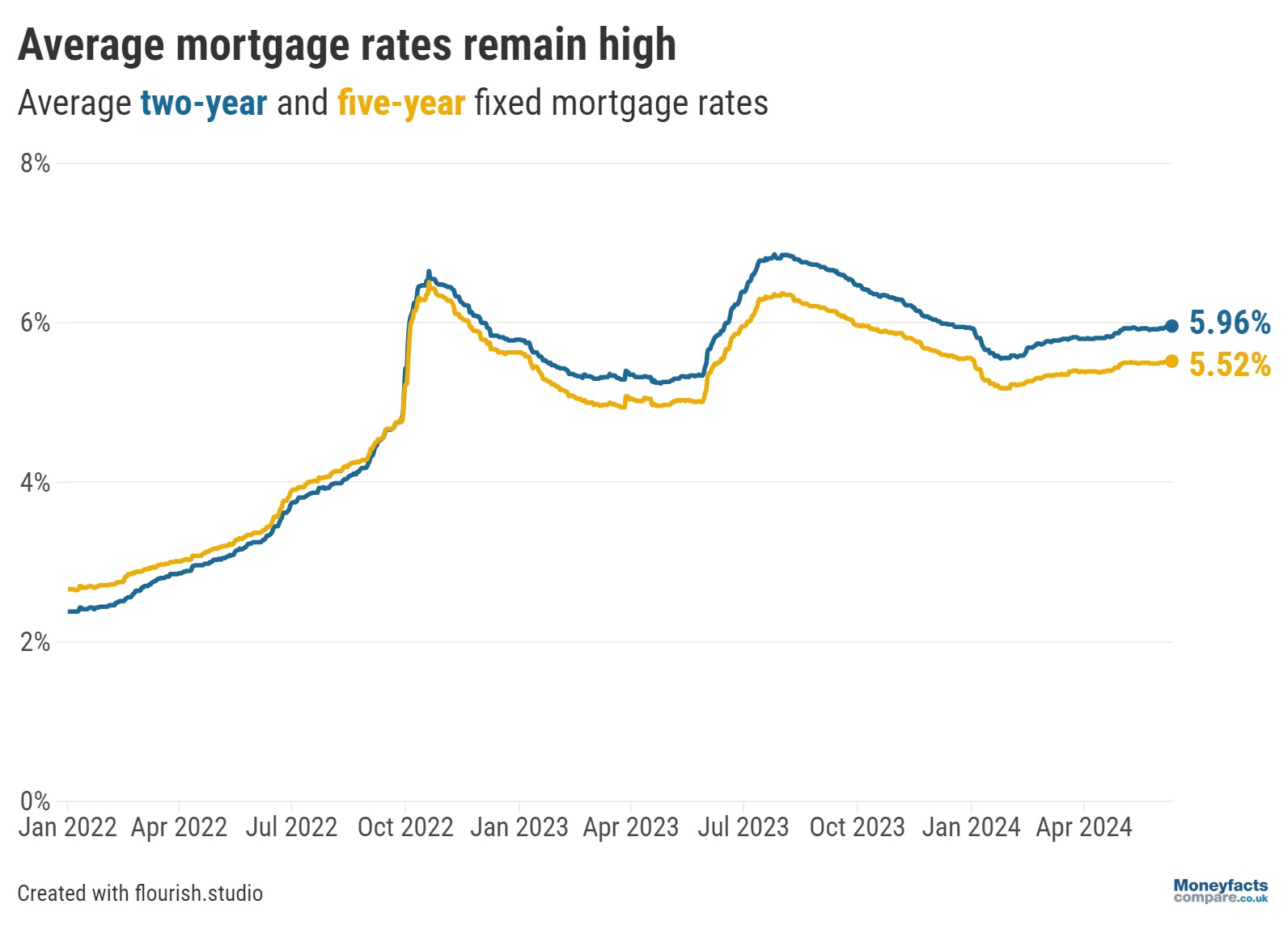

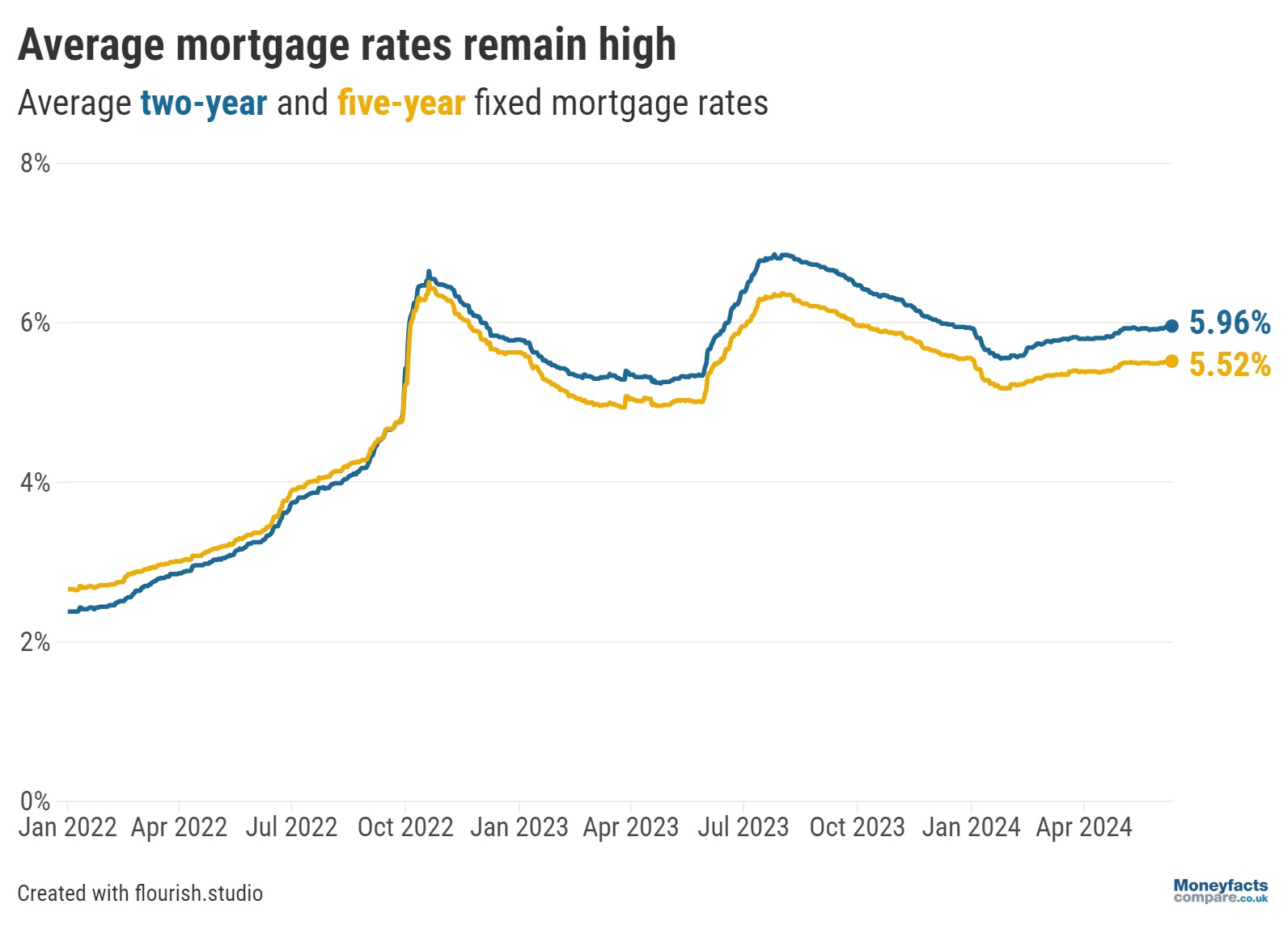

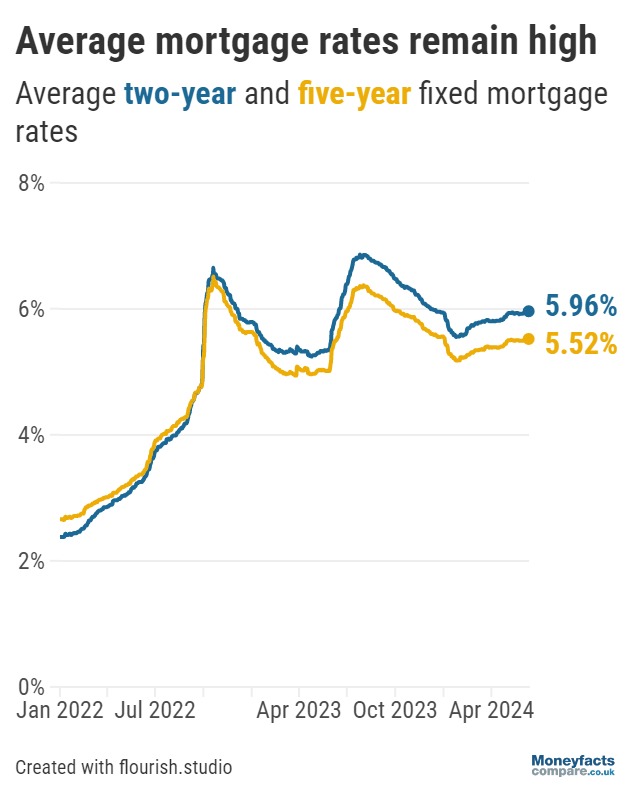

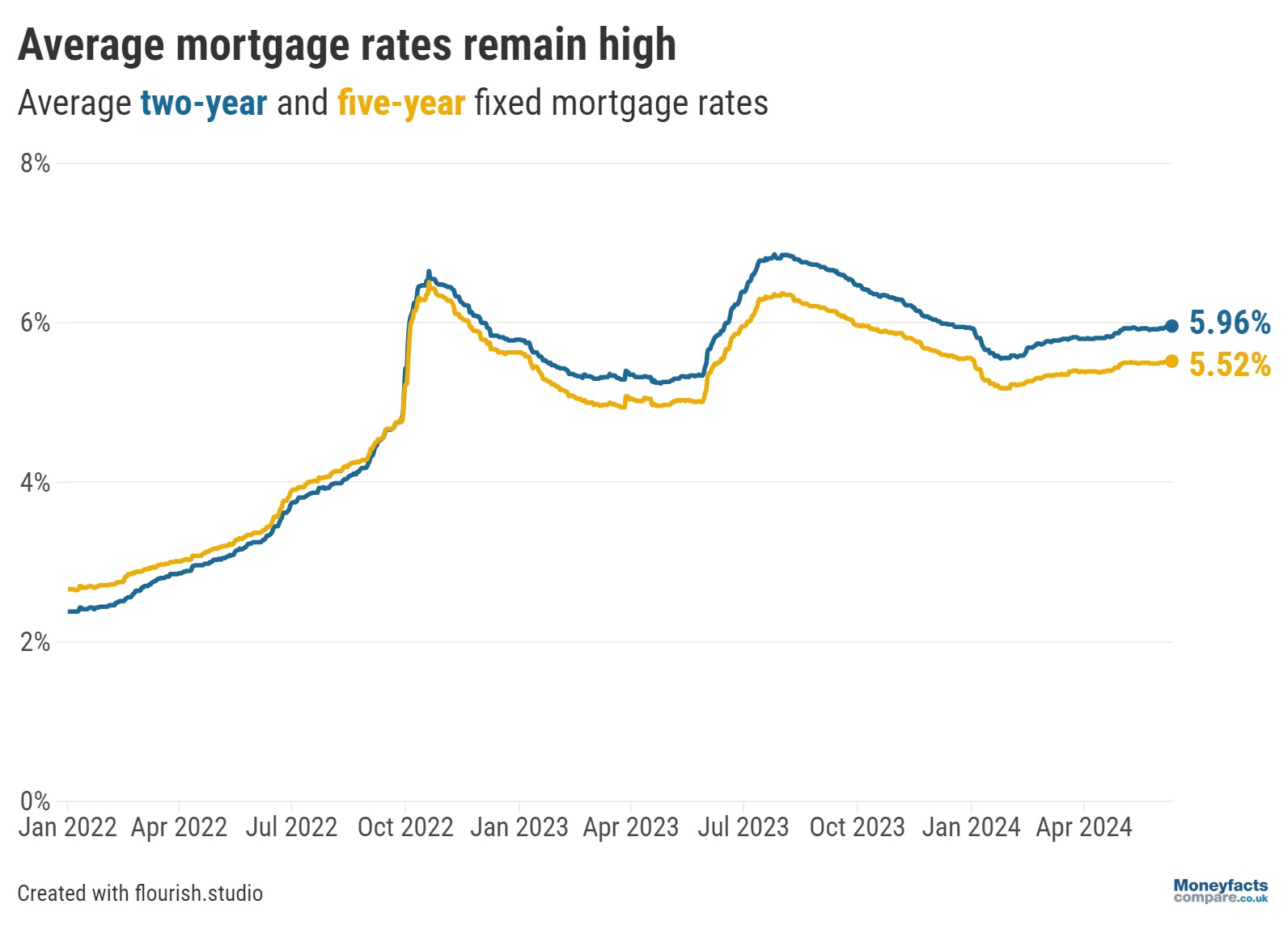

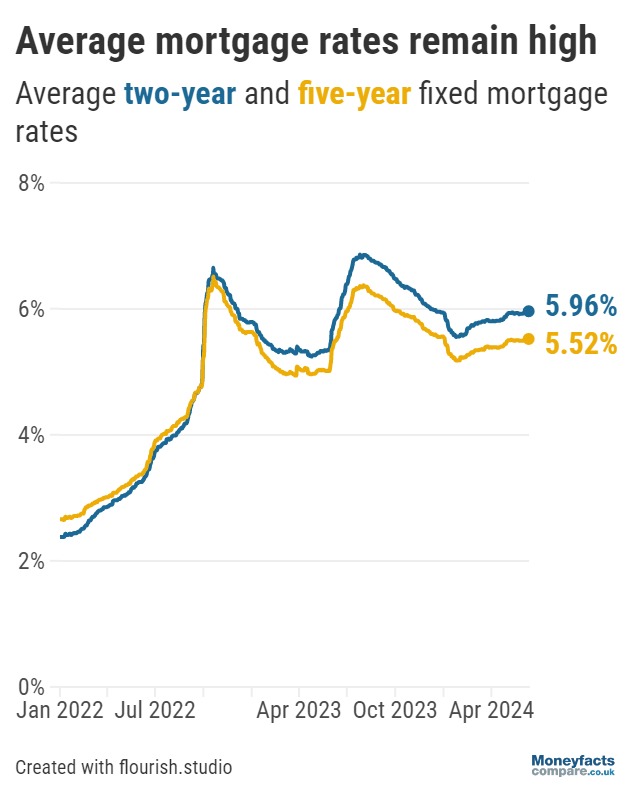

Average mortgage rates have steadily increased since February and, in the month to June, the average two- and five-year fixed rates rose once again by 0.02 percentage points.

The average two-year fixed rate stood at 5.93% at the start of June while the average five-year fixed rate stood at 5.50%.

However, even though borrowers may be disappointed to see rates continue to rise, this was the smallest monthly increase we’ve seen this year. Furthermore, average rates remain lower than they were in December 2023.

