However, climbing rates are countered by longer shelf-life and increased product availability.

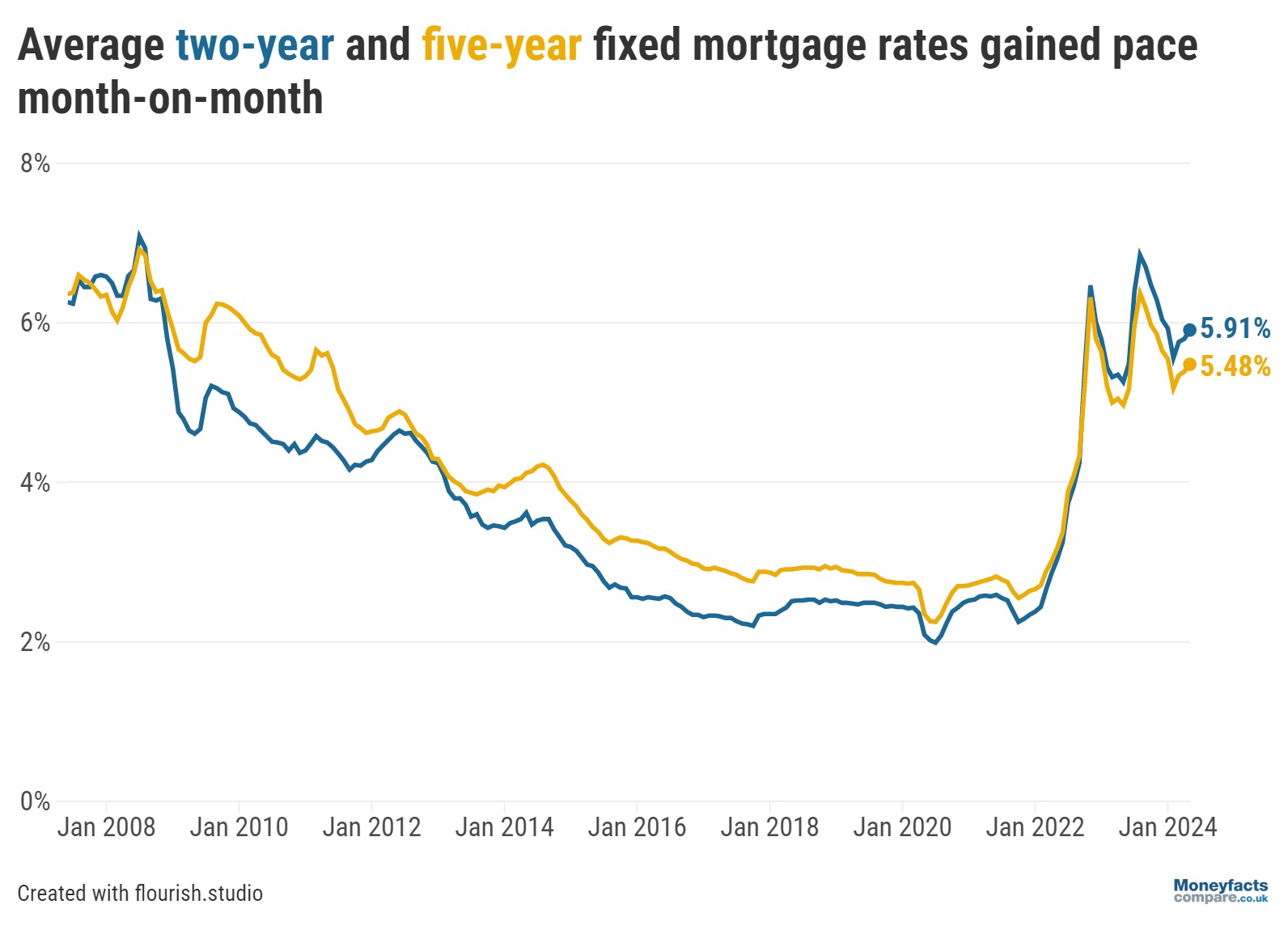

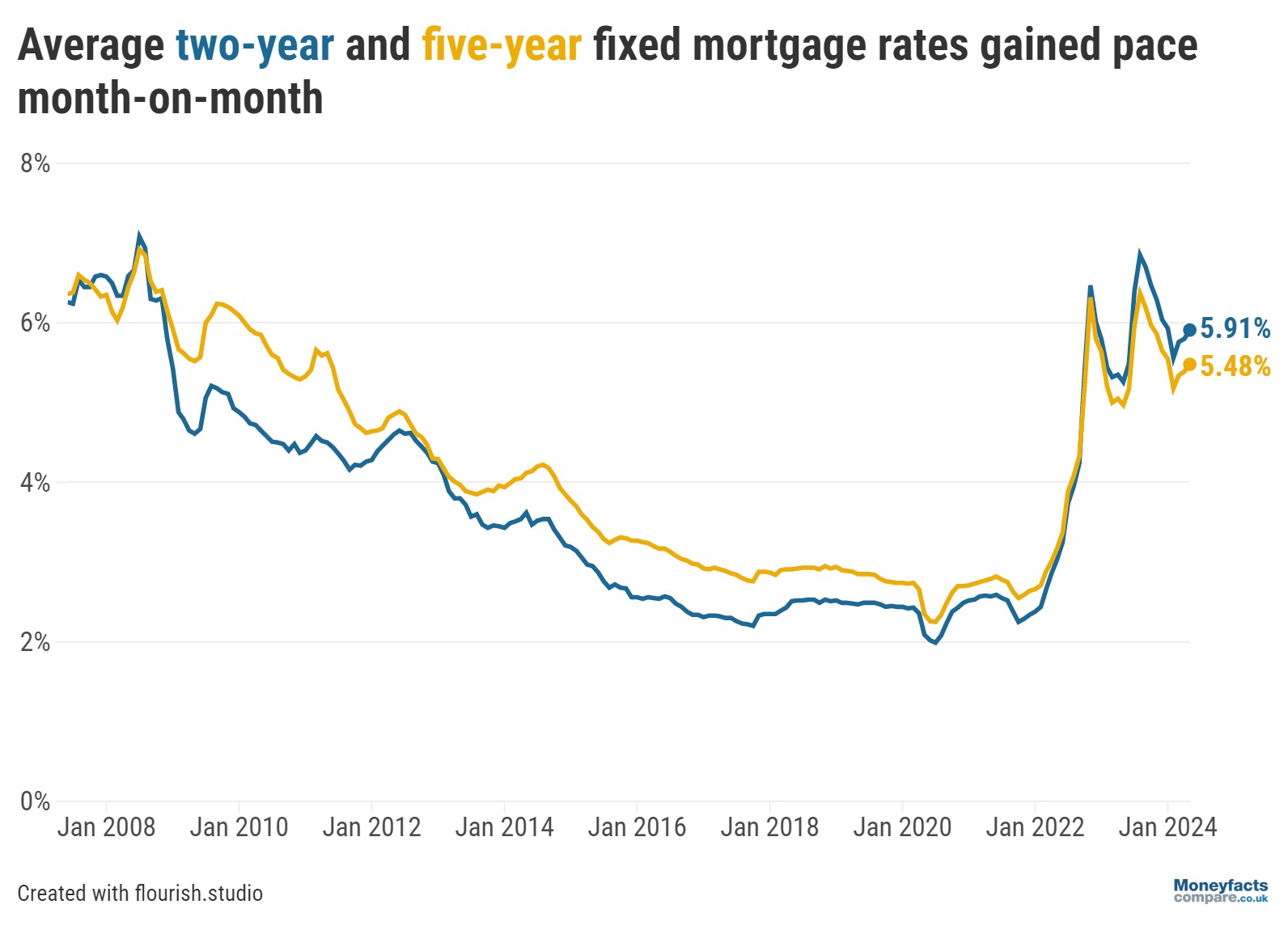

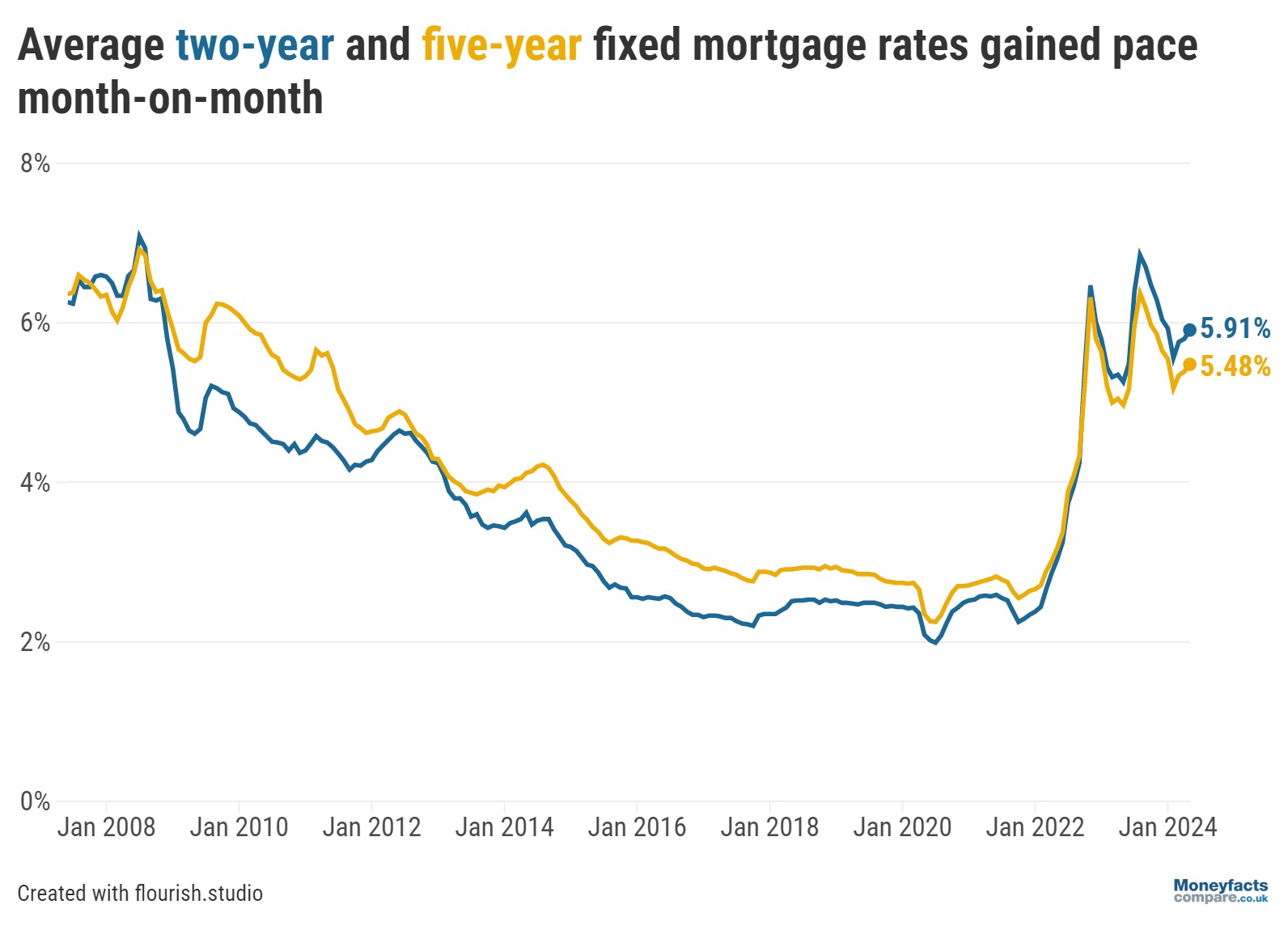

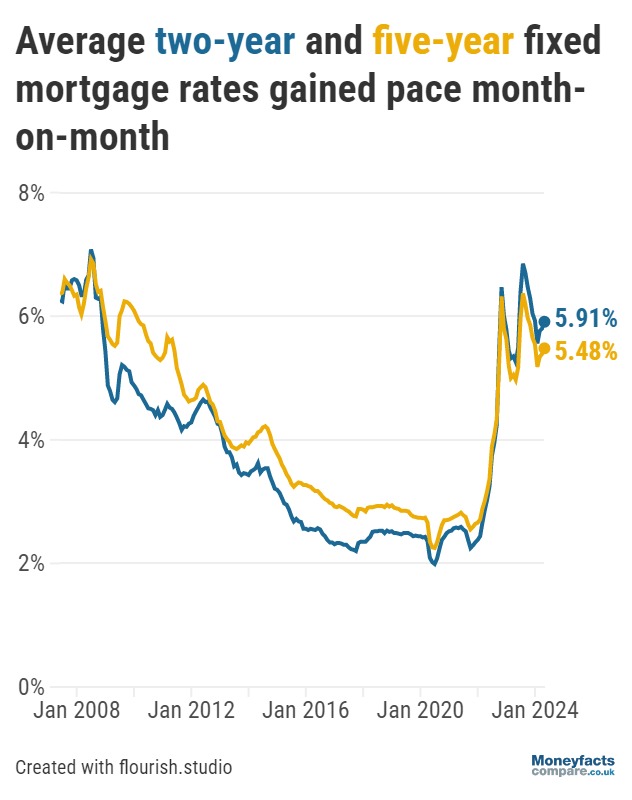

Borrowers will likely be disappointed to learn mortgage rate rises gained momentum throughout April; the average two-year fixed deal increased to 5.91% by the start of May – up from 5.80% the previous month.

This is according to data from the Moneyfacts UK Mortgage Trends Treasury Report, which found the average five-year fixed rate experienced a similar jump – rising from 5.39% to 5.48% over the same period. In both instances, this is the biggest month-on-month hike in average rates since March 2024.

Caption: Despite a promising start to 2024, average mortgage rates are starting to rise more rapidly.

The change in trajectory may come as a surprise as average rates had seemed to be cooling off from their recent peaks after falling for six consecutive months between September 2023 and February 2024.

However, with forecasts delaying expectations for any future cut to the base rate, as well as ongoing volatility in the swap market, many lenders are taking the opportunity to review their pricing. Over recent months, this has resulted in some sub-5% deals being pulled from sale as average rates close in on levels not seen since the start of this year.

While these upward movements may concern borrowers, solace can be found in other aspects of the mortgage market showing greater resilience.

“One positive point to take from the latest trends is that mortgage shelf-life has stabilised to 28 days,” highlighted Rachel Springall, Finance Expert at Moneyfactscompare.co.uk. This is a stark contrast to July 2023, when the average shelf-life of a product stood at just 12 days – the lowest on our records.

Furthermore, despite some lenders making withdrawals, Springall reported “no mass exit of products”. Instead, overall product choice increased month-on-month to 6,565 options – its highest level in over 16 years.