Caption: Average mortgage rates continued to rise slowly in the month to June.

Those coming to the end of a two- or five-year fixed mortgage will probably find that current rates are higher than their existing deal. But, with the average Standard Variable Rate (SVR) standing at 8.18%, locking into a new deal, whether that’s a fixed or variable rate option (such as a tracker mortgage), is still likely to be a cheaper option than reverting to your lender’s SVR.

“Consumers concerned about rising rates would be wise to seek advice from an independent broker to see if they can lock into a deal early, as some will let borrowers do this from three to six months in advance,” Springall suggested.

In an encouraging sign for first-time buyers, the number of products at 90% and 95% loan-to-value (LTV) increased year-on-year.

At the start of June, there were 353 products at 95% LTV and 792 at 90% LTV, increases of 124 and 156 respectively from June 2023.

This is despite several providers withdrawing their higher LTV mortgage products at the end of May.

In less welcome news, average rates on deals at 90% and 95% LTV increased between the start of May and the start of June, with 95% LTV deals seeing a particularly noticeable rise.

The average two-year fixed rate at 95% LTV rose from 6.14% to 6.20% and the average five-year fixed rate rose from 5.64% to 5.73%.

By contrast, the average two-year fixed rate on deals with a maximum LTV of 60% stayed the same between May and June while the average five-year rate dropped.

Some borrowers may be hoping that the Bank of England will cut the base rate in the coming months and that this will cause mortgage rates to fall. However, many different factors affect the mortgage market and, especially with a General Election in less than one month’s time, it can be difficult to predict the direction of mortgage rates.

As a result, it’s a good idea to regularly compare rates and, when you’re ready, speak to a professional for tailored advice on your situation.

View our mortgage charts to compare the latest mortgage rates, whether you're a first-time buyer, planning to move home or simply looking to remortgage.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.