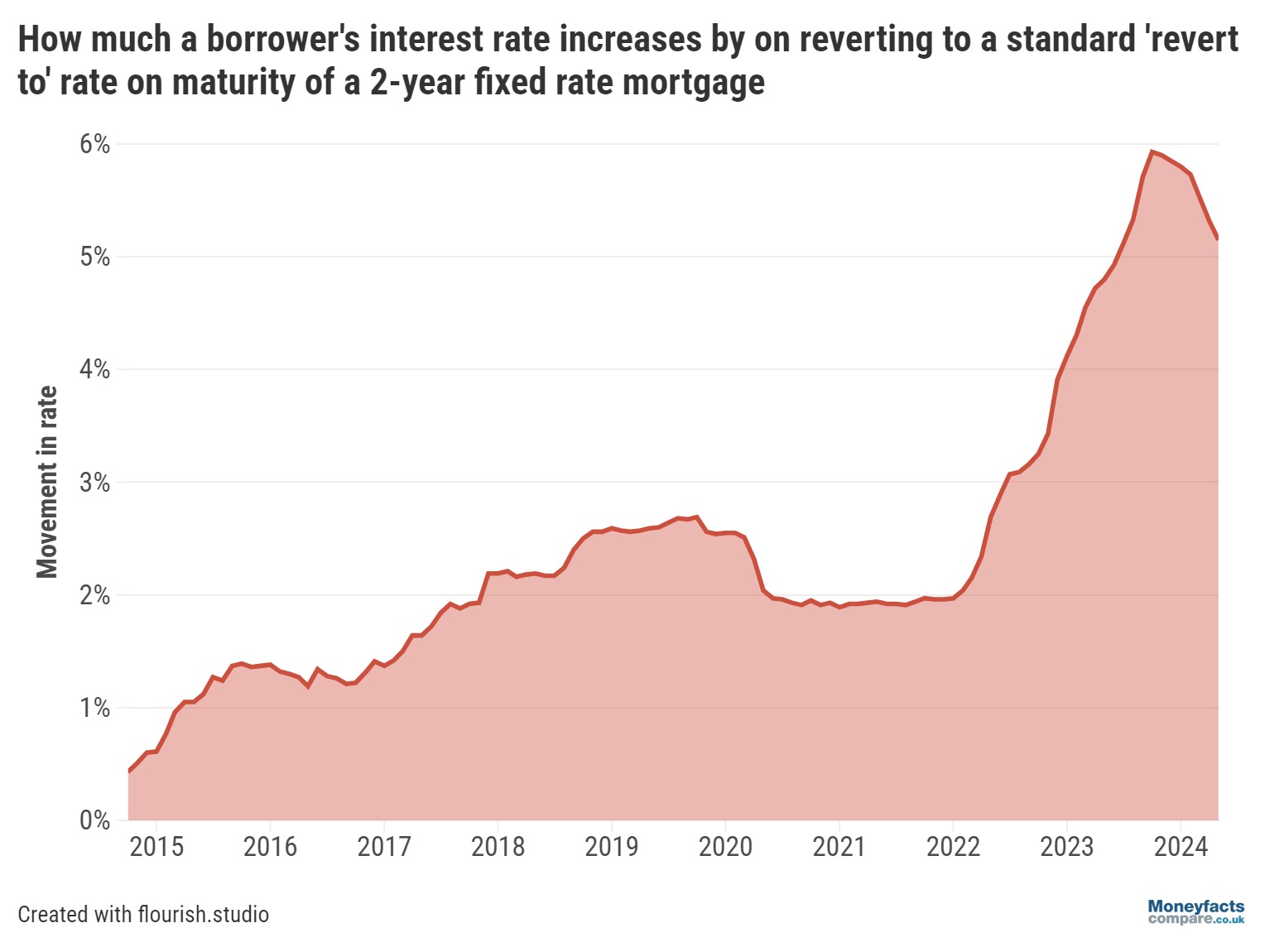

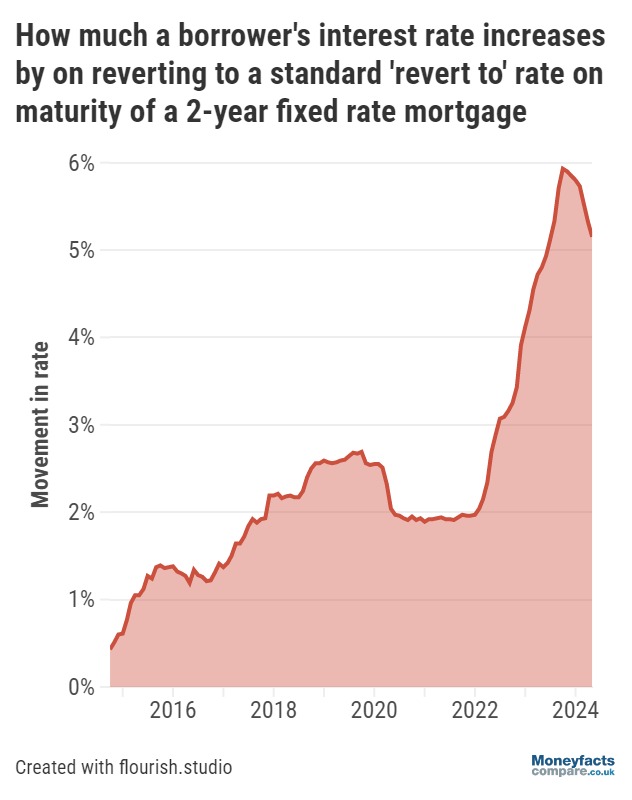

Those coming to the end of an initial fixed term will likely face higher rates when shopping around for a new deal. In May 2022, the average two-year fixed mortgage charged 3.03%, while, in May 2019, the average five-year fixed rate was 2.85%.

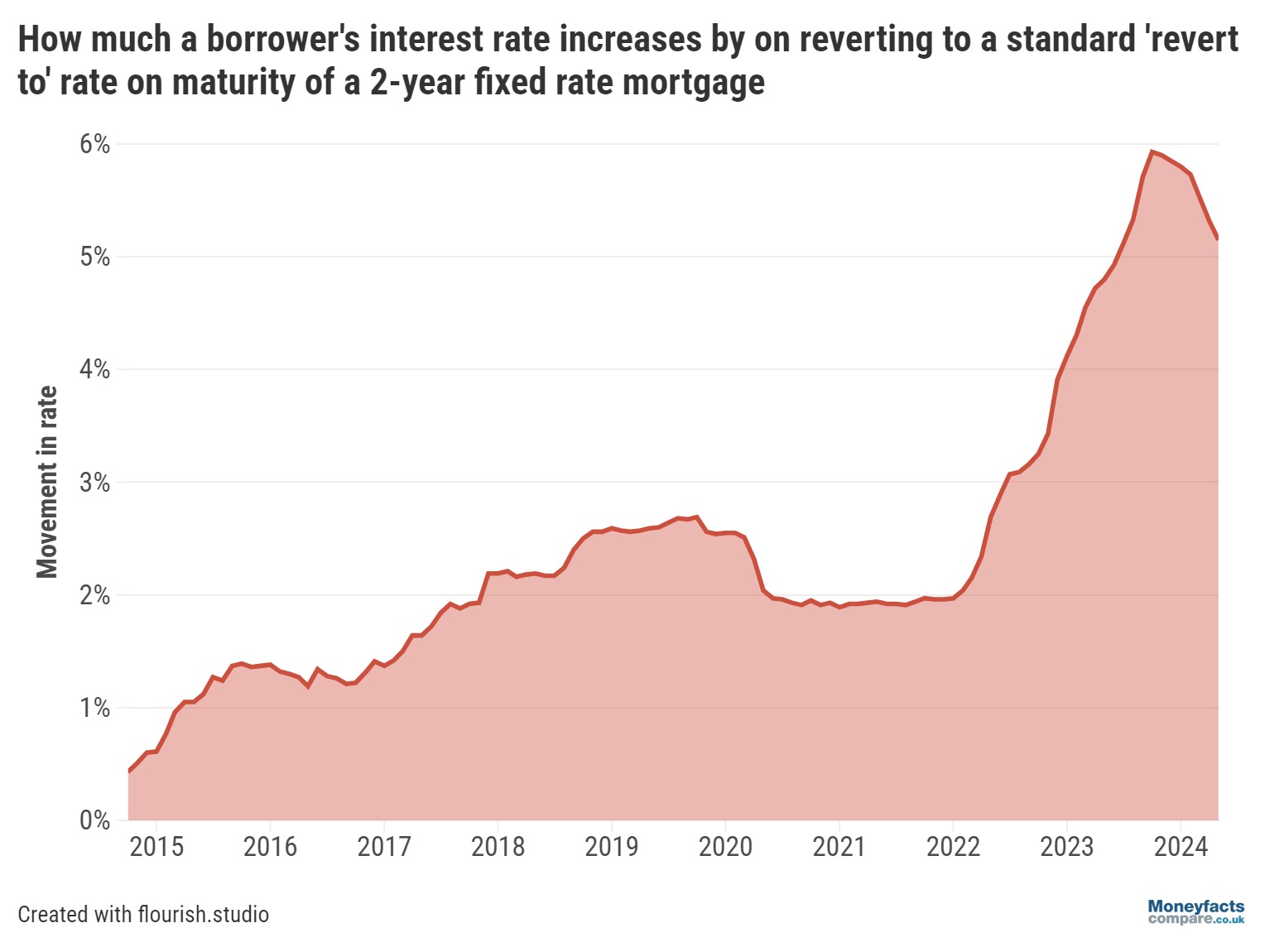

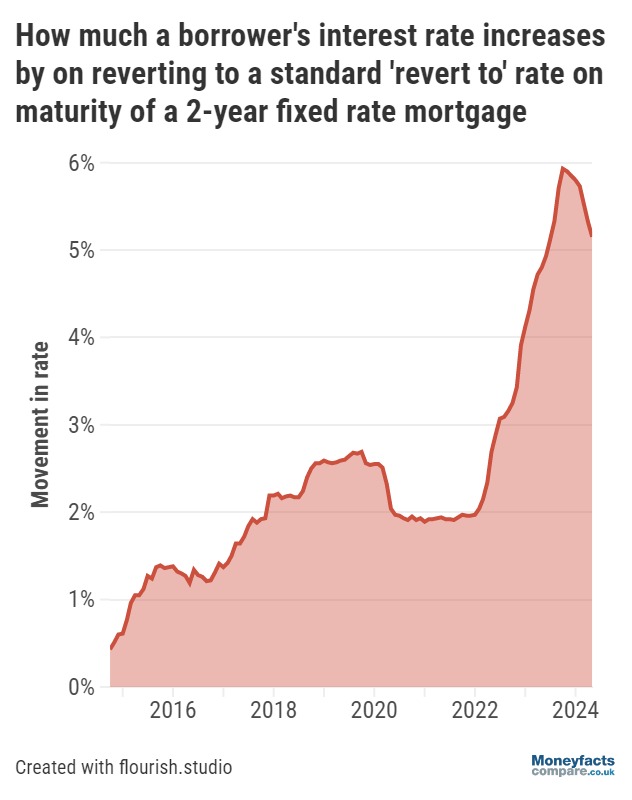

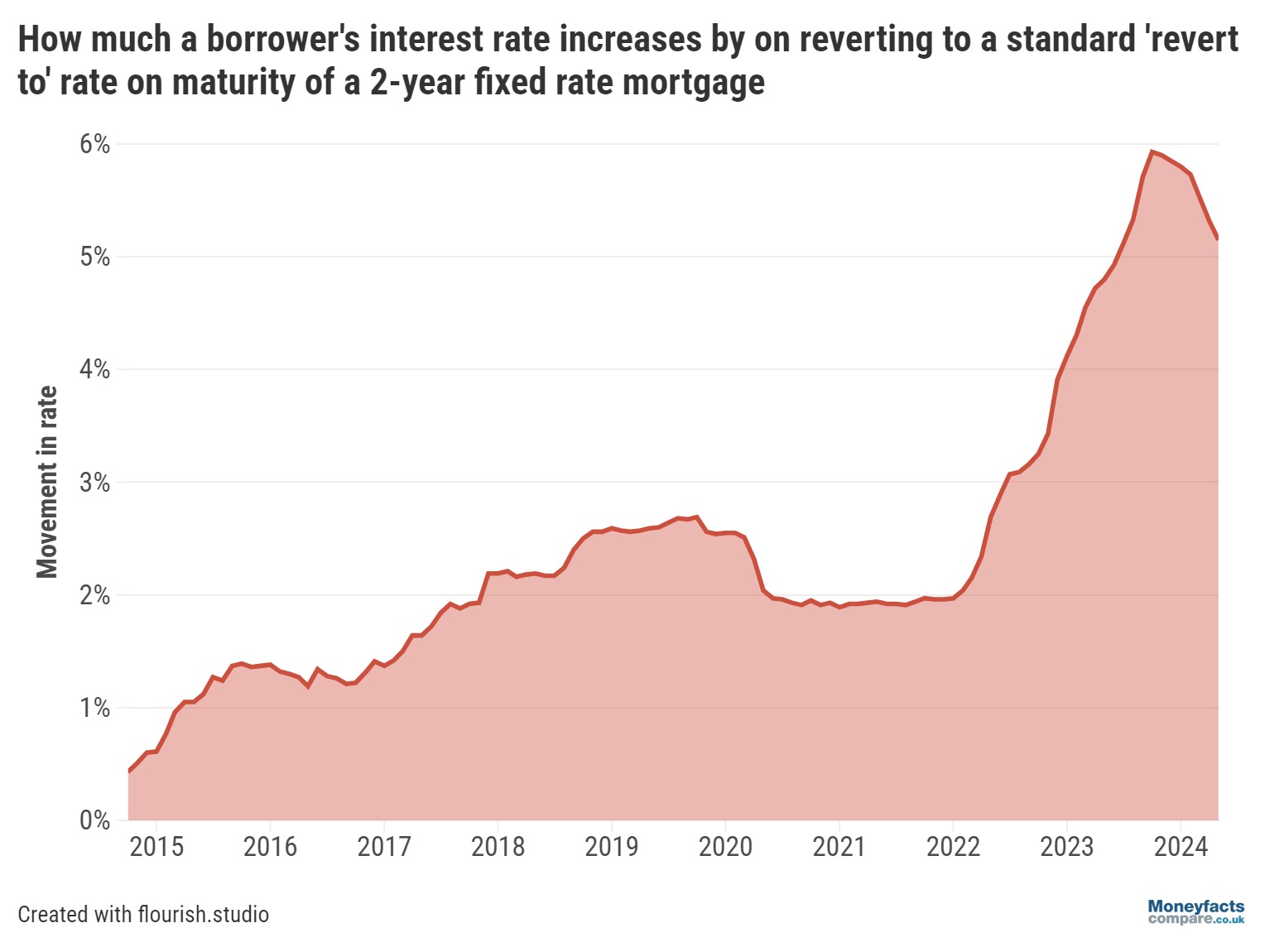

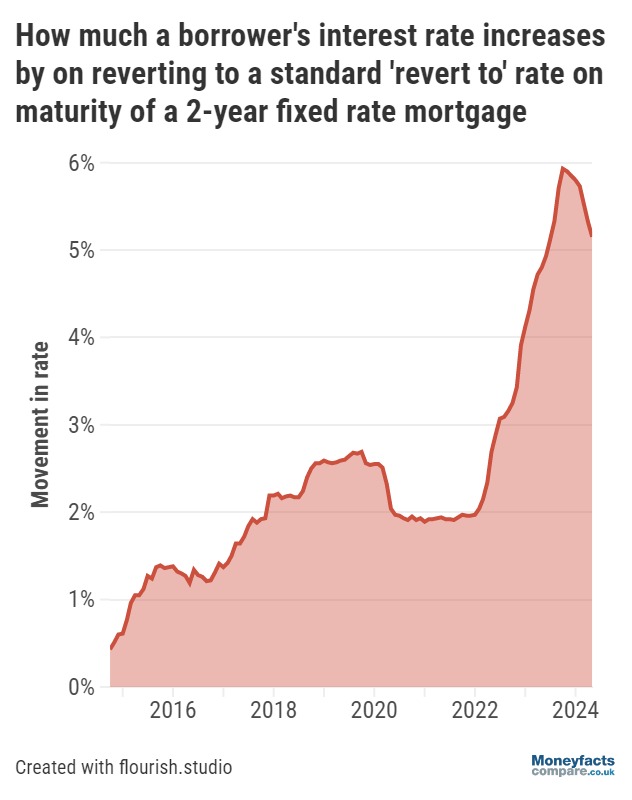

Although this may discourage some from securing a new fixed product, doing so could prove more cost-effective than sitting on a lender’s Standard Variable Rate (SVR).

The average SVR remained at 8.18% in May – only marginally lower than the high of 8.19% recorded in November and December 2023. At this rate, borrowers would pay around £290 more each month than if they took out a typical two-year fixed deal (based on a £200,000 mortgage over a 25-year term).

Caption: Although fixed mortgage rates are on the rise, it could prove more costly to sit on a lender's Standard Variable Rate (SVR).

Our mortgage charts are regularly updated throughout the day to show the lowest rates available.

However, keep in mind the lowest rate may not always be the best, or most cost-effective, choice for your needs. It’s also important to consider other factors such as product fees and incentives when comparing deals.

Our weekly mortgage roundup provides more information on the lowest rates available, as well as some Moneyfacts Best Buy options which feature based on their overall true cost.

With economists predicting the Bank of England will cut the UK’s central interest rate later this year, borrowers who share this opinion may be considering a base rate tracker mortgage.

This type of product charges a variable interest rate that usually rises and falls in line with changes to the base rate.

If you’re not sure whether a variable mortgage best suits your circumstances, or for help navigating the mortgage market, consider seeking advice from a broker.

If you’re looking for a variable mortgage, our dedicated chart is regularly updated throughout the day and covers the whole of the market.

Mortgage brokers remove a lot of the paperwork and hassle of getting a mortgage, as well as helping you access exclusive products and rates that aren’t available to the public. Mortgage brokers are regulated by the Financial Conduct Authority (FCA) and are required to pass specific qualifications before they can give you advice.

Get friendly, expert advice free of charge as a visitor of MoneyfactsCompare

Mortgage Advice Bureau have 1,600 UK advisers with 200 awards between them.

Speak to an award-winning mortgage broker today.

Call 0808 149 9177 or request a callback

Mortgage Advice Bureau offers fee free mortgage advice for MoneyfactsCompare visitors that call on 0808 149 9177. If you contact Mortgage Advice Bureau outside of these channels you may incur a fee of up to 1%. Lines are open Monday to Friday 8am to 8pm and Saturday 9am to 1pm excluding bank holidays. Calls may be recorded.

Your home may be repossessed if you do not keep up repayments on your mortgage.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